Sitcoms are one of the cornerstones of American TV culture. Ever since the 1940’s, Sitcoms have been shaping the audience’s cultural landscape and promoting trends. According to Parrot Analytics data, Sitcoms are the most in-demand sub-genre in the US in 2022 so far, ahead of Crime Drama by more than 12.5%.

With short-length episodes and a loose storyline that makes a show easy to follow even if watched in non-sequential order, sitcoms are highly rewatchable and often the kind of show that people have in the background while doing something else.

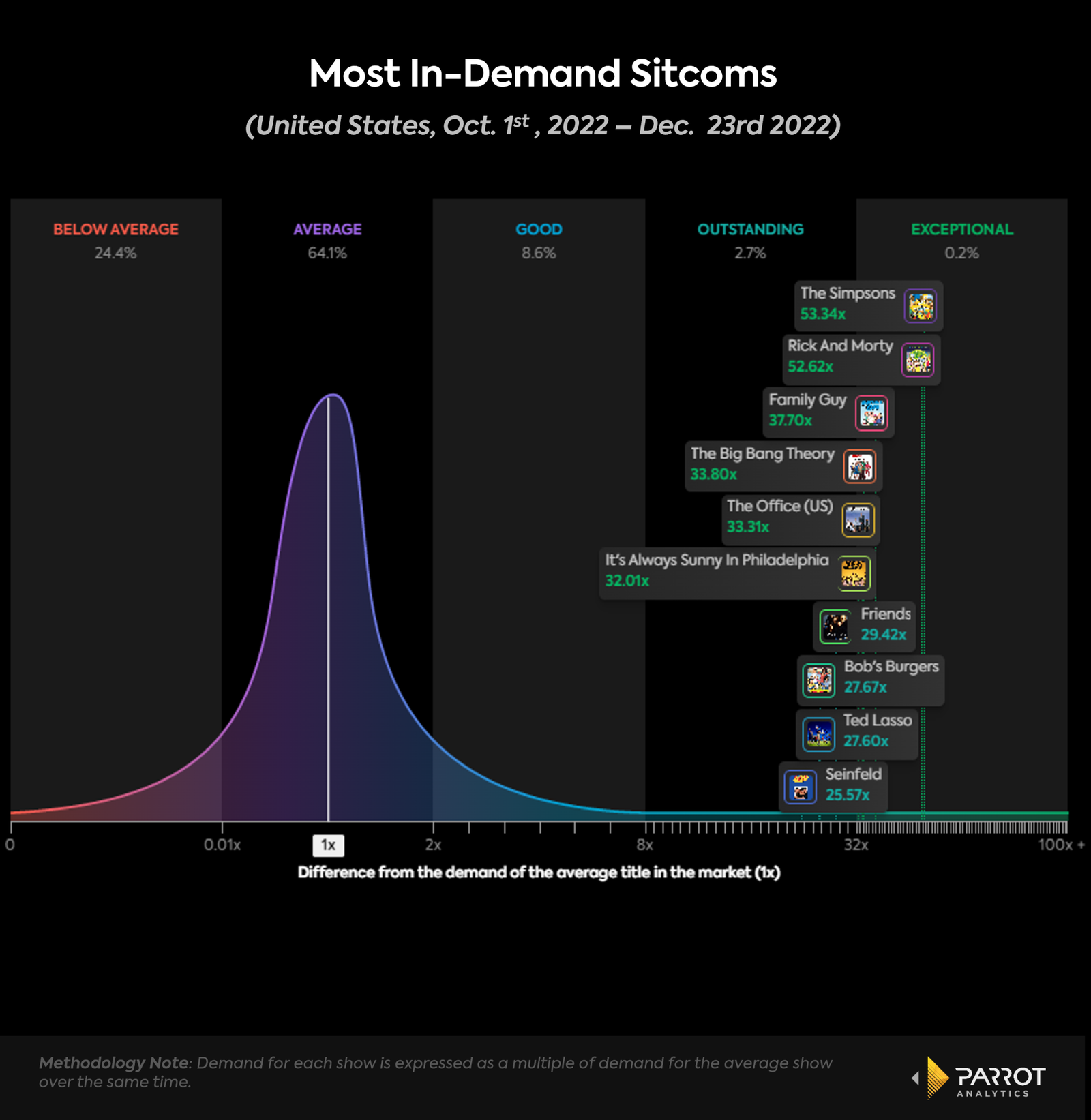

All top 3 sitcoms in the US at the end of 2022 in audience demand are animated sitcoms. The top one, The Simpsons, is arguably the most globally well-known American animation and remains very successful with audiences more than 30 years after its first season. The legacy show is followed closely by another Animated Sitcom, Rick and Morty. Both shows are the only sitcoms to figure among the top 10 overall shows in the US in that same period, placing 7th and 8th among all series.

The top non-animations in that list are CBS’s The Big Bang Theory, NBC’s The Office (US) and FX’s It’s Always Sunny In Philadelphia. Huge hit shows from the 1990s and highly influential legacy shows Friends and Seinfeld came up as 7th and 10th place in that period. It’s interesting to note that the top non-animated sitcoms on the list are centered around groups of friends or coworkers, while the Animated sitcom, like The Simpsons, Family Guy and Bob’s Burgers are centered around families.

