Image credit: CBS; ABC; Facebook Watch; The CW; Netflix

In the current age of “peak TV”, content consumers have a dizzying amount of choice not only in terms of which TV shows to watch, but also on which platforms to watch them on. And when you consider that a newly premiering TV series must compete not only against returning seasons of other shows but also reboots of legacy IP, adaptations of already popular books/movies and spinoffs of successful shows, it can seem like an almost impossible task to attract audiences to try out a new show.

So how can a content distributor make sure that audiences in a market are giving their titles a chance? One way of boosting success in this arena is to know exactly what factors inspire audiences to sit down and try a series that they haven’t seen before.

To discover which of these factors are most motivating to American audiences, Parrot Analytics commissioned a survey asking the following straight-forward question: “What inspires you to try a new TV show?”

The survey involved participation from 500 respondents in the USA and had six answers to freely choose from, as well as an option to provide a custom response.

Americans try new shows because they are like the kind they already watch

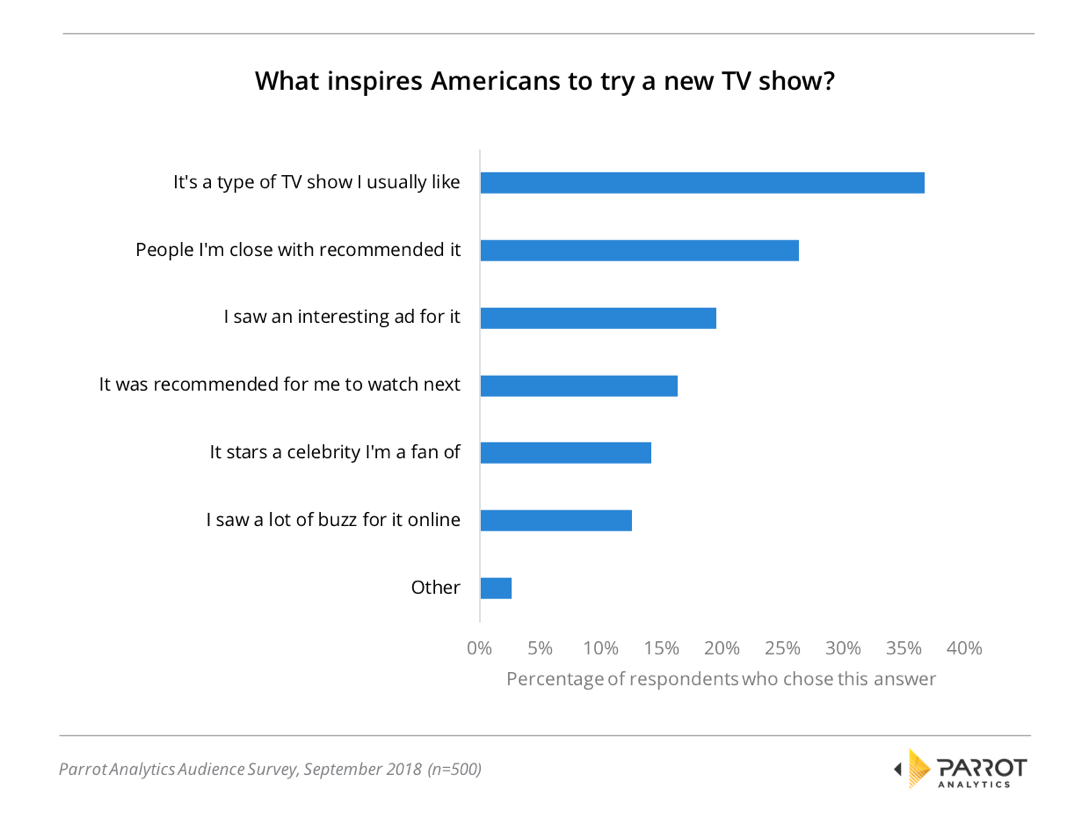

The following chart reveals how Americans answered this question, showing the most common reasons for American audiences to try a new show. Note that as participants could choose as many reasons as applied to them, the percentages do not add up to 100%.

Convincingly, the most common reason Americans gave for trying new TV shows is that it is a type of show they usually like; 36.7% of respondents chose this answer. The feature of shows that describes this best is subgenres: Once a viewer knows that they enjoy a particular subgenre, for example they identify as a fan of procedural dramas, then a large percentage of them are likely going to give other shows in the same subgenre a chance.

This finding complements existing industry wisdom, as many U.S. channels are built on a specific subgenre niche where all the shows fit within well-defined parameters. Viewers know they can tune into these channels at any point in time and see a show that fits their tastes: The property reality-focused HGTV is a good example of this.

Personal recommendations are the second most common reason Americans chose to watch a new show: A recommendation from someone close like family or friends drives 26.3% of participants to try something new.

19.5% of participants in the survey have tried a new TV series because they saw an advertisement that made the show look interesting. An effective commercial or well-placed ad campaign can therefore make a real difference to the initial success or failure of a show.

