2023 Insights - Full Year

Italy television and streaming market share analysis 2023: Netflix, RAI, Disney, CBS and HBO.

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report and to discover the latest content analytics and trends for TV series on cable, broadcast, OTT and SVOD streaming platforms around the world.

Fill this form and don't miss our next Parrot Analytics LIVE webinar!

Presented below is the section for Italy from The Global Television Demand Report. Enjoy!

Italy genre and subgenre preferences

- 62.7% of demand for shows in Italy was for a drama series. This is the largest share of demand for drama in this report which was also reached in Spain for the year.

- The science fiction genre has fans in Italy where it made up 19.1% of demand in 2023. This was the highest share of demand for the genre in this report.

- Italy was the least receptive market to documentary content in this report. Only 4.4% of demand for shows in 2023 was for a documentary series, which is smaller than in any other market in this report.

- Shows with LGBTGI+ themes made up a larger share of demand in Italy than in any other market in this report, accounting for 7.7% of demand here.

- The true crime subgenre underperforms in Italy. This was one of only two markets in this report where the share of demand for true crime series fell below 1% for the year.

- Demand for the superhero subgenre outperforms its share of titles in most markets. However, Italy was the only market in this report where superhero content accounted for more than 4% of demand in 2023.

Italy originals share of demand and demand distribution

- Italy was the most Netflix-loving market in this report. 10.0% of demand for shows was for a Netflix original in 2023–the platform’s largest share of demand in this report. This is also a slight increase from Netflix’s share of demand in 2022 (9.8%).

- RAI, the public broadcasting company of Italy, had the second largest share of demand for its originals in 2023 (6.1%).

- Amazon Prime Video original content succeeded in Italy in 2023. 3.2% of demand for all series was for anAmazon original. This was the only market in this report where Amazon surpassed a 3% demand share for the year.

- Disney+ revived the Italian comedy Boris in 2022 after it had ended in 2010. Choosing a classic local series to revive has paid off for the platform as the show continued to have high demand in 2023 and ranked as the 9th most in-demand show in Italy for the year.

- Mare Fuori was the most in-demand scripted series from Rai 2. Its third season premiered in February 2023 and the show had 13.2 times the average series demand for the year.

- The Turkish drama, Another Love, won over audiences in Italy in 2023. The show had 8.3 times the average series demand and ranked higher here than in any other market in this report.

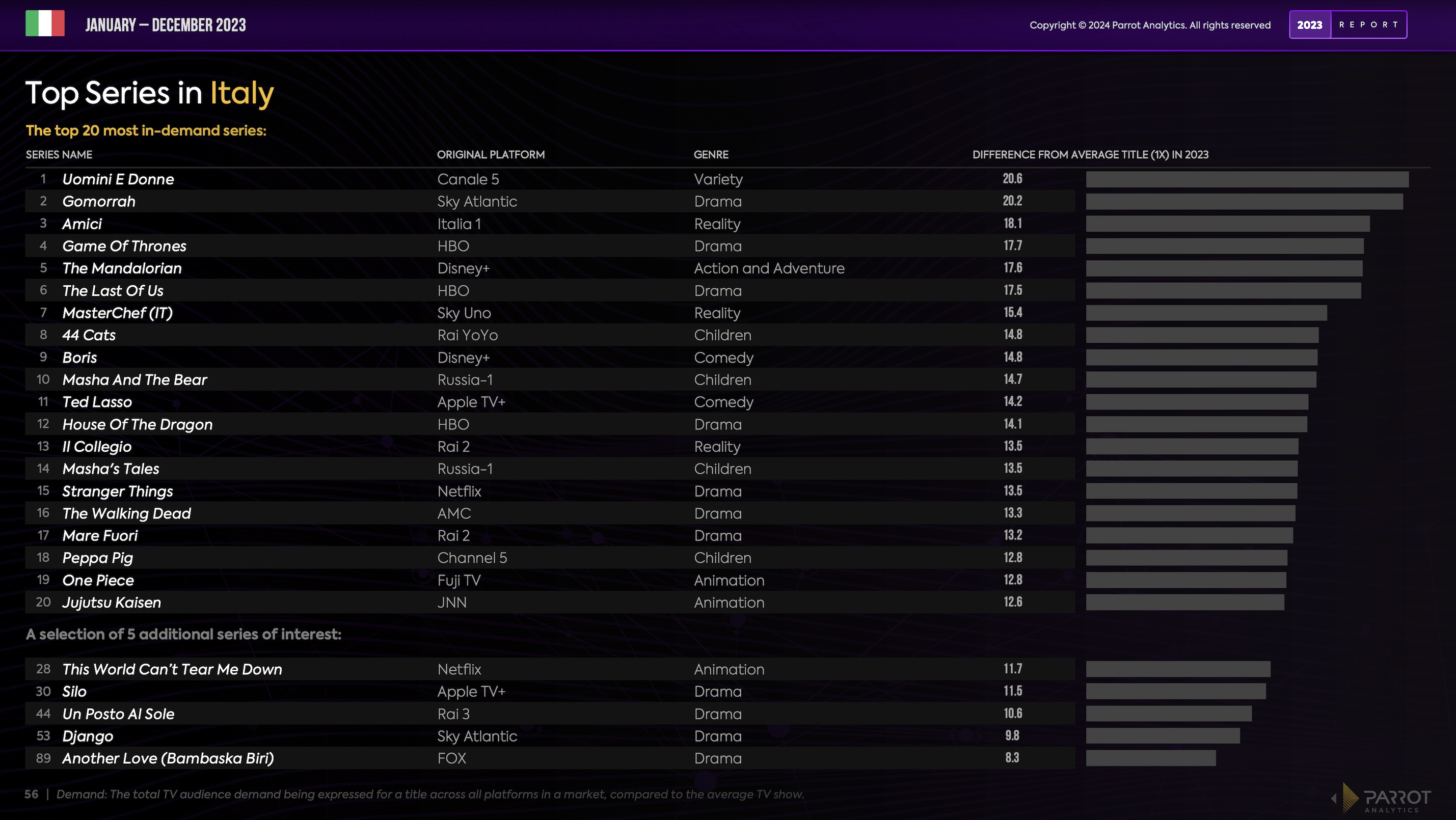

Top series in Italy

Here are the top 20 most in-demand series in 2022 in Italy across all platforms:

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report.

2022 Insights - Full Year

Italy television and streaming market share analysis 2022: Netflix, RAI, HBO, Disney and CBS.

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report and to discover the latest content analytics and trends for TV series on cable, broadcast, OTT and SVOD streaming platforms around the world.

Fill this form and don't miss our next Parrot Analytics LIVE webinar!

Presented below is the section for Italy from The Global Television Demand Report. Enjoy!

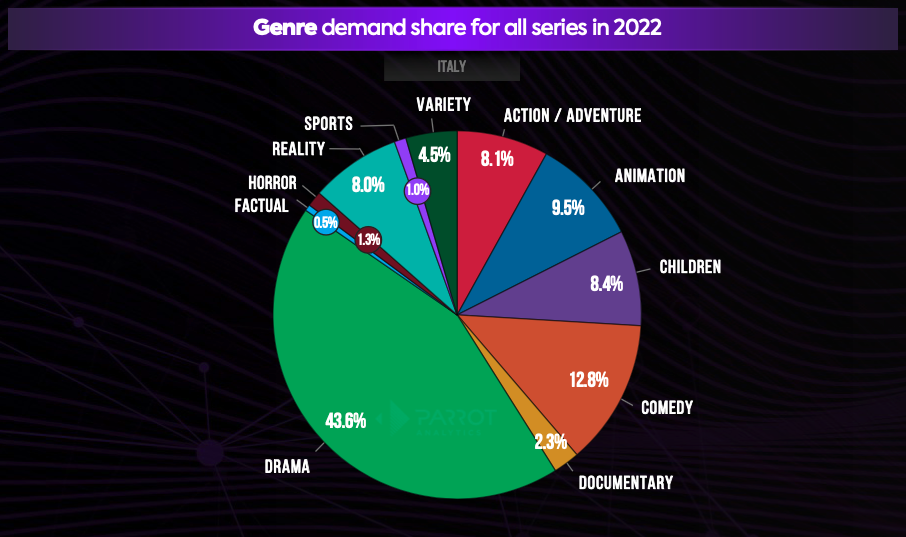

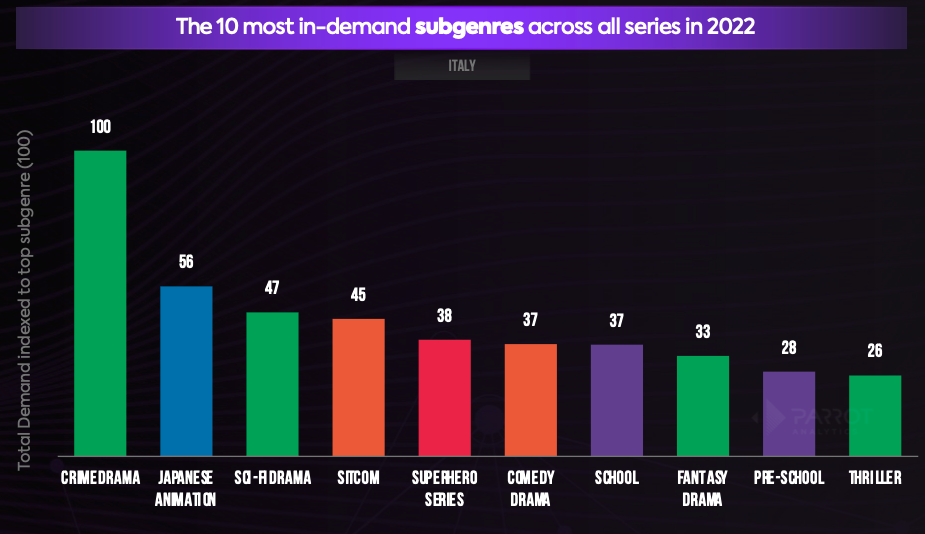

Italy genre and subgenre preferences

- Italy was the market in this report that had by far the largest share of demand for the action/adventure genre. 8.1% of demand in Italy was for a show in this genre, no other market in this report even reached a7% share.

- Italian audiences gave a 43.6% share of demand to shows in the drama genre. This was the second largest share in this report, behind only drama-loving Spain.