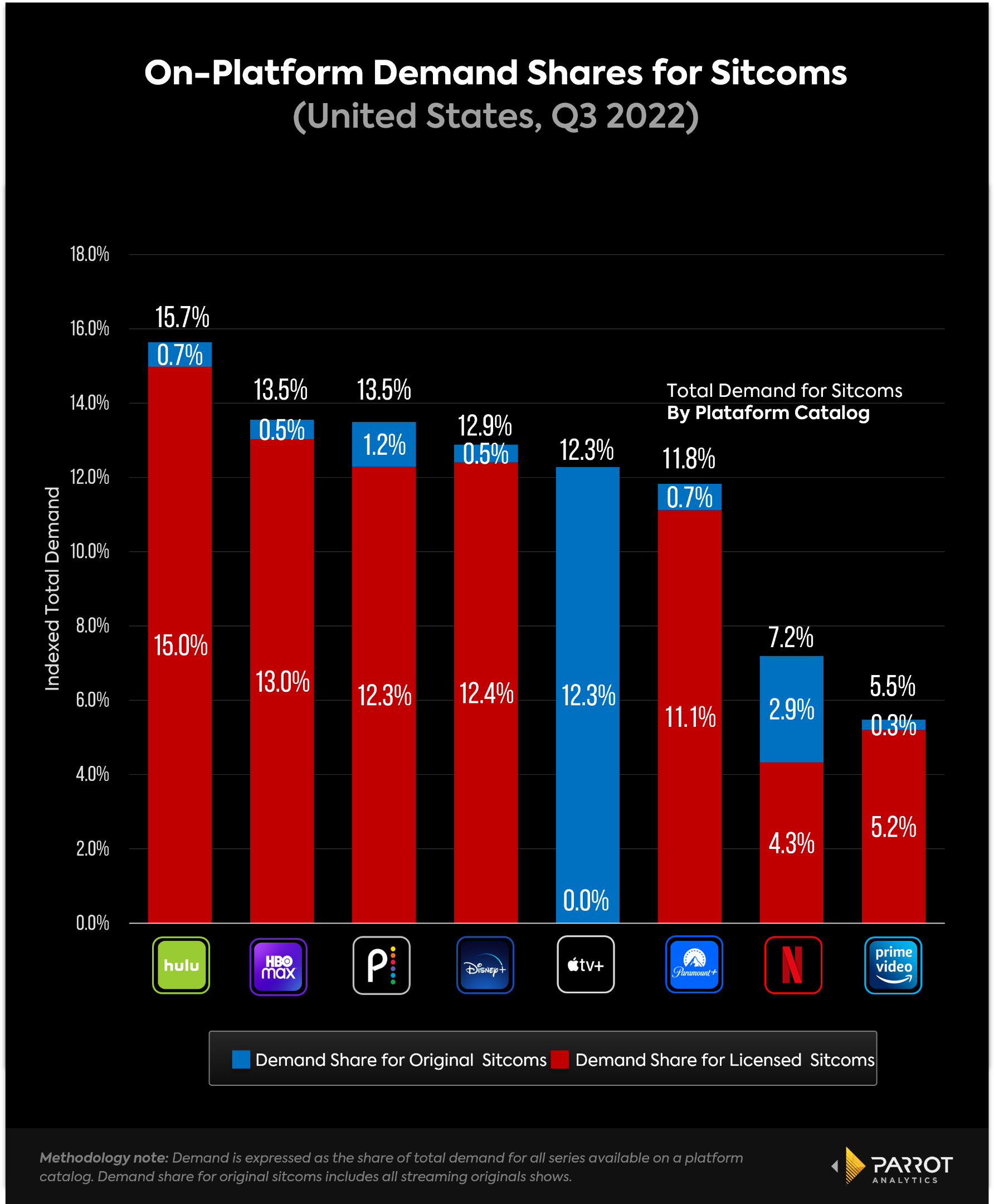

The ranking also shows that when it comes to sitcoms, network-released titles are preferred by the public. Only one show on the top 10 list is a streaming original, Apple TV+’s Ted Lasso. Despite the low number of highly in-demand streaming original sitcoms, streaming platforms rely heavily on this content. As shown in the chart below, sitcoms represent a relevant share of the total catalog demand for the major SVOD platforms, with the exception of Netflix and Amazon Prime Video. From the top four platforms with the highest share of demand for sitcoms, almost all of the demand for sitcoms comes from a licensed show.

The best example of this is Hulu. Sitcoms are responsible for 15.7% of the total demand for Hulu’s catalog in the third quarter of 2022, of which 95.8% comes from a licensed show, meaning that 15.0% of the total demand for the platform’s catalog is from a sitcom licensed from a network. Hulu's ability to invest heavily in acquiring highly in-demand shows for its catalog is what makes the platform the one with the higher share of demand for sitcoms. Of the 10 most in-demand sitcoms shown in the chart above, half of them were available on Hulu’s catalog during the third quarter of 2022, including the top three shows.

Besides Apple TV+, all of the main SVOD platforms garner most of their sitcom demand from a licensed show. Even Netflix, which boasts raunchy animated sitcoms such as BoJack Horseman and Big Mouth, sees around 60% of its demand for sitcoms coming from more in-demand licensed shows such as Seinfeld and Community. Besides that, Netflix has a lower dependency on licensed sitcoms than some of the other platforms where the sub-genre plays a larger role. While platforms like Hulu, HBO Max, Disney+, and Peacock have more than 12.0% of their catalog demand from licensed sitcoms, Netflix's share is only 4.3%

This is something of a safety net for Netflix in the eventual case that some networks reclaim their licensed content from the streamer for their own exclusive in-house platforms.