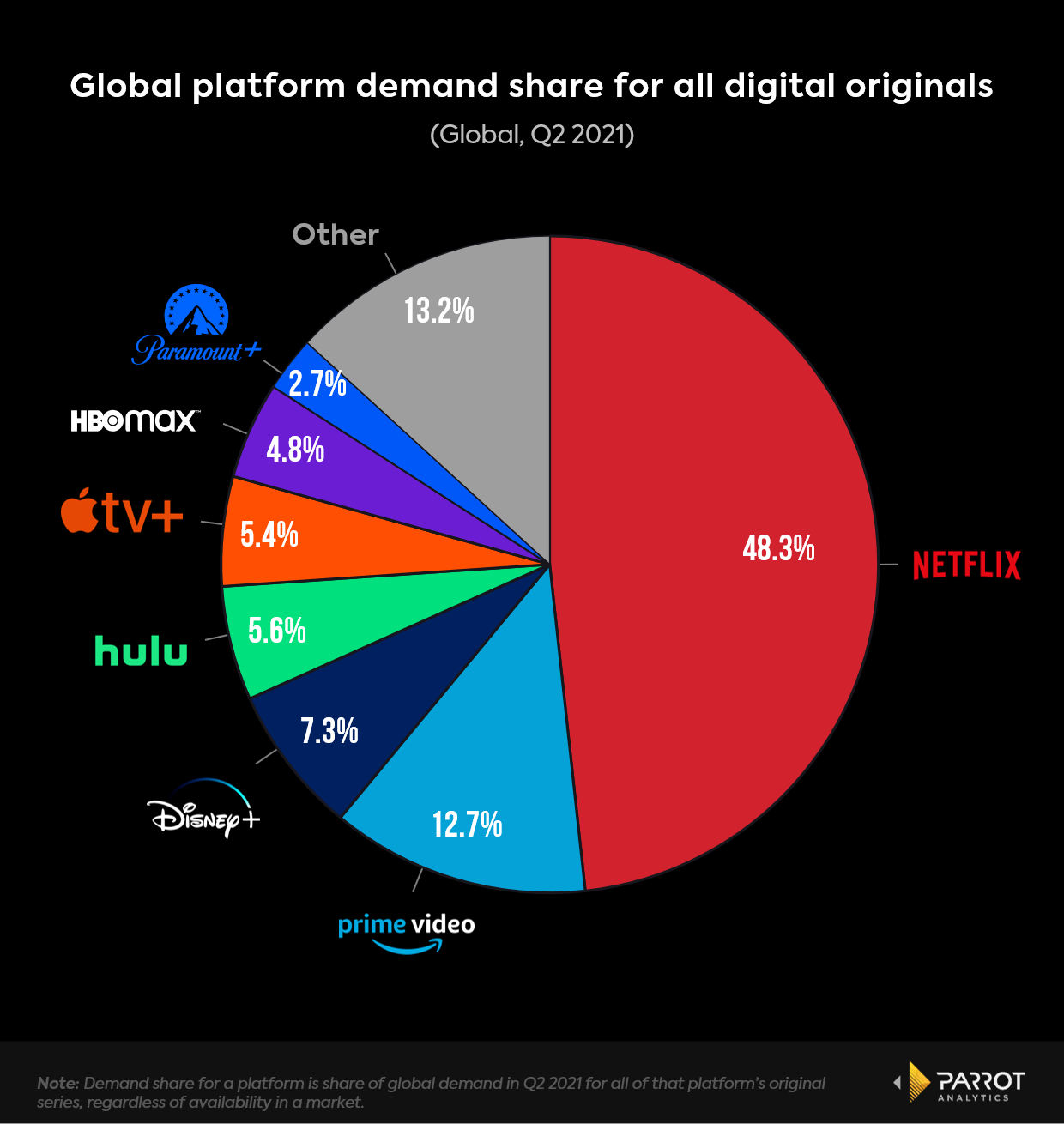

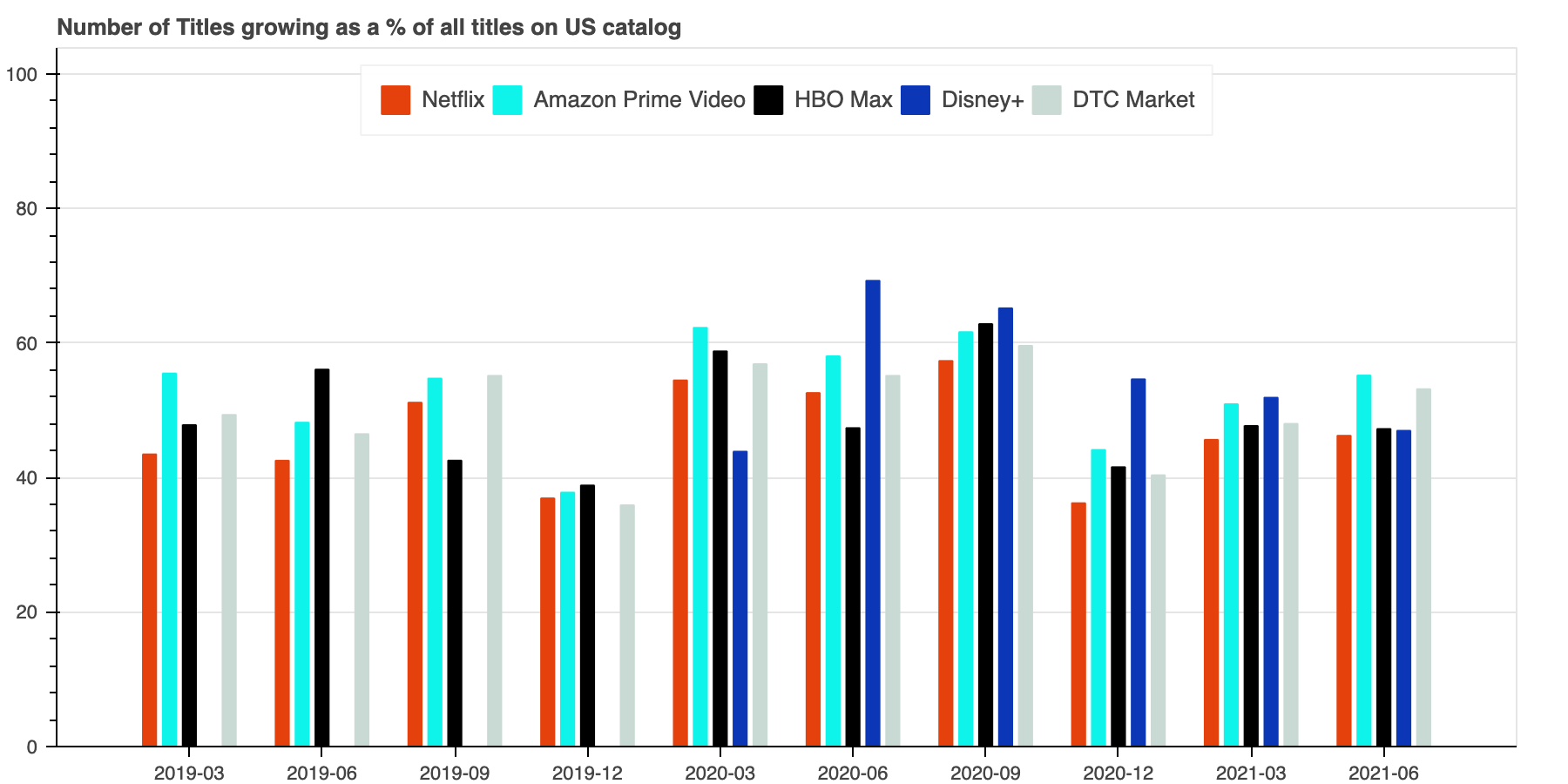

Netflix added 1.54 million subscribers in its second quarter, beating previous guidance of one million subscribers. Even with beating guidance, increased competition in the streaming space and a lack of exciting new originals actually contributed to global demand for Netflix original series dropping below 50% for the first time since Parrot Analytics began measuring quarterly results. (Data is presented in the chart below.)

Despite the drop in demand, Netflix’s churn rate has remained low globally compared to those same competitors, pointing to the importance of a balanced library of originals and licensed content.

