In a fragmenting market, marketing content to the right audience is harder than ever

At Parrot Analytics, we believe that the content industry is now solidly in the attention economy. What does that mean for content marketing? At its core, the business of content marketing is unchanged: fundamentally, two questions must be answered:

• Who and where are the consumers who might watch your show?

• How do you activate the highest number of these consumers for your budget?

The effect of the new attention economy is that answering those questions is now much more difficult. Even just within the world of serialized visual media – ignoring the countless other demands on consumer attention - consumers have more options than ever for content to watch in this era of ‘Peak TV’. This alone makes it harder and harder for a piece of content to break through the noise and find its audience.

Crucially though, the media landscape itself has fundamentally changed in just the past few years. There are more platforms than ever for consumers to both discover and/or view content on, fragmenting traditional advertising targeting. Conventional demographic-targeting media mix planning is increasingly being shown as inadequate for the modern world, with several high-profile examples of legacy media companies betting big on expensive content that never found the audience hoped for. Netflix, one of the most data-driven media companies on the planet, does not make content plans based on the demographics of its users. As Todd Yellin, Netflix’s VP of product innovation told Wired “Geography, age, and gender? We put that in the garbage heap.”

These factors make it more critical than ever to answer these two questions accurately.

The 2020s approach to planning marketing campaigns.

Luckily, the attention economy arrives alongside content and audience Big Data. Using actual consumer behaviour – not dependent or biased by survey self-selection or imprecisely estimated via age & gender stereotyping – offers a path to optimize marketing based on real data.

This is what a data-based marketing plan for the 2020s looks like:

This is the Parrot Analytics Marketing Planning workflow. After this workflow, you will have clarity on WHO is best to target, WHEN is best to engage and can partner with your marketing agency using the audience profiles to plan HOW to reach them. These are the steps we will take to reach this:

1) We will use the Content Proxy Analysis or data from previous season to understand your content.

2) We will determine what other content your potential audience enjoys.

3) We will determine what brands/influencers your potential audience is interested in.

4) We will identify your audience profiles based on the above and from these profiles, plan the best channels to reach them.

5) We will plan your campaign flighting using demand profiles for your market.

Step 1: Understanding the content to find the right audience

In order to understand what the potential audience is for a piece of content we must first understand that content. For marketing Season 2+ of an existing show, this is very easy as we will already have extensive post-airing audience data about the title.

However, the most crucial marketing of a show’s lifetime is the first season. Yet for the first season of a pre-release title there is little existing audience data to draw on. This means the first season marketing is both the most important to get right, yet the hardest to plan!

