Image: One Piece, Fuji TV

The U.S. is a significant market for Japanese animation, known as anime. Data from Parrot Analytics reveals that anime accounted for 5.1% of the total demand for shows in the US in July 2023. This strong demand has ignited intense competition among streaming platforms vying for Japanese titles. SVOD platforms value anime because of its potential for subscriber retention; anime's compelling intellectual properties can maintain audience interest throughout the year.

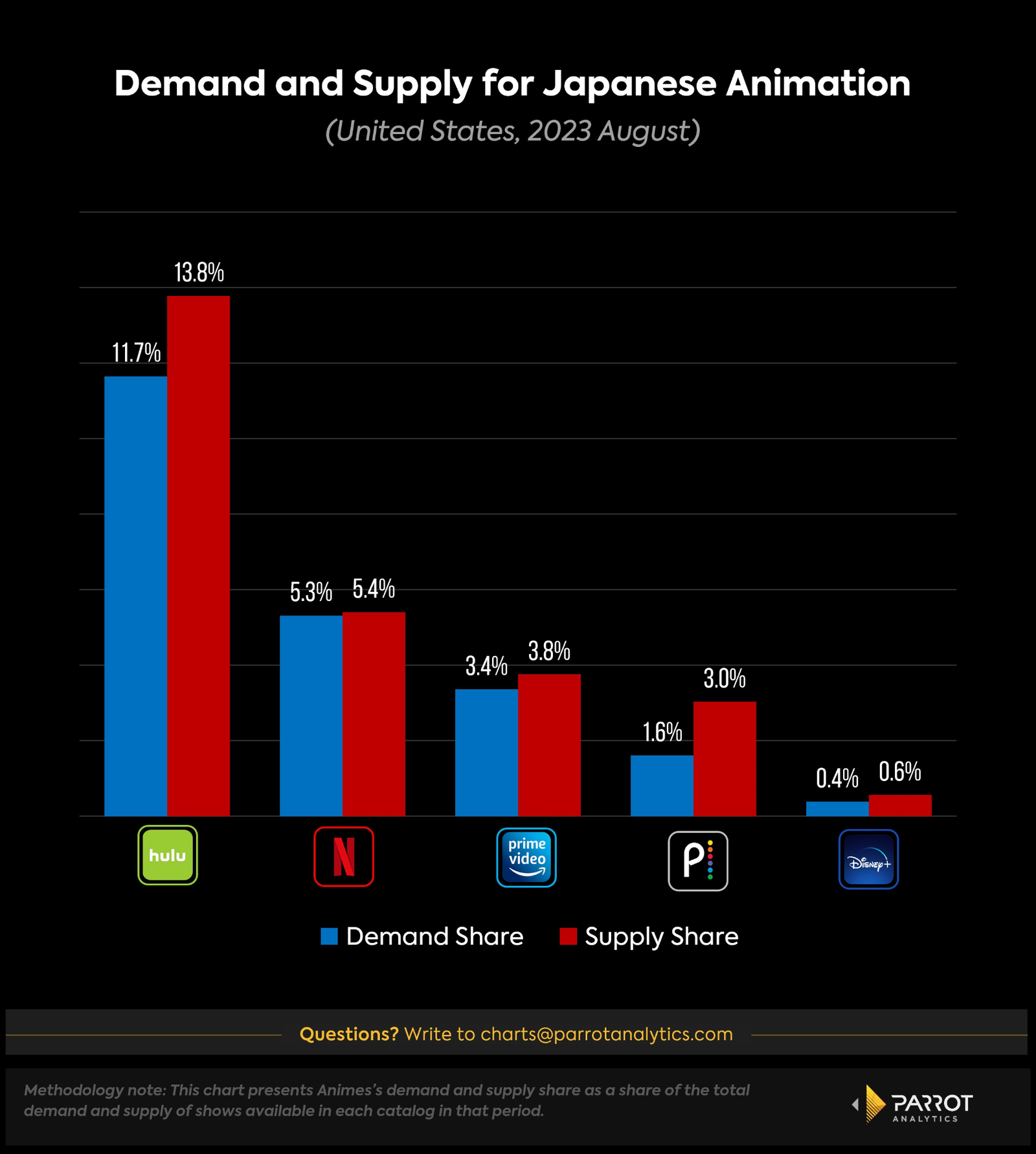

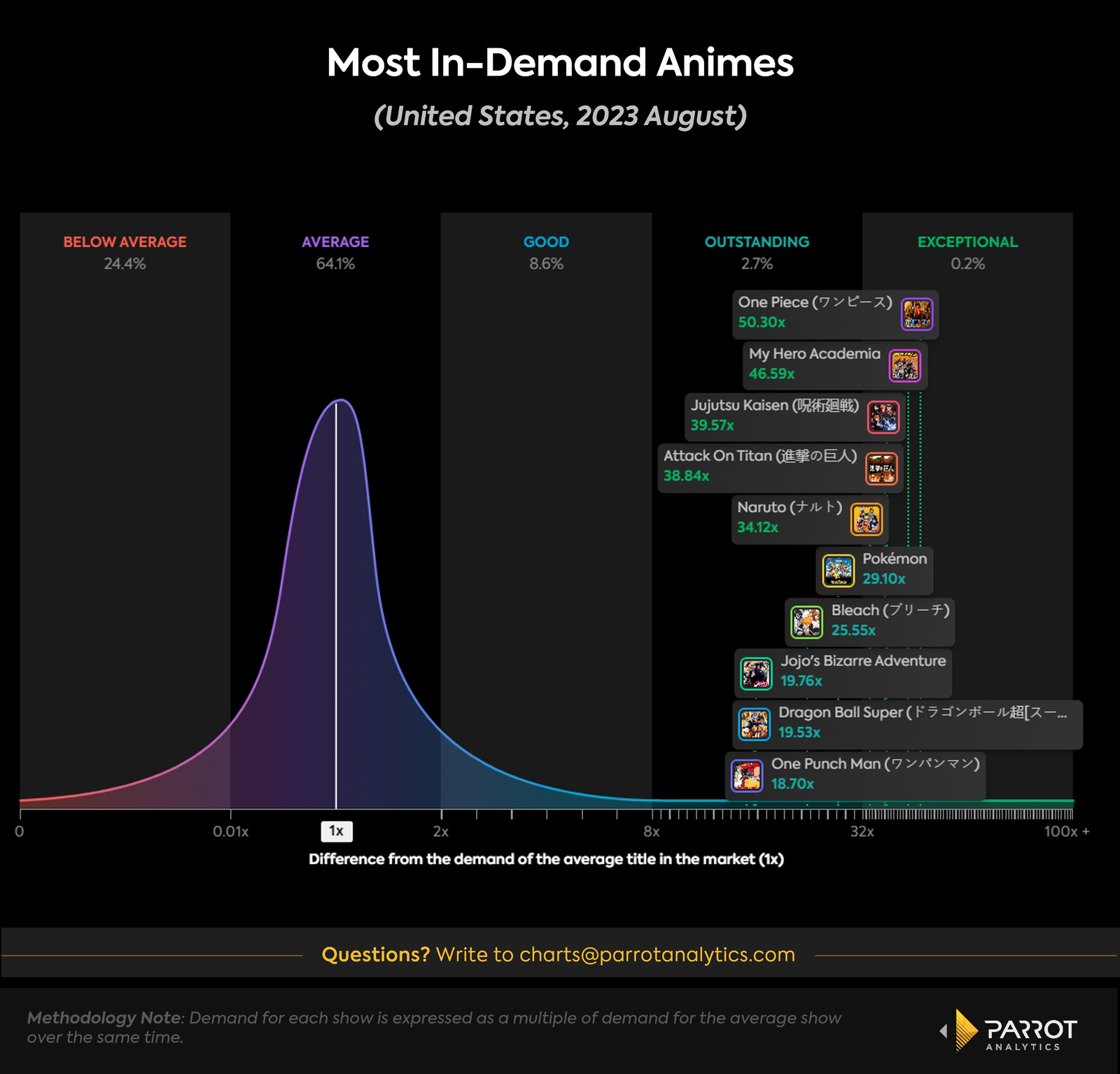

Hulu is at the forefront of this trend, recently launching a dedicated hub for anime and adult-skewing animation. When comparing major streaming services (excluding the anime exclusive Crunchyroll), Hulu boasts the highest demand and supply percentages for anime content. Anime represents 11.7% of Hulu’s overall TV catalog demand and 13.8% of its available shows. Remarkably, Hulu's library features nine of the ten most in-demand anime in August, including exclusive titles like My Hero Academia, Attack on Titan, and Bleach.

Netflix pioneered the anime trend among SVOD platforms as the first to heavily invest in the medium and collaborate with Japanese animation studios. As of now, Netflix holds the second-highest demand share for anime at 5.3%. Its most popular titles include One Piece —the top anime in the U.S. last month, which is gaining traction due to the recently launched live-action series — Naruto, and Jojo’s Bizarre Adventure.

New entrants to the anime scene include Amazon Prime Video, Peacock, and Disney+. They typically invest in renowned non-exclusive titles like Naruto, available on Prime Video, Netflix, and Peacock, and Vinland Saga, accessible on Prime Video and Netflix. Presently, anime constitutes 3.4% of Prime Video’s demand, 1.6% of Peacock’s, and a mere 0.4% for Disney+.

