Image: True Detective (HBO / Warner Bros. Television Distribution)

The volume of content being released in this era of Peak TV has a very clear downside for individual producers: With so many more content hours being made available to the public it is harder than ever to make a series stand out in a market.

A compelling plot and a stellar cast obviously help in this regard, but the industry is rapidly heading to a place where it is easy to conceive a scenario where a show is one of 4 similar titles launching in the same month – each with the marketing weight of a different platform behind them. Additionally, the relative ease of access to library programming offered by SVOD platforms means you not only have to win “mind share” from current competitors, but you also have to compete with past hits that have remained in high demand.

By leveraging Parrot Analytics’ global TV demand data and content genome capabilities, it is now possible to reduce risk and increase ROI, enabling investment in productions that have a better chance at finding an underserved audience, even prior to the script stage, by exploring new production ideas in the context of undersaturated subgenres.

Subgenre saturation: A closer look at Ireland

The saturation of a particular subgenre is a measure of how the number of titles in that subgenre compare to the total demand of all titles. Consequently, it follows that an oversaturated subgenre is one where the number of titles in that subgenre outweigh the total audience market demand, giving the median title in that subgenre a lower average demand than the genre as a whole.

What is the value of knowing this? In short, market-driven development.

A framework for market-driven development

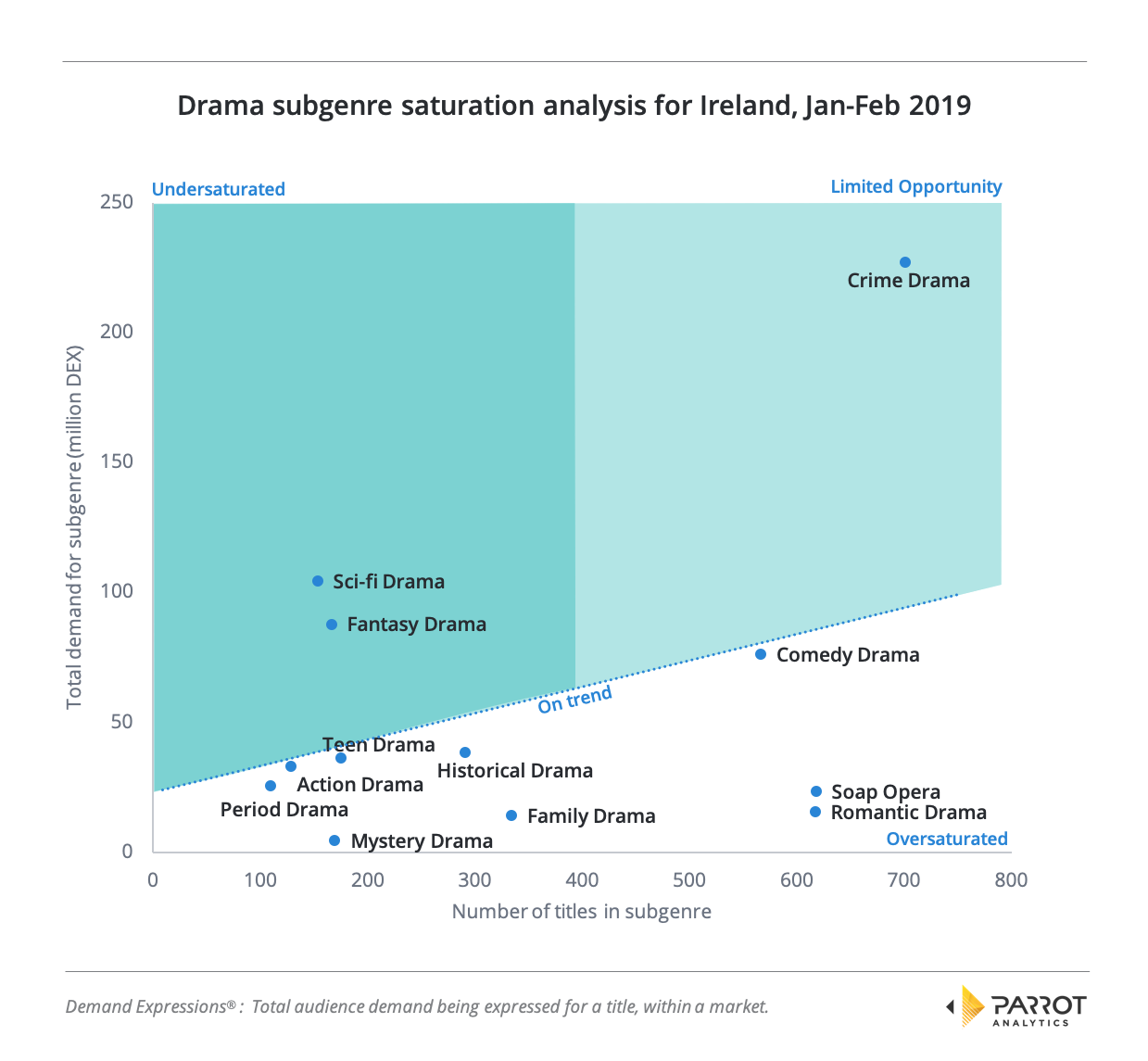

To illustrate the concept for one specific market (Ireland), the below chart quantifies its opportunity size by plotting the total demand across drama TV subgenres against the number of titles in each subgenre.

In doing so we are able to uncover attractive market opportunities where the subgenre is undersaturated (high demand, low number of titles) as well as additional areas of limited market opportunity (high demand, high number of titles).

Additionally we demonstrate which subgenres are not attractive for investment; these exist near the bottom of the chart, simply labelled “oversaturated”. Note: For this analysis we have used large (>100 titles) drama subgenres, only.