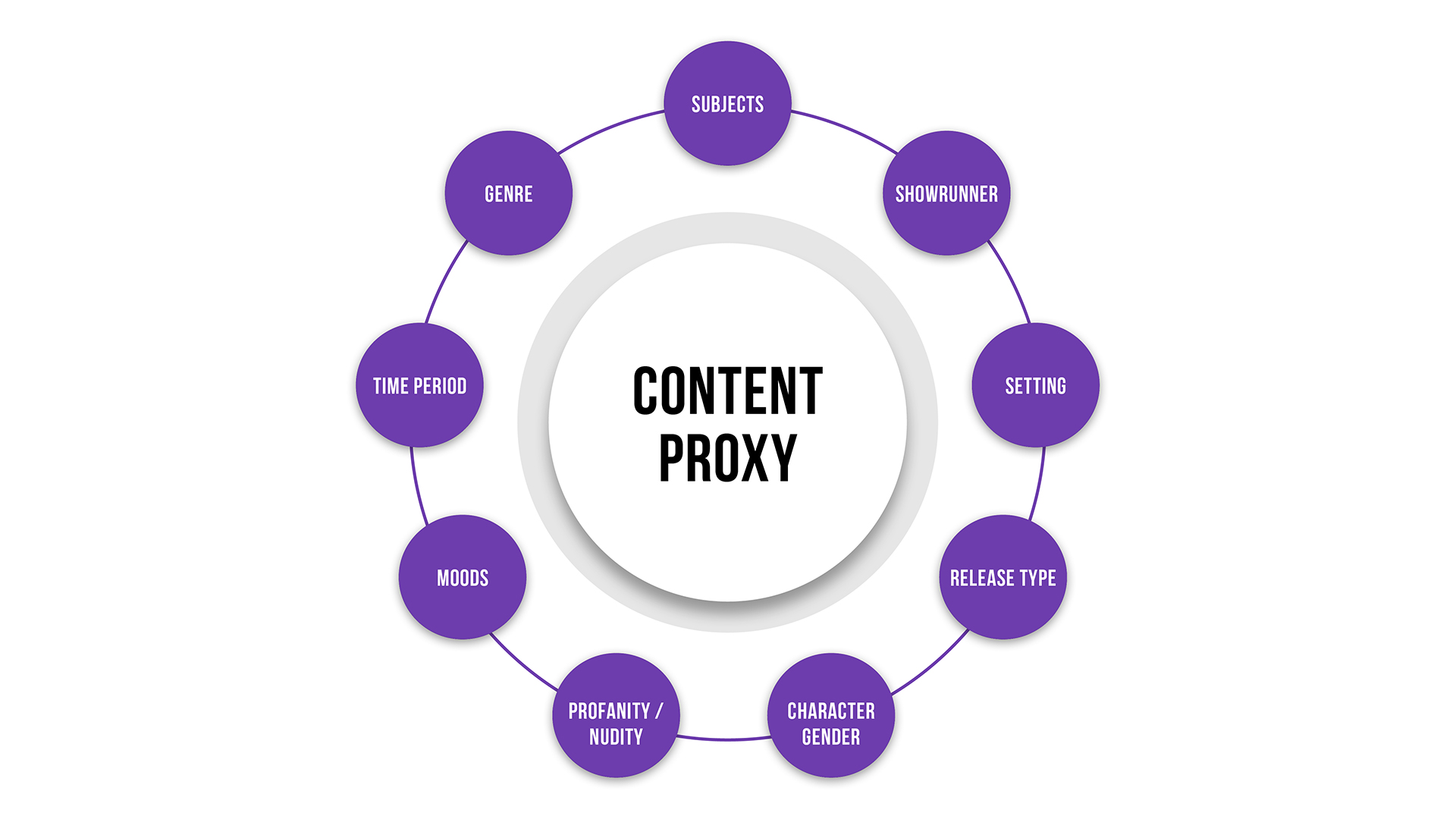

To fill the data gap, we can use Parrot Analytics’ content genome to conduct a Content Proxy Analysis on the content. This takes the fundamental factors (‘genes’) of the new show – the genre, subjects, themes, strength of IP, etc – and assesses their appeal within your market.

The ‘content proxy’ resulting from this analysis represents the potential such a show would have if it did exist in the current market, based on how shows with related genes have already performed. As such, it can be used in place of the pre-release title.

To illustrate this, consider a pre-release present-day teen drama. The very simplest content proxy is to only consider how the market responds to teen dramas – the typical market demand for teen dramas is then our proxy. To make this more useful we might then refine it to the typical demand of serialized teen dramas.

However, as we continue to refine and improve the proxy the more complicated the modelling becomes! Factors become interdependent – for example, all content using an existing IP has higher potential than a new IP, but this difference in potential is even greater if the content is a drama series.

The Content Proxy Analysis involving the full content genome is only possible using machine learning algorithms and creates the most accurate results available in the industry today.

For this article, we will take as our example a teen drama that is approaching its Season 1 premiere in the United States. The genomes of this example teen drama include: New IP, Highly Serialized Plot, New York City Setting, Strong Female Characters. We have created a content proxy for this example that we will use for the rest of the workflow.

Now we understand our content, we can determine where the market’s activatable audience for it lies.

Step 2: Understanding the taste clusters for the content

Taking our content proxy, we can now fit the title within the market. To do this, we use Content Affinity.

Content affinity is a measure of how strongly related consumption of content is to consumption of other content. This is measured by observing consumer behavior directly, basing the metric on the number of people who have watched both titles on video download and streaming platforms as tracked by Parrot Analytics. As associations between titles are market-specific, so is affinity.

