Parrot Analytics has recently taken an in-depth look at SVOD demand trends in Australia, including:

- The top 20 digital streaming shows in Australia across all SVOD platforms in the country.

- Which genres Australian audiences prefer and how these preferences have changed over a period of 12 months.

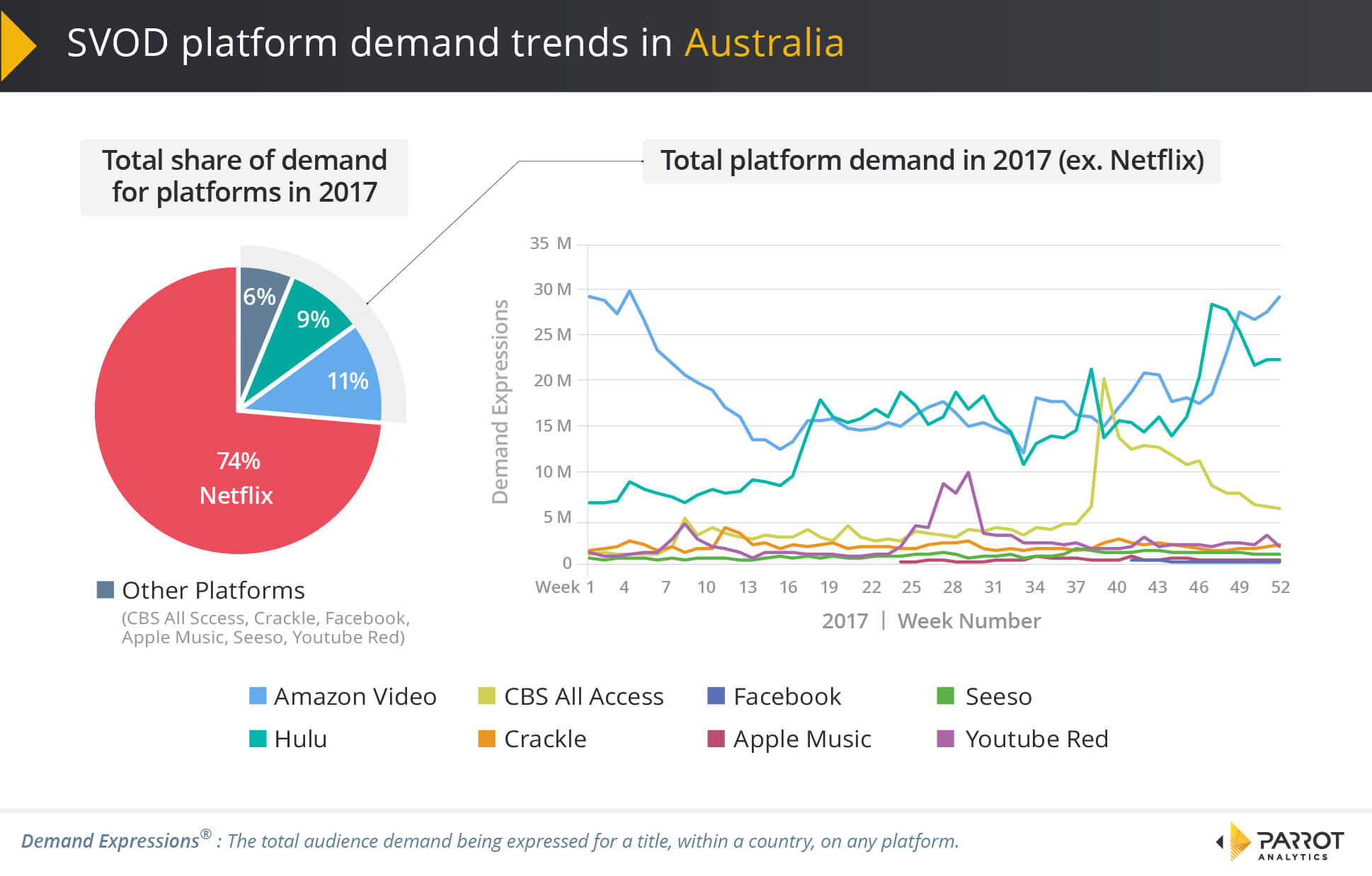

- The market share of the major OTT platforms Netflix, Amazon Video and Hulu in Australia.

- How the platform share of audience demand changes over time for Apple, CBS All Access, Crackle, Facebook, Seeso and YouTube Red.

We are pleased to reveal the following findings of our comprehensive study.

Top SVOD Platforms and Streaming Television Shows in Australia

Netflix had nearly 75% of the demand share in Australia, followed by Amazon Video which became available in the market in late 2016. Despite Hulu’s growth in demand over the year, Amazon remained the second-most in-demand SVOD platform.

In contrast to many other markets, 13 Reasons Why was the most popular digital original series of 2017 in Australia instead of Stranger Things. In addition, the most popular non-Netflix digital original series was Amazon’s The Grand Tour instead of CBS All Access’ Star Trek: Discovery. These rankings indicate that Australia has slightly different tastes than other English-language markets.

Wolf Creek, on Australia’s Stan, was more popular than CBS All Access’ other major title, The Good Fight, and all titles on Crackle and YouTube Red except for Escape the Night.

Top TV Series Genres in Australia

Demand for most individual genres remained fairly steady, but drama increased over 2017. Science fiction also increased at the end of the year due to the release of Stranger Things and Star Trek: Discovery.

For more information, check out the most up-to-date Australia television industry overview.