What can be observed on the chart is that many subgenres are more or less in line with the overall trend for large drama subgenres, indicated by the blue dotted line: One example is action drama which attracts low total market demand as a whole, however, there are also a comparatively small number of shows in this subgenre.

Similarly, at the other end the scale, the comedy drama subgenre attracts high total market demand, but there are also a large number of titles within that subgenre. Once again, this subgenre is more or less “on trend”, as indicated by its proximity to the blue dotted line.

We must also investigate the TV drama subgenres with many titles but low total demand: These have been quantified as oversaturated, such as romantic drama. And although some of the titles in the romantic drama subgenre may well be big hits in Ireland, most of the subgenre is comparatively low-demand. In other words, getting your show to stand out from the large number of competing titles will be harder in this subgenre, than in other subgenres.

Let us now consider where the production and investment market opportunities might lie with audiences in this market.

Opportunities for investment and production

The key subgenres to invest in for Ireland fall into the undersaturated dark green quadrant. Indeed the further we navigate to the top left in the green quadrant, the more opportunity exists: High market demand in the context of a small number of competing titles means we are promised a high return from any investment into a production targeting this subgenre, with other factors of production held equal.

Take, for example, the sci-fi and fantasy drama subgenres where there exists high market demand with fewer competing titles; while of course not a guarantee of success, producers of titles for these undersaturated subgenres will likely find it easier to stand out.

Interestingly, although crime drama represents the largest subgenre by number of shows, audience market demand for this subgenre is even more impressive. And it is because of this high demand that crime drama titles may present some limited opportunity for investment – despite the large number of titles already present.

The combination of demand and the number of competing titles in a given subgenre is of course market-specific: There are varying levels of saturation across global markets.