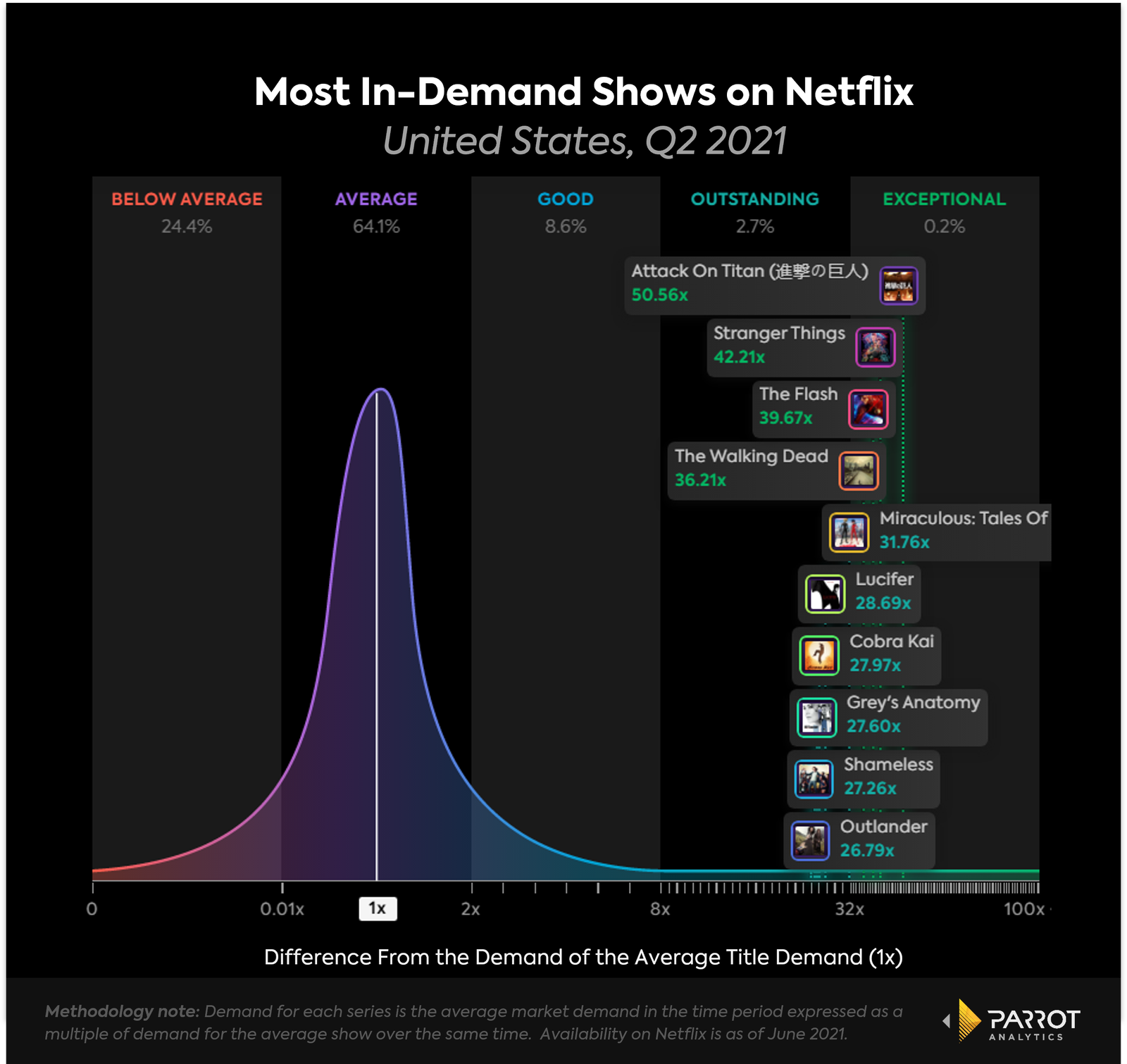

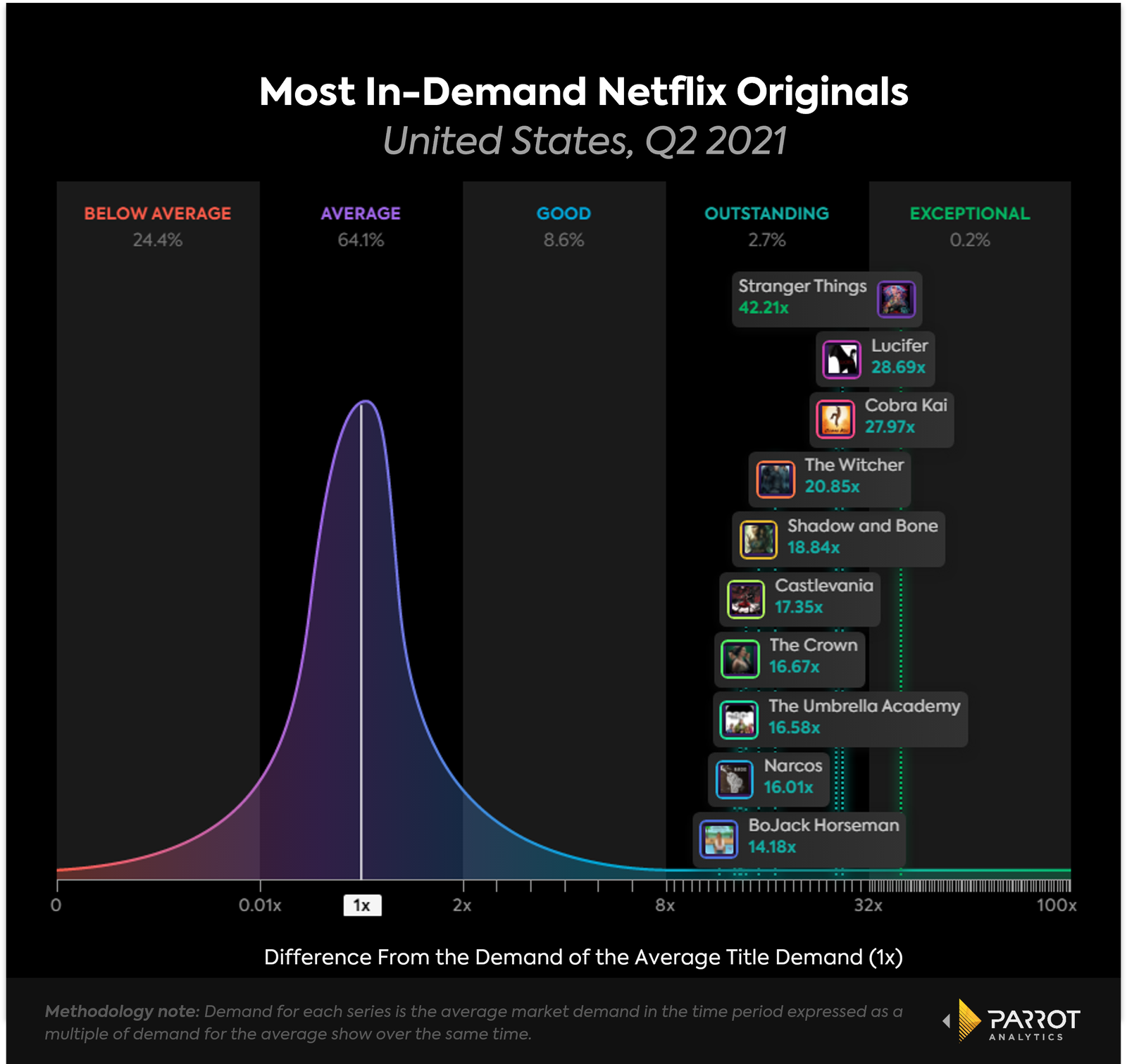

When comparing the average demand of original Netflix series to licensed content from other networks, a large number of the most in-demand titles available on Netflix within the United States last quarter were licensed, as seen in the chart below.

Even with a consecutive drop in demand for original series over the last two quarters, the amount of “snackable” TV content that Netflix carries remains crucial for providing entertainment that consumers are looking for, globally and in the United States, alongside original series. It’s an aspect of the business that executives are pointing to as a core part of the Netflix experience, where second run programming is “discovered,” including Cobra Kai, Lucifer, and Schitt’s Creek.