- Italy was tied with Mexico for the lowest share of demand given to shows in the documentary genre. Both countries had a 2.3% share of demand for documentaries. This was only slightly greater than half of the global share of demand for documentary series (5.2%).

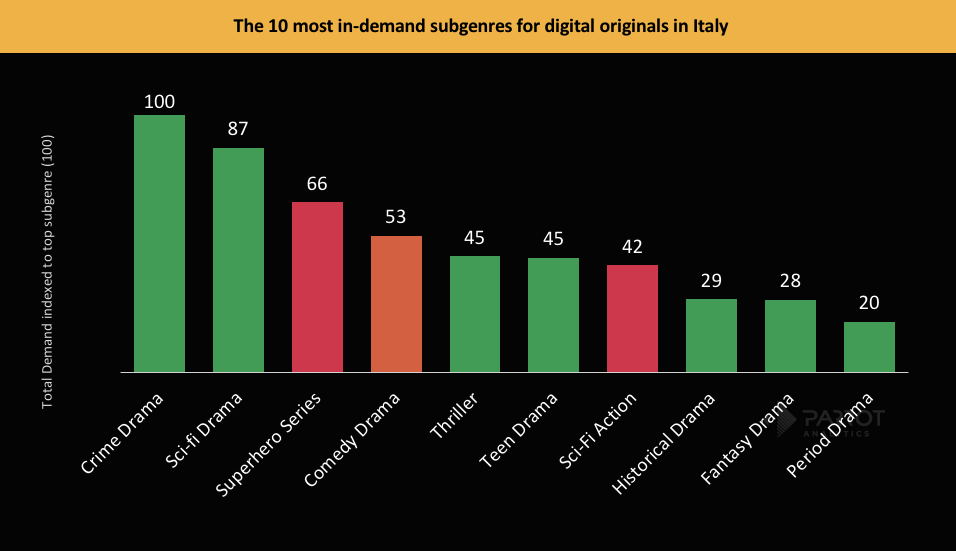

- Italy was one of five markets in this report where crime drama was the most in-demand subgenre of 2022.The others were Australia, the UK, Canada, and Spain.

- As the fifth most in-demand subgenre, superhero series ranked higher in Italy than in any other market in this report.

- Fantasy drama ranked as the eighth most in-demand subgenre in Italy in 2022. This was the subgenre’s highest rank in this report. It was also the eighth most in-demand subgenre in Canada and Brazil.

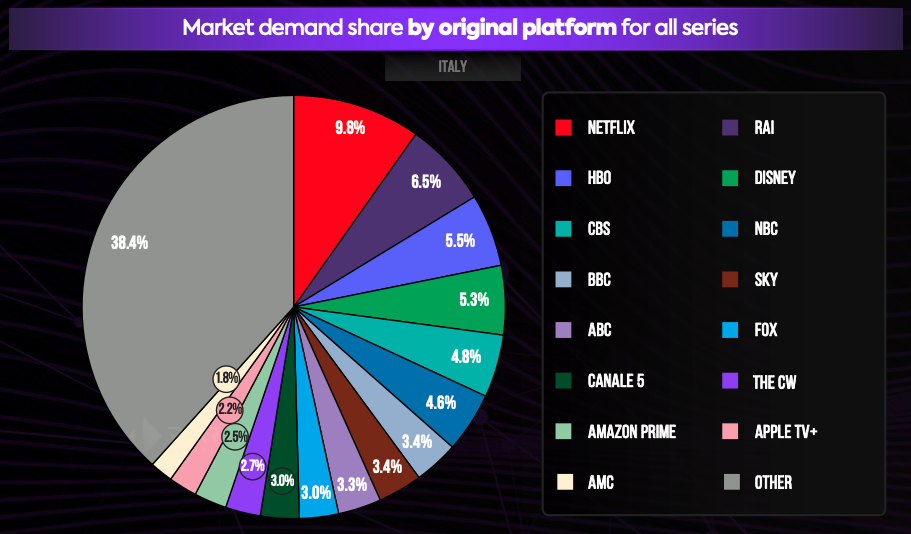

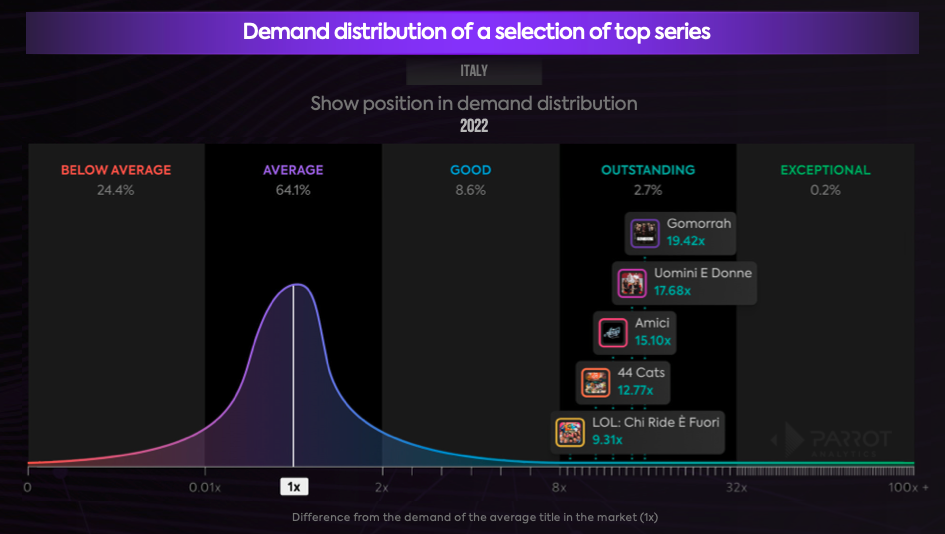

Italy originals share of demand and demand distribution

- Italy was the most Netflix-loving market in this report. 9.8% of demand for shows was for a Netflix original in 2022–the platform’s largest share of demand in this report.

- RAI, the public broadcasting company of Italy, had the second largest share of demand for its originals (6.5%), beating out even HBO (5.5%).

- Demand for content that originally premiered on a Disney branded channel or platform made up 5.3% of demand in Italy, a larger share of demand than it reached in any other market in this report.

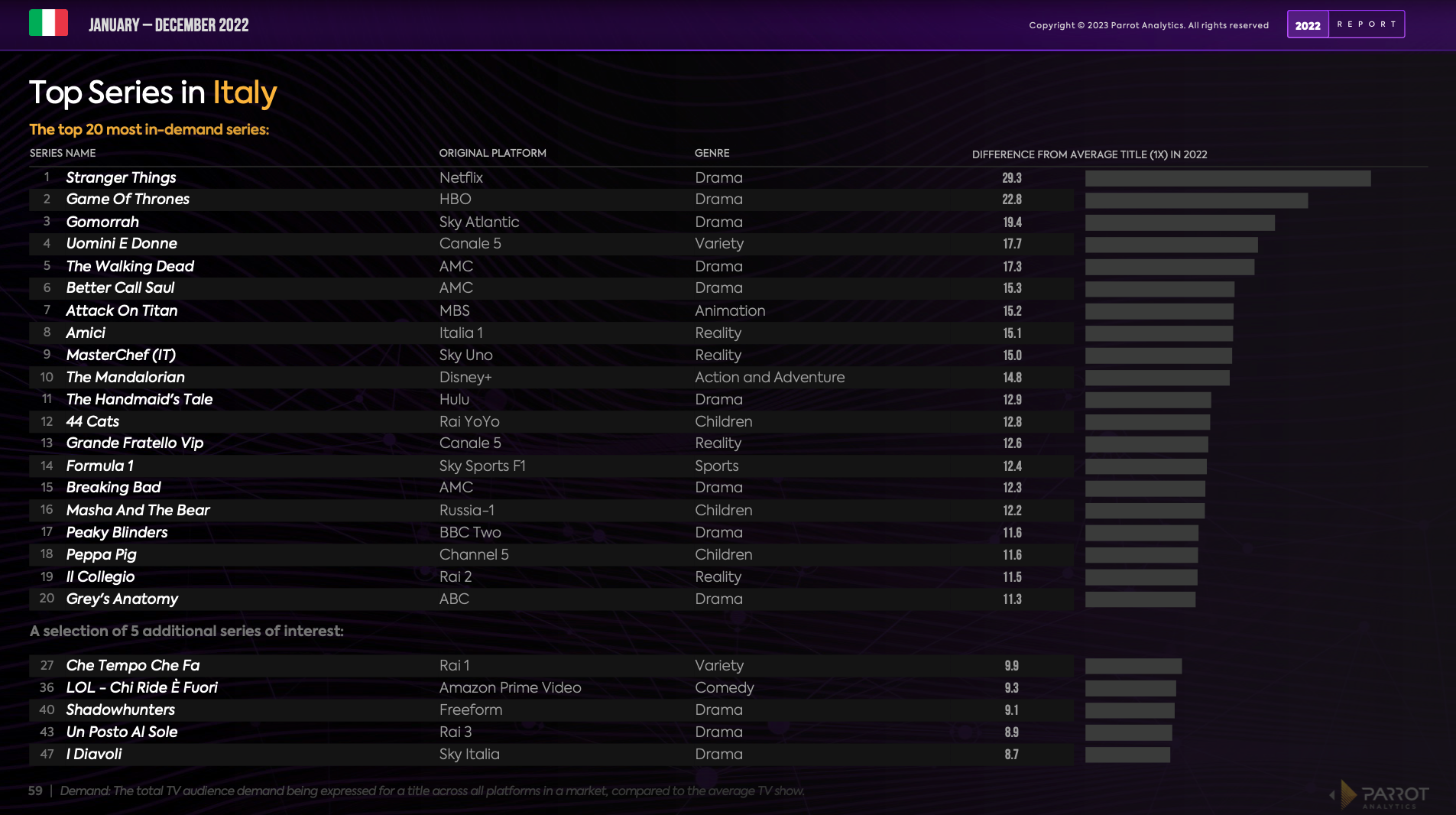

- Gomorrah, a drama from Sky Atlantic, was the most in-demand local series in Italy of 2022. It had 19.42x demand and ranked as the third most in-demand show overall for the year.

- 44 Cats, an Italian animated children’s series, was the most in-demand children’s show in Italy for the year with 12.77 times the average series demand.

