In the days since Disney reported earnings for the company’s second fiscal quarter of the year (first quarter of the calendar year), the share price of the company has been under pressure - down by over 10%. Last quarter saw Disney+ report its first ever subscriber loss, but consensus estimates on Wall Street had forecast subscriptions to grow very slightly this quarter. The actual numbers revealed a 2% decline in subscribers to 157.8 million globally, falling well short of the estimated 163.2 million.

The company is faced with complex challenges on multiple fronts. Disney must continue boosting the ad-supported tier of Disney+ to reignite subscription growth and alternative revenue sources, wrestle with disappointed Disney+ Hotstar users in the high-upside Asia Pacific region, and determine a future course of action with Hulu. At the same time, it must further re-establish strong theatrical windows to maximize revenue, stave off the ongoing decline of linear television and hope the ongoing writer’s strike ends before impacting its content pipeline following massive disruption from the early pandemic. No one ever said Hollywood was easy.

The announcement that Disney will begin making Hulu content available on Disney+ seems to be an acknowledgement that the family-friendly franchise power of Disney+ may need an assist from more expansive programming. On the bright side, however, is the fact that Disney owns 23 of the 25 most in-demand series on Disney+ in Q1 ’23, representing an advantage over rivals both in original development and prospective licensing opportunities moving forward. Conversely, fewer than 10 of the 25 most in-demand series on Hulu last quarter were owned in-house, adding another layer to the debate about keeping or selling the US based streamer.

