Image: Parrot Analytics CEO Wared Seger in discussion with Andrew Wallenstein, Editor-in-Chief at Variety, at Massive Marketing Summit 2018

We’re often asked why we do what we do at Parrot Analytics. The short answer is within our mission statement: We believe in the magic of content and the impact it has on people’s lives. Operating at the intersection of art, science and business within the premium content universe, we’re witnessing one of the most dramatic paradigm shifts across media, technology and consumer behavior. If you’re reading this, you’re undoubtedly witnessing it too.

Yet, these are unsettling times for the industry.

Speaking to hundreds of television industry executives (the term “television” hereon in this piece encapsulating all premium content across platforms), common concerns emerge throughout the value chain. Fragmentation of audiences, consolidation of content providers, rapidly changing business models and the lack of tools to navigate through that complexity leaves much to be desired.

Attend any industry conference and you’ll hear various takes on the same issues, often centered around an ever-increasing list of “new” names in the industry: Google, Netflix, Amazon, Apple, Facebook… whatever latest direct-to-consumer company deciding to own more of the IP earlier in the premium content industry value chain.

When you consider the nuances of an attention economy within the information age we now live in, these “new” developments become more predictable and understandable. According to Cisco’s latest global networking report, video content will constitute 82% of all consumer internet traffic by 2021. Premium content will continue playing a critical role in attracting, retaining, and monetizing consumers for the foreseeable future.

How do we define popularity?

To effectively utilize premium content in an attention economy, however, the industry is now – seemingly overnight – facing two critical challenges. First, measuring the “popularity” of that content on a real-time, cross-platform and country-specific basis – which is what this post dives into. Second, the discovery and recommendation challenge of surfacing the right content to the right consumer, at the right time, on the right platform, through the right device (the subject, perhaps, of a future post).

Measuring the popularity of content used to be relatively easy in the linear world but, despite there being exponentially more data than ever before, it’s in fact become more difficult as we’ve witnessed the rapid proliferation of distribution platforms in recent years. The consequence, of course, has been the emergence of a highly fragmented audience, which in turn is causing our industry to be increasingly less effective in understanding what is really resonating with viewers, what will resonate with them in the future, and via what platform.

So, the television industry has found itself in a rather dire situation. How do we unequivocally say what is popular and prove our claims to clients — whether that’s advertisers or distributors or buyers? How do we drive more informed production and investment decisions?

It was this predicament that inspired an industry-wide movement away from the panel- and survey-based measurement systems it had become reliant upon and into a concerted effort to adopt a much more empirical and holistic approach to understand consumer demand for content across platforms.

The global TV measurement standard

At the heart of this effort to find this new industry standard has been the need to gain a better understanding about the relationship between consumers and content. And this has become more and more complex. Depending upon whether you’re in production, marketing or distribution, different data drives different decisions along the value chain. It leads us to the inevitable question: What is popular?

How do we even define popularity now? The very definition of the term seems to be changing. It’s almost as if we’ve woken up and overnight and popularity is suddenly in the eye of the beholder. What’s popular depends on who you ask. If you’re a TV ad sales person, you live and die by your ad revenue and linear ratings, so what’s popular is what rates well. But it you’re a head of content acquisition at an SVOD platform, what’s popular for you is what’s going to drive subscriber growth and retention; you couldn’t in fact care less about ratings. As recently as ten years ago, 10 out of 10 industry executives would have given the same answer to a question about content popularity. You might just get 10 different answers today.

So, different people have different definitions of what is popular and yet we need a ubiquitous system that allows us to understand what consumers want. So, the goal is to understand how people express their demand for content and to capture and measure that in some way. How do we do that? Well, the answer is that consumer behaviors and activities are actually the very best signal of content demand. The signal that I am referring to here, of course, is population-wide and not a sample.

We now have 4 billion people using the internet and, soon, it will be the entire planet: Whether you’re watching content, streaming it, discussing it, searching for it, reading or rating it, or even illegally downloading or sharing it, you are in fact expressing demand for content. You have to look at all these ways of how audiences are interacting and watching content to get the true, empirical picture of the extent of demand that is expressed for a certain piece of content. The holistic approach of combining the various “forms” of demand expressions (search, consumption, critique, etc.) is critical.

If you just looked at social media chatter, for example, you will most definitely get a skewed picture of popularity based on a few very enthusiastic and prolific fans. We already know that the level of social media chatter varies dramatically based on the genre and type of TV series. What about viewers who rarely tout a show on social media, but continually seek out new shows to stream, download and otherwise just passively consume?

The art and science of popularity

Fortunately, we now have the technology infrastructure and computational power to collect and process massive amounts of data across the internet and around the world. Recent advances in cloud infrastructure, big data analytics and artificial intelligence have provided us the tools to seek out and make sense of consumer behavior and activity; differentiating concepts like “engagement” versus “awareness”, which are so important to advertisers and marketers alike. We can do this by aggregating over 3.5 trillion data points, adding to over a billion new data points each day and applying an ever-improving set of machine learning models to extract actionable insights for clients across the industry value chain.

