Image: The Bear, FX

Hulu has remained a top contender in the streaming landscape in recent years. With the third-largest TV and total catalog among SVOD platforms (behind Netflix and Max), Hulu attracts an audience to the Disney Bundle that seeks more than just Disney content.

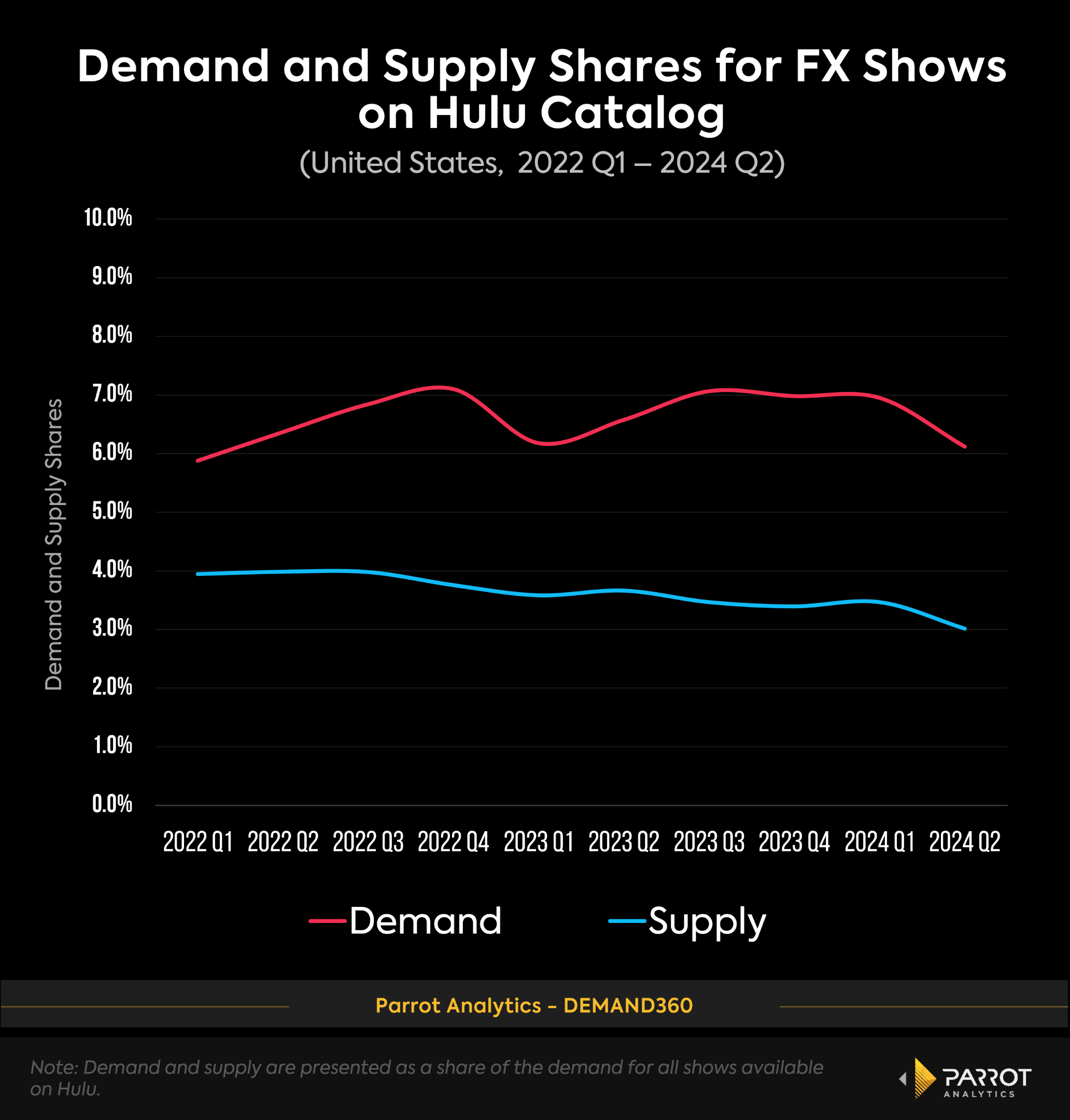

Licensed cable network shows play a crucial role in Hulu’s strategy, especially since the platform heavily relies on such content. Notably, Hulu is the exclusive broadcaster of most FX titles in the US. Over the years, FX has contributed around 3-4% of the TV shows available on Hulu, but its content drives about 6-7% of Hulu’s TV demand—demonstrating how FX shows consistently outperform their availability, sometimes doubling their impact.

