Image: Good Omens, Amazon Prime Video

Historically, television content has largely originated from the United States and spread to other parts of the world. However, in recent years, this dynamic has begun to change, with British television shows experiencing a surge in popularity in the U.S. market. This shift can be attributed chiefly to the rise of streaming platforms, which have made international content more accessible to U.S. audiences.

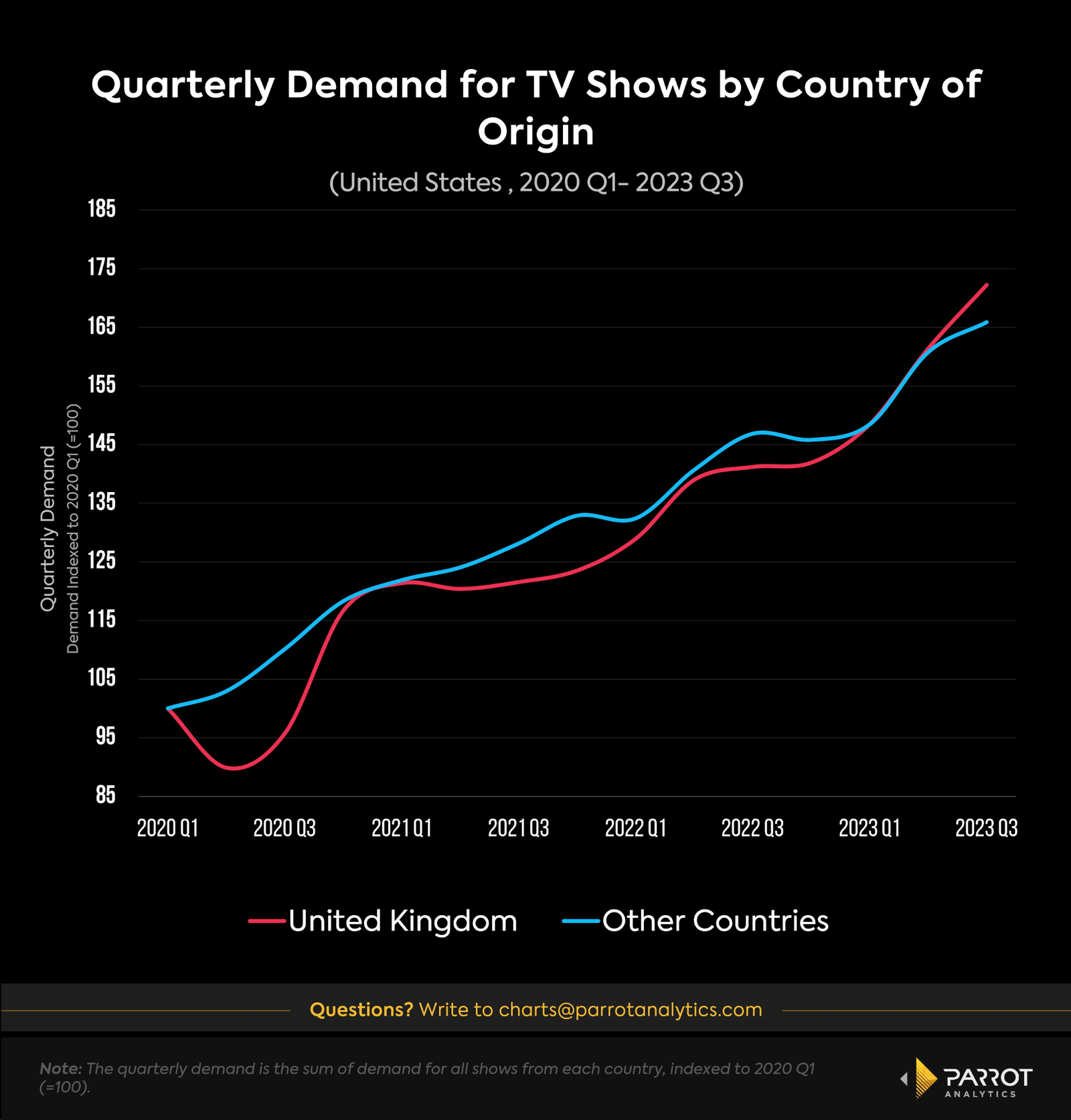

Recent data reveals that British TV shows accounted for nearly 6% of the total demand for TV series in the U.S. during the third quarter of 2023. This figure represents the largest demand share for foreign content, surpassing other notable producers of TV content such as Japan and South Korea. Impressively, the demand for British shows in the U.S. has grown by 75% over the past three and a half years, outpacing the 65% growth rate for shows from other countries (including the US) during the same period.

