Image: Wednesday, Netflix

Netflix handily beat Wall Street estimates when it reported adding 13 million subscribers to end 2023. This brought the platform’s total number of subscribers to over 260 million globally. The company’s stock price rallied by more than 10% in response to the positive results. This could be a sign that Netflix is expanding its moat as the undisputed streaming and entertainment leader in 2024 and beyond, rather than a bullish signal for the streaming business more broadly however.

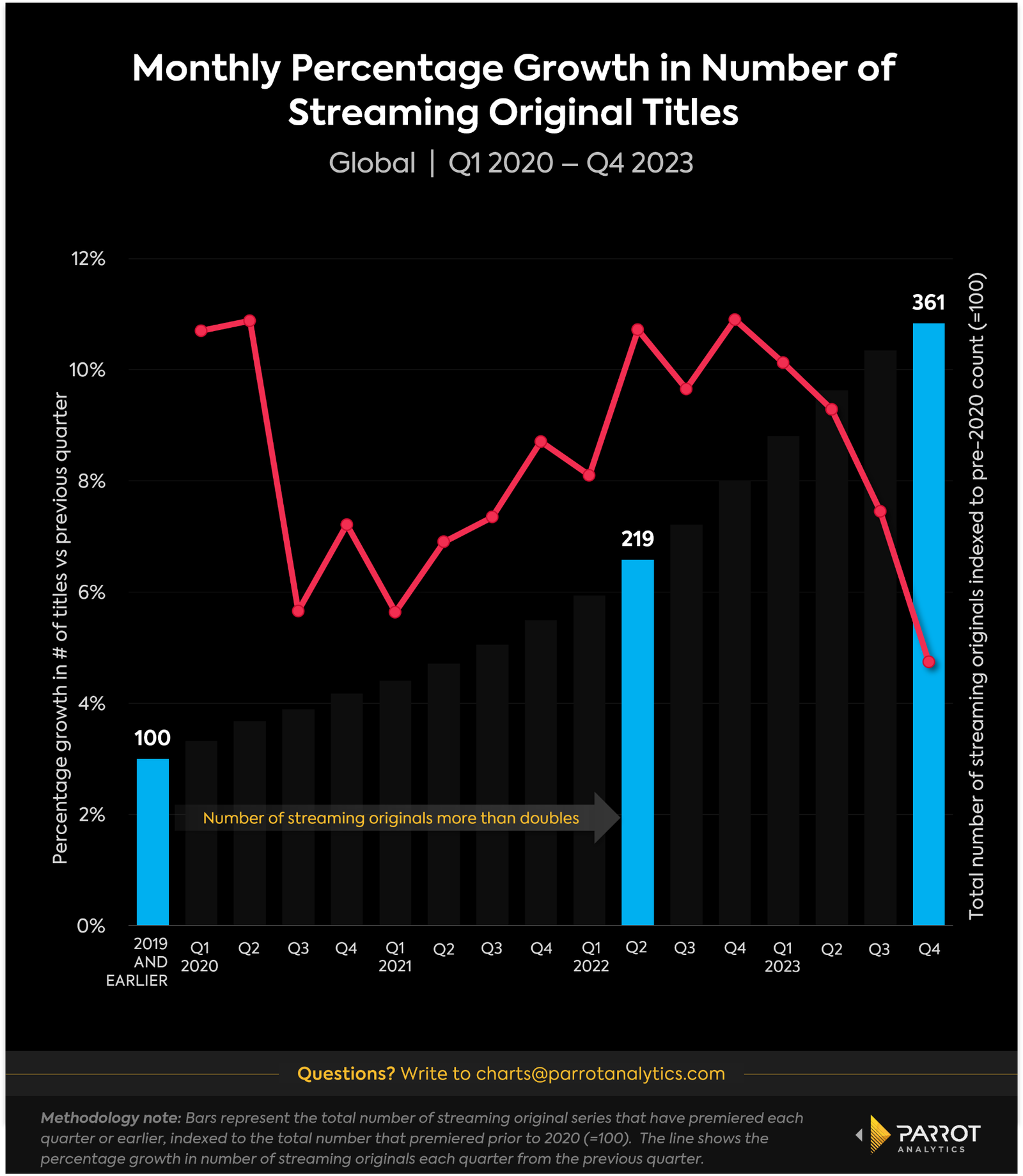

Using Parrot Analytics Content Panorama we can see how the fourth quarter of 2023 marked the fourth consecutive quarter of slowing output from streaming services. Each quarter of 2023 the rate of new streaming original series premieres slowed down. In the middle of the year this could be attributed fairly directly to the dual strikes paralyzing Hollywood, but there has not been a quick rebound in the number of new shows in the final months of the year.

