Image: Hazbin Hotel, Amazon Prime Video

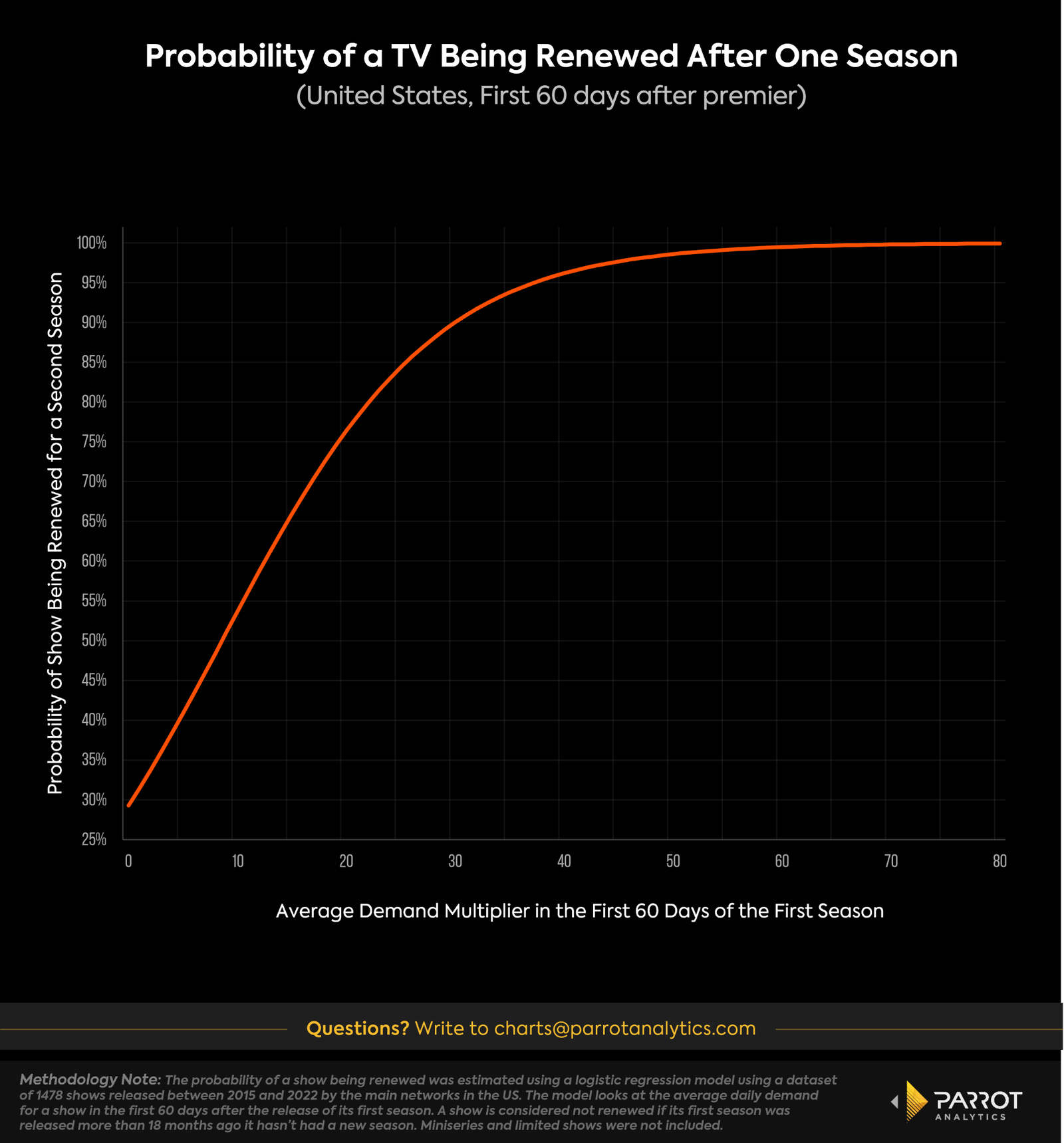

We’ve previously covered how audience demand for a TV series within the first 60 days of availability can help predict the cancellation or renewal chances for a second season. As a refresher: shows with demand less than 9 times the average are more likely to be cancelled after their inaugural seasons. Those generating 10x more demand than the average TV series have a 53% renewal probability. Shows that generate at least 20x more demand than average within the first 60 days typically score a renewal rate around 76%, which rises to 90% for a 30x multiplier, and nearly 100% for shows exceeding 50x.

Of course, there are extenuating circumstances that contribute to this decision such as budget, talent relationships, completion rate and more. But unsurprisingly, the greater demand a TV series generates in its first two months of availability, the greater chance of being renewed. Simple enough.

