Disney wraps up the latest cycle of media earnings in the wake of CEO Bob Iger suggesting the company’s linear assets are up for sale.

Disney is still the market leader in corporate demand share, a good sign for longterm streaming health and short-term ability to ride out extended strikes by leveraging highly in-demand library content.

However, Disney+ has declined in streaming originals demand share both globally and in the US for two consecutive quarters, coinciding with a dip in subscribers.

Breaking Up?

Following decades of industry consolidation — much of it led by Disney and Iger during his first tenure as CEO — both Disney’s CEO and Wall Street have hinted towards a preference for scaled down versions of leading media corporations.

Paramount Global shares saw a brief bump following the news that it is selling off publisher Simon & Schuster to private equity giant KKR, after the US Justice Department denied a proposed merger with a rival publisher. While an even bigger acquisition (Microsoft-Activision) is set to go through, will this regulatory uncertainty, combined with the recent KKR deal, open the flood gates for more linear media assets being sold off to private equity?

Iger has tapped his former top deputies, Kevin Mayer and Tom Staggs, as consultants to help navigate these choppy waters. Their current company, Candle Media, is backed by even bigger PE firm Blackstone, and these two will have influence over the future of Disney’s size moving forward.

ABC has been mentioned as possibly being up for sale, but with lucrative sports rights (including the NBA Finals and two Super Bowls in the next eight years), it is unclear who would buy it and how Disney would replace that revenue.

Content Demand

Disney+ has posted subscriber losses in each of the past two quarters, coinciding with shrinking demand share for streaming original series during the first half of 2023. As recently as December 2022, Disney+’s originals share appeared on its way to taking over Amazon Prime Video for second place in the US. Instead, Disney+ now finds itself in fourth, overtaken by Apple TV+ in the most recent quarter.

Disney+ also stayed flat in on-platform demand share but lost a position to a surging Paramount+. Hulu’s share ticked down and it got leapfrogged by Max for second place in the category. That said, any future combination of Hulu and Disney+ onto the same service is poised to jump well ahead of Max and Netflix as the most in-demand platform with US audiences when it comes to total catalog, which includes both original and licensed movies and TV series. Hulu is crucial to Disney’s ability to compete for adult audiences and stay among the top three streaming companies alongside Netflix and Warner Bros. Discovery.

One other major asset that Mayer and Staggs potentially bring to the table is Moonbug Entertainment, owner of kids favorites Blippy and Cocomelon. Disney+ is seeing significant demand for kids show Bluey, which is licensed from BBC Studios. Buying Moonbug and placing these two shows exclusively on Disney platforms would help lock in parents for years, and provide insurance if BBC ever claws back its Bluey deal.

ESPN BET: Fun for the Whole Family?

Transitioning ESPN to a DTC offering is among Iger’s top legacy items. Disney took a big step towards the future of sports media with the announcement of its sportsbook ESPN BET, in partnership with Penn Entertainment. How gambling fits in with Disney's family values remains to be seen.

NOTE: The charts below refer to the April-June quarter as Q2 2023; Disney refers to the same period as its Q3 2023.