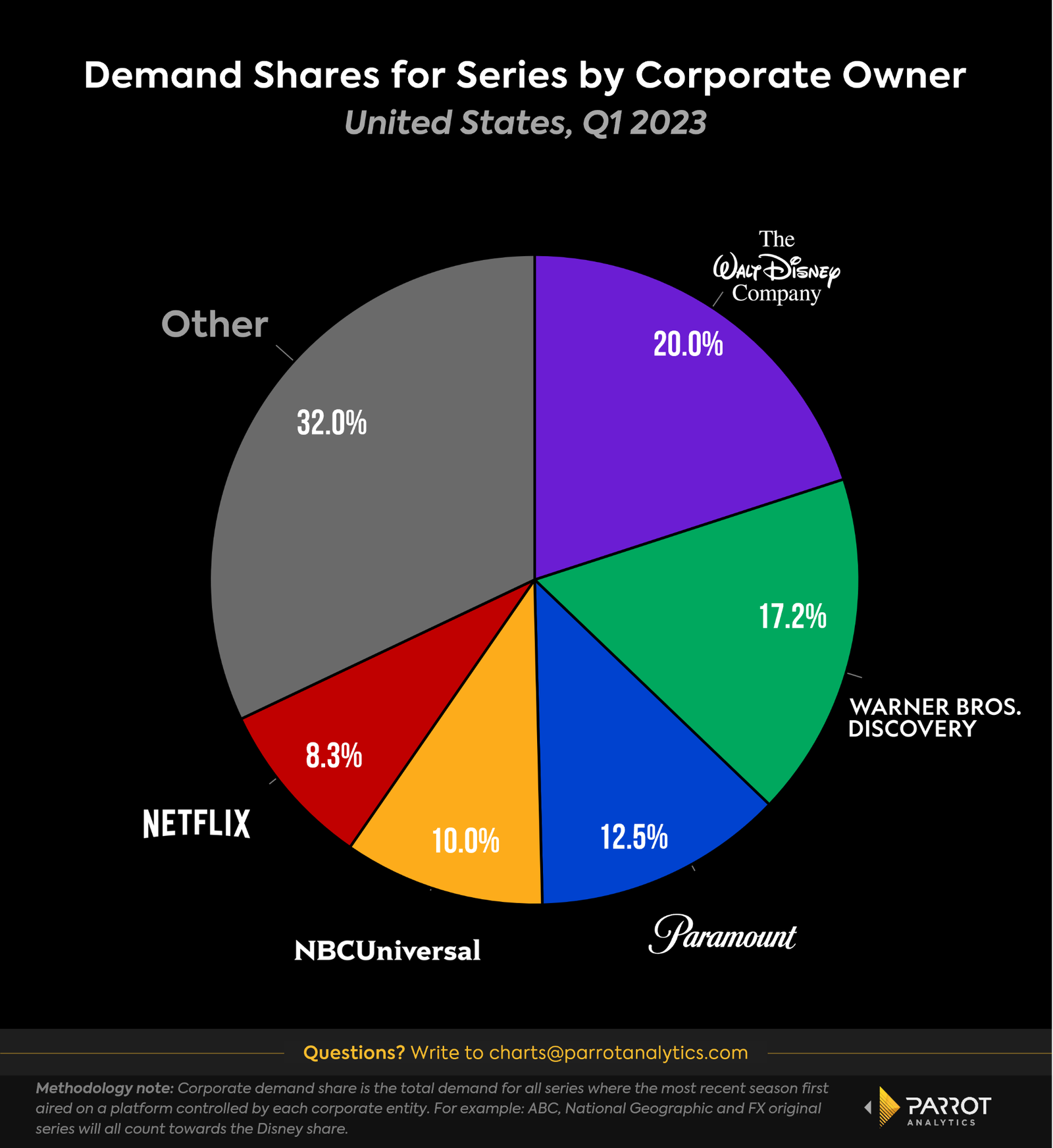

If we zoom out and consider the highest level perspective of the competitive landscape we see that Disney remains the leader at the corporate level in terms of demand for its series. Corporate demand share can assess which companies have the most valuable content to license. This analysis can effectively help value a conglomerate’s legacy and library content in aggregate.

20% of demand for series in the US in Q1 2023 came from a show that originated on a Disney owned platform or channel, reflecting a deep library of resonant content across the company’s linear and streaming portfolios. Translating the company’s leading corporate demand share to streaming dominance will be a key problem to solve going forward.

