Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report and to discover the latest content analytics and trends for TV series on cable, broadcast, OTT and SVOD streaming platforms around the world.

Presented below is the section for Israel from The Global Television Demand Report. Enjoy!

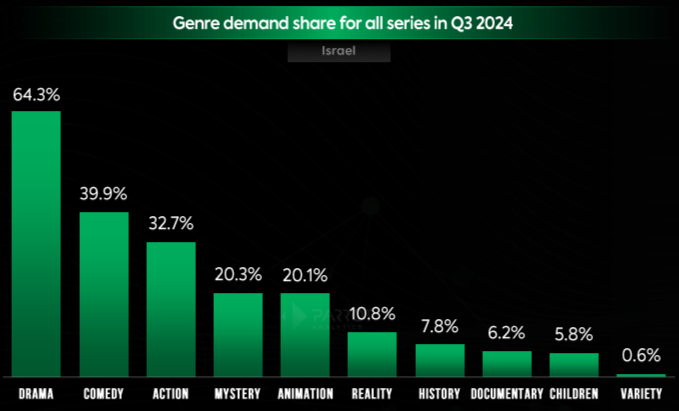

Israel genre and subgenre preferences

- Historical content resonated with Israeli audiences this quarter. 7.8% of demand was for a show in the history genre – a larger share of demand for this genre than in any other market in this report.

- Conversely, variety content captured a relatively small share of Israeli audience attention. Only 0.6% of demand in this market was for a variety series – less than half the global share of demand for variety shows (1.5%).

- Over a fifth of demand for shows in Israel was for a mystery series. The 20.3% share of demand for this genre in this market is above the global average for mystery series (17.2%).

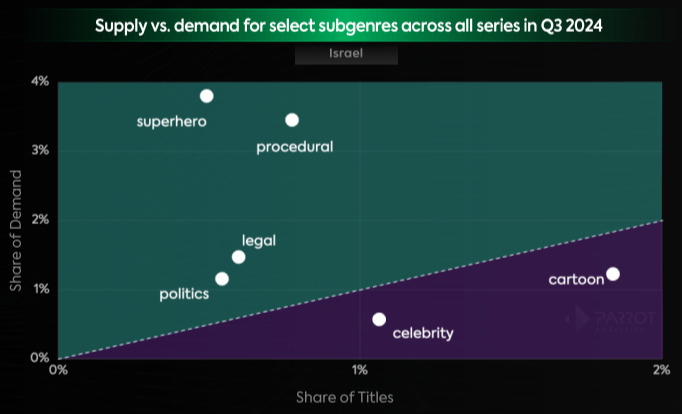

- Legal series are popular in Israel, accounting for 1.5% of demand for all shows. This is larger than the global share of demand for the legal subgenre (1.1%) and more than twice the supply share these titles make up (0.6%).

- Politics is a similarly popular subgenre of content in Israel, accounting for 1.2% of demand in Q3 2024. This was a larger share of demand for political shows than in any other market in this report.

- Cartoons made up a smaller share of demand in Israel than other markets in this report. 1.2% of demand for shows was for a cartoon, below the global share of demand for cartoons (1.9%).

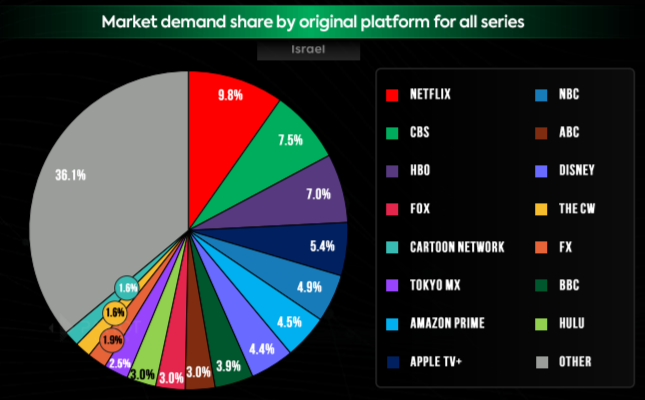

Israel originals demand share and digital originals demand distribution

- CBS content resonated with Israeli audiences. CBS originals made up 7.5% of demand for shows in Israel in Q3 2024 which is a larger share for the channel than in any other market in this report.

- Apple TV+ reached its highest demand share in this report in Israel. 5.4% of demand for shows in this market was for an Apple TV+ original.

- Despite the platform not being available in Israel, Hulu’s original content has still managed to break through with Israeli audiences. High demand for shows like The Bear and Only Murders in the Building contributed to the platform’s 3.0% demand share here which is larger than in any other market in this report.