Recommendations from sources other than people who knew the participant inspired 16.3% to watch a new TV show. This refers to both personalized recommendations on content services like Netflix and Amazon as well as the more general “people who watched this may also like” recommendations found on IMDB and similar sites. As recommendation algorithms and the datasets powering them become ever more sophisticated, it’s very likely this percentage will climb in the future.

A draw for many Americans is the celebrity involvement in a series: 14.1% of respondents said that they try new shows specifically because a celebrity they like is starring in it. Even as early as the pre-production, smart casting decisions can be made which could give your project an edge in standing out on release.

It’s estimated that around two thirds of American adults are daily users of social media, so it’s no surprise that 12.6% of survey participants cited “online buzz” as a reason they have checked out a new TV show. As we have highlighted many times in the past, positive chatter on social media can spread awareness and viewership of a show far beyond initial airings.

A small proportion (2.6%) gave a different response that was not part of the answers above; the biggest group of which was people that cited reviews as a main reason for trying new shows – the opinion of critics, though in this case more a case of “the wisdom of the crowds”, continues to carry some weight.

Women are inclined to stick to their genre and men trust recommendation algorithms

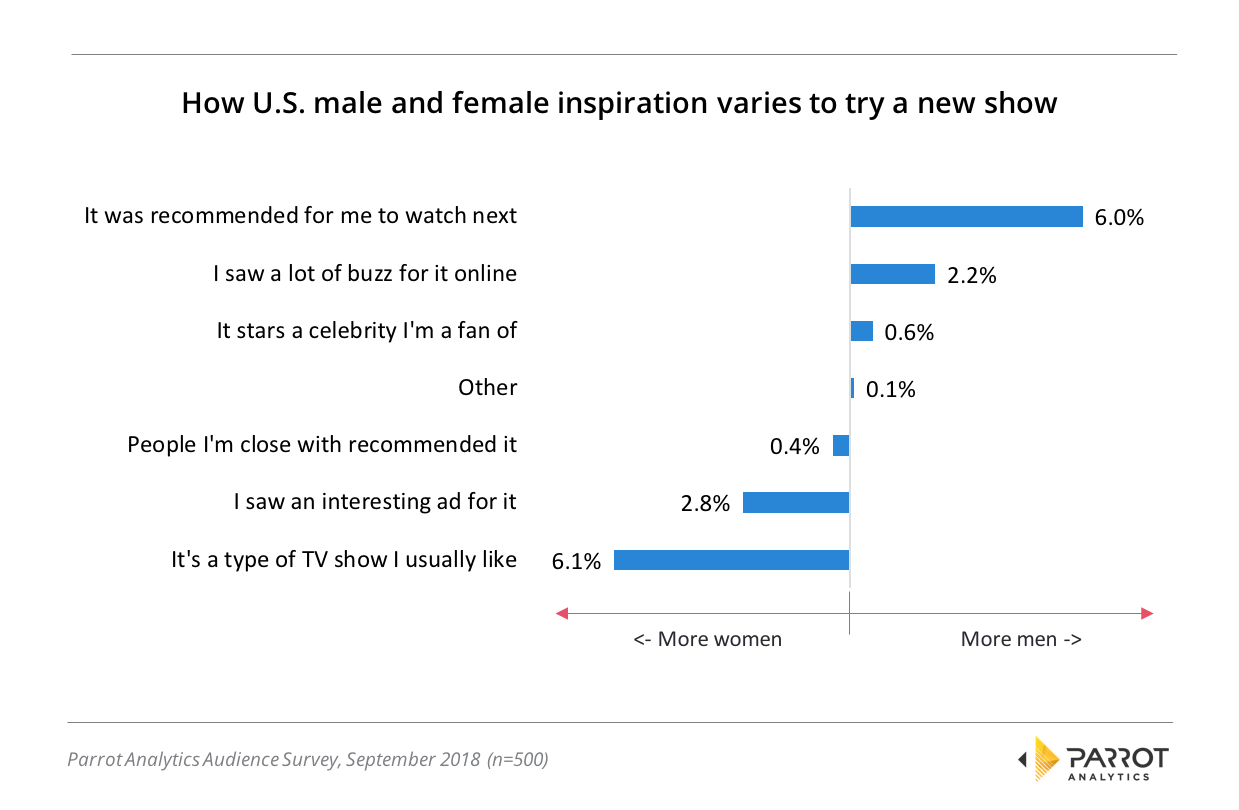

To go deeper, we investigated how the level of responses given changed depending on the gender of the survey participants.

Whilst, as always, the caveat is that only 500 respondents were considered for this survey, we found that American women are more likely to try a new show if it is similar to their preferred type of show. Our survey reveals that 6.1% more women than men stick to their preferred genre and women were also 2.8% more likely than men to try shows based on ads they had seen.

On the other hand, American men are 6.0% more likely than women to watch a new series based on algorithmic recommendations. They are also 2.2% more likely to try shows based on Internet buzz.

