Image: Brooklyn Nine-Nine, NBC/FOX

While the TV industry is swiftly evolving to the point where commissioning, premiering and renewals/cancellations of titles is a constant process, the US TV season is still a crucial part in the global “content lifecycle”.

With details of the first shows of the 2018-2019 season being released, the 2017-2018 TV season is coming to a close. To see what insights and trends can be discovered from the decisions made, we have investigated some of the cancelled titles of the past season by leveraging our global TV demand data for the United States.

Which shows might not stay down?

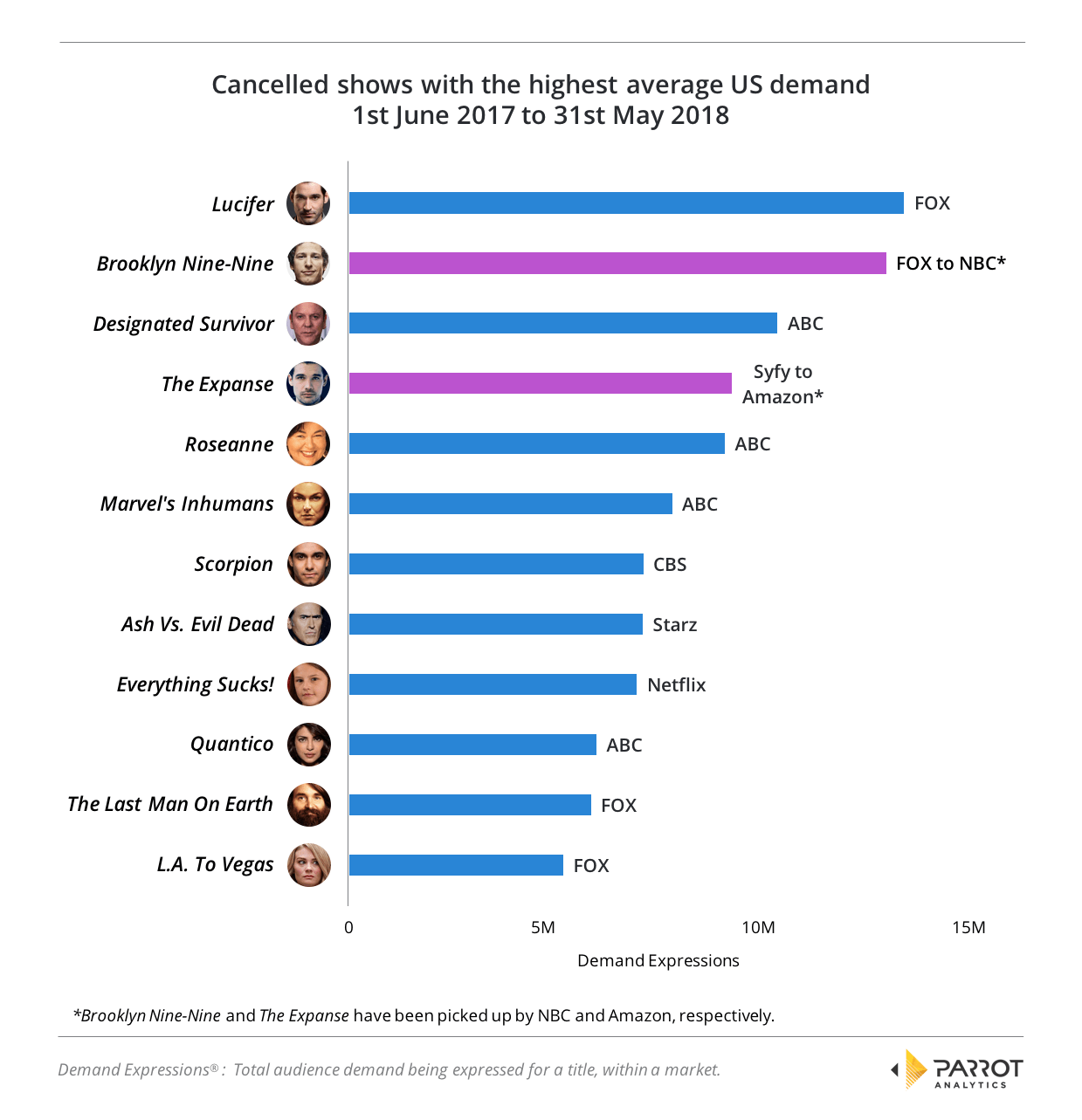

Some of the initial cancellations of the 2017-2018 season have already found a new home on a different network/platform. The most dramatic examples of these “saved” shows are Brooklyn Nine-Nine’s lightning fast pickup by NBC after FOX cancelled the show, and then Jeff Bezos personally taking an interest in Amazon acquiring The Expanse after Syfy decided not to continue with it.

The obvious question to investigate first is which of the other cancelled shows might also be candidates for renewal elsewhere. To answer this question, we can examine the average US demand for the cancelled titles over the past 12 months to see which performed best, as well as how they compare to shows that have already been saved from cancellation. The following graphic illustrates this well:

Another stand out is the next highest in-demand cancelled title, Designated Survivor. Netflix already owns the international rights and as one of the most popular shows on this list, they must certainly be giving strong consideration to adding Designated Survivor to their portfolio of Netflix originals.

As a cautionary note, and directly related to the nature of today’s global content marketplace, taking an average over 12 months in one country only will not be the only factor that TV executives will be considering as they make these types decisions. Conversely, even a title with reasonable domestic appeal might not be worthwhile to consider if the show has bad international returns.

In Lucifer’s case – as per the screenshot below taken directly from Parrot Analytics’ Demand Portal – it is certainly clear that there are some well-performing international markets where its popularity is clearly outpacing that of the United States. For example, Lucifer has been more than twice as popular in Brazil over the last 12 months (9.41 Demand Expressions per capita, DEX/c) than it has been in the United States (4.29 DEX/c).

Though when only the last 90 days are considered, its popularity “premium” in Brazil, compared to the United States, shrinks to a difference of +22%. Still, this suggests that there exists at least one market worthy of consideration, and several others that are on par with the United States such as France, Poland and Russia.

Finally, there can also be external factors that will impact on decision making, beyond the performance of a show itself – as in the recently well-publicized controversies surrounding ABC’s now-cancelled Roseanne reboot.