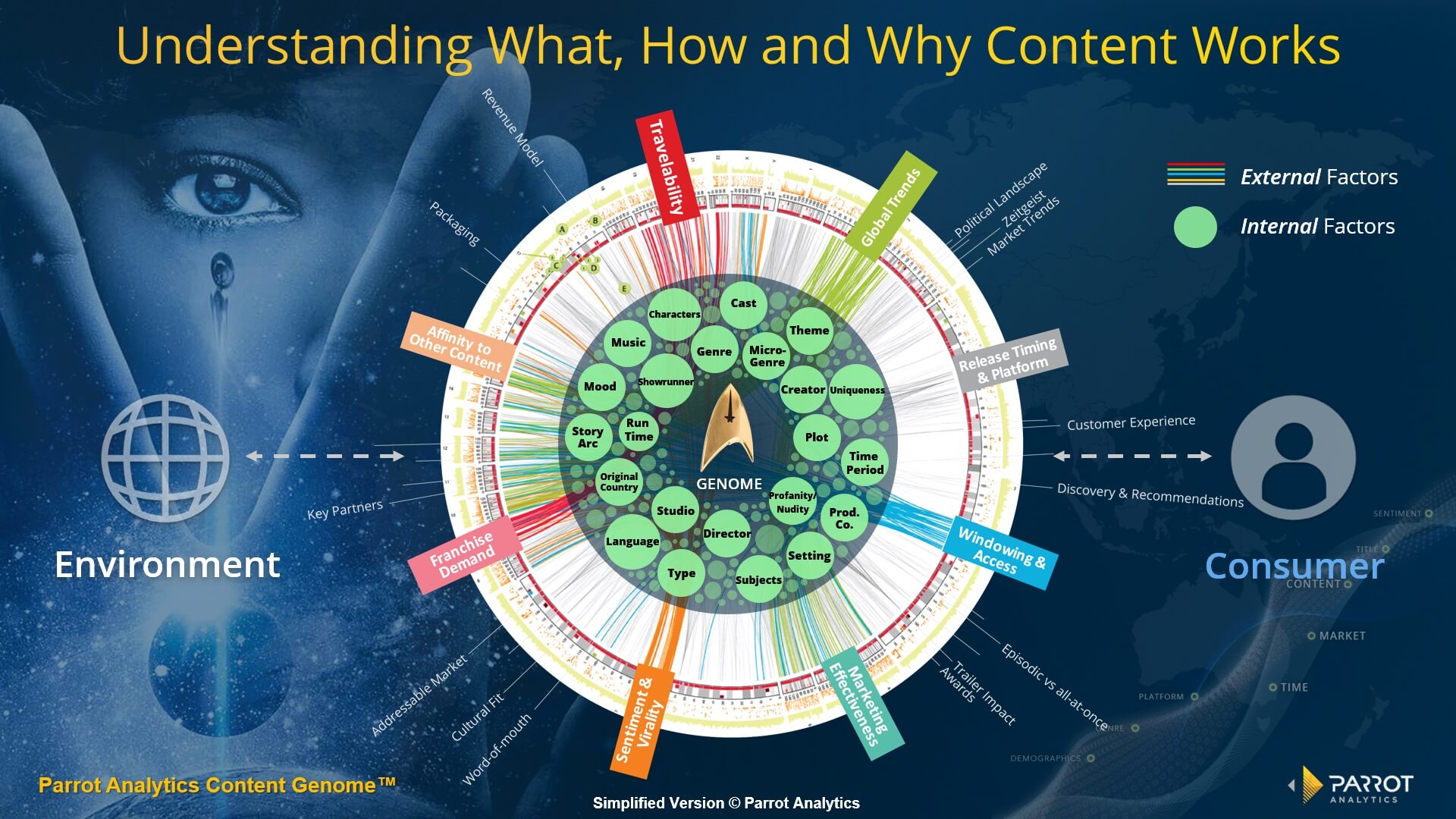

Whether a TV show or a movie “works” is a combination of internal factors specific to that TV show, its genome, a range of external environmental factors, and, how those environmental factors interact with each of the content’s internal characteristics. Quantifying and understanding this is a complex science, as the below graphic illustrates:

Determining what is popular has become a combination of art and science. Today, demand measurement is rapidly becoming the global standard for understanding content popularity across platforms, but we would say that it took world-class early adopters that operated at the intersection of media, science and technology to bring it to life. Now more than any time in our history, despite the fractured state of the television industry, we can know more about audiences’ true demand for content around the world; looking through opaque walls and challenging outdated systems – measuring empirical demand for all types of premium content, in all languages, across all platforms, in all markets around the world.

This is a “tip of the iceberg” moment in the world of global content demand measurement, where we’re only just beginning to realize the full potential of this kind of technology. Beyond assessing demand for specific content titles, we can now look at the popularity of certain genres, sub-genres, themes, cast members, show-runners and even more accurately predict what kinds of content will resonate with viewers in certain territories around the world and what non-content brands they’ll have high affinity with (driving sponsorships and partnerships). There are virtually endless possibilities and opportunities to slice and examine a global dataset unprecedented in its breadth, depth and categorization to answer any business question or challenge at hand. Overlay a Content Genome™ layer on top of the global data and you now also have the ability to find “white spaces” where there will be future demand for premium content not currently available.

Popularity might be in the eye of the beholder, but we are now able to quantify it according to different constituents’ definitions of popularity… and do so more accurately than ever before.

The future is truly exciting.

Wared Seger is the co-founder and CEO of Parrot Analytics, the data science company that enables the television industry to understand global demand for content. Headquartered in Los Angeles, Auckland, London and New York, Parrot Analytics has developed the industry’s first and only cross-platform global demand measurement standard for TV content. With a background in neuroscience, Wared has led Parrot Analytics’ vision and impressive growth from the company’s inception to global expansion. Wared believes that society’s biggest advancements have come from an intersection of science, technology, and entrepreneurship. A content-loving technology entrepreneur at heart, Wared is now leading the industry’s narrative on the “The Science of Popularity”: By reverse-engineering the wisdom of the crowds, Wared’s company Parrot Analytics ultimately connects creators with consumers by helping the industry take the guesswork out of content decisions and providing it with the most sophisticated data-driven insights possible. The world’s most recognized media, technology and consulting companies now leverage Parrot Analytics’ demand data to make more effective content-related decisions.