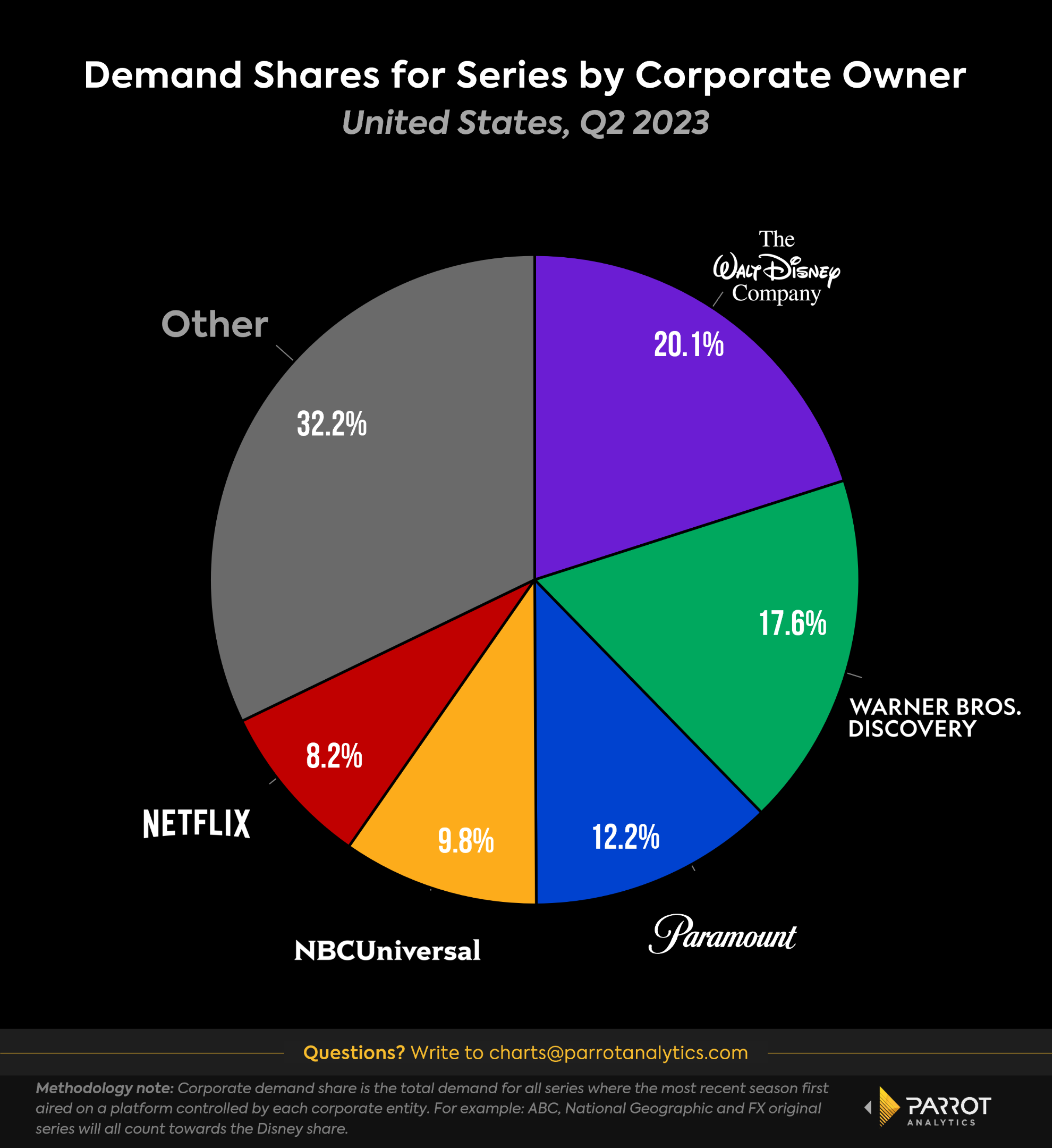

Corporate Demand Share

- Corporate demand share can assess which companies have the most valuable content to license, helping to effectively value a conglomerate’s library content in aggregate. It also shows who has the most volume to sustain a dragged out Hollywood labor stoppage potentially into late 2023 and early 2024.

- Disney once again leads the industry at 20.1%, up slightly from the previous quarter, reflecting a deep library of resonant content across its linear and streaming portfolios.

- Disney has been number one in this category since we starting measuring it (2018), but any hypothetical future M&A action involving Warner Bros. Discovery (17.6%), Paramount Global (12.2%) and NBCUniversal (9.8%) would likely result in the new corporate entity leapfrogging Disney for first place.

- Disney’s stock has had a lackluster 2023 so far, but the above data should be reassuring to anyone taking the longview.