Maintaining this balance is key to keeping global subscribers happy, and therefore paying. Acquisitions are dependent on new content bringing people in, but retaining those customers is providing enough adored content that they don’t feel the need to leave. This is especially key as the proliferation of streaming services and easy-to-cancel technologies creates a fractured environment where customers can unsubscribe at any time.

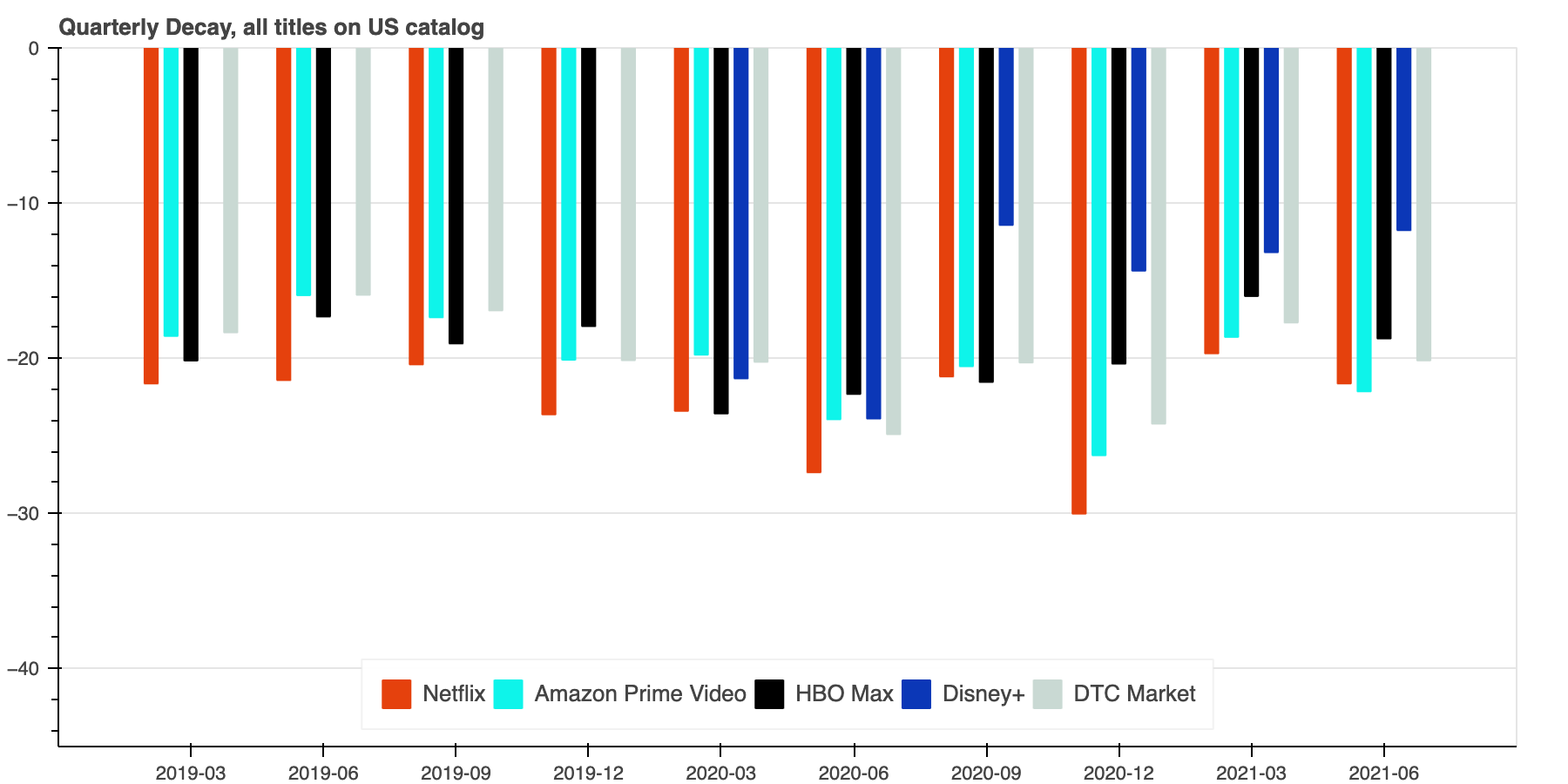

The chart below demonstrates the effect of demand decay — how much less demand is there for catalog titles (original and licensed) that remain. An improvement in decay can help to diminish churn. If demand for “snackable” content remains, even if demand for originals continues to slide slightly, then churn remains low. Through a combination of both, Netflix remains steady.