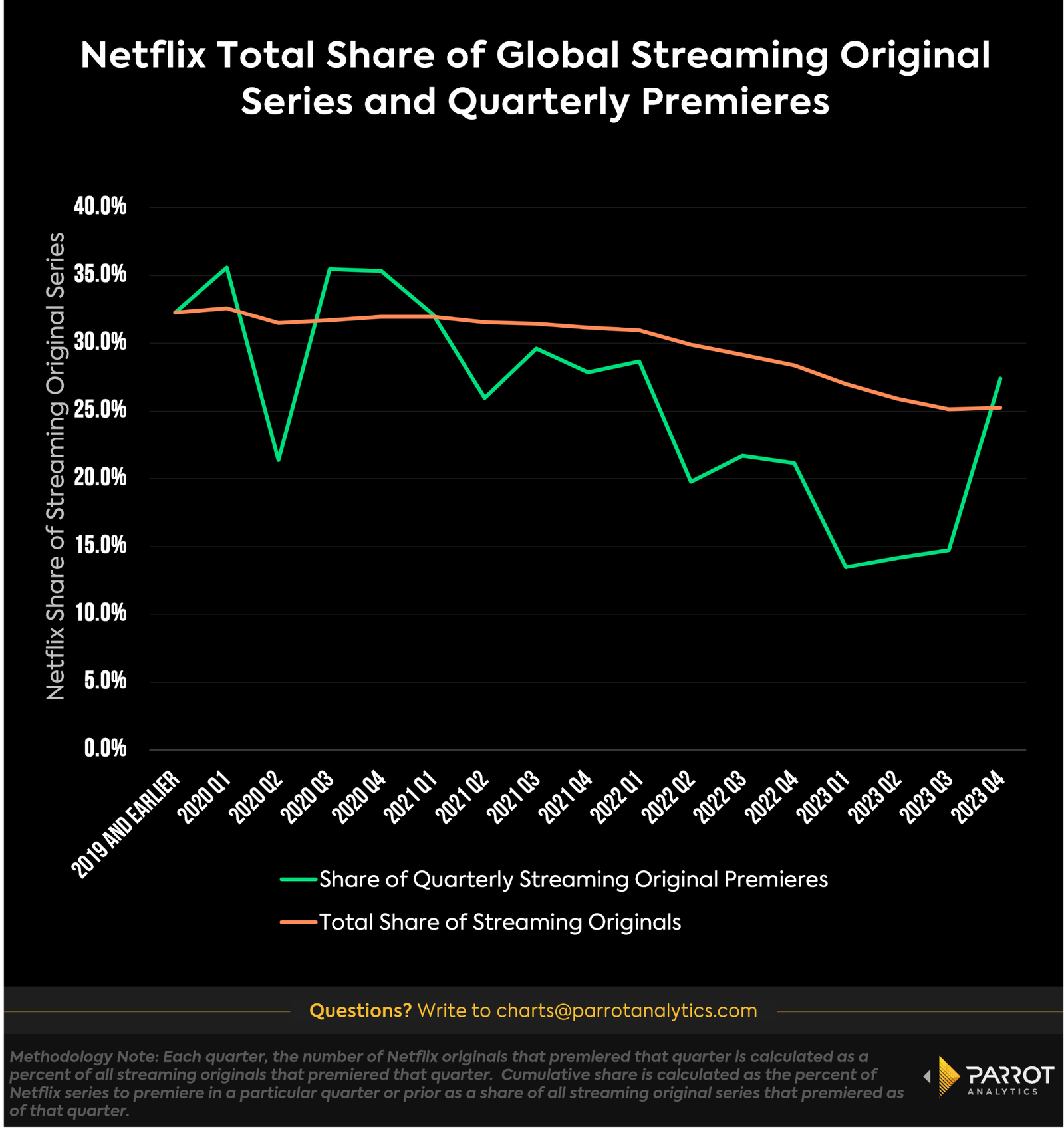

Additionally, by leveraging the platform specific granularity of our supply side data, we can trace the longer term trend of Netflix premieres making up a smaller share of new content premiering each quarter. Netflix’s share of new streaming original titles premiering has fallen from over a third in 2020 to less than 15% for the first three quarters of 2023.

While the broader market may have slowed down its content pipeline in 2023, whether as a result of the strikes or in a bid to improve profitability, Netflix bucked the trend and had a greater number of new series premiere in Q4 than any other quarter this year. The biggest quarter of new premieres for Netflix this year combined with significantly fewer premieres on competitive platforms translated to a large jump in the share of new series premieres on Netflix. This increase in new content likely gave Netflix an advantage in attracting subscribers.

