Netflix reported its Q4 earnings last week, beating global subscriber estimates but falling significantly short of earnings per share expectations. The biggest news of the day, however, was that Reed Hastings, the long time head of the company and architect of its transition from a DVD-by-mail service to global streaming leader, would be stepping down as CEO. Alongside numerous metrics, this might be the most outwardly apparent sign that Netflix is at an inflection point in its trajectory as a company.

Netflix hit a new low in terms of the global share of demand for its original series in Q4. In the final quarter of 2022, Netflix originals accounted for 39.6% of demand for streaming original series globally. This was the platform’s first time falling below a 40% share globally and reflects how new competitors entering the market have cut into its dominant market share.

In the trend chart we can see how in Q3 Netflix actually had an increase in its demand share due to the global success of Stranger Things (whose impact was stretched out over a longer period thanks to a two-part release strategy). But Netflix’s demand share fell to new lows after the impact of their flagship series faded.

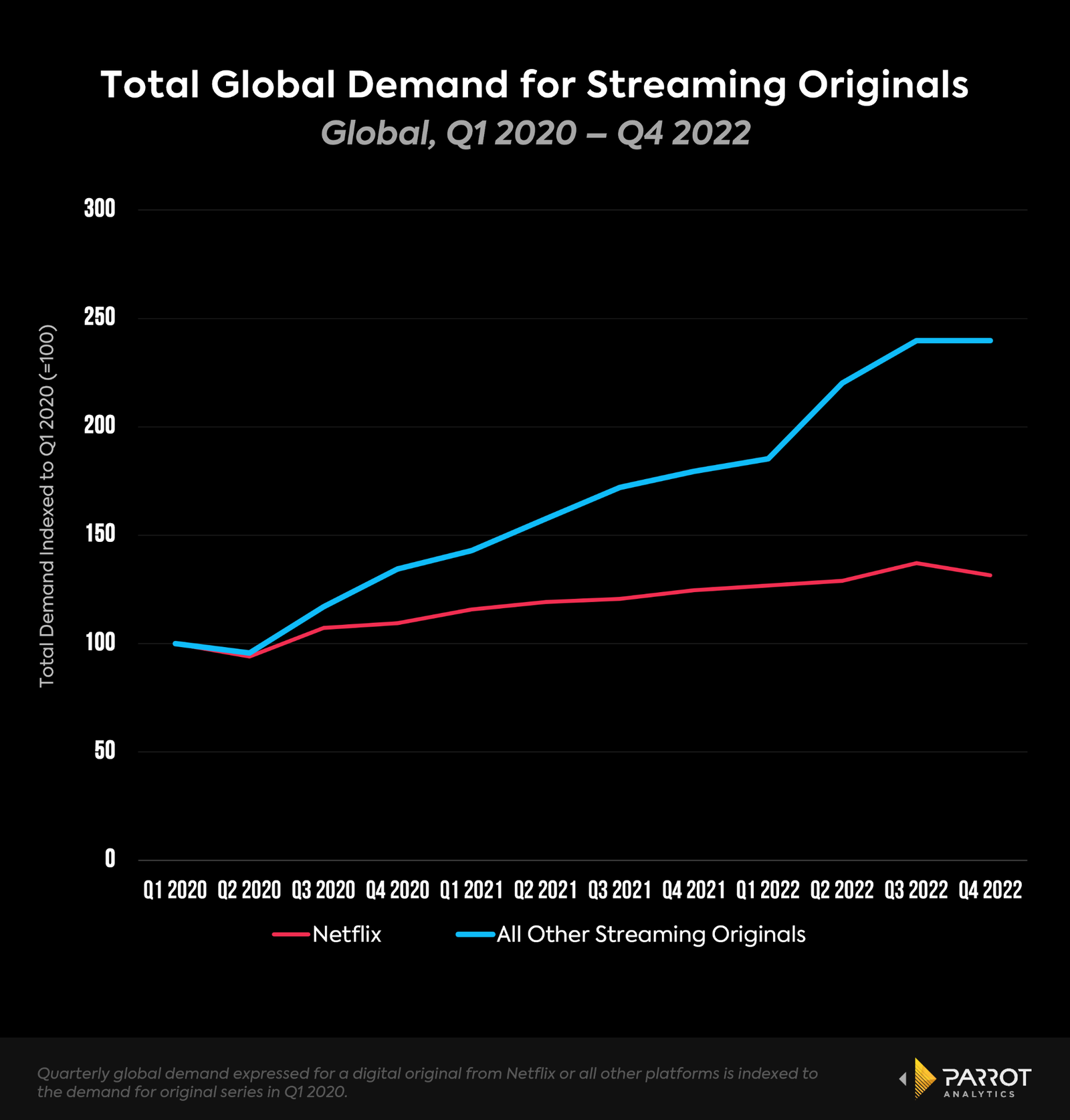

While the trend of the platform ceding ground to newer competitors is not new, one recent development in the past quarter has been plateauing demand for original content across streamers. Total global demand for original content from all streamers excluding Netflix was flat from Q3 to Q4 2022. After nine consecutive quarters of growth (albeit at a slower rate than its competitors) the total demand for Netflix originals actually fell 4.1% from Q3 to Q4. This contrasts sharply with the clear upward trend of growing demand for original series from Netflix’s competitors over the past few years and looks like a signal that the global SVOD industry may be approaching saturation levels, or at least a new era where the fight for audience attention will become even more challenging.

With Netflix and Wall Street pivoting to focus on financials over subscribers as a metric, this raises questions about the costs of attracting new subscribers in a saturating and highly competitive environment. If a two part season of their biggest hit, Stranger Things was barely able to stop their declining demand share for a quarter, what massive content investments would be needed to bring in new subscribers who have a plethora of other streaming options?

If attracting subscribers with ever more content is getting too costly for Netflix, it is now looking to tap into the potential revenue represented by the 30 million people using Netflix for free in the US (and 70 million globally) by cracking down on password sharing. While it isn’t a given that these freeloaders will be willing to cough up money to keep accessing Netflix content, the fact that Netflix is pursuing this now seems to indicate that monetizing these potential subscribers is easier than attracting them with more and better (and more expensive!) content in a competitive and saturating environment.