Netflix reported today a loss of nearly 500,000 subscribers in its US and Canada markets between Q1 and Q2, but the addition of beloved series — including 30 Rock and Friday Night Lights — may give subscribers a reason to return or prevent those thinking of leaving from doing so.

Netflix released the most original series in the last quarter compared to others, but despite releasing twice as many original series as the next digital competitor, Netflix’s demand share still dropped while Prime Video’s increased.

The question is what type of content is Netflix looking to license out in order to bring in possible subscribers and keep those who are paying engaged every single week. It’s not just about how much is being bought, but what is being bought and why.

Is it worth it for Netflix to spend hundreds of millions of dollars on a beloved sitcom if it cuts churns rates (already pretty low) even more? Or should Netflix pick up a drama that everyone is talking about to hopefully bring those customers in and give them a chance to watch it all in an incredibly simple way?

There are two points to consider: Netflix is still the most subscribed-to streaming service out of any competition and that means it’s hitting a saturation point faster than others in different countries, especially the United States. Local originals and big, whopping new series may help to bring back subscribers who dropped the service for another option, but figuring out licensed series that play around the world is also integral.

These may be shows that are in high demand and have high supply that streaming services like Netflix can pick and choose from; CBS crime procedurals (Criminal Minds, NCIS), medical procedurals (Grey’s Anatomy), long-running sitcoms (New Girl) or multi-season genre programming (The Walking Dead, The Vampire Diaries). Netflix is still relatively new to creating original content; executives haven’t had decades to create thousands of series that a streaming service could lean on to keep people coming back.

As Netflix continues to invest in its own original series to get to that point, licensing shows that people will return to every night is the bread and butter for engagement in-between new, highly anticipated original series launching.