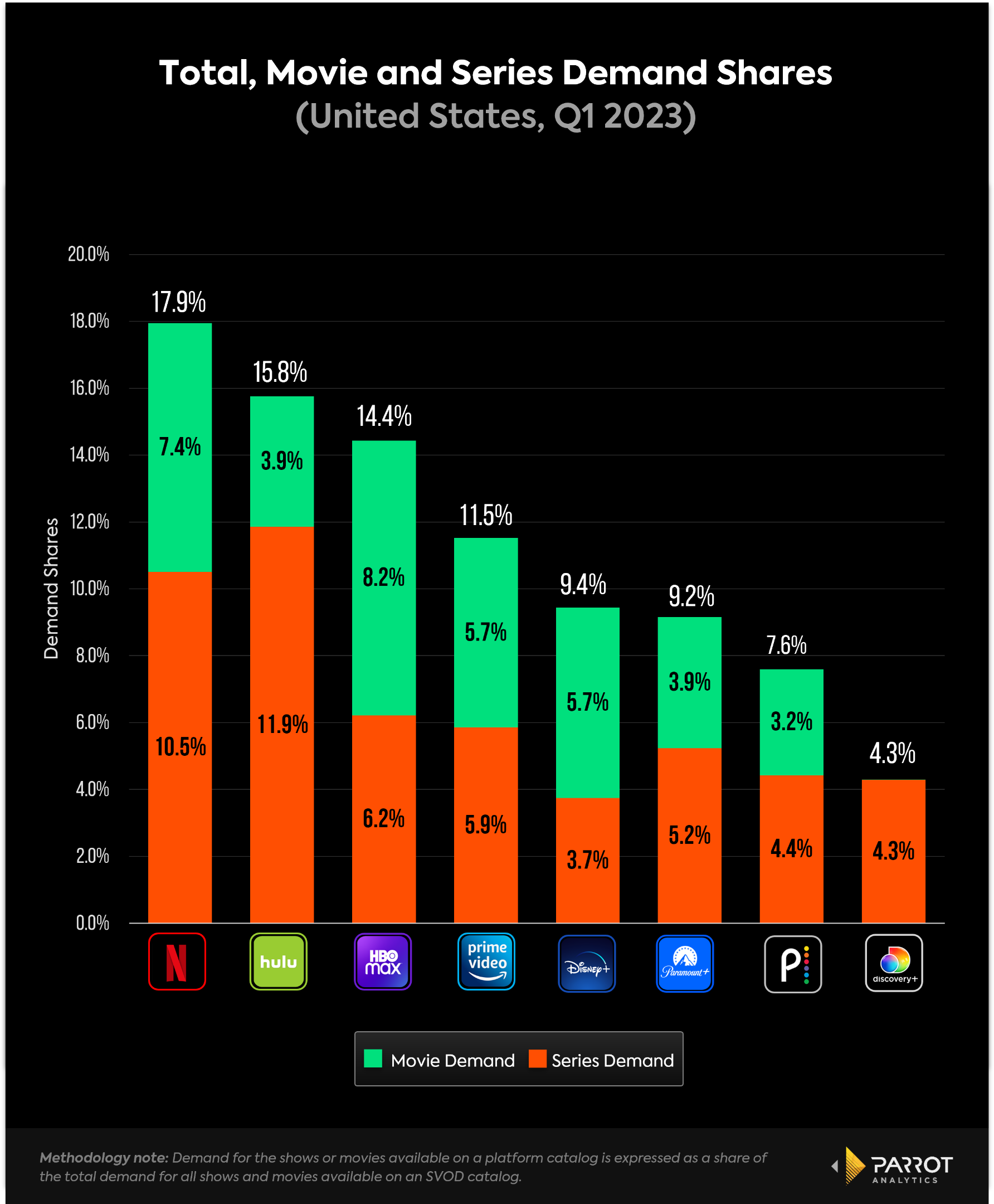

The total catalog demand share of a platform is a good indicator of which SVODs consumers are most likely to use as a default ‘streaming home,’ accounting for all TV series and movies available on a platform. If we consider demand for all content available on SVODs in the US, Hulu stands out as a competitive strength for Disney. As of Q1 ’23, Hulu had the second largest demand for its on-platform shows and movies (with 15.8% market share) and Disney+ ranked fifth at 9.4%. Taken together, the Disney+ Hulu bundle is a formidable juggernaut that easily surpasses Netflix as the top overall streaming destination in terms of demand for the content on its bundled service.

It is also worth noting that despite a smaller movie library than many of its rival streamers, Disney+ is tied for third in total movie demand (5.7%) behind just Netflix (7.4%) and HBO Max (8.2%). This speaks to the power of Disney’s established film brands such as Marvel, Star Wars and Pixar. We can expect the looming arrival of hit blockbuster “Avatar: The Way of Water” to also generate immediate interest in the streamer’s film catalog.

Disney+’s strength in movies is complementary to Hulu’s strength in TV series. Hulu had the largest demand for its on-platform series across all SVODs in the US. Another dimension in which these two streaming services are well matched is the demographics of the audiences they appeal to. When we last considered the path forward for Disney and Hulu, we noted how the demographics of original content on both platforms are complementary. While the action heavy slate of Marvel and Star Wars series from Disney+ has a younger and more male-skewing audience, Hulu’s dramas tend to appeal to an older and more female audience.