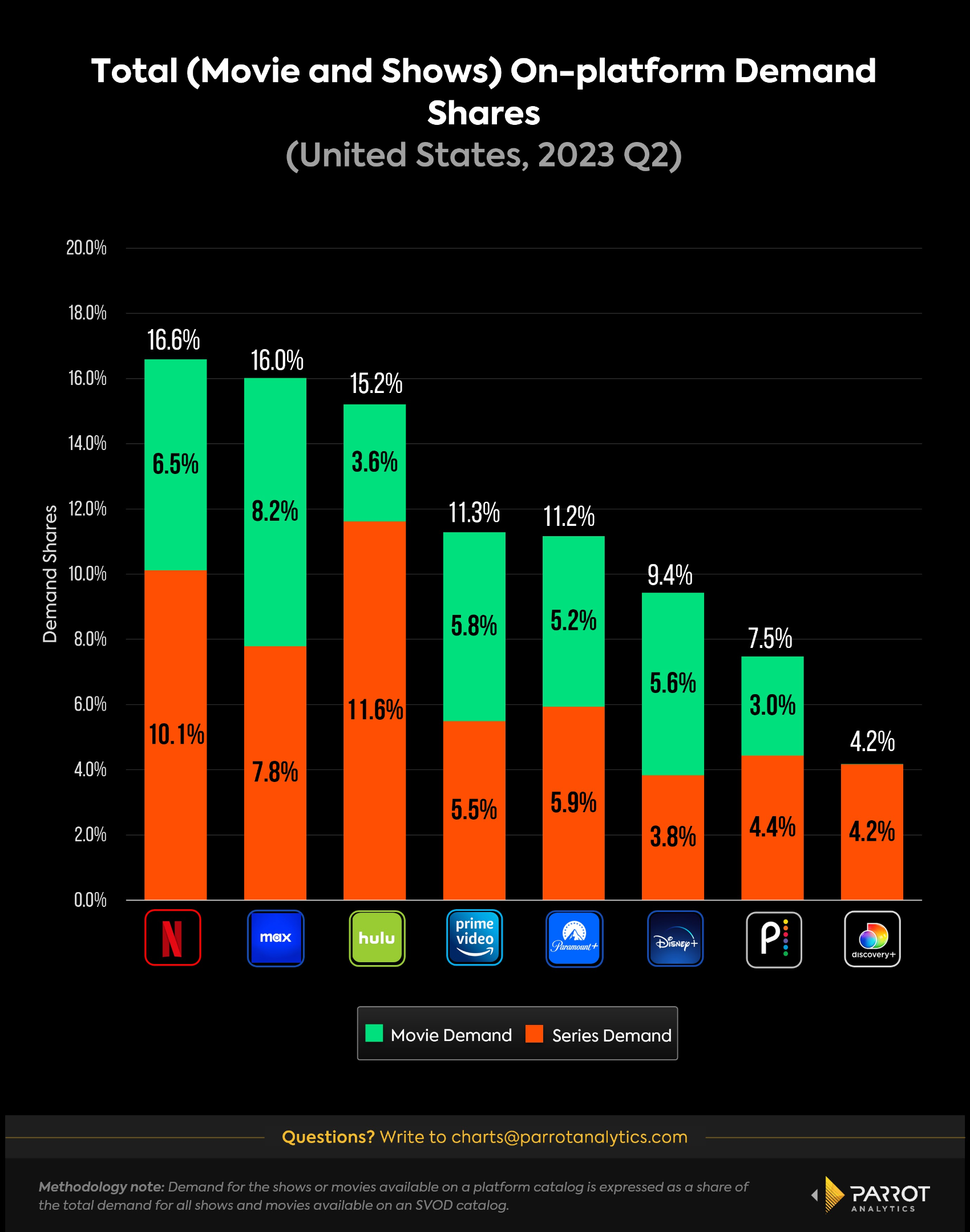

Total Catalog Demand Share

- While demand for original content drives subscription growth, library content is key for customer retention, an increasingly crucial element of all streaming strategies as the market matures and consumers are offered more choice and easier ways to cancel than ever.

- The total catalog demand share data is a good indicator of which SVODs consumers are most likely to use as a default ‘streaming home,’ accounting for all TV series and movies available on a platform.

- Library content will also be a crucial short-term asset as Hollywood’s labor strikes prolong, with new shows and movies likely to run dry in late 2023 and early 2024.

- There is a clear ‘Big Three’ in terms of general entertainment platforms. This quarter, the relaunched Max platform leapfrogged Hulu for second place. In Q1 2023, HBO Max was in third place with 14.4%, well behind Netflix’s 17.9%. Max (16.0%) is now within one percentage point of Netflix (16.6%) in this category.

- That said, once Hulu (15.2%) and Disney+ (9.4%) are combined, that streamer should easily top both Netflix and Max when it comes to total on-platform demand for content.

