Image: Making A Murderer, Netflix

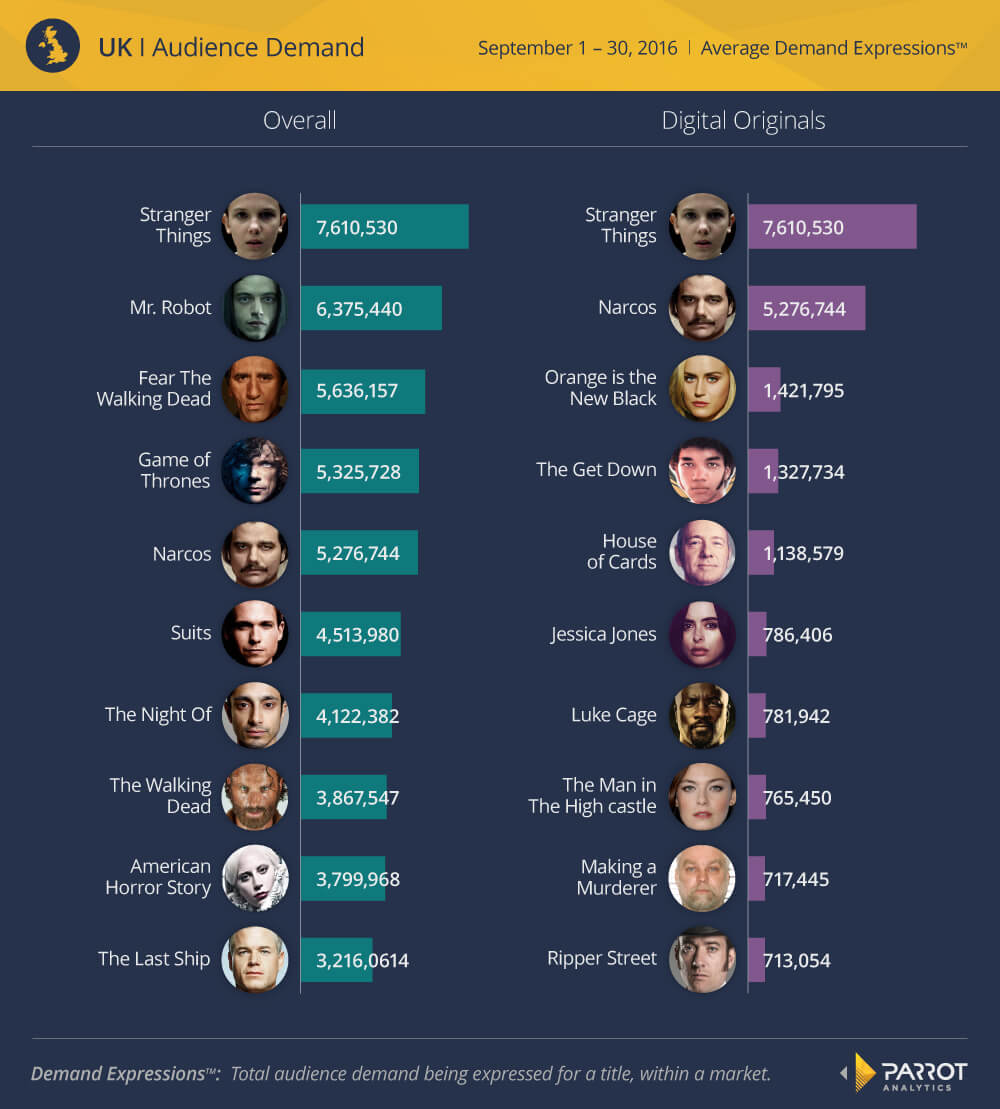

With MIPCOM underway, we thought it would be interesting to see what the most popular shows are right now in some of the major MIPCOM buyers markets. We can find this out by looking at the Average Demand Expressions™ for each market for both Digital Original Shows and Overall Shows for the month of September.

The market we’re looking at today is one of the most important and influential in the industry, especially known for its quality Dramas. But is that reflected in the United Kingdom‘s Top Ten lists?

Netflix OTT measurement requires a sophisticated tv analytics approach. Parrot Analytics global TV demand measurement platform is based on Demand Expressions, which represent the total audience demand being expressed for a title, within a country, on any platform. The audience demand is a weighted, country-specific measure of demand. All Demand Expressions, such as social media comments or P2P file downloads, are captured with no panels or extrapolation involved. And they are country-specific as they incorporate the country’s population and enable comparison of titles within a single market. In addition, there is no ceiling to the number of Demand Expressions a title can generate. Let us now take a look at the UK market using this metric.

As before, we’ll start with a look at the Digital Original shows. Just like France, the top show in the UK in September was Stranger Things, while in second place is crime drama Narcos, with prison show Orange Is The New Black third. Unlike France, Netflix Originals aren’t quite as dominant in the UK. While 8 out of 10 shows are from that provider, Amazon Video gets two into the Top Ten: the Sci-Fi/historical thriller The Man In The High Castle and Victorian-set crime drama Ripper Street. No surprises that the former BBC show still has followers in the UK, especially as audiences look forward to Ripper Street’s final season in October.

An oddity in the Digital Originals list is Making A Murderer, a true crime documentary and the sole documentary to feature in any country’s Top Ten. The appetite for crime shows in the UK doesn’t stop there as featured in the Overall Top Ten is The Night Of, which is also unique to the UK’s lists. The Night Of is a crime drama, and an American adaptation of a British series on top of that. It seems that is a recipe for popularity in the UK as the show is seventh most in demand for September. The final unique show in the UK Overall Top Ten is The Last Ship, an action drama about a US Navy ship trying to cure a virus outbreak.

Of course, it’s not just crime shows in the Top Tens. Not only does Stranger Things lead the Digital Original shows but it’s also the top Overall show; UK audiences have been enthralled by the 80s-set mystery show. Stranger Things tops drama Mr. Robot by 19%, which in turn beats zombie show Fear The Walking Dead into third. Game Of Thrones of course makes a Top Ten appearance, followed by an unusually high place compared to other markets for slick legal drama Suits.

With its September 30th release, new Marvel title Luke Cage just managed to make it into the top this month. This show was hotly anticipated in the UK, as proved by the fact that with only a single day available out of the whole month it went straight to 7th place on the Digital Original list, on its way to even higher demand in October.

Whilst UK audiences certainly enjoy all types of content, it seems their affinity for dramas and especially those involving crime carries over to viewing preferences. And on that note, if you really want to appeal to UK audiences, make a historical true-crime documentary about a haunted ship!

Stay tuned as we cover the most in-demand content in other global territories this week in our MIPCOM-special reports!