Broadcast still requires the highest popularity standards for titles

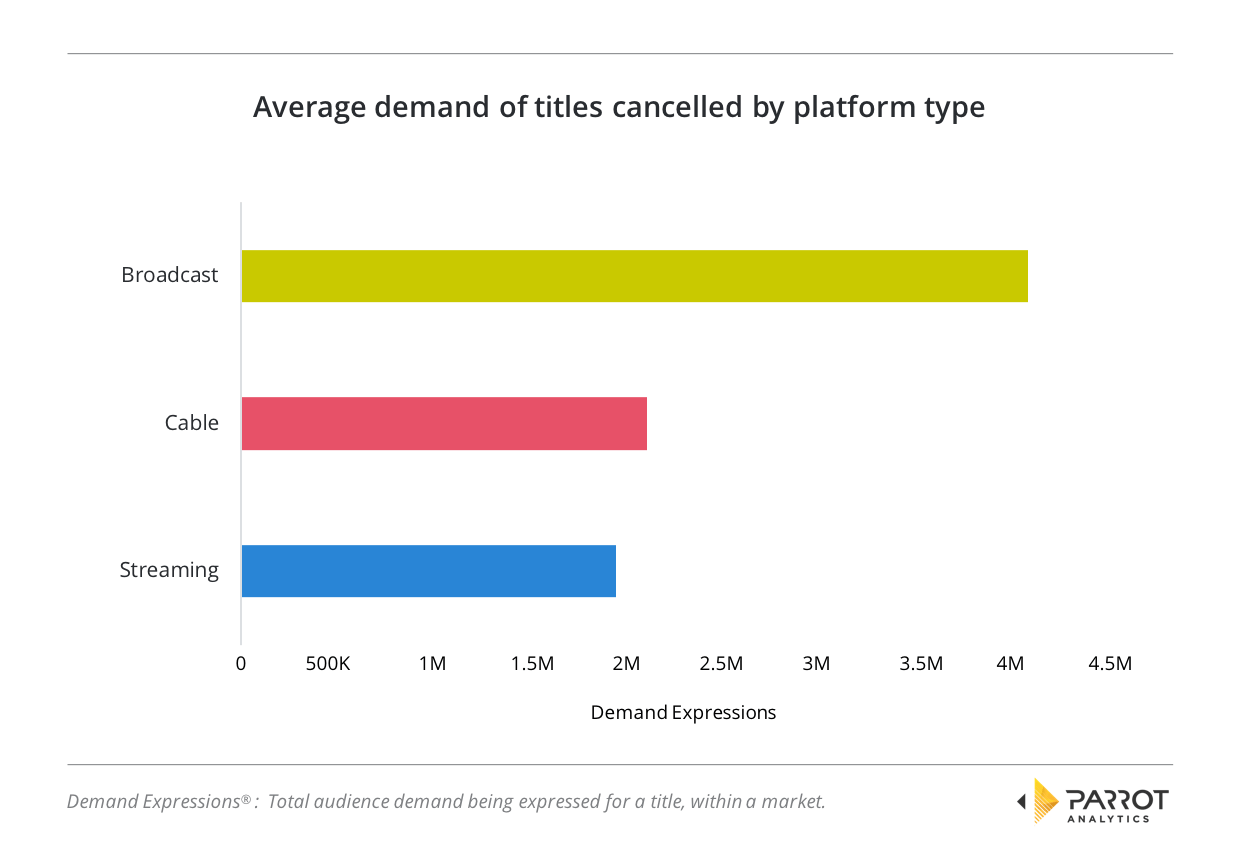

Moving from individual shows to examining trends from the cancellations as a whole (and so no longer considering the “saved” titles), we can see if anything is revealed when the average demand of all the titles cancelled for a certain content distribution type is considered:

Although broadcasters cancelled the most titles (31, compared to 20 for cable and 13 for streaming), the titles that we determined not to be continued had over twice the average demand of the cable network and streaming service cancellations.

This shows that the mass-market nature of the big broadcasters is still driving their content decisions. The networks therefore need a higher audience fit for each title to make a return on their investment – and at least for this season, they appear to be far more willing to drop anything not meeting this requirement.

In contrast, smaller shows with lower demand can often thrive happily on cable and streaming services with a niche audience, and thus the popularity threshold to clear can be set lower.