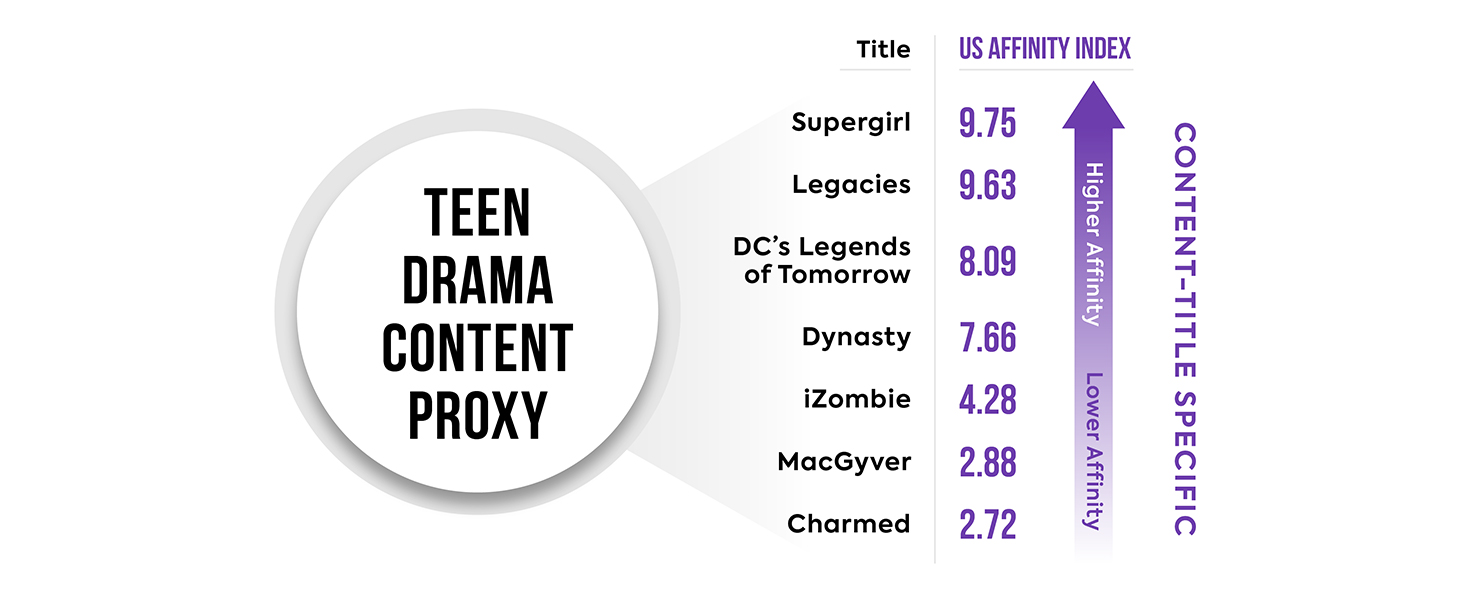

This graphic shows the content with the highest affinity to our teen drama content proxy in the USA. Supergirl is the closest related show: if our proxy was a currently airing title and you asked a fan what other show they enjoy, the most common answer would be Supergirl.

For audience activation purposes, individual titles can be misleading to draw audience profiles from. We therefore take the content affinity data and analyse them to identify ‘taste clusters’ of titles. These taste clusters are groups of titles that have a strong consumption relationship to each other. Simply put, the content in each cluster is generally enjoyed by the same people:

