Parrot Analytics Genre Trend reports reveal which genres and subgenres appealed to a market's audiences the most during the quarter.

The key questions investigated in this report include:

1. Which genres are most in-demand for Middle Eastern & North African (MENA) audiences in Q4 2020?

2. How do MENA genre trends compare to global trends for Q4 2020?

3. Which subgenres are most in-demand for MENA audiences Q4 2020?

4. For only digital original series, what genres are most demanded by MENA audiences Q4 2020 and how is this different to the overall shares?

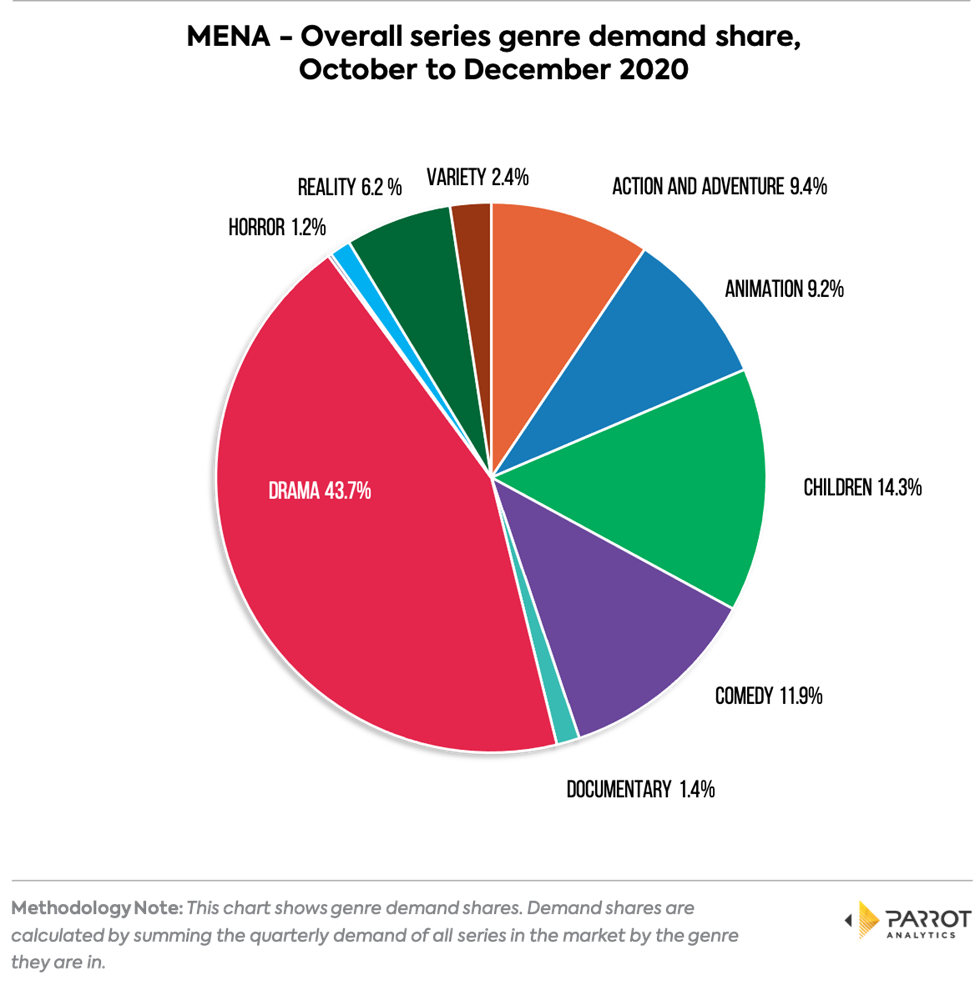

For all titles, which genres are MENA audiences demanding most?

• The most in-demand genre of series in MENA is drama. 43.7% of all demand expressed in MENA in this quarter is for a drama title. The top title in this genre in Q4 2020 is Game of Thrones.

• Children’s shows are more popular than usual in this market. 14.3% of the total quarterly demand is for children series, with the most demanded title being Spongebob Squarepants followed closely by Masha and the Bear.

• Comedy titles are highly in-demand among MENA audiences. 11.9% of demand this quarter is for a comedy title. This quarter, thus far, Mr. Bean is the most in-demand comedy title.