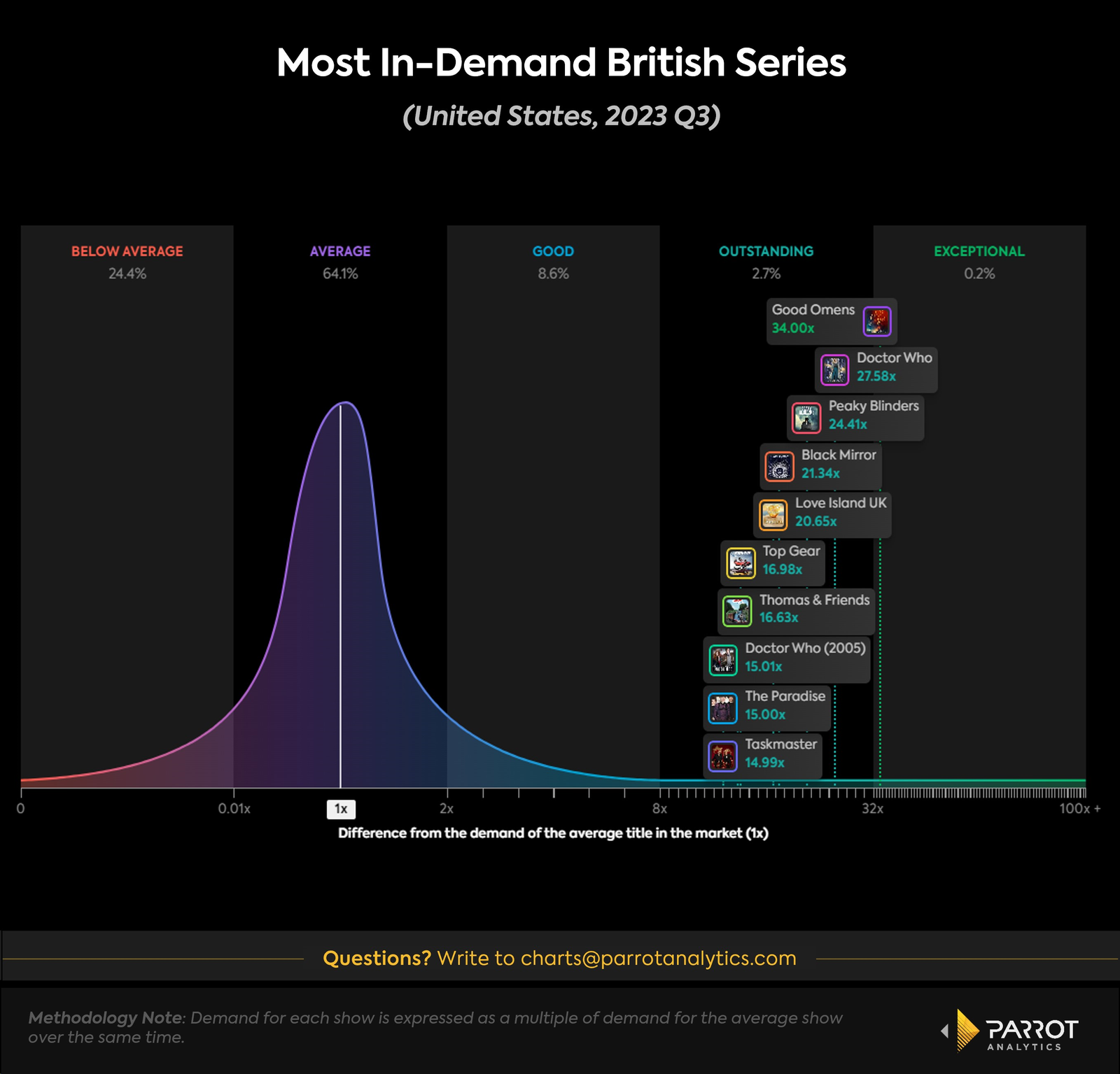

In response to this increasing demand, the BBC, the UK’s primary broadcasting network, has entered negotiations for a partnership with Lions Gate. This collaboration aims to boost the production of TV shows tailored to American audiences. The BBC has already made a significant impact in the U.S. with shows like Good Omens (a co-production with Amazon Prime Video and the most in-demand British show in the U.S. for Q3 of 2023), as well as other highly sought-after series such as the original and the 2005 revival of Doctor Who, Peaky Blinders, Top Gear, and The Paradise. All these shows ranked among the top 10 most in-demand British shows in the U.S. for the same quarter.

Availability on major Subscription Video On Demand (SVOD) platforms has been key to the success of these British series in engaging American audiences. Netflix hosts a considerable number of these popular shows, including Peaky Blinders, Thomas & Friends, Top Gear, and its own original, Black Mirror. Hulu offers the UK version of Love Island, while the 2005 reboot of Doctor Who is available on Max and will soon be moving to Disney+. Notable exceptions are the original Doctor Who series, which is exclusively available on Britbox, and Taskmaster, available on Pluto TV.