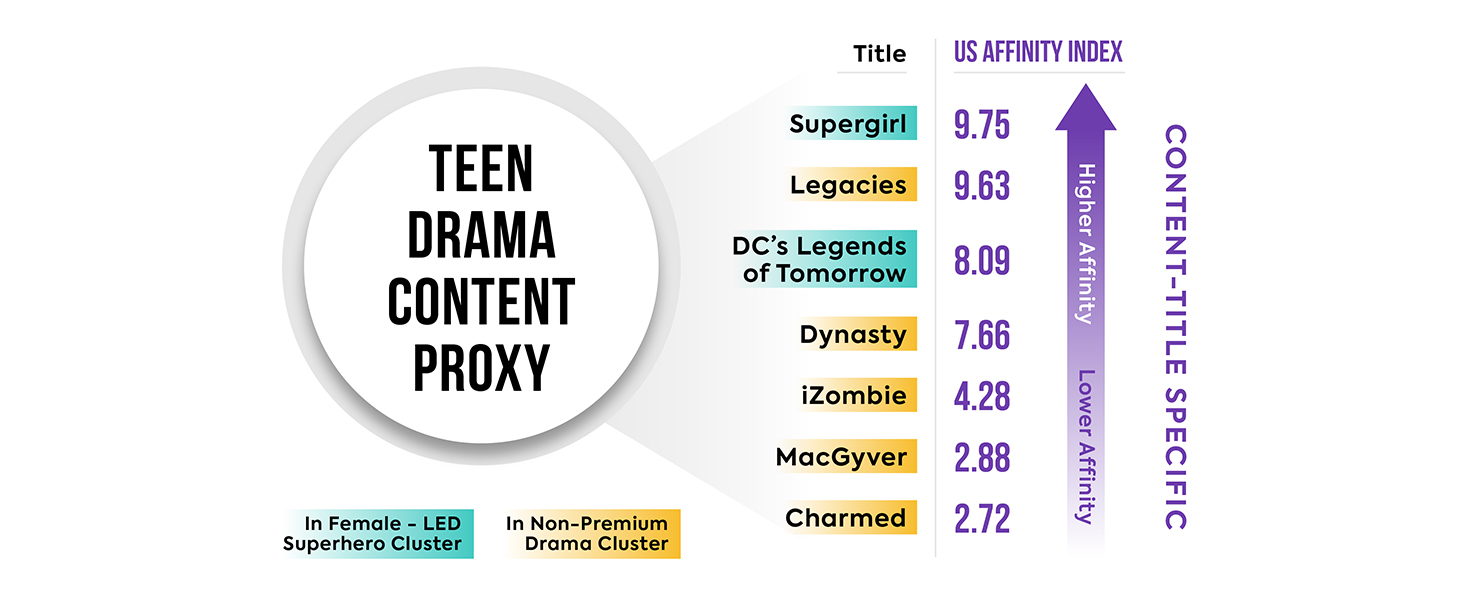

Here’s how our same high affinity titles look with taste cluster information. Analysis has revealed that for these most related titles, all of them fall into two taste clusters. There are more clusters in the full dataset, but for simplicity we will just discuss these two.

Most of the high content affinity titles to our content proxy are what we have labelled as the ‘non-premium drama’ taste cluster. The cluster includes other titles from the teen drama subgenre, like iZombie and Charmed, as well as dramas from other subgenres like the telenovela Dynasty and action drama MacGuyver. This highlights the fact that a show’s subgenre does not tell the full story when it comes to fitting a title within a market.

However, another taste cluster includes multiple superhero series that feature female leads like Supergirl and DC’s Legends Of Tomorrow. Two of these shows have very high affinity to our proxy. This shows that the audience of these types of shows could be activated into consumers of our content. This result showcases one of the strengths of using actual consumer behaviour: it may reveal unknown advertising vectors that traditional demographic-based profiling would not discover.

A second strength is that Parrot Analytics consumption data is platform agnostic. While internal data for existing titles may show which titles on the same platform have a strong viewer overlap, Content Affinity can discover strong overlaps for off-platform titles. This may reveal new potential audiences who could be attracted to your platform with this new content.

Step 3: Understanding the brand affinity for the content

Now we understand both our content and the content taste clusters that our content sits in, but we still need to detail our target consumer groups further.

Understanding which brands and influencers the potential audience for our content engage with most will allow us to identify commonalities and so build profiles of target audience segments.