- LOL-Chi Ride È Fuori, a comedy game show based on the Japanese series Documental, has found success in Italy on Amazon Prime Video where it had 9.31 times the average series demand for the year.

Top series in Italy

Here are the top 20 most in-demand series in 2022 in Italy across all platforms:

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report.

2021 Insights - Full Year

The leading SVOD platforms in Italy 2021: Netflix, Disney+, Amazon Prime Video, Apple TV+, Hulu and more.

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report and to discover the latest content analytics and trends for TV series on cable, broadcast, OTT and SVOD streaming platforms around the world.

Presented below is the section for Italy from The Global Television Demand Report. Enjoy!

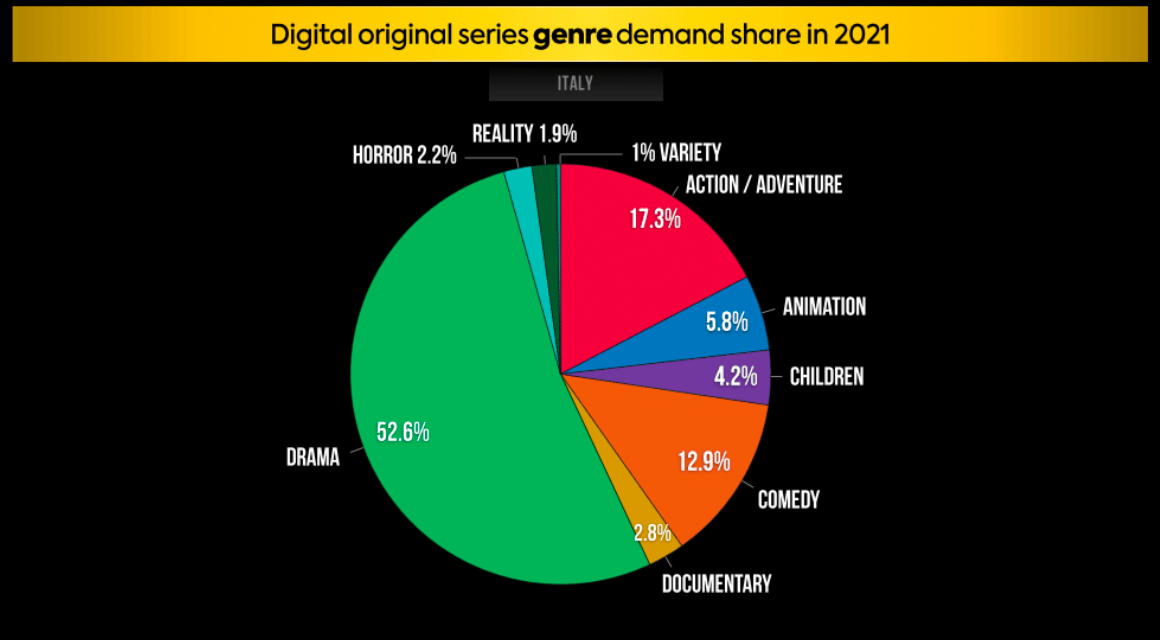

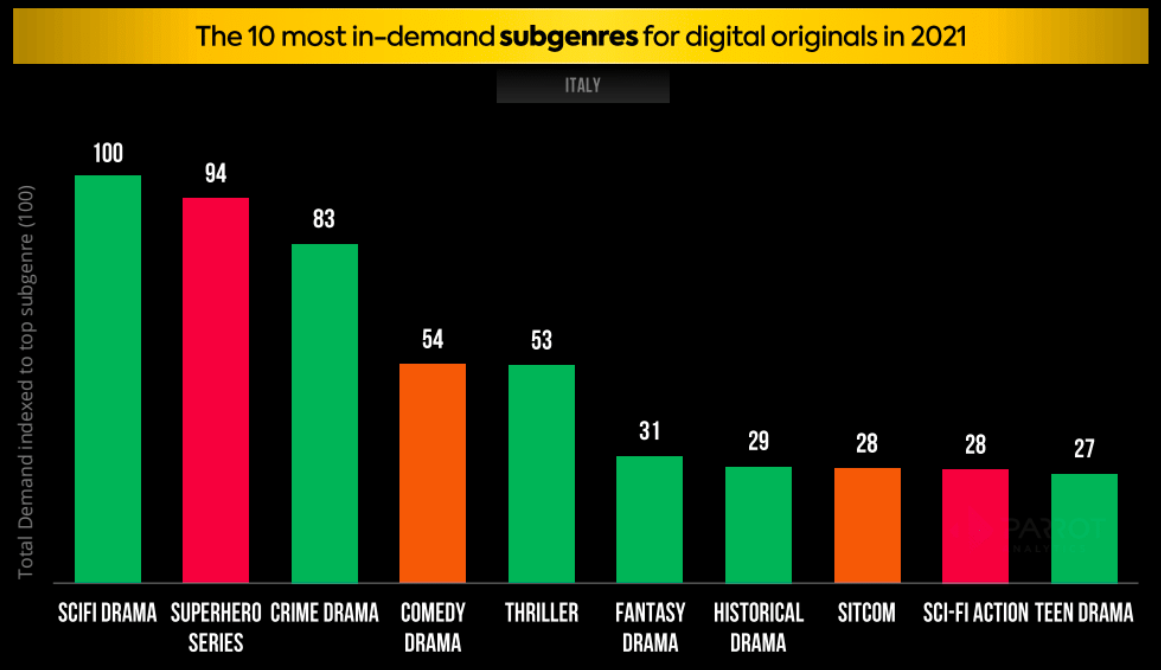

Italy digital original genre and subgenre preferences

- With 52.6% demand share, drama is the most in-demand genre in Italy for 2021. While last year, Italy was the most drama loving market we covered, this year it has been surpassed by Spain in this report.

- In contrast, comedy captured only 12.9% of Italian audiences’ attention in 2021. This is the smallest share for that genre across all markets in this report, but it is up slightly from its 12.6% share in 2020.

- Italians had a share of demand for the documentary genre (2.8%) that was less than half of the global demand share for this genre (6.0%)

- Fantasy drama was a uniquely successful subgenre in Italy this year. It was the 6th most in-demand digital original subgenre in 2021, a higher rank than in any other market in this report.

- Italian audiences have low demand for comedies, but sitcoms in particular struggle to succeed here. As the 8th most in-demand subgenre, sitcom ranked lower in Italy than in any other market in this report.

- However, comedy drama still performed well. As the 4th most in-demand subgenre it ranked higher than in half the markets in this report. It seems that the drama-loving Italian market appreciates a dash of drama inits comedies as well.

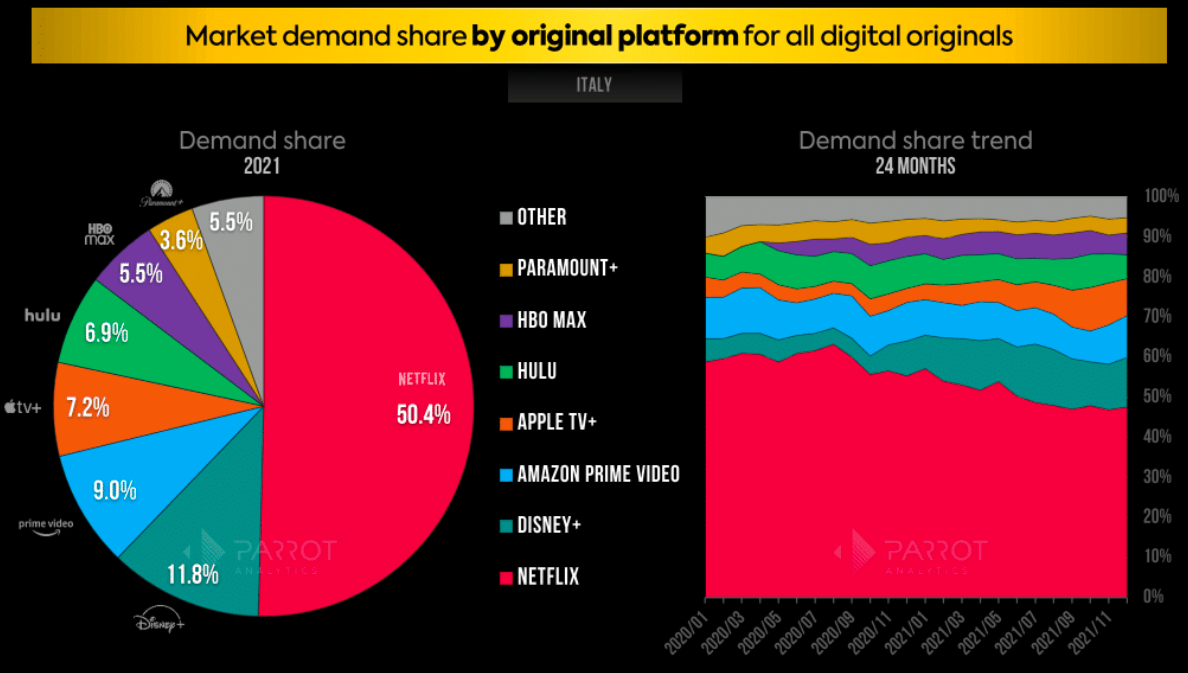

Italy platform demand share and digital originals demand distribution

- Italy was the only market in this report where Netflix had a greater than 50% share of demand in 2021. This is down from last year when it had a 60% share.

- Italy was one of four markets in this report where the share of demand for Disney+ originals (11.8%) surpassed Amazon Prime Video’s share (9.0%).

- Italy has one of the smallest shares of demand coming from Other platforms not broken out here. Only 5.5% of demand for digital originals in 2021 was for an original series not from one of the above platform.