Younger people are influenced by celebrities, older people know what they like

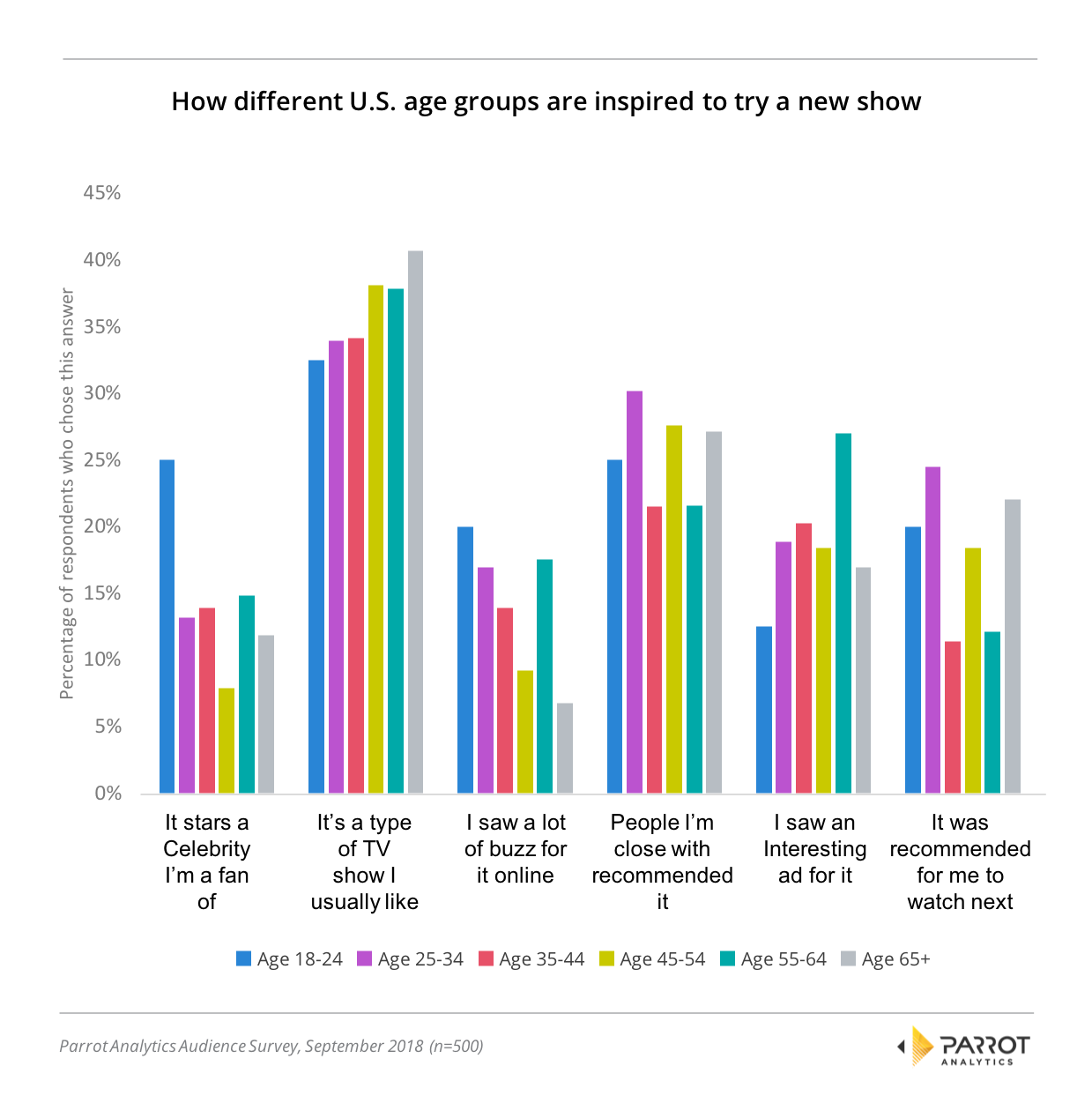

Finally, we investigated the differences in answers based on the age demographic of survey participants.

Generally, we found that the older Americans get, the less likely they are influenced to try new shows by online buzz. Also, as Americans get older, they are more likely to have decided what type of show they like and are inspired to try new series based on that.

Recommendations – both personal and algorithmic – show some fluctuations but on average are roughly equally important to all age groups.

Finally, the 18-24 age group is around twice as likely as all other age groups to be influenced to try a show by the presence of a celebrity star, but are least likely to try something due to seeing ads for it. Making a new TV show attractive to this age group takes very different tactics to the other groups.

This article demonstrates that not just appealing to potential viewers but also reaching the right potential audiences is a complicated business.

For more information, reach out to Parrot Analytics for a live demonstration of our Demand Portal, or watch our latest product video.

The data in this article are based on Demand Expressions (DEX). DEX is the globally standardized TV measurement metric developed by Parrot Analytics, which represents the total audience demand being expressed for a title, within a market. Audience demand reflects the desire, engagement and viewership, weighted by importance; so a stream/download is a higher expression of demand than a ‘like’/comment.