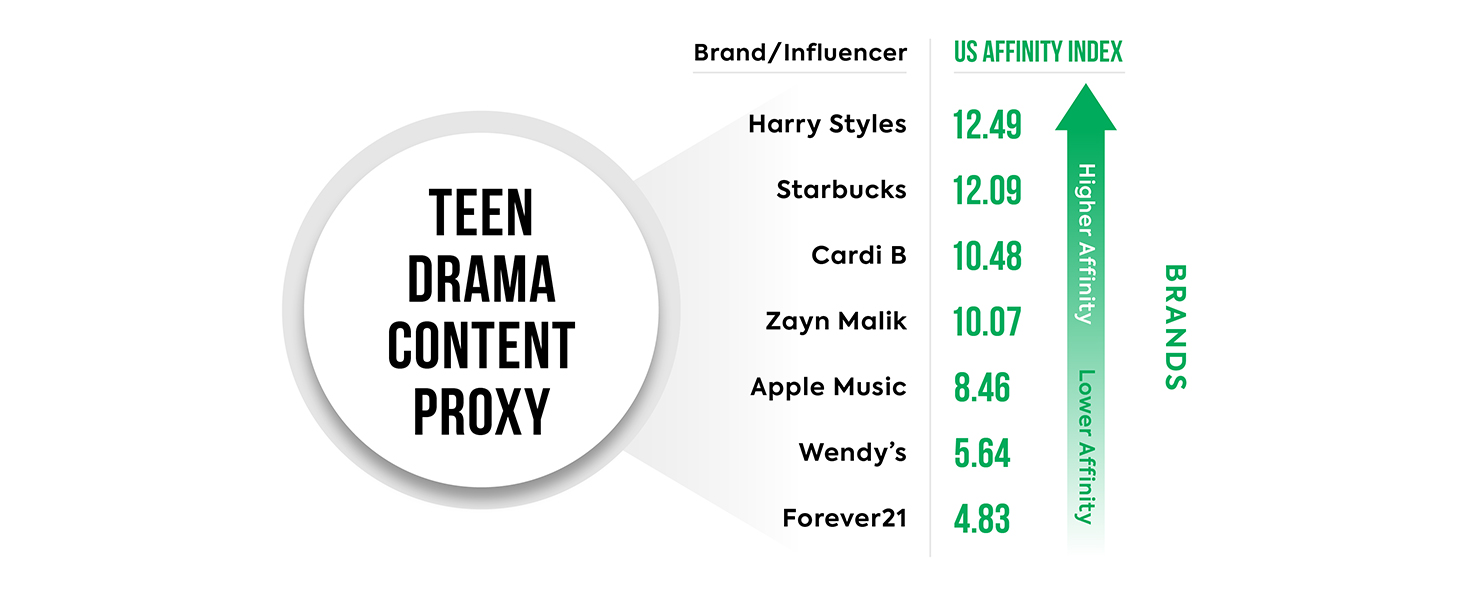

To do this, we carry out a Brand Affinity Analysis. Brand Affinity follows the same affinity method as step 2, but instead of content consumption behaviour we analyse brand consumption behavior.

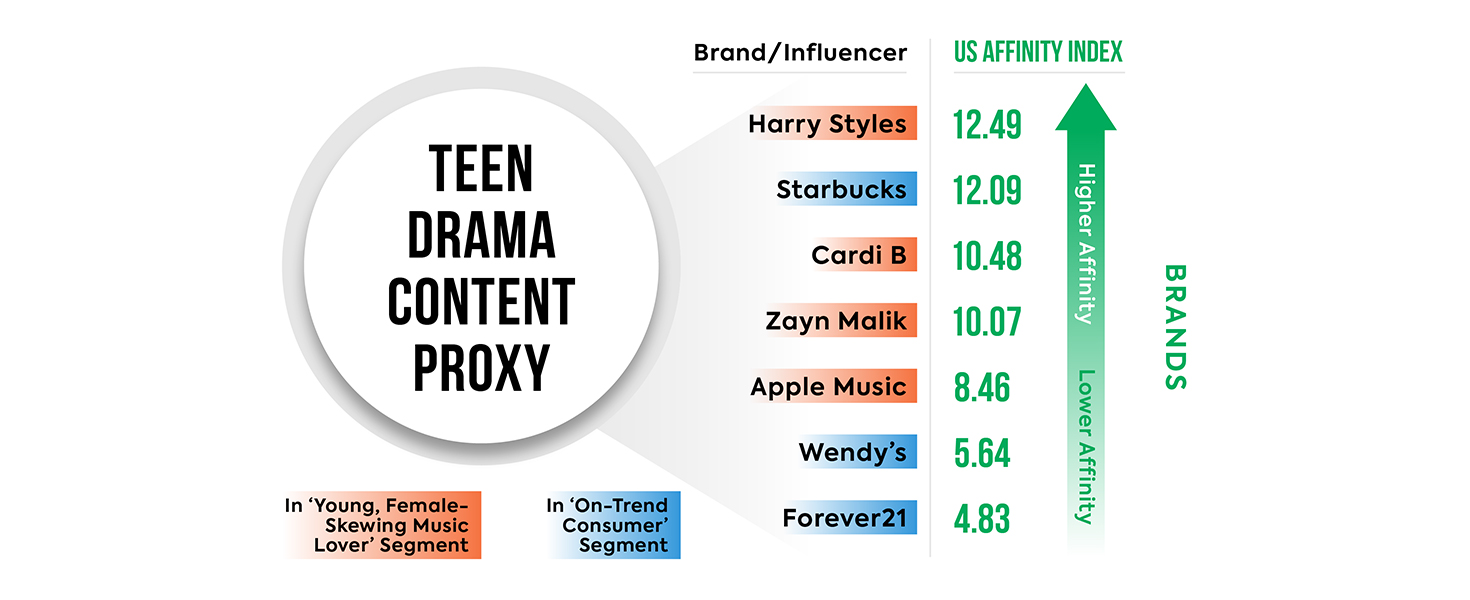

The graphic shows the brands/influencers with the strongest affinity to our content proxy. As with the content affinity, these affinity results are most useful when they are transformed into clusters of like-minded consumers, which we refer to as audience segments:

As we discovered with content affinity, the highest affinity brands/influencers for our content proxy fall into two audience segments.