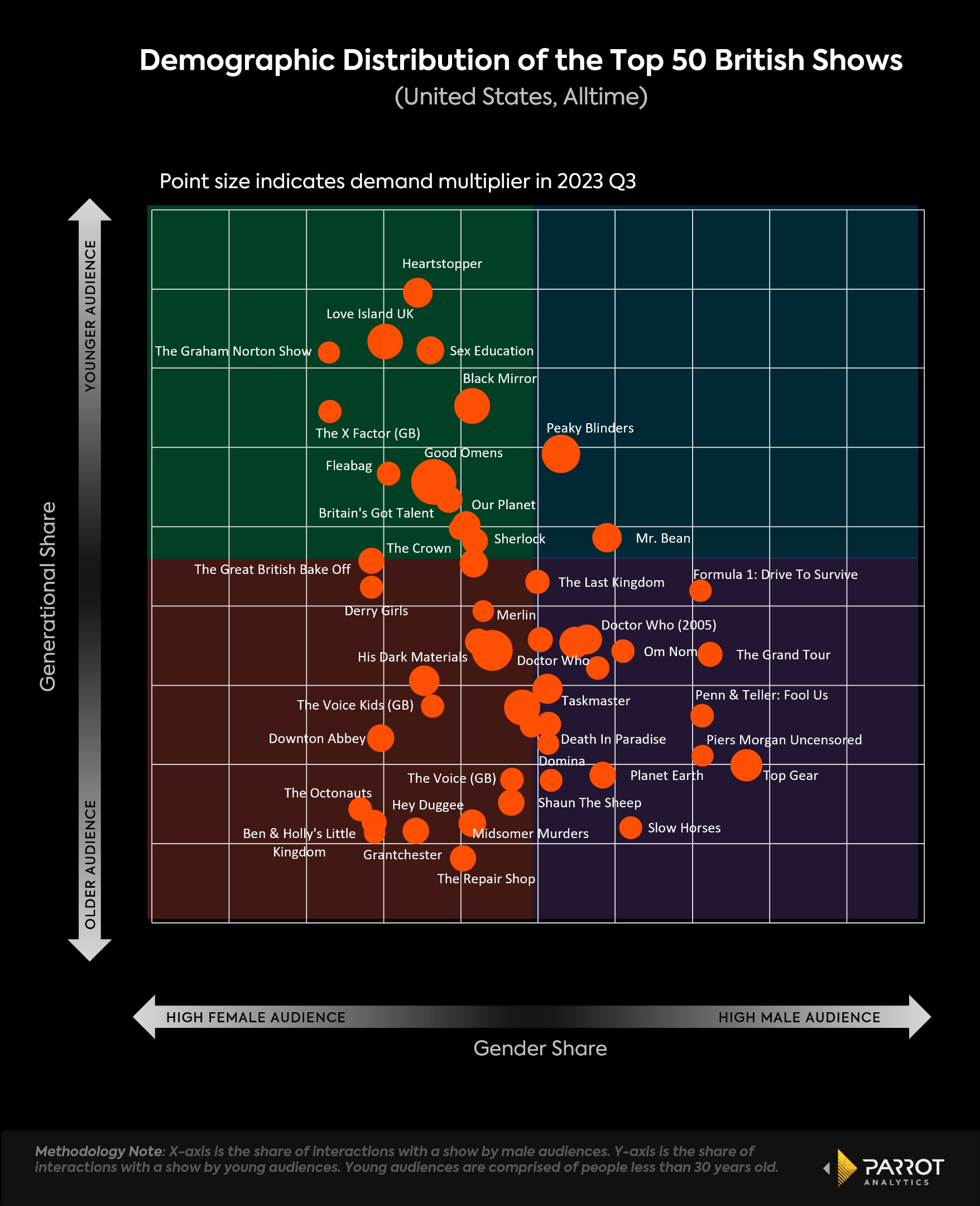

British television shows have a distinctive appeal, particularly among female audiences. Parrot Analytics’ demographic data reveals that most of the popular British series resonate more strongly with women, across various age groups. For instance, contemporary shows like Heartstopper, Love Island UK, and Sex Education are notably popular with younger female viewers. On the other hand, series such as Downton Abbey and Grantchester attract a significant older female viewership.

While very few British shows align with young male audiences, there are notable exceptions that have garnered substantial attention from this demographic group. Peaky Blinders, for example, has cultivated a large and active fanbase, maintaining a robust online presence even beyond its airing seasons. Similarly, Mr. Bean, despite being a 33-year-old sitcom, continues to be a global symbol of British humor, appealing to a diverse audience.

The popularity of British shows in the U.S. underscores their potential value for streaming platforms. These shows can be strategic assets for services aiming to enhance engagement with female audiences. Additionally, the diverse appeal of certain British titles makes them ideal for platforms seeking to broaden their appeal across different viewer segments, aspiring to be a full-quadrant service catering to a wide range of demographics.