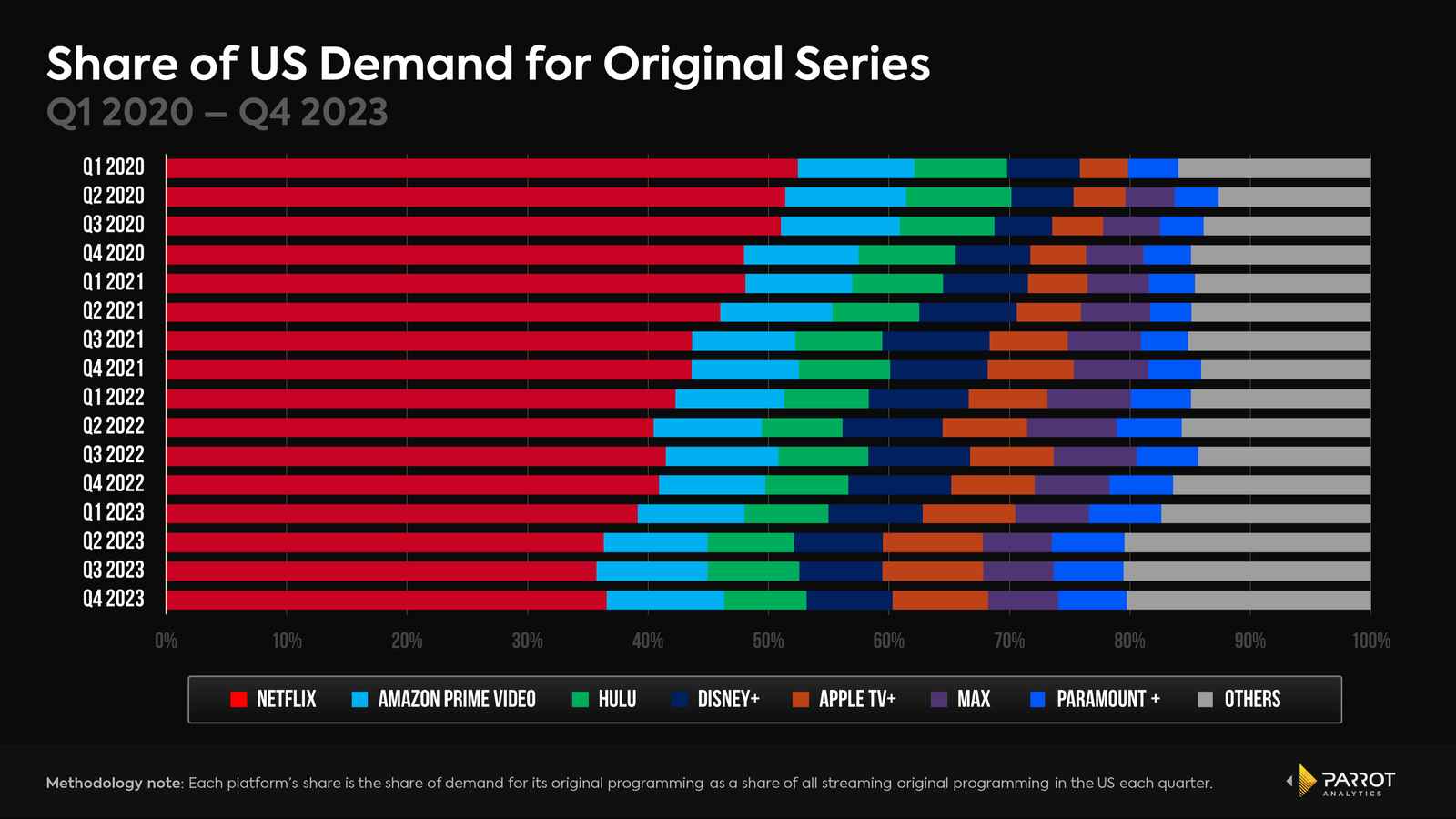

In Q4 2023, Netflix grew its demand share for original series with global and US audiences for the first time in over four years, since before Disney+ and Apple TV+ launched. The wave of new content this quarter helped Netflix reverse the trend of losing US market demand share to the competition. The last time it was able to turn the tide in the US (even if only for a single quarter) was in Q3 2022 when the return of “Stranger Things” gave the platform a massive boost in audience attention.

In Q4 2023 Netflix managed to gain market demand share without new episodes of “Stranger Things,” “Wednesday,” or “The Witcher.” Does this point to a more sustainable shift? The supply side of the equation helps explain the underlying drivers but understanding how this translates to demand for platforms’ content will ultimately show which platforms are able to monetize audience attention.