The largest of these is the pink segment, which we have categorized as ‘young, on-trend, female-skewing music lovers’. The top brands this segment is interested in are music platforms, while the top influencers are all musicians. We can infer this group is young and majority female from the musicians that rate highly in the segment. In total, this segment represents around 20% of the audience for our content proxy.

The yellow cluster is slightly smaller at 15% of the audience. The top brands for this segment include fashion retailers and food brands. The top influencers in this segment are Instagram fashion bloggers, although none appear in the top eight presented here for the content proxy.

As in content affinity the remainder of the audience is represented in more, smaller segments in the full analysis. These audience segments will inform other marketing approaches, however for clarity we will focus on just these two largest segments.

With content taste clusters and brand/influencer segments we now have two insights that give us context of the preferences of the audience most likely to engage with our title. We can now build a profile of our target audience to plan exactly how to activate them.

Step 4: Build your audience target profile

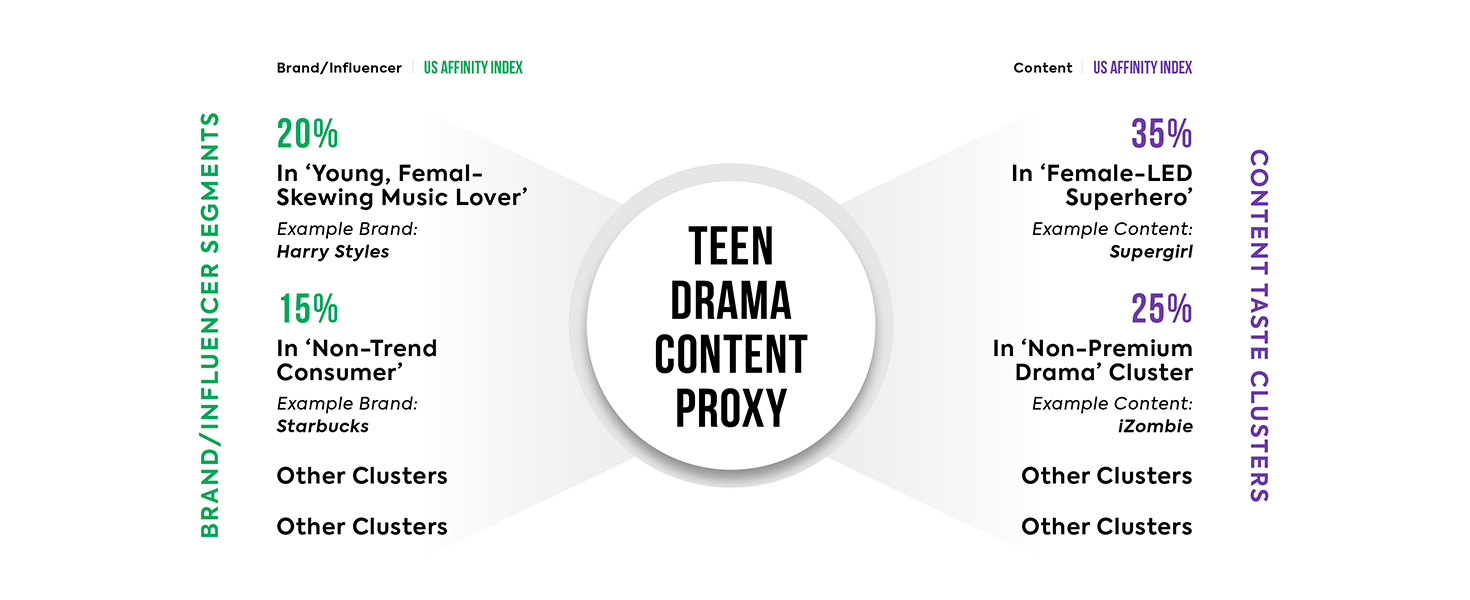

Now, we can combine the content and brand data to obtain comprehensive profiles of the target audience for our content. A show will have multiple content taste clusters and audience segments to construct profiles from. The following image shows the most important profile for our Teen Drama example:

Here, the size of each audience element is an indication of how important it is to activate them with campaigns. This is a way to prioritize marketing efforts if you do not have the resources to target every profile.