Subgenre saturation is market-specific: The Austrian market context

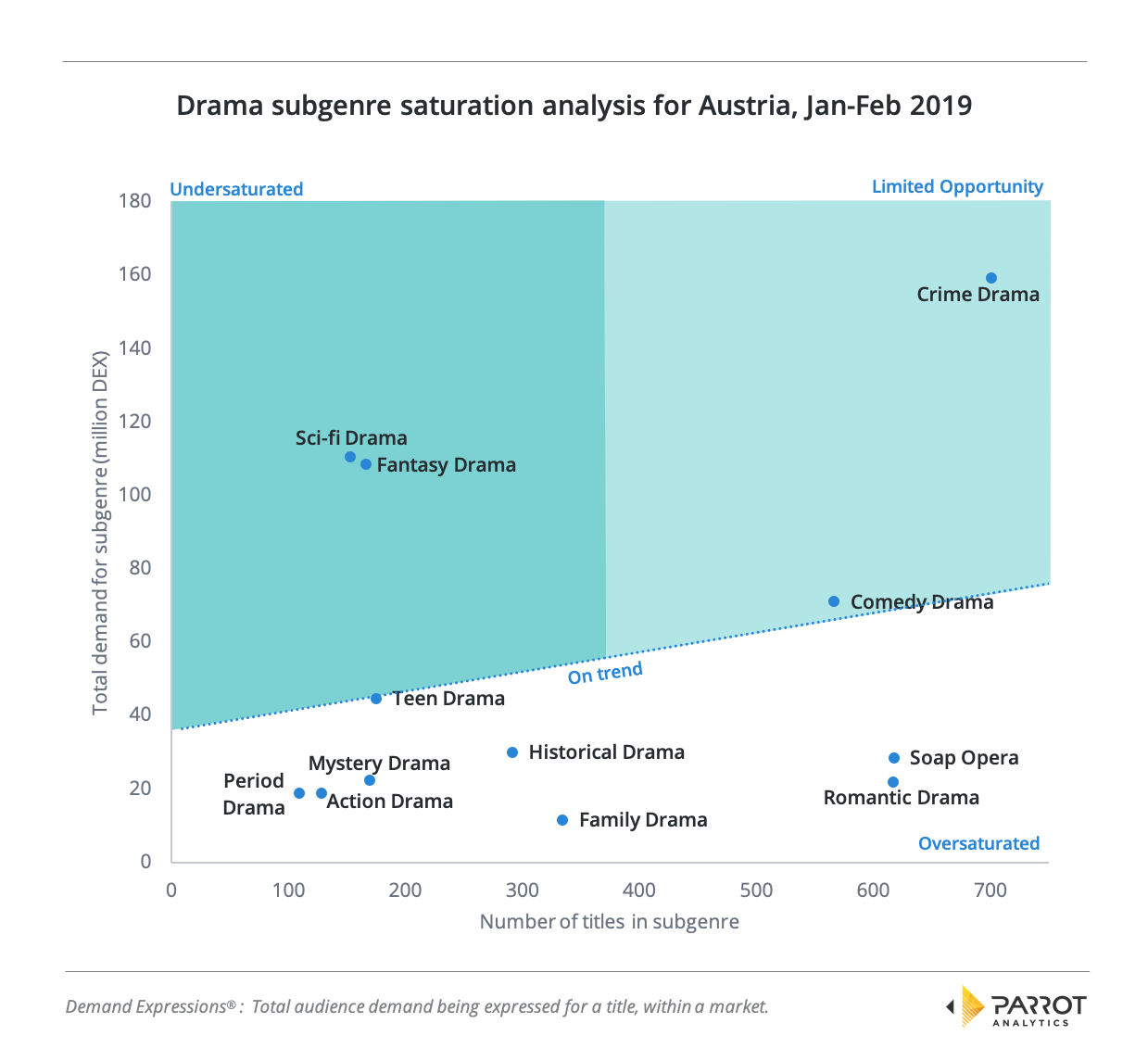

For comparison’s sake, how does Ireland compare to a market that is twice its size, for example, Austria? To illustrate, the following chart shows the large TV drama subgenre saturation in Austria for the same period.

In this market we can see, for example, that comedy dramas have a higher total market demand relative to the Austrian trend line; this subgenre can therefore be considered to lie on the undersaturated spectrum in this market. (Note: For this analysis we have once again used large (>100 titles) drama subgenres, only.)

Broadly, the large drama subgenres in both markets appear to be offering similar opportunities for content producers, which reflects the fact that some subgenres are more universal than others.

For example, although soap operas appear oversaturated in Austria, there are many soap operas and the soap opera subgenre is relatively low in demand (in both markets examined). In addition, with a few notable exceptions soap operas tend to be heavily local: Few Austrians will likely be fans of Colombian telenovelas that obviously center on Colombian cultural quirks and issues.

Conversely, sci-fi dramas are generally speaking set in space, the future or some other non-contemporary society, and are thus more or less equally accessible to all cultures.