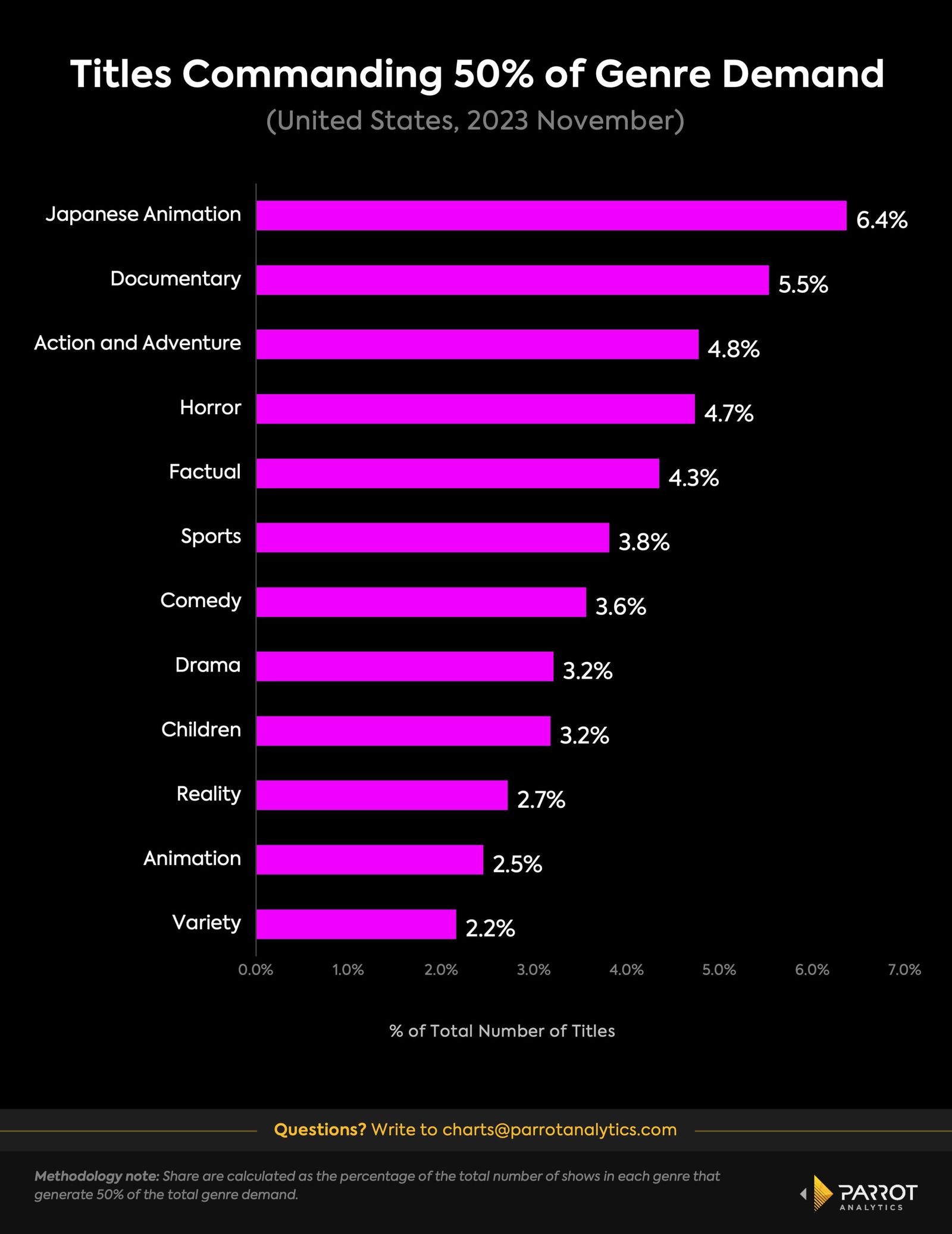

Yet taking this one step further can help provide a greater understanding of which genres are comprised of more tightly packed demand. Knowing these intricacies can shed light on programming decisions as well as cancellation and renewal decisions. The below chart explores what percentage of titles within each genre is responsible for 50% of the genre’s total demand. In other words, how top heavy or evenly distributed demand is throughout these genres. This speaks to how crowded or uncrowded each genre may be with popular series.

Though this is partially tied to the volume of supply, it can be better to have a larger percentage of titles within a given genre command at least 50% of demand as opposed to a smaller percentage, at least from a platform perspective. The smaller the number, the more concentrated demand is among a select few high-performing titles. This can leave a library vulnerable to unexpected production stoppages or consecutive creative misfires without the necessary stockpile to weather the storm.

Understanding this, a break out variety or animation series can more easily stand out from the crowd and garner more renewal consideration given the relative dearth of major titles in these programming lanes. A smaller number of series in these genres account for more than half of the demand. This can be seen as a whitespace opportunity for studios, streamers or production companies with the safety and runway to experiment.

However, action/adventure and horror series — genres that have more evenly distributed demand among its supply — likely stand a better shot at securing a green light for a second season overall, even amid a more crowded market place. That may be more useful insight to a risk-averse programmer. Ultimately, it depends on what the status and goals are of each individual network or service.

Warner Bros. Discovery CFO Gunnar Wiedenfels previously noted that “a small percentage of titles really drives the vast majority of viewership and engagement,” while FX Networks President John Landgraf previously said only 20% of TV viewing is dedicated to “lean-forward” programming. As such, it’s incredibly difficult to develop and deliver new series that truly cut through the clutter and capture a significant share of the viewing public’s attention. Yet by understanding where audience demand is concentrated within the major programming lanes, one can identify upside potential and portfolio optimization strategies that help position any service for success.