Now you know the profiles of your potential audience and their relative importance, you can decide on which channels to use to reach them. Local content marketing planners will of course know how best to use these profiles, as cultural and social mores are different in each market.

For our United States teen drama example, the profile above suggests that our largest single taste cluster is the ‘Female-led Superhero’ content cluster. Given the high importance of reaching this audience, investing in targeted TV ad buys to reach fans of the closest aligned content in this cluster (e.g. Supergirl) are likely to give high reach. To double-dip on this audience profile, the TV buys could be supplemented by a one-to-one campaign leveraging social media and/or programmatic targeted to fans of the same content.

Another campaign is suggested by the strong affinity to music seen in the largest brand segment. We can reach our target audience there using a one-to-many digital campaign on music hubs such as Spotify.

Both approaches let us build awareness of our content to the exact consumers most likely to want to engage with it. Other audience segments will suggest different channels, with the level of investment each segment warrants depending on the size of the segment.

Now that the segments and their importance to the overall campaign is known, you can use other resources like Scarborough, MRI/Simmons and IPSOS to plan the perfect media mix.

Step 5: Flighting analysis

The final step in activating audiences is when to deploy your advertising resources for maximum impact. Too late and the show ‘comes out of nowhere’ and risks not having an initial audience to spread the vital word-of-mouth personal recommendations. Too early, and you risk decay reducing your mindshare by the time the show premieres.