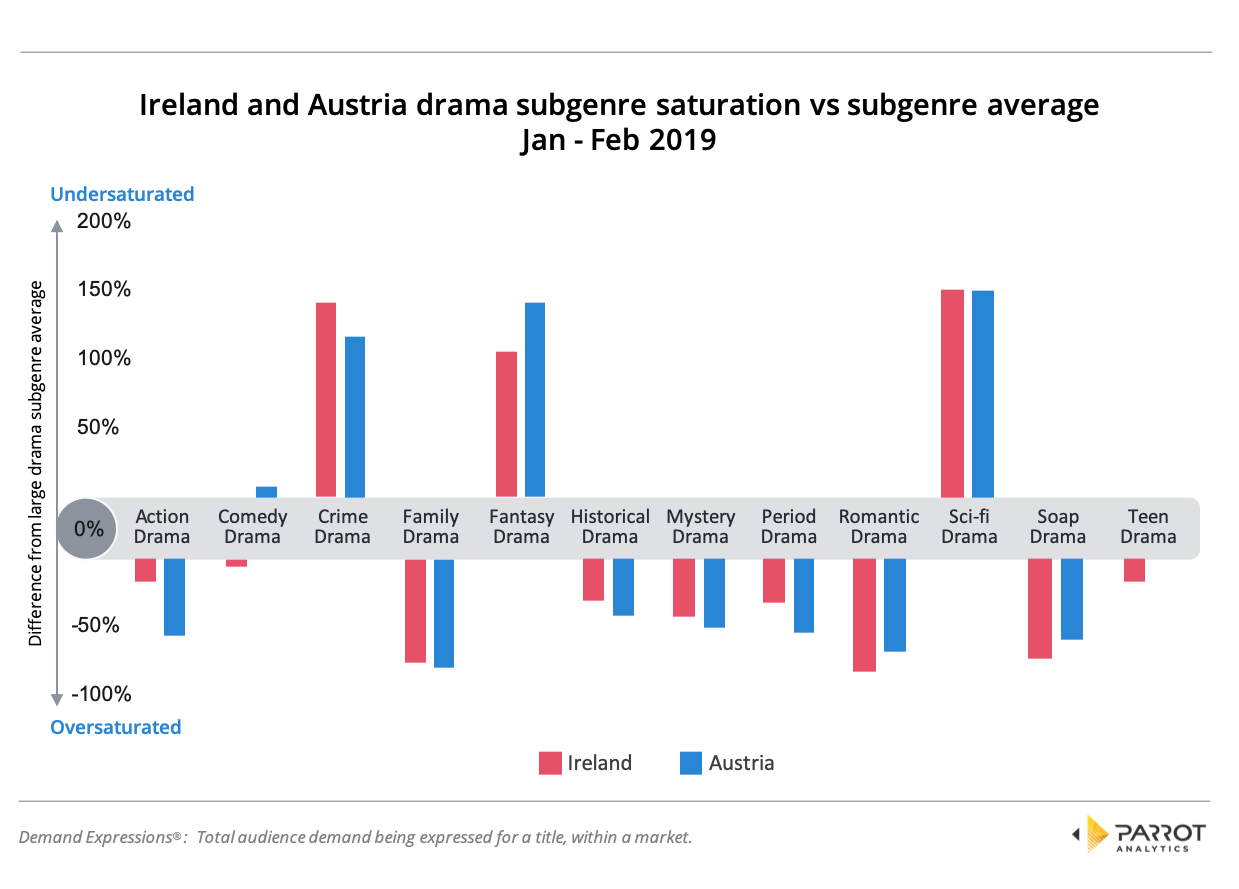

A perhaps more useful cross-market metric is therefore to compare each subgenre’s difference from the trend line in each market.

Market-to-market differences in production opportunities

The following chart highlights the market-to-market differences more effectively. It is now much easier to see that romantic dramas, for example, are more oversaturated in Ireland, while period dramas are more oversaturated in Austria. On the undersaturated side, the crime drama subgenre is more undersaturated in Ireland while fantasy drama is more undersaturated in Austria.

This analysis of subgenre saturation is an introduction that has only covered a small number of drama subgenres in two specific markets. Because TV demand data is available in 100+ markets, these types of analyses can easily be expanded to cover global markets involving a much longer timescale.

Global TV demand data can also be leveraged in conjunction with other valuable metric inputs, giving producers with global ambitions the necessary framework to invest in content where not only the subgenre is optimal, but other factors of production have also been incorporated into the content success model as well.

Insights such as these can inform not only production decisions, stakeholders along the entire content supply chain can equally benefit from understanding which types of content have the best chance of excelling in which markets. Please reach out to Parrot Analytics for more information about the benefits of leveraging our content genome capabilities alongside global TV demand data.