Everyone wants to make the next The Big Bang Theory

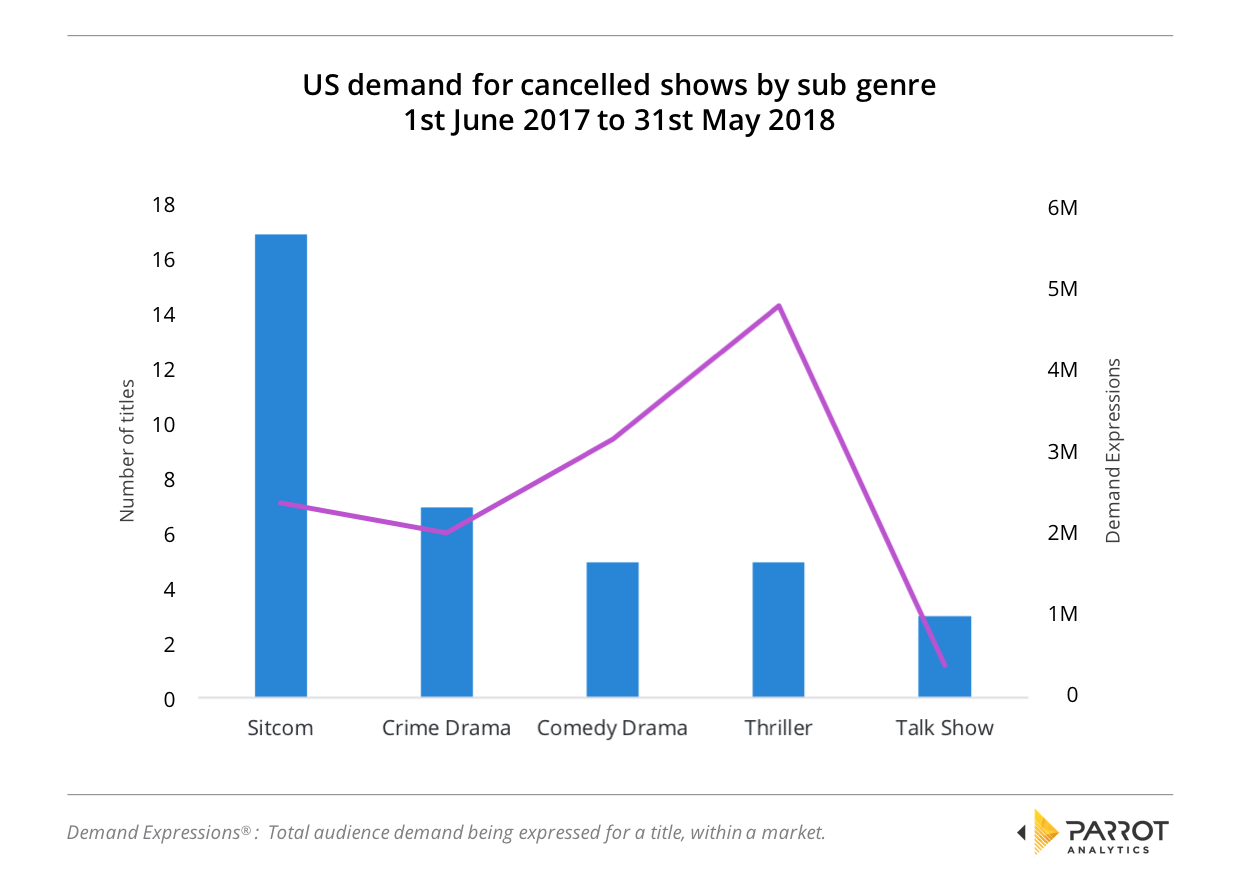

One subgenre in particular had far more cancelled titles than any other. Consider the next graph which shows all the subgenres that had more than three 2017-2018 titles cancelled, along with the average demand of those cancelled titles.

Sitcoms were cancelled more than any other subgenre, with 17 sitcom titles currently not renewed by their networks. However, the large numbers of sitcoms cancelled is partly a result of the large numbers commissioned: As the rewards for launching a successful sitcom are huge – the top sitcoms are some of the biggest, most enduring titles – it is no surprise that every network and platform puts a lot of effort into trying to find the next hit.

The next most cancelled subgenre is crime dramas. The graph shows that in this sample, both the sitcoms and crime dramas cancelled this season have fairly average demand. At other end of the spectrum, the cancelled talk shows had low average demand. This is likely due to production economics: Because talk shows are cheaper to make than scripted series, it is much easier for them to generate a positive ROI even with lower popularity.

Conversely, thrillers tend to be expensive even for scripted series and therefore will need to attract bigger audiences to achieve expected returns. So, even though the cancelled thrillers here generate the highest demand average, they underperform compared to the thriller subgenre as a whole.

Closing Remarks

As not all shows are instant hits, it is an extremely challenging task to balance a disappointing first season with a show’s future potential. Yet, allowing a “dud show” to take up time and resources is just as bad as prematurely ending something which could be the next watercooler sensation.

Studios, networks, distributors and SVOD platforms can rely on Parrot Analytics’ content genome and global TV demand data to go deeper and discover the true factors that make a show a success, allowing for smarter, more timely and data-driven content decisions.