Image: NCIS, CBS

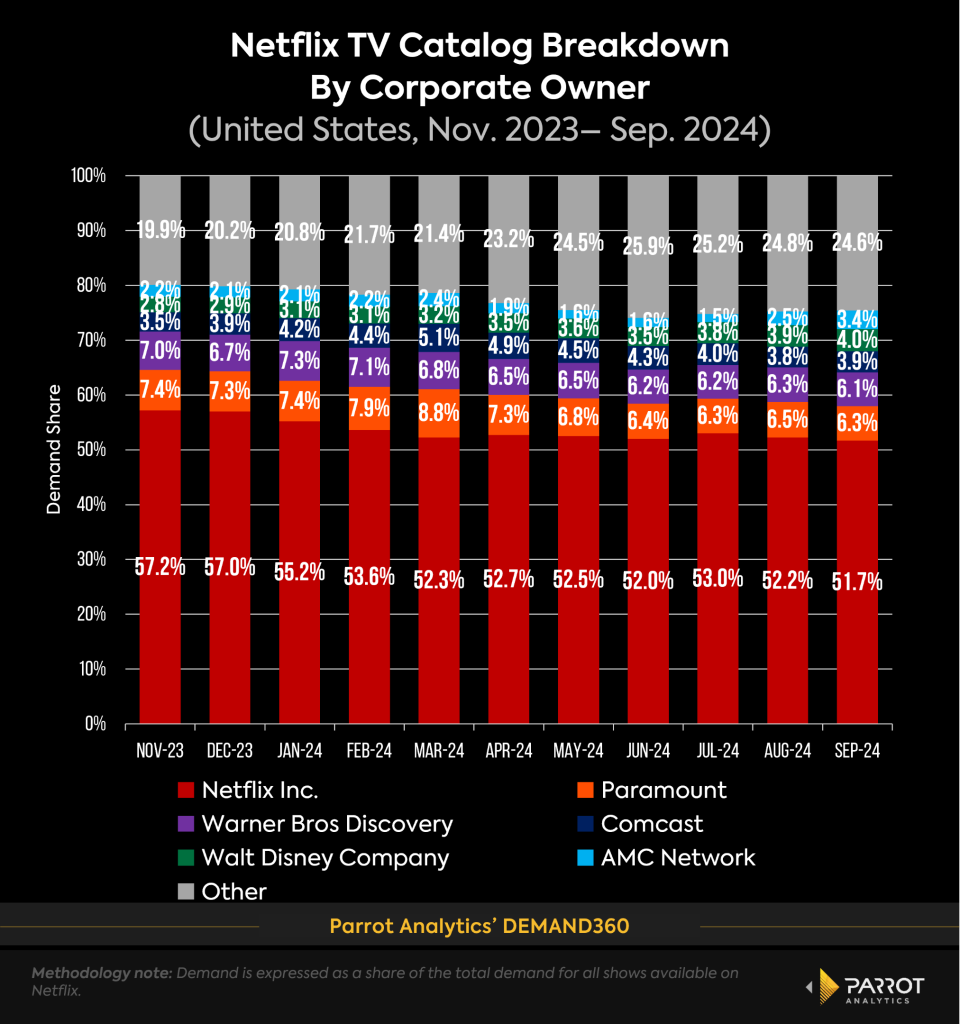

Licensed content is a key component of Netflix’s streaming strategy. In September 2024, licensed titles accounted for nearly half of the demand for Netflix’s TV catalog, marking an increase from November 2023, when they made up 42.8%. Paramount stands out as one of Netflix’s primary licensing partners, responsible for 6.3% of the platform’s TV catalog demand — more than any other TV corporation.

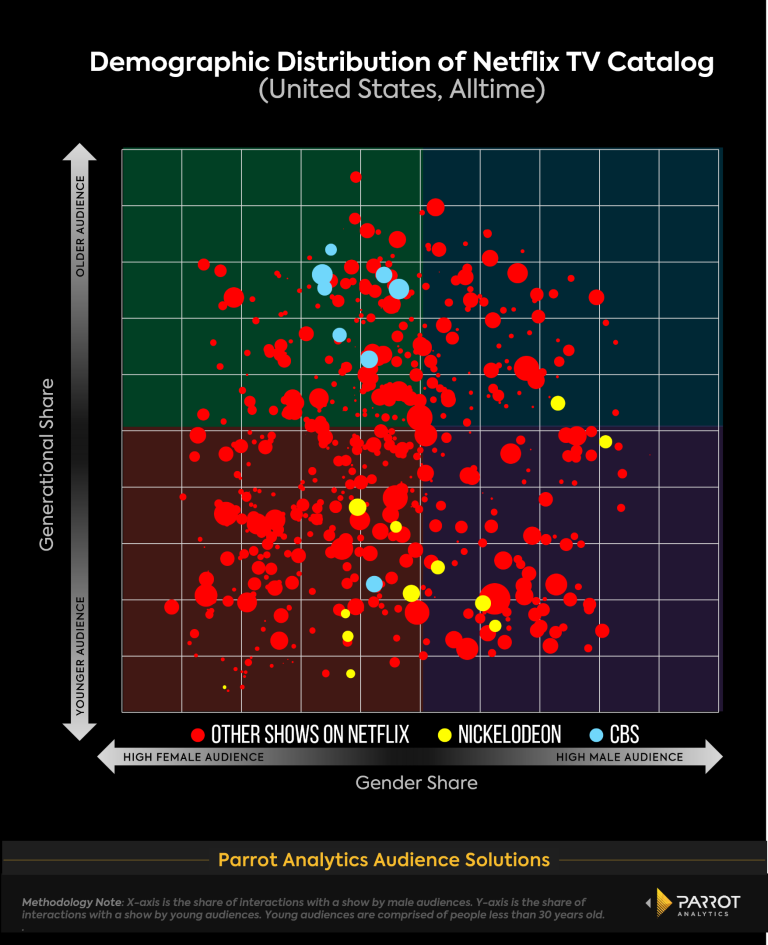

A significant portion of Netflix’s licensed content from Paramount comes from Nickelodeon, which helps the platform attract and engage younger audiences with popular shows like “Henry Danger” and “Avatar: The Last Airbender.” By contrast, CBS shows are overwhelmingly skewed toward older audiences, with the sitcom “How I Met Your Mother” being the exception due to its younger viewership compared to other CBS programs.

These shows offer viewers a taste of traditional broadcast TV, featuring long-running procedurals, sitcoms and reality shows, often referred to as “background TV” due to their familiar and easy-to-watch nature. Such titles contribute to subscriber retention for Netflix by keeping audiences engaged while they wait for new seasons of their favorite Netflix originals. Long-running shows like “NCIS,” which has six seasons available on Netflix, and “Young Sheldon” play key roles in this strategy.

According to Parrot Analytics’ Streaming Metrics, Netflix has consistently maintained the lowest churn rate among the main SVOD platforms over the past few quarters. This low churn rate is driven, among other factors, by Netflix’s strategy of licensing content that appeals to all generations.