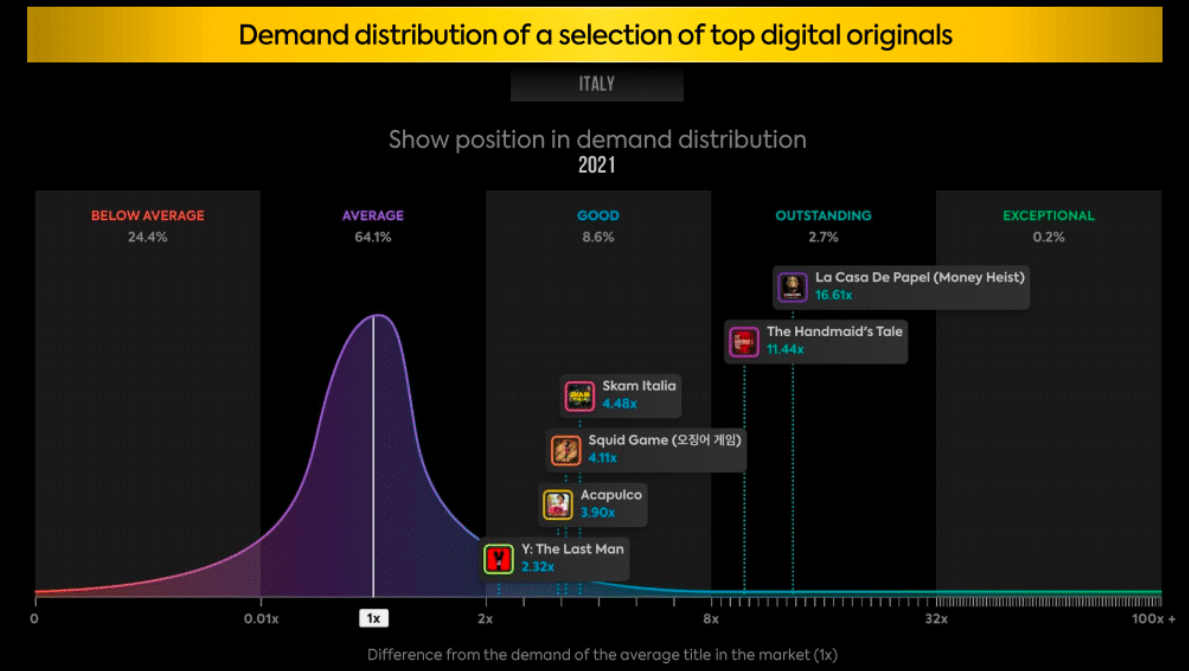

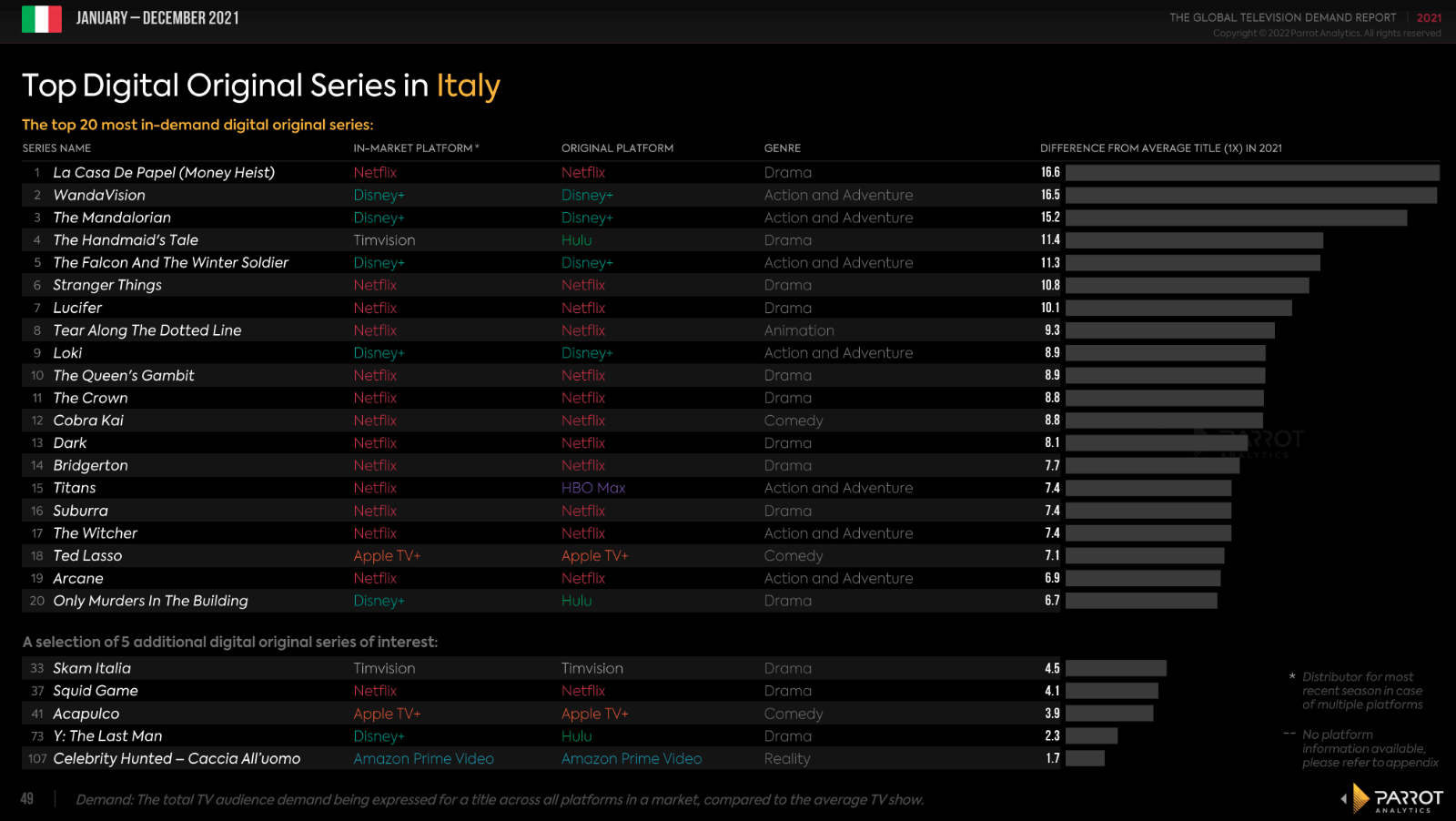

- As with two other market in this report (France and Spain), La Casa de Papel was the most in-demand digital original in Italy for the year with 16.61 times the average series demand.

- The Handmaid’s Tale, while popular around the world, found particular success in Italy this year where it had 11.44 times the average series demand and ranked as the 4th most in-demand digital original-higher than in any other market in this report.

- Apple TV+’s comedy, Acapulco, performed well in Italy this year. It had 3.9 times the average series demand and ranked higher here than any other market in this report.

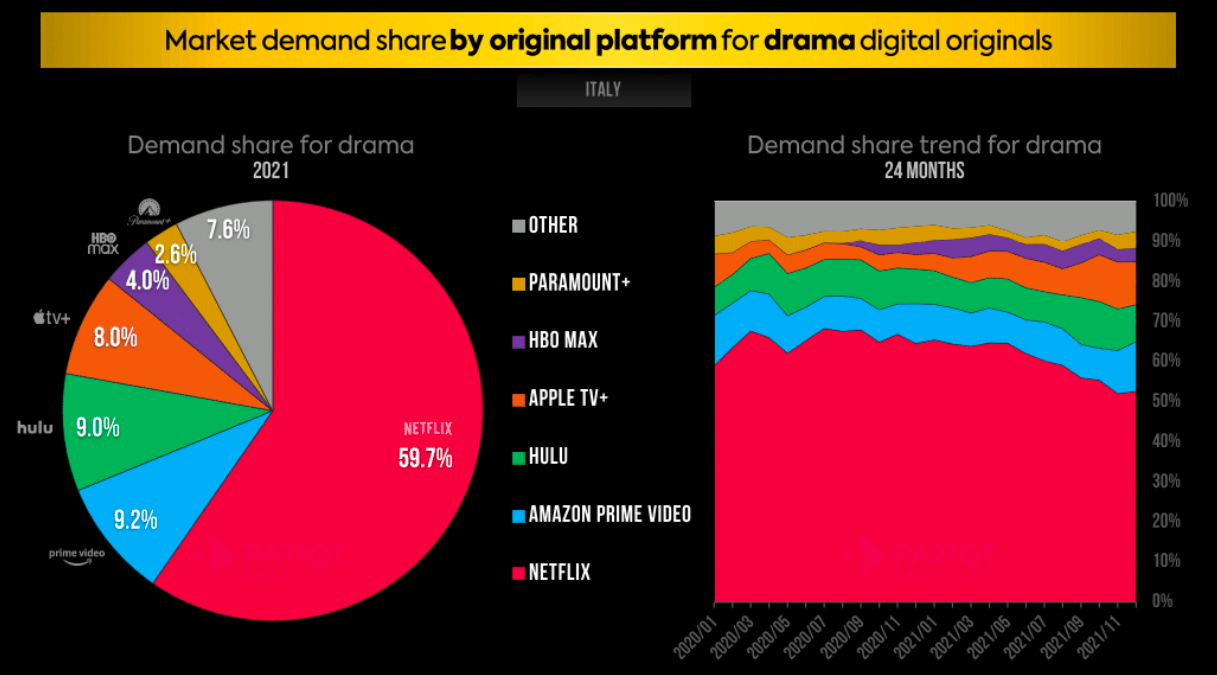

Italy platform demand share for drama and action/adventure digital originals

- Italy was the market in this report with the largest share of demand for Netflix’s original dramas. 59.7% of demand for original dramas was for a Netflix original in Italy this year.

- Amazon has suffered the most as a result of Netflix’s dominance here. Its share of demand for original dramas (9.2%) was among the lowest of markets in this report and well below its global share of demand for dramas (13.0%).