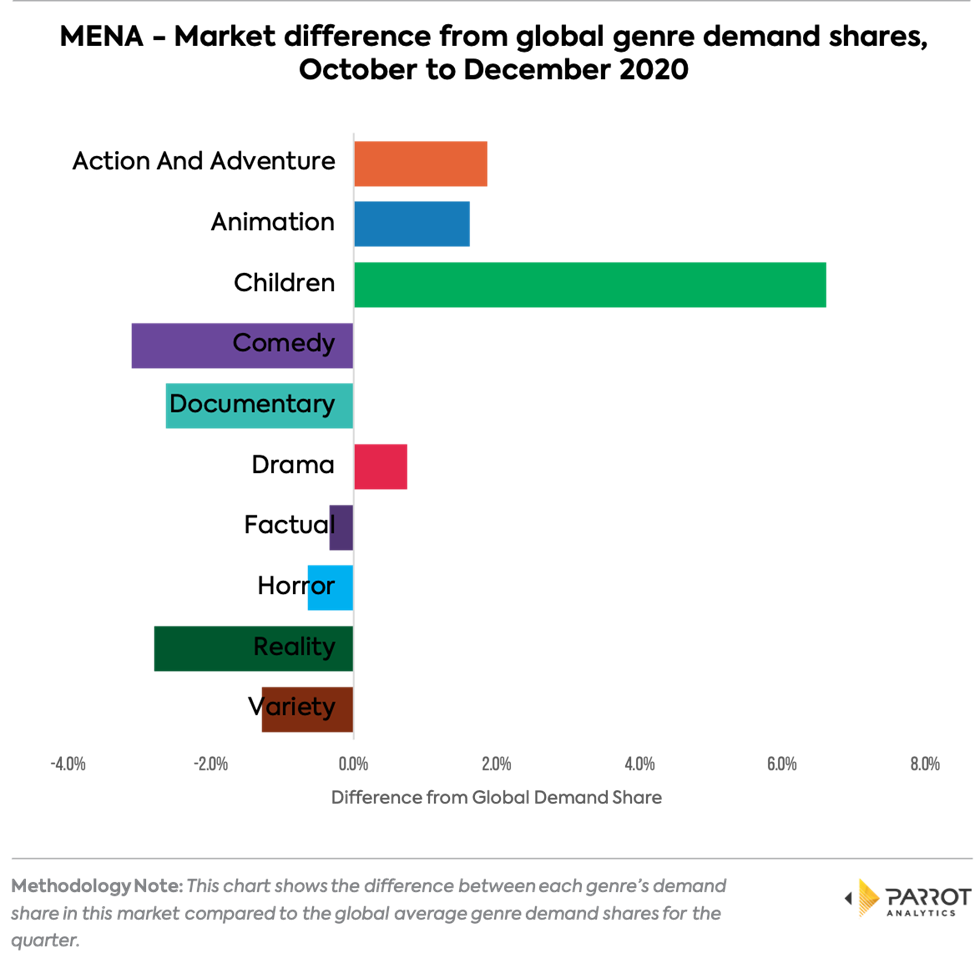

How do Genre Demand Shares in the MENA region compare to global trends?

• Compared to global audiences, Middle Eastern and North African audiences are 6.6% more likely to express demand for children’s series.

• However, comedy series are relatively less popular. The genre has 3.1% less demand share in this market than the genre does on average around the world.

• The demand share for reality and documentary series are also lower than the global average. These genres each have around 2.6% less demand share in MENA.

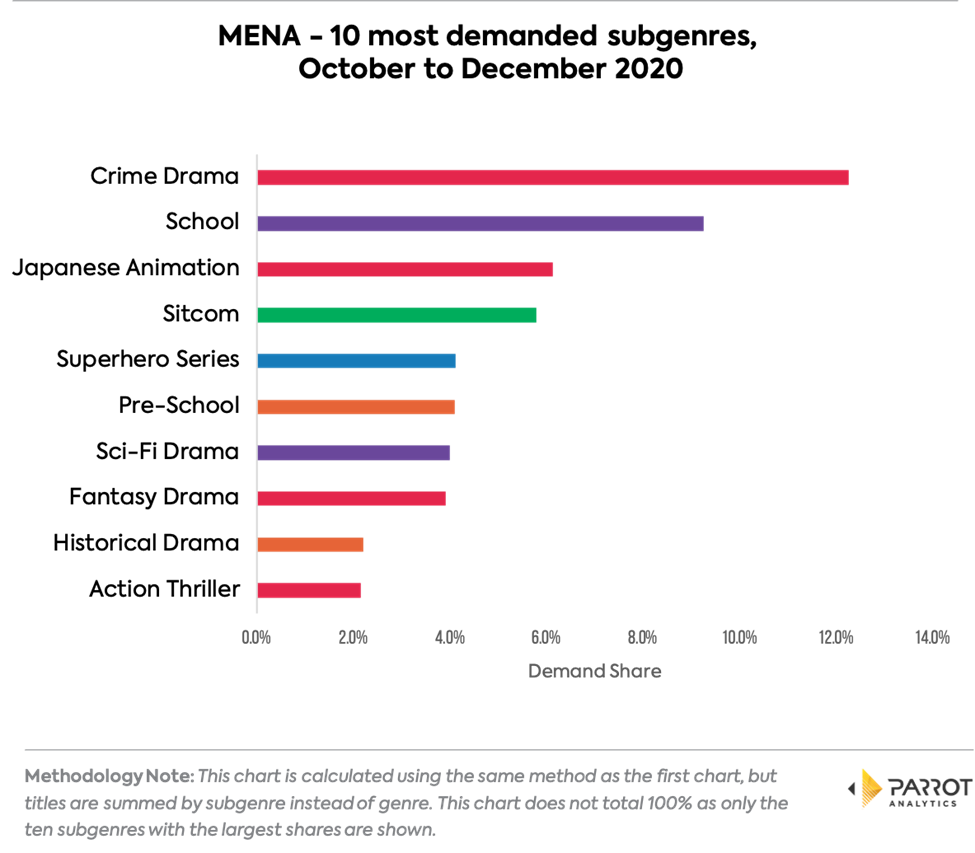

For all titles, which subgenres are MENA audiences demanding most?