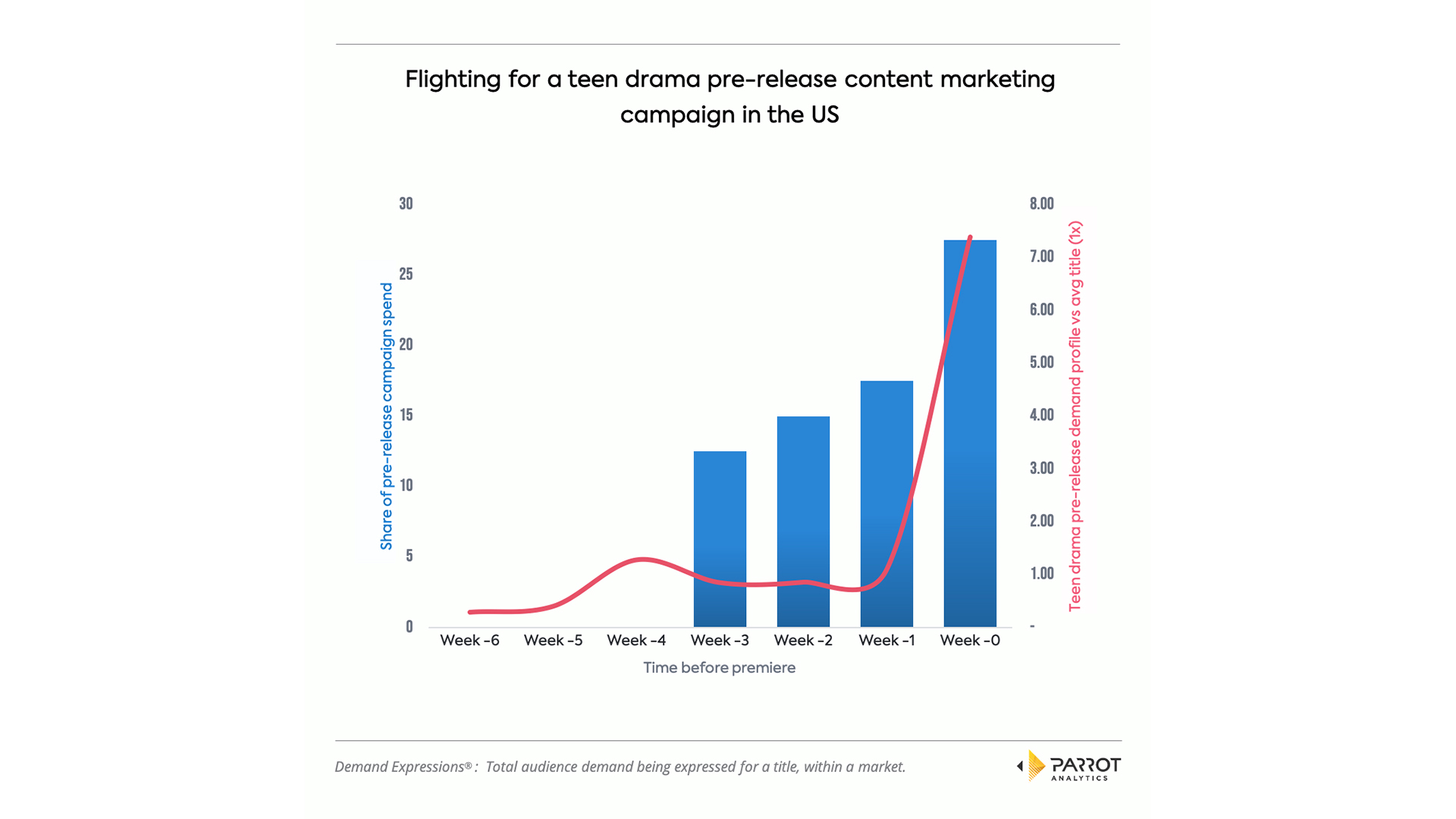

Using premiere data from hundreds of high-value titles, Parrot Analytics have modelled the pre-release demand for shows with different content. From this model, we can recommend how to flight the advertising spend on your title for optimal demand impact, taking into consideration media half-life.

Continuing our example, this chart shows the typical demand profile for a teen drama premiering in the US alongside the optimal flighting for a teen drama pre-release campaign in the USA.

Owned marketing can be active long before the show’s premiere, but along with other approaches ramps up in the months immediately prior to the premiere date. The graph shows the impact of owned marketing on the demand before paid marketing begins. 4 weeks before the premiere, the official trailer is released on the show’s official social media accounts. This results a sizable boost to show demand that week.

The paid campaign begins after this, three weeks prior to the premiere. The campaign’s goals are twofold. Firstly, the paid marketing works to counteract decay from the trailer event. Secondly, it works to activate wider audiences who have not organically engaged with the prelaunch marketing. An example of this is buying TV spots for the trailer targeted at closely aligned shows, as outlined in the previous step.

The graph shows the impact of the paid marketing. After the trailer event, the demand does not return to the pre-trailer baseline, instead remaining twice as high.

As the premiere becomes imminent the share of the campaign spending should increase sharply, with the highest spend being the week of release. Every likely viewer identified as part of one of the audience profiles should have been activated by either owned, earned and/or a paid channel. They now know what actions to take to access your content on release, whether that’s tuning in to Channel X at 9pm, subscribing to Platform Y by the 10th or downloading your app.

The audience profiles from the previous step can be utilized to determine campaign ordering: initial paid marketing can be targeted at highly convertible segments to build awareness for the biggest fans. Later, more costly but wider campaigns aimed at broader segments can occur later. This then builds on the earlier campaign: potential but undecided viewers who are reached at this stage may decide to research further, where they encounter enthusiasm from the fans already activated.

Recapping the audience activation plan for the attention economy

After this workflow, you will have clarity on WHO is best to target, WHEN is best to engage and can partner with your marketing agency using the audience profiles to plan HOW to reach them.

6) Using Content Proxy Analysis or data from previous season, understand your content.

In our example, we used a content proxy to determine the potential of a pre-release teen drama

7) Determine what other content your potential audience enjoys.

We found the taste clusters our content proxy sits in and the specific shows it has highest affinity with.

8) Determine what brands/influencers your potential audience is interested in.

We uncovered audience segments for our content proxy, the largest of which was young, on-trend, female-skewing music lovers.

9) Identify your audience profiles based on the above and from these plan the best channels to reach them.

Knowing the content and interests of our most important audience segments, we identified Spotify and targeted TV buys as the ideal channels.

10) Plan your campaign flighting using demand profiles for your market.

Using pre-release demand models, we know how much of our campaign budget to invest each week for maximum impact.

In the next article, we talk through how demand data can be applied past the planning state and in your marketing campaign management. Specifically, we show how demand allows effective campaign tracking and post-campaign analysis in the attention economy.