- HBO Max dramas succeeded despite Netflix’s strength in the Italian market. 4.0% of demand for original dramas was for an HBO Max original–above the platform’s global share of demand in this genre (2.9%)

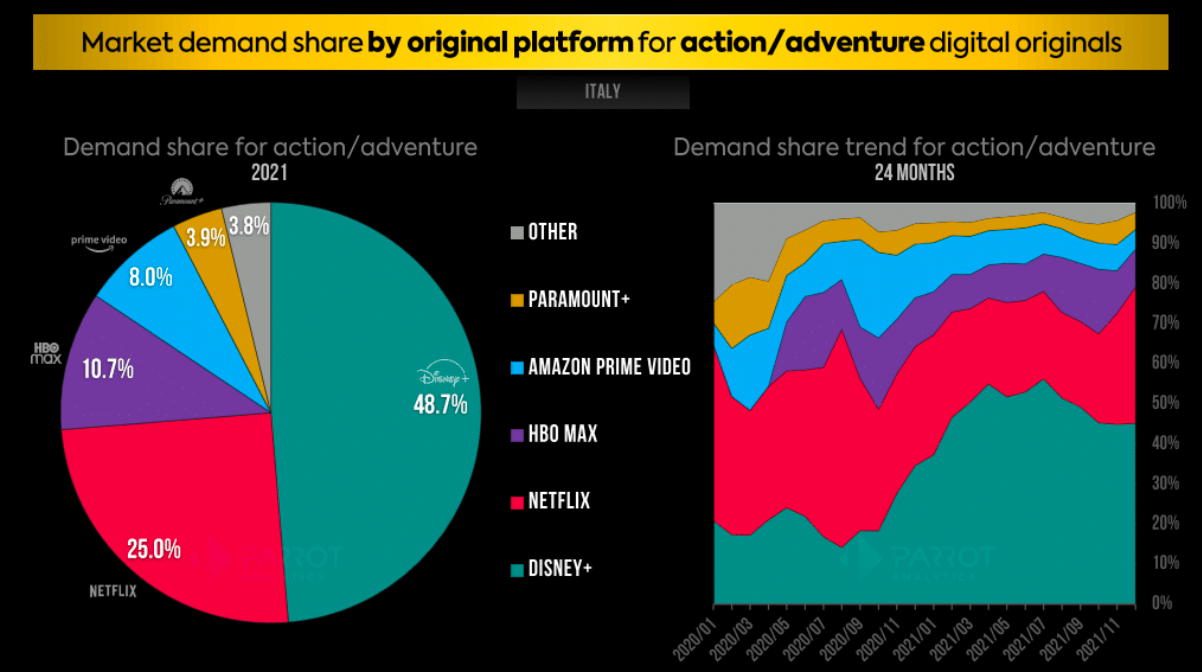

- Disney+ has strong demand for its action/adventure originals in Italy. Its originals nearly made up 50% of demand for the action/adventure genre this year, falling just short at 48.7%

- HBO Max originals made up a smaller share of demand for the action/adventure genre in Italy than in any other market in this report. The platform’s 10.7% share of demand in Italy was below its global share of demand in the genre (13.2%).

- Amazon Prime Video struggled in the action/adventure genre this year. The share of demand for its originals in Italy hit a two year low point in December when it reached 5.0%.

Top digital original series in Italy

Here are the top 20 most in-demand streaming original series in 2021 across all platforms:

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report.

2020 Insights - Full Year

Italy streaming market share analysis 2020: Netflix, Amazon Prime Video, Hulu, Disney+, Paramount+ (CBS All Access) and more.

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report and to discover the latest content analytics and trends for TV series on cable, broadcast, OTT and SVOD streaming platforms around the world.

Presented below is the section for Italy from The Global Television Demand Report. Enjoy!

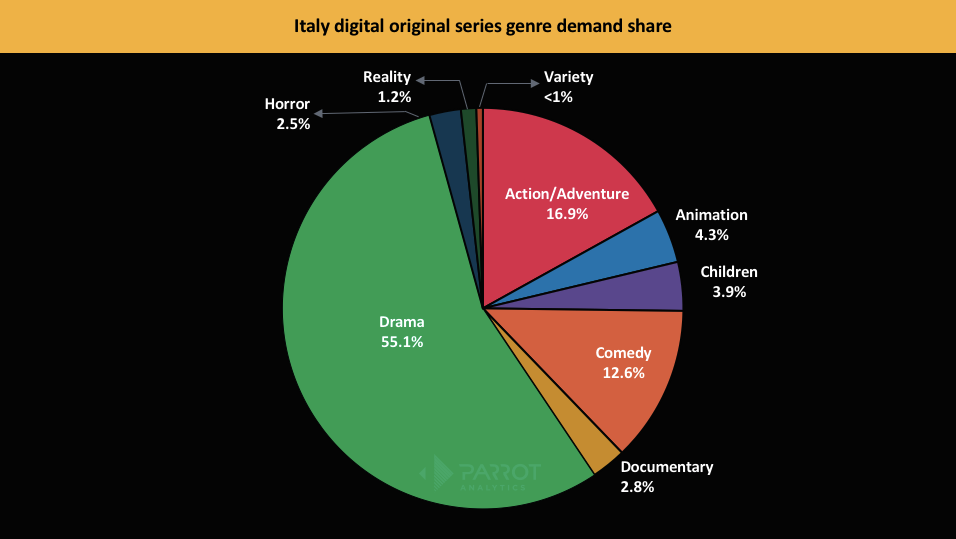

Italy digital original genre and subgenre preferences

- With 55.1% demand share, drama is the most in-demand genre in Italy for 2020. Italy is the market in this report with the greatest demand for drama.

- In contrast, comedy captured only 12.6% of audiences attention in 2020. This is the smallest share for that genre across all markets in this report.

- Due to drama’s outsize share in this market, most other genres have a below average demand share here. The exception to this is action/adventure. While Italy had a well below average demand share for this genre in 2019, this market saw the largest growth in demand for action adventure, up from 13.2% last year. Italy’s 16.9% demand share for action adventure originals is now above average.

- Italy has the most drama dominated subgenre ranking of markets in this report. Seven of the top ten subgenres are dramas.

- Crime drama is the most in-demand subgenre in Italy for 2020. It is one of 3 markets (along with Mexico and Spain) where this was the top subgenre.

- Teen drama achieved its highest demand rank in Italy out of all markets in 2020 as the sixth most demanded subgenre. This is the same as in 2019, indicating this category has a lasting popularity in Italy.

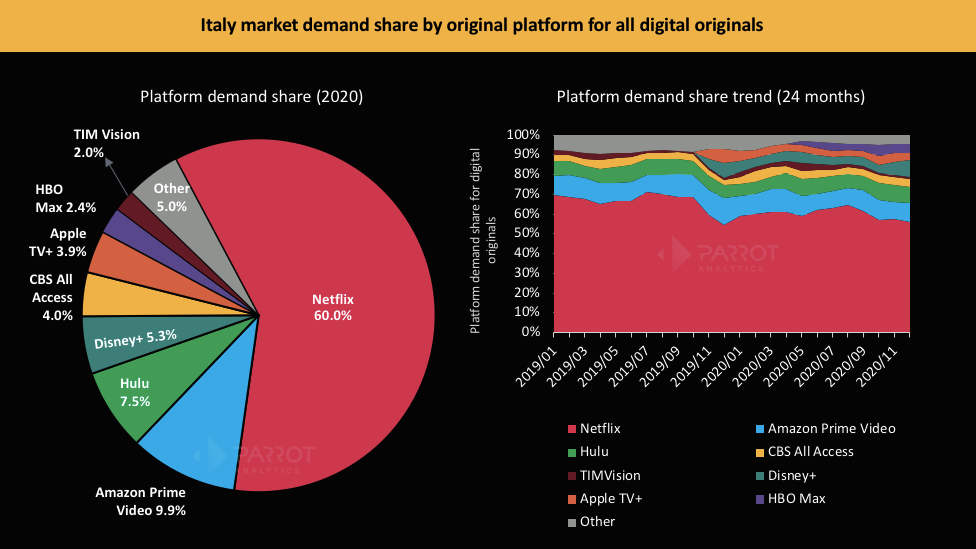

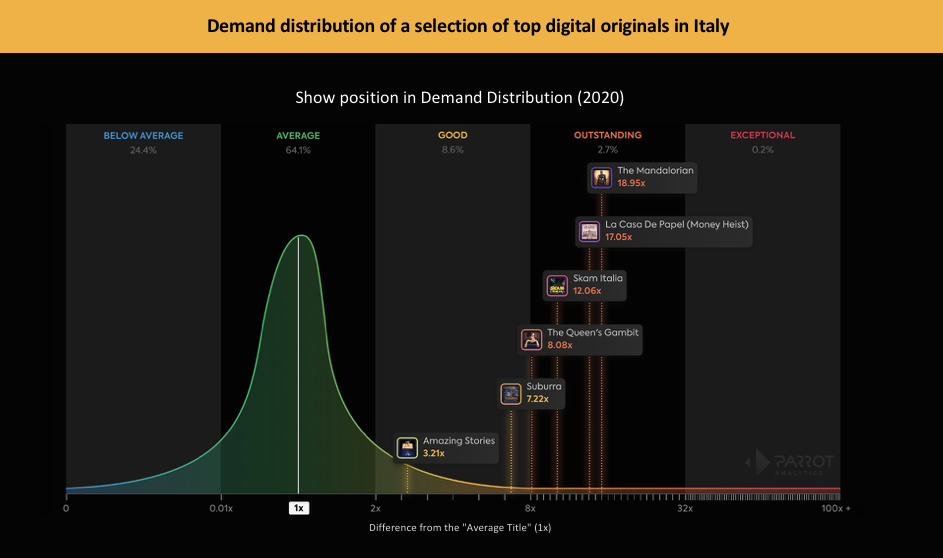

Italy platform demand share and digital originals demand distribution

- In 2020, 60.0% of demand expressed for all digital originals in Italy is for an original series from Netflix. In no other market in this report does Netflix have a larger demand share.

- As result of Netflix’s dominant position in Italy, the share of demand for originals from Other platforms is the smallest of any market in this report at 5%. The local Italian platform, TIMvision carved out a respectable 2.0% demand share for the year.

- HBO Max has the second smallest demand in Italy of markets in this report. With a 2.4% demand share for 2020, the new platform’s originals have not gained as much traction in this market.