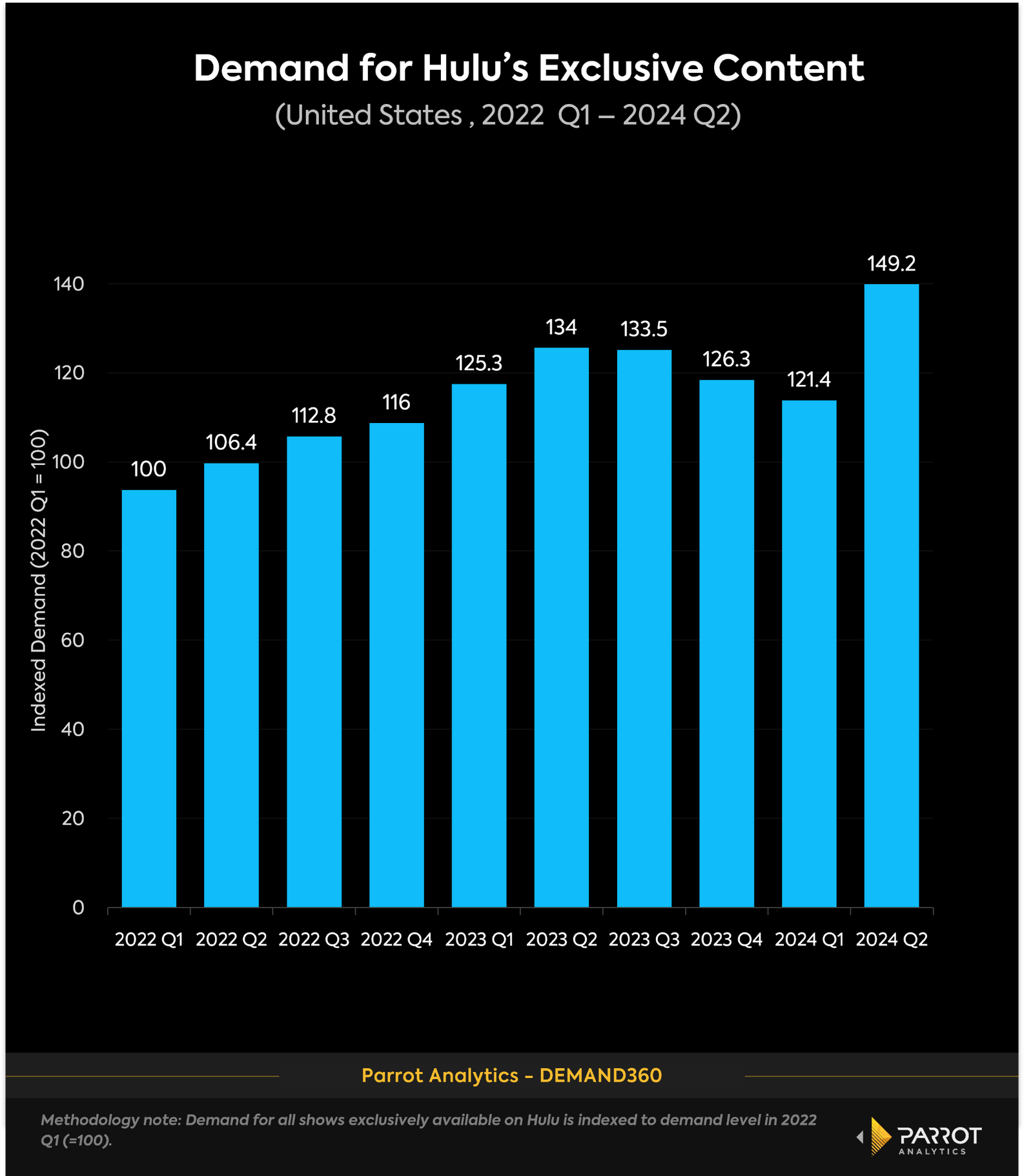

As of Q2 2024, FX held the fourth-largest demand share in Hulu’s TV catalog, following Fox, ABC, and Hulu originals, all of which have more titles. Beyond their popularity, FX shows also bolster demand for Hulu's exclusive content. According to Parrot Analytics Streaming Metrics, which provides visibility into the key metrics driving financial performance for major streaming platforms, demand for exclusive content is one of the most important factors influencing churn rates on streaming platforms.

Hulu’s total demand for exclusive content (TV + movies) is at an all time high in 2024 Q2 while its churn rate dropped to an all-time low of 3.4%, down from 5.7% last quarter, driven by releases like FX's “The Bear” Season 3 and “Shogun” (whose season aired across Q1 and Q2). Both shows combined popularity with critical acclaim.

Prior to Q2 2024, Hulu’s peak demand for exclusive content occurred in Q2 2023, coinciding with the release of “The Bear” Season 2. During that time, Hulu’s churn rate decreased from 6.2% in Q1 2023 to 4.4% in Q2 2023, also according Parrot Analytics’ Streaming Metrics’ estimates. This reduction wasn’t due to a single show but to a broader strategy of investing in high-quality exclusive content, which keeps subscribers engaged and reduces churn.