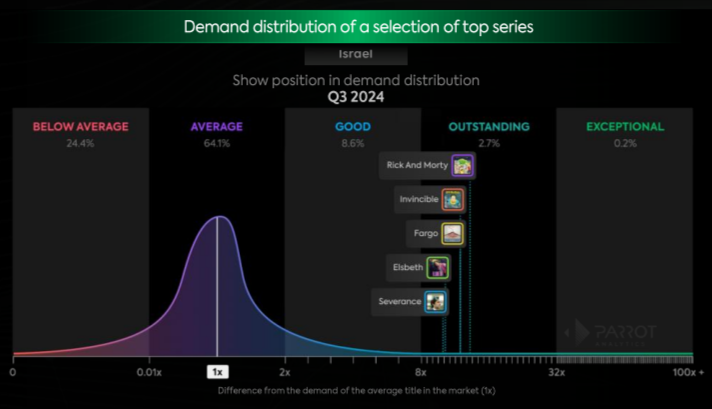

- Many Apple TV+ series had high demand in Israel. In particular, Severance ranked as the 67th most in-demand show for the quarter, higher than in any other market in this report. This is despite not having released a new season since 2022. High off season demand for the show here bodes well for its second season due in early 2025.

- Despite the country having a lower share of demand for the animation genre overall, a few animated series stood out in Israel. Both Rick and Morty (#8) and Invincible (#15) ranked higher in demand in Israel than in any other market in this report.

- Elsbeth, a new CBS series that premiered earlier this year ranked higher in demand in Israel (#60) than in any other market in this report.

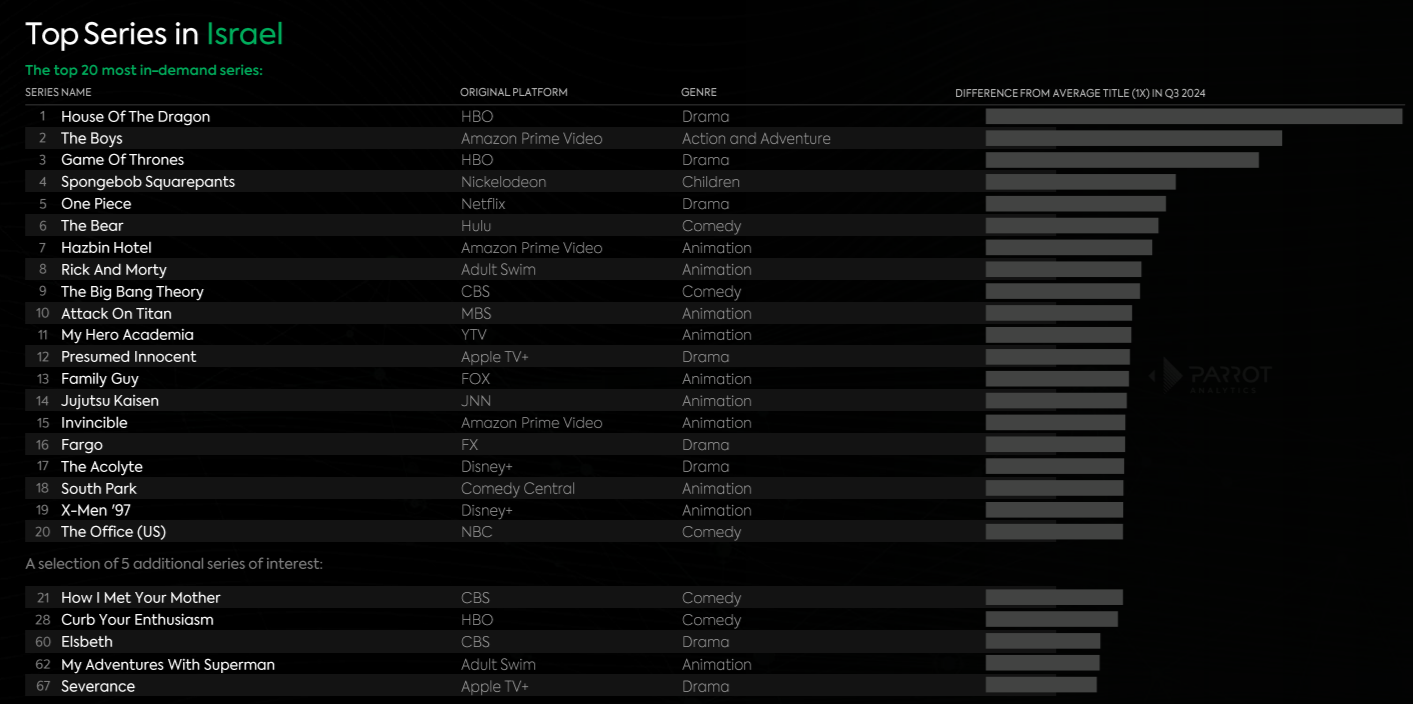

Top series in Israel

Here are the top 20 most in-demand series in Q3 2024 in Israel across all platforms:

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report.