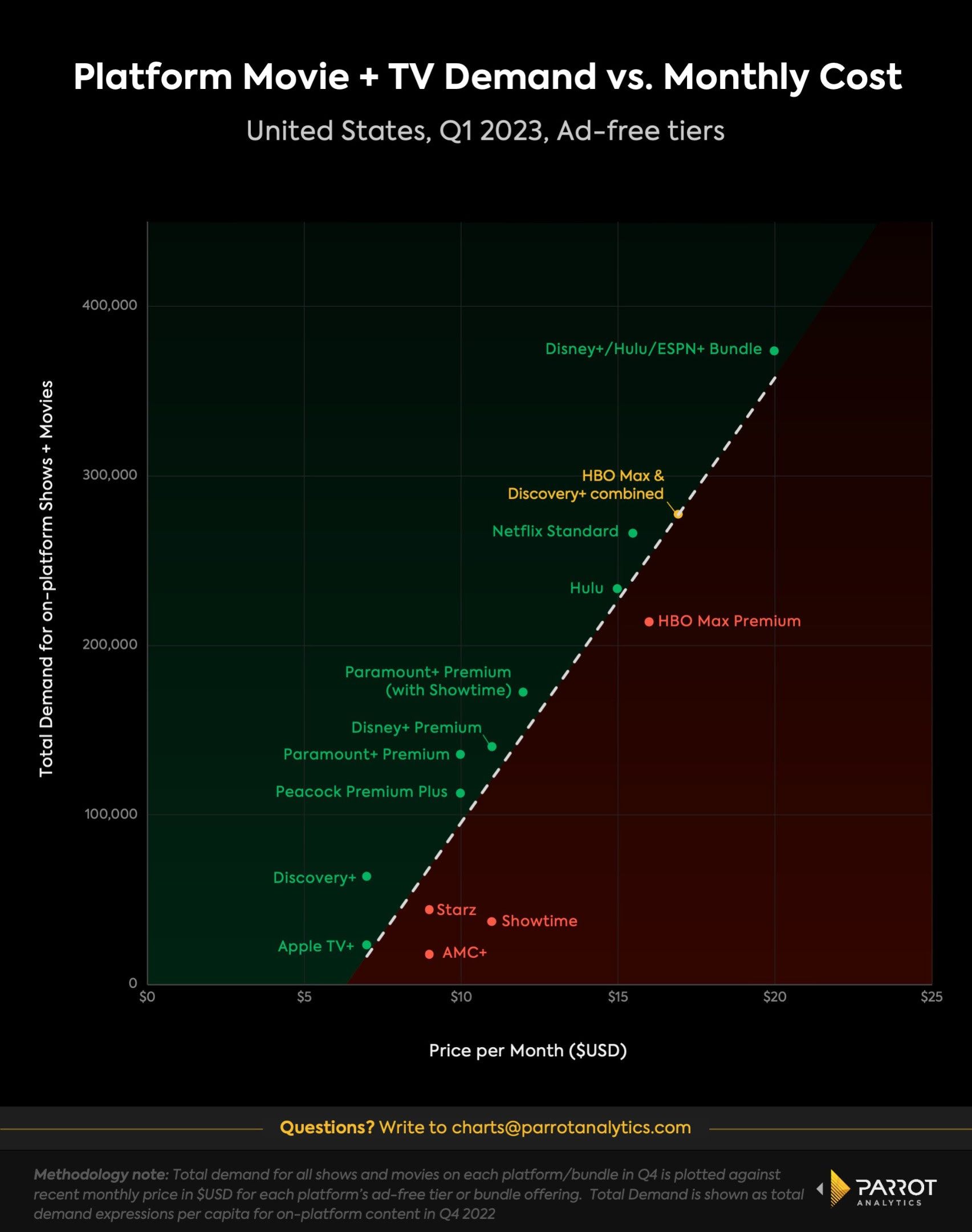

On Wednesday, the company also announced it would be increasing the price of its ad-free service later this year, similar to price increases we have seen from other platforms. Compared to the ad-free plans of competitors, the amount of demand for content on Disney+ looks attractively priced for consumers at the current price point ($11/month). This means that the platform has some room to raise prices without significantly denting its competitiveness in the eyes of consumers. The addition of content from Hulu should also help to soften the blow of future price increases for subscribers.

Disney is juggling multiple priorities here. It is clearly still figuring out how to balance Hulu and Disney+, what the role of each service is, how they relate to each other, and what the ownership of Hulu will be in the future. The market’s reaction to the company’s quarterly financials is a reminder that the company must manage subscriber churn while increasing its ARPU through not-too-jarring price increases. Bob Iger’s familiar leadership is looking like a welcome and stabilizing force for these tumultuous times.