Interestingly, across all major platforms, the supply of anime surpasses its demand, which is unexpected given the genre's popularity in the U.S. This suggests platforms might be acquiring many shows, but only a select few resonate with viewers. This disparity is most evident on Hulu, which has the most extensive anime catalog and the widest supply-demand gap. Conversely, Netflix's minimal difference between supply and demand implies its efficiency in curating its anime selection.

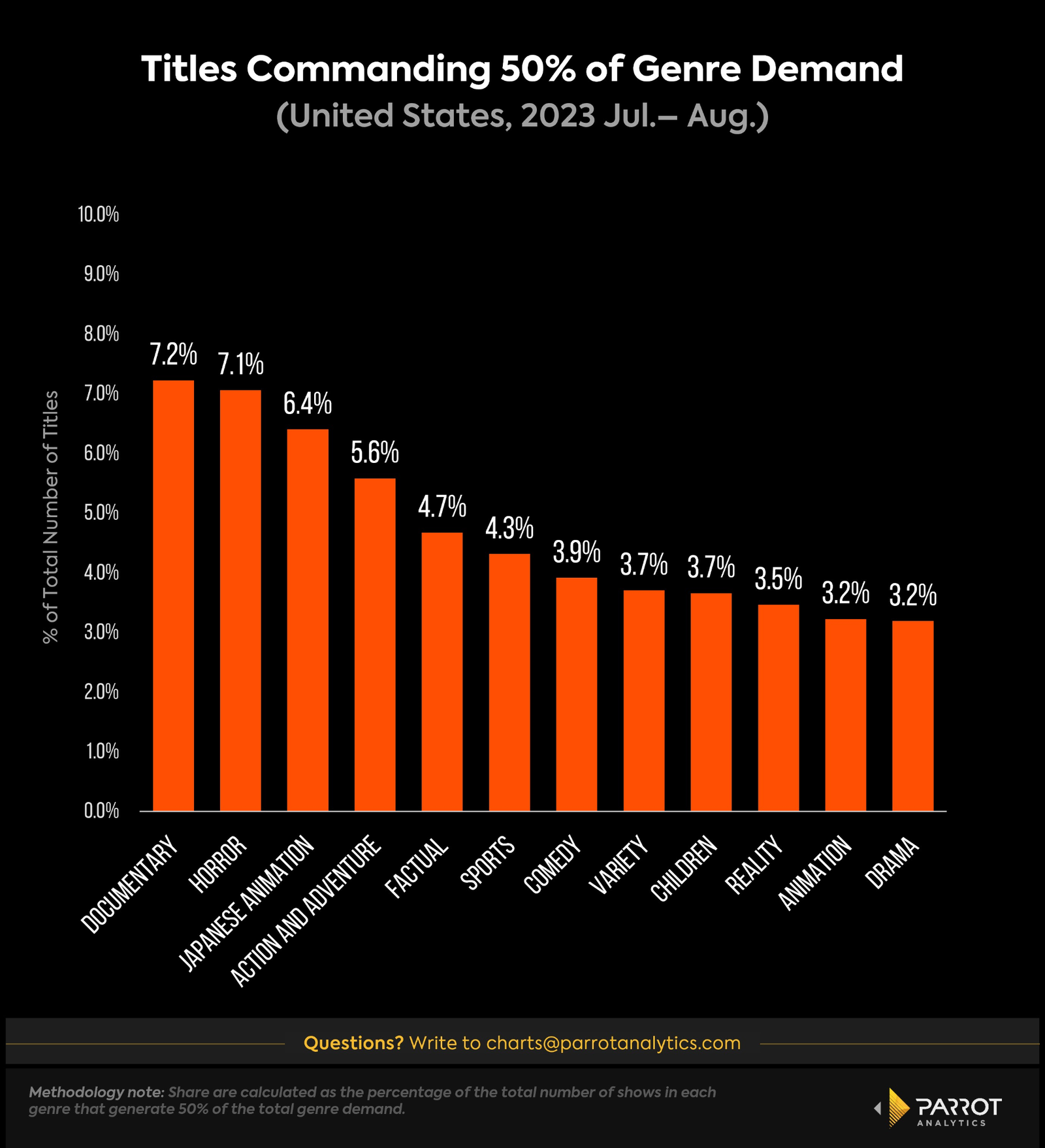

Another noteworthy aspect of the anime genre is its substantial number of successful titles relative to its total volume. The chart below displays the percentage of shows accounting for 50% of the total demand for each genre in the U.S. This metric gauges how demand is spread across various titles. Anime ranks among the genres with a broader distribution of demand across multiple shows, indicating that its appeal isn't limited to just a handful of series. This diversity suggests a rich array of above-average titles in the genre. The enduring popularity of iconic IPs like Dragon Ball, Pokemon, and Naruto, which remain fan-favorites decades after their debut, contributes to this phenomenon.

While all genres are driven by hits, it appears that anime consistently excels in producing them.