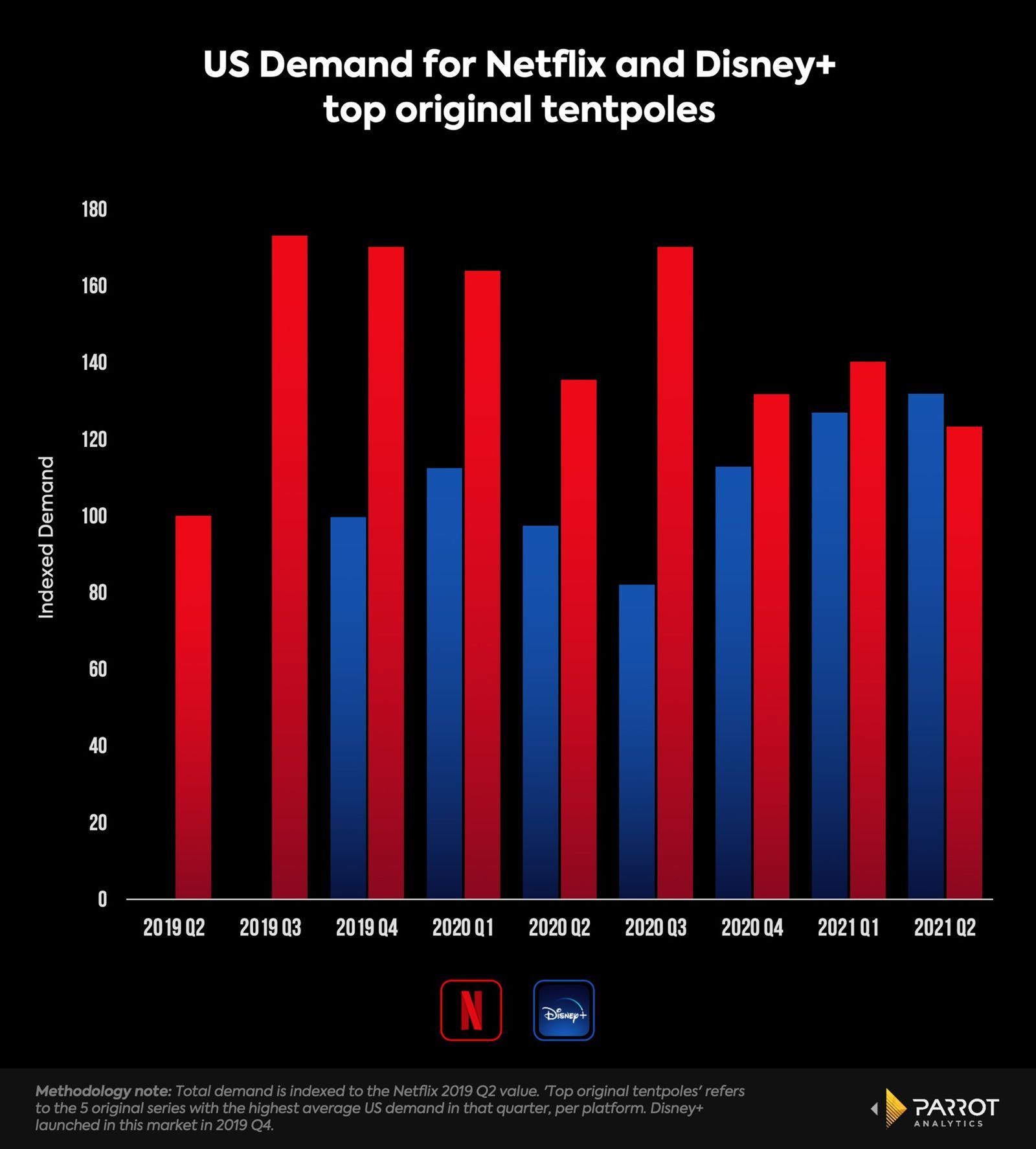

A new season of Stranger Things and The Witcher may take a year or more to become available, but having Rick and Morty and Star Trek: Discovery in global territories or The Walking Dead, Shameless, and Grey’s Anatomy in the US fills that spot.

Splashy new originals bring people in, licensed content keeps them after they’ve marathoned a show, and that continued engagement encourages subscribers to check out new series that Netflix is dropping every week.

It’s a sellers market. Both conglomerates with massive libraries (ViacomCBS, NBCUniversal, and Disney to name a few) and studios with sought after titles are in a position to license their series on an exclusive, non-exclusive, or hybrid basis for a period of time to content distributors who don’t have the deep library catalogs yet — Netflix, Amazon Prime Video, and Apple TV+, for example. In-demand, top series are licensed out for a hefty fee.

At the same time, trying to license top in-demand series from the biggest conglomerates, and therefore those with the largest libraries, is getting exceptionally more difficult as individual streaming services launch. WarnerMedia pays $450 million to have Friends exclusively on its streaming service in the US (Netflix carries it in many regions globally). NBCUniversal pays $500 million for The Office in the US (Netflix and Amazon Prime Video carry it in many international markets). Disney shifts most content from its top brands exclusively to Disney+ in regions where it’s available.

Netflix executives have talked about the importance of producing as many originals as possible because of increased competition and aforementioned exclusivity plays. For Netflix to continue appeasing subscriber demand, working with suppliers globally to ensure there’s always some form of in-demand content is necessary. Licensing deals will continue to happen, with a focus on ensuring those titles are available to as many subscribers as possible globally.

As long as the percentage of titles across the board show an increase in demand, then churn is reduced. Whether this is thanks to originals, thanks to licensed content, or both, the endgame is the same. Often, this is only accomplished through a combination of both; that’s why having the right licensed content at the right time is critical.

The ratio of originals to licensed content may vary from month to month, but average demand for the entire library has to remain consistently good, ideally outstanding. As Netflix continues to build its franchises and try to develop long lasting series, licensed content is still vitally important to satiate subscribers demand, as seen through our data.

In markets where saturation is finally hitting (like the US), giving customers a reason to open Netflix every day and convincing them not to leave becomes the goal more so than adding a plethora of subscribers every quarter. Licensed content helps increase average demand every quarter, and aids in Netflix staying a necessity not becoming an optional monthly subscription