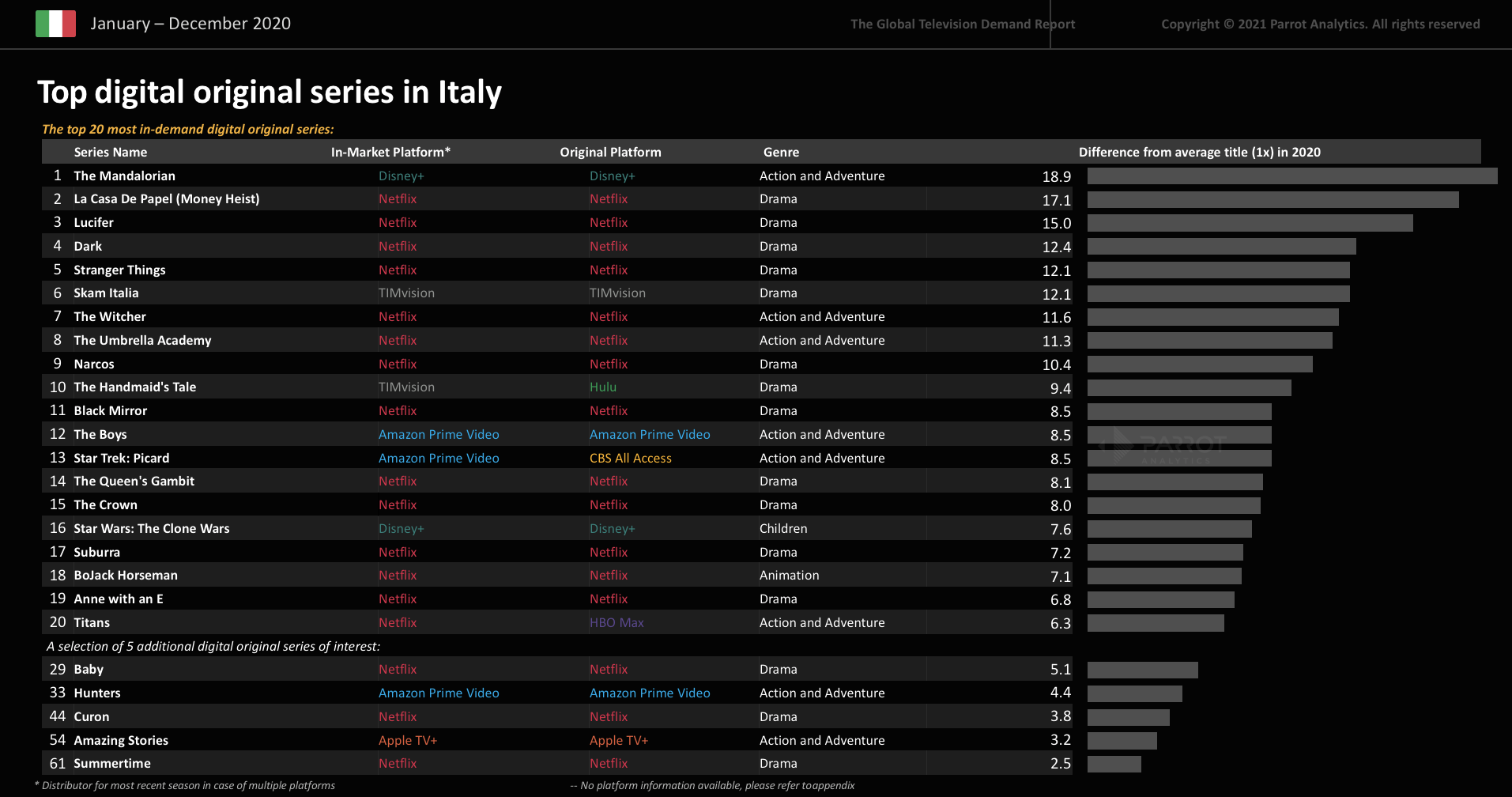

- This year’s most in-demand digital original series in Italy is The Mandalorian. It reached 18.9 times the demand of the average show.

- Netflix’s Suburra was the 17th most in-demand digital original in Italy. This Italian crime drama was 7.2 times the demand of the average show.

- Apple TV+’s Amazing Stories performed particularly well in Italy this year. This reboot of the original Amazing Stories was 3.2 times more in-demand than the average series.

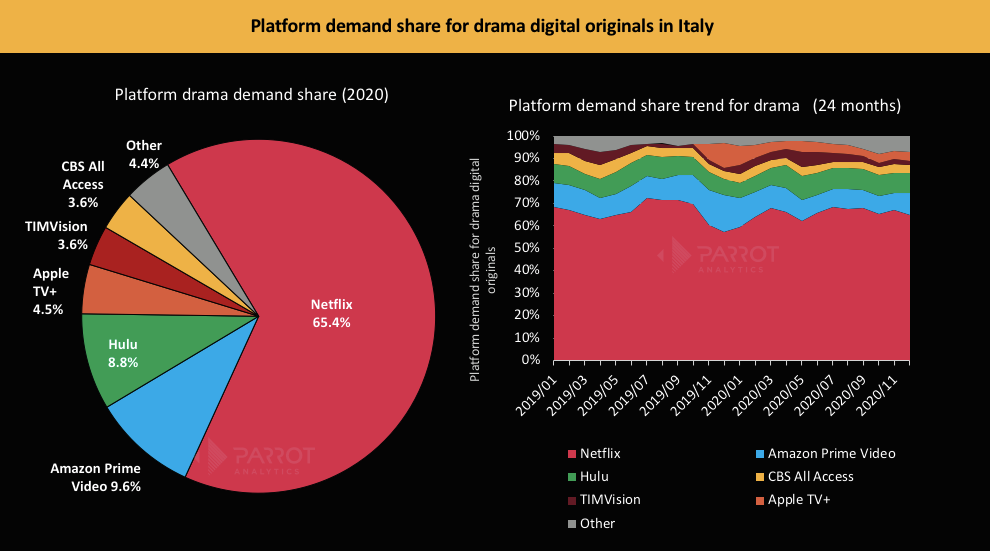

Italy platform demand share for drama and action/adventure digital originals

- Nearly two thirds of demand for drama digital originals in Italy is for a Netflix original. This makes Italy the market where Netflix has the largest share of demand for drama originals.

- As a result of the above, all other platforms have a below average demand share in Italy for drama digital originals.

- The Italian OTT service TIMvision carved out a respectable 3.6% share of demand for drama originals in Italy. TIMvision’s Skam Italia was the 6th most in-demand series overall in Italy for 2020.

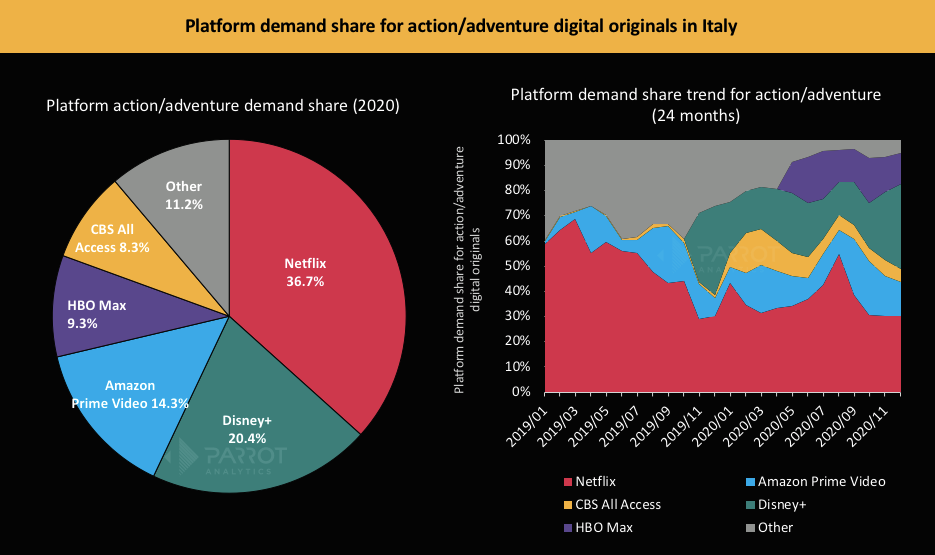

- Netflix has a 36.7% demand share for action/adventure original content in Italy. Along with Spain, Italy is the country with the highest demand share Netflix achieved in this category this year.

- In August this year, Netflix achieved a 54.9% demand share for action/adventure original content in Italy. It has not had a majority share of demand in this market since July 2019.

- In December, Disney+ reached a share of action/adventure demand not yet seen in Italy. It had a 34.0% share for the month, primarily due to The Mandalorian concluding its second season.

Top digital original series in Italy

Here are the top 20 most in-demand streaming original series in 2020 across all platforms:

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report.

2020 Insights - Q2

Parrot Analytics SVOD platform trend reports reveal which SVOD’s digital original series are appealing most to audiences in a market during these three months, dive deeper into how this looks for the dynamic action and adventure genre and shed light on the overall size of digital original series within the entire market.

The key questions investigated in this report:

1. Are Italian audiences demanding more linear or more digital content?

2. Which SVOD’s original series are demanded most by Italian audiences and how is this evolving?

3. In the Action and Adventure genre, which SVOD’s original series are demanded most by Italian audiences and how is this evolving?

Are Italian audiences demanding more linear or digital content?