•The most in-demand subgenre in MENA in Q4 2020, thus far, is crime drama. Crime dramas account for 12.3% of all expressed demand, having a 3% lead on the next largest subgenre. MENA’s most demanded crime drama this quarter is The Blacklist.

• Children’s school-age shows are the next most demanded with a 9.3% demand share. Most strikingly, Middle Eastern and North African audiences express much more demand for children’s school age shows than the average worldwide.

• Japanese anime series as the third most demanded shows among MENA audiences with 6.1% of the market’s attention. Like children’s school age shows, these shows are more popular in MENA than they are on average worldwide. The top Japanese Animation title in this quarter is Attack on Titan.

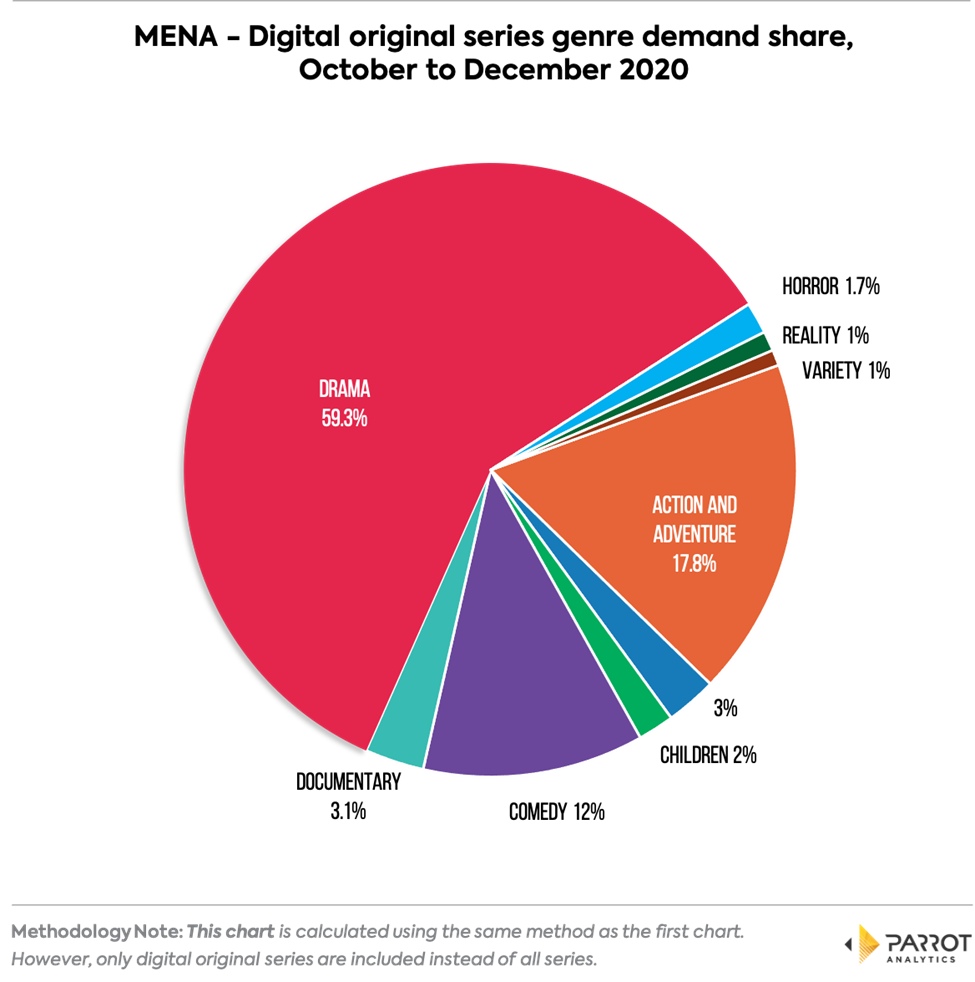

For digital original titles, which genres are MENA audiences demanding most?

• When only digital original titles are considered, the demand share for dramas in the Middle East and North Africa (MENA) rises. 59.3% of demand is for digital original dramas series compared to the 43.7% drama share of all titles. The top digital original drama this quarter is La Casa de Papel (Money Heist).

• The MENA share of demand for action and adventure nearly doubles for digital original series to 17.8% from just 9.4% of the all-title genre share. The top series in this genre for the quarter is The Boys.

• The most under-served genre for digital originals in MENA is children’s series. Although children’s titles have 14.3% of the all-title demand share for digital originals this is just 2.4%, a difference of -11.9%.

This report is intended as a high-level overview of genre trends in this market. To access more granular genre demand trends for specific platforms, types of titles, timeframes and more, contact your Parrot Analytics representative.