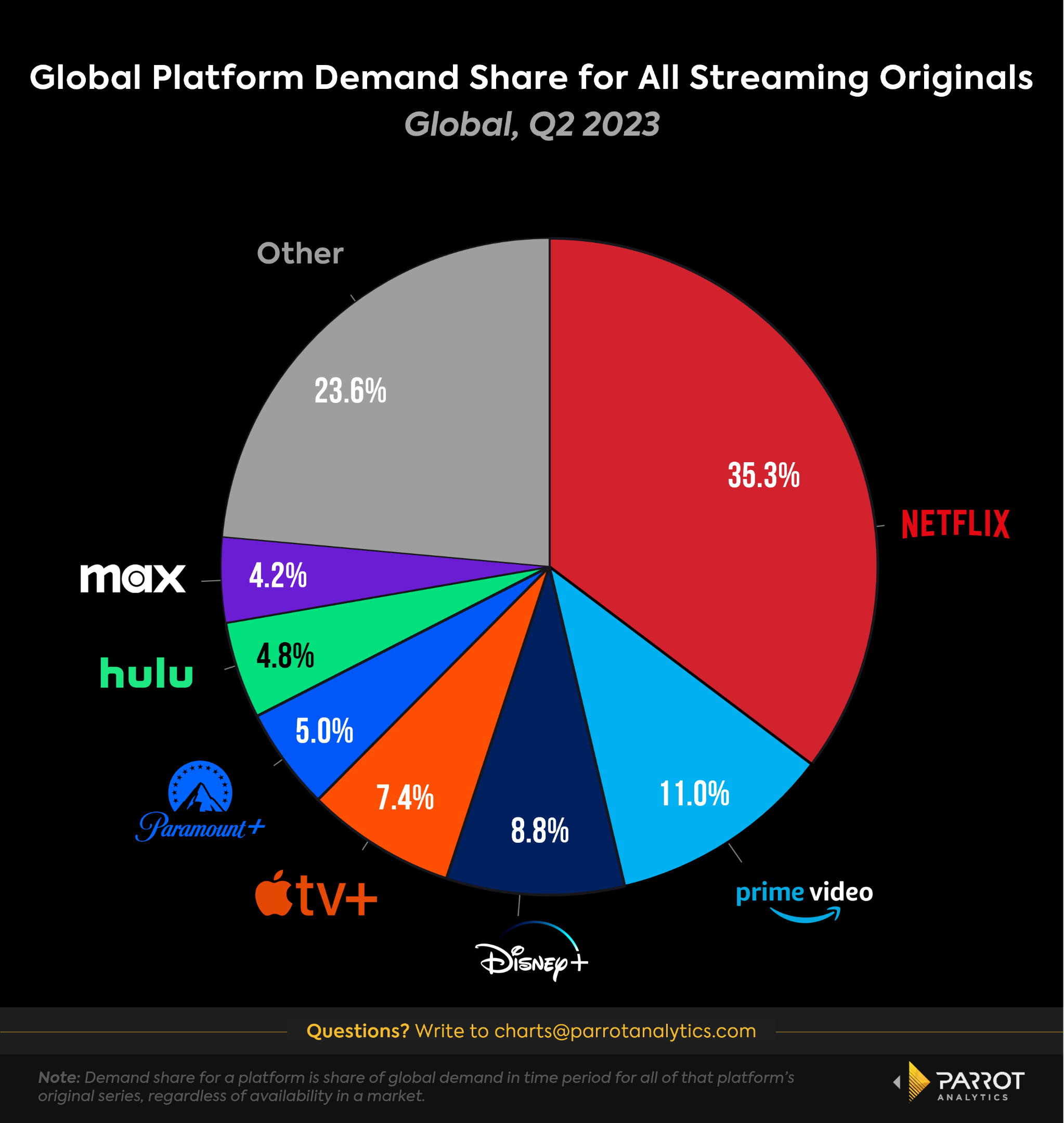

Streaming Originals Demand Share

- Demand for original series is a key leading indicator of subscriber growth for SVODs. For example, The Mandalorian drove tens of millions to sign up for Disney+ when it first launched, helping Disney+ to become one of the biggest players in global and US streaming.

- However, Disney+ has lost momentum in 2023, ticking down from 10.2% global share at the end of December 2022, to 9.4% by March 2023, and 8.8% as of June 2023.

- The latest live action Marvel series Secret Invasion has performed well, and was the number one series worldwide across all platforms during its June 21-July 26 run. That said, any bump in Disney+’s demand share or subscriber will likely been seen next quarter.