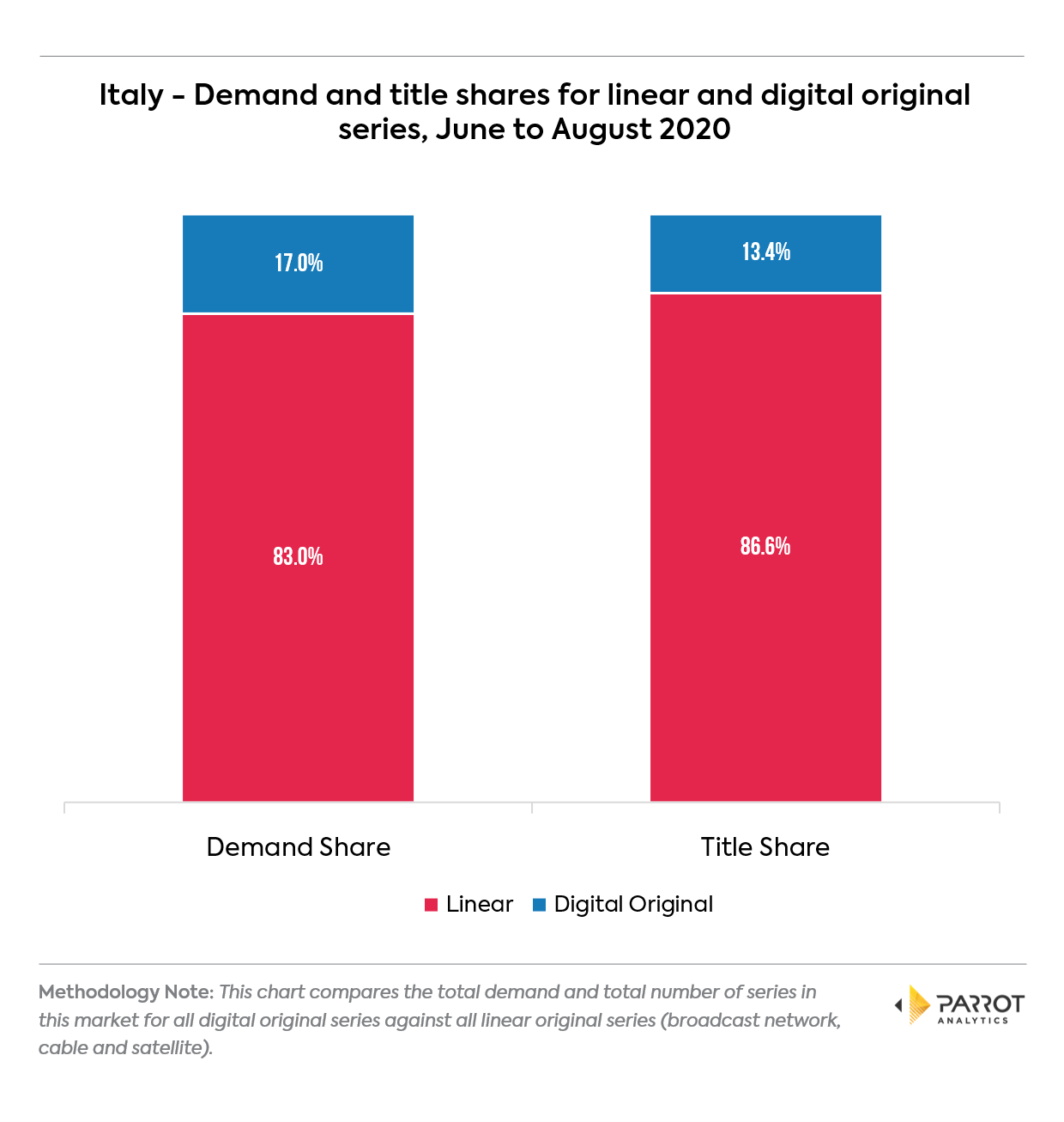

• In Italy, 17.0% of all demand is expressed for a digital original series. The majority of audience demand, 83.0%, is expressed for shows from linear networks.

• However, the average digital original series is more effective at attracting Italian audience attention. Digital originals only make up 13.4% of all titles in this market compared to their 17.0% demand share.

• Italian audiences demand linear series slightly more when compared to the global average. The worldwide average demand share for linear titles in this period is 82.2%.

Which SVOD’s original series are most in-demand by Italian audiences?

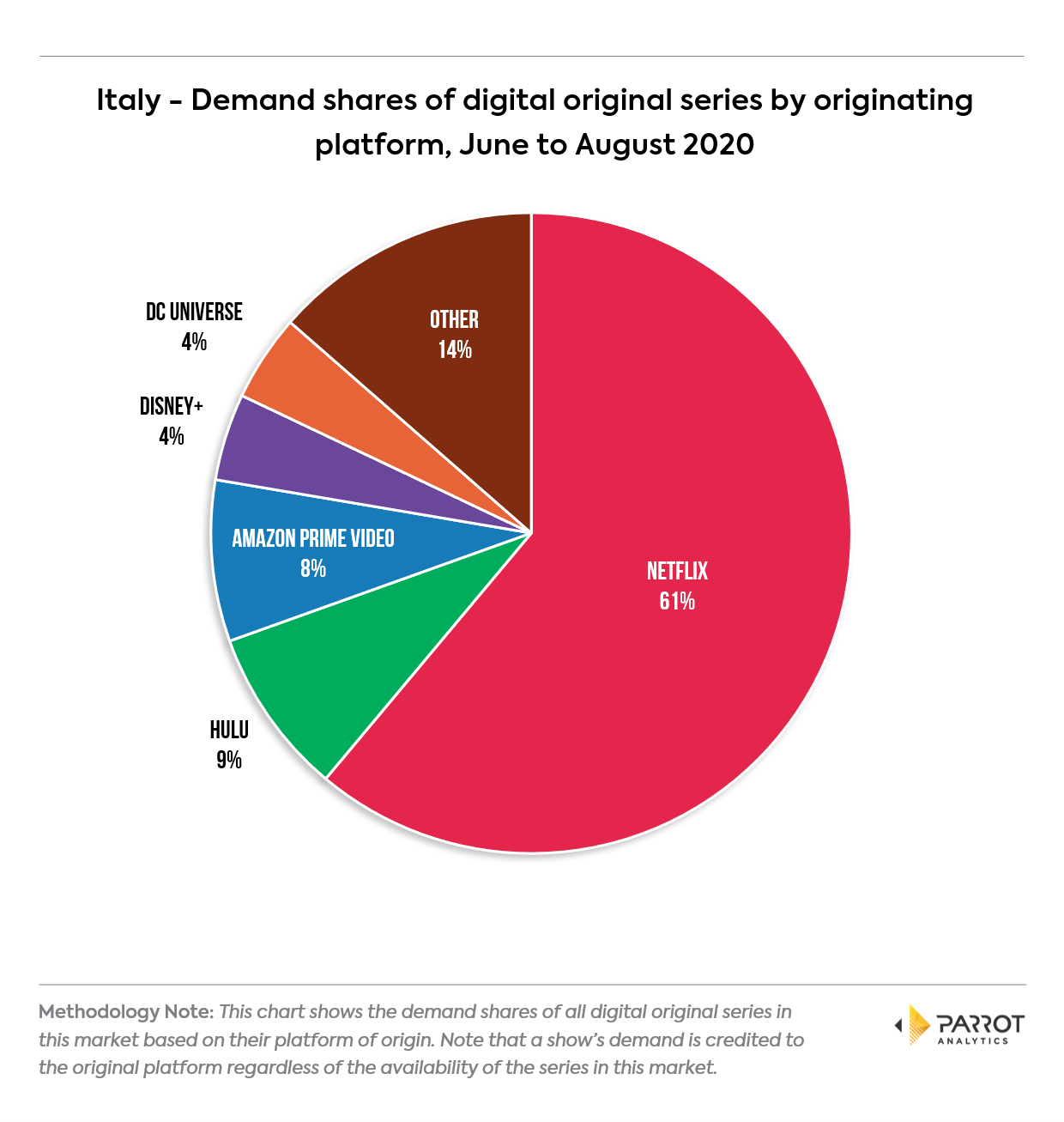

• Netflix original series have a 61.1% demand share of all digital original series demand in the Italian market between June and August 2020.

• Italy is a strong market for Netflix. The 61.1% demand share for Netflix titles in Italy is 4.2% higher than the global average Netflix demand share of 56.9%.

• Italy is one of the roughly two dozen markets where Disney+ series are officially available; the platform launched in Italy in March 2020. This helped Disney+ digital originals have the fourth largest demand share in Italy with a 4.4% share. Globally, the platform has the sixth largest share during these three months.

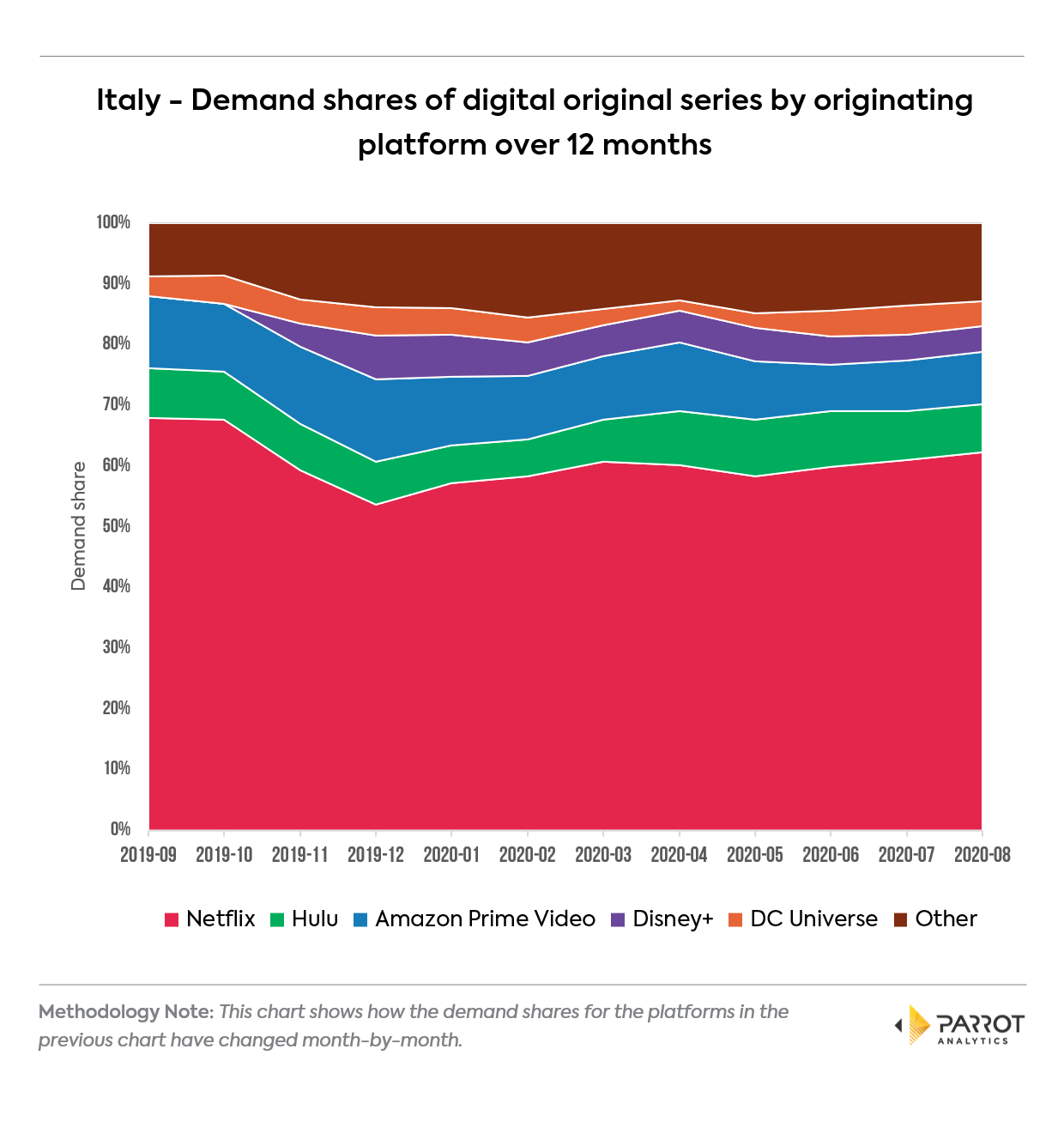

The next chart shows how the demand shares for these five platforms have evolved over the past 12 months:

• Even at its lowest share of demand over the past 12 months, Netflix series never had less than half of the Italian digital original market. The lowest Netflix share is 53.7% in December 2019, the month after the global launches of Disney+ and Apple TV+. Since that point, the demand share for Netflix series has grown in most months.

• Interestingly, demand for Disney+ series surges before the official Italian launch of the platform in March 2020. The Disney+ demand share peak is 7.2% in December 2019. This indicates many Italians did not wait for the arrival of Disney+ series like The Mandalorian, which had its finale in that month.

• The demand share for Hulu original series is consistently within a few percentage points in Italy. As Hulu is a US-only platform, some Hulu series are available in Italy on local and/or global platforms, for example The Handmaid’s Tale on Timvision and Amazon Prime Video. Other series do not yet have Italian distribution.

Which SVOD’s Action and Adventure original series are demanded most by Italian audiences?

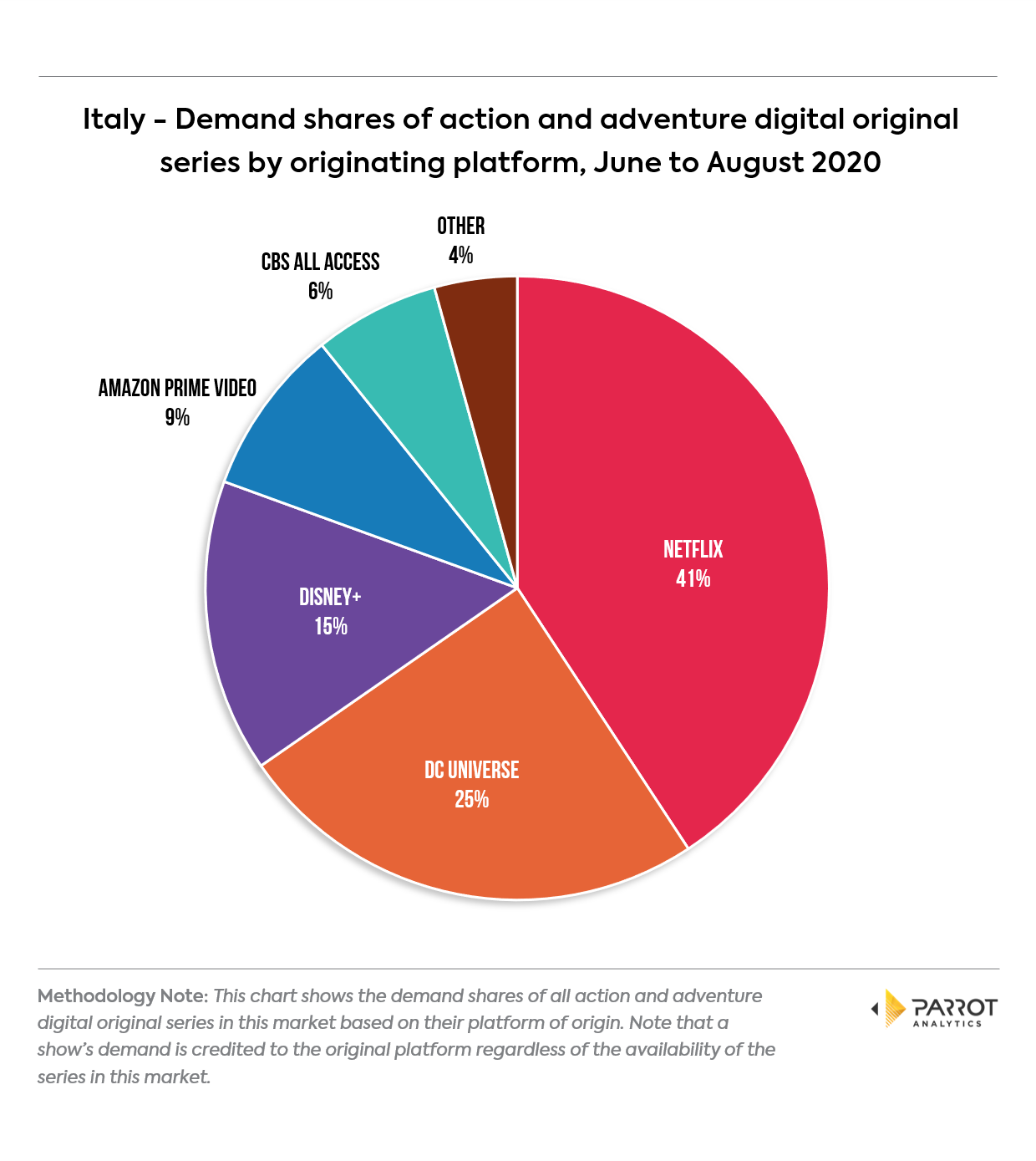

• In contrast to the overall Italian digital original market, CBS All Access series make up one of the five largest demand shares in the action and adventure genre. Highly demanded series like Star Trek: Picard helped CBS All Access originals capture 6.5% of demand in this genre, although the sci-fi action series is available in-market on Amazon Prime Video.

• Keeping with the overall digital original market trend, the 40.8% Italian demand share for Netflix in this genre is larger than the global average share of 37.2%.

• DC Universe series are the second most demanded type of action and adventure originals with a 31.1% demand share in Italy. Between June and August 2020, Stargirl is the most demanded DC Universe original with Italian audiences.

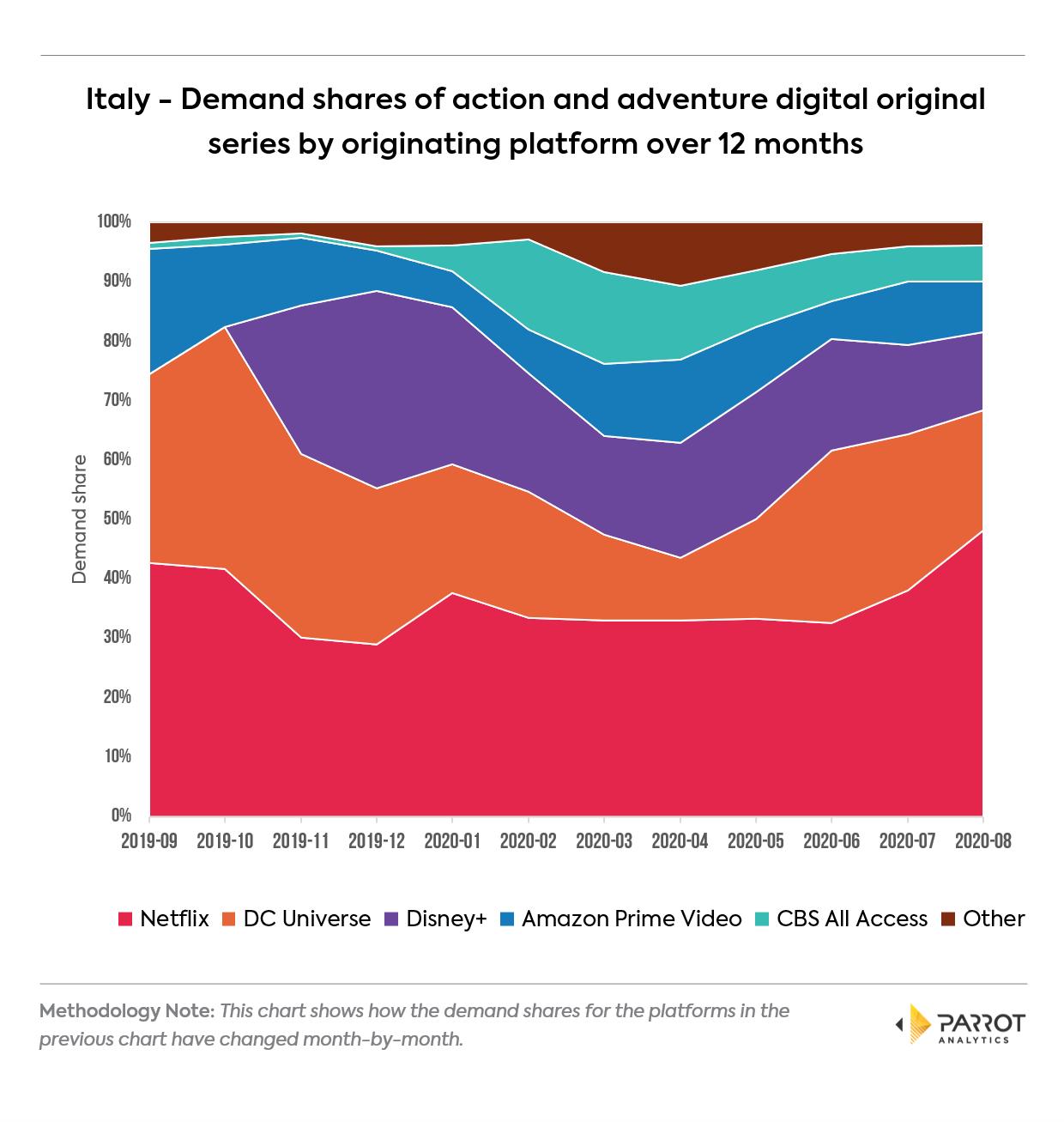

The next chart shows how the action and adventure demand shares for these five platforms have evolved over the past 12 months:

• The global arrival of Disney+ had a greater effect in this genre than in the overall Italian digital original market. In December 2019 when The Mandalorian released its finale, Disney+ peaked with a 33.2% demand share of action and adventure originals.

• Over the most recent three months, the share of demand for Netflix action and adventure originals has climbed from 32.6% in June to 48.1% in August. A significant amount of this demand increase is due to the release of The Umbrella Academy Season 2 on July 31st.

• Amazon Prime Video had a demand share increase in July 2020, going up to 10.6% of demand for action and adventure digital original series. The main driving force for this in Italy is the release of Season 2 of Hanna.

This report is intended as a high-level overview of the SVOD market in this country. To access more granular platform demand trends for specific platforms, genres, timeframes and more, contact your Parrot Analytics representative.

Need more information? Check out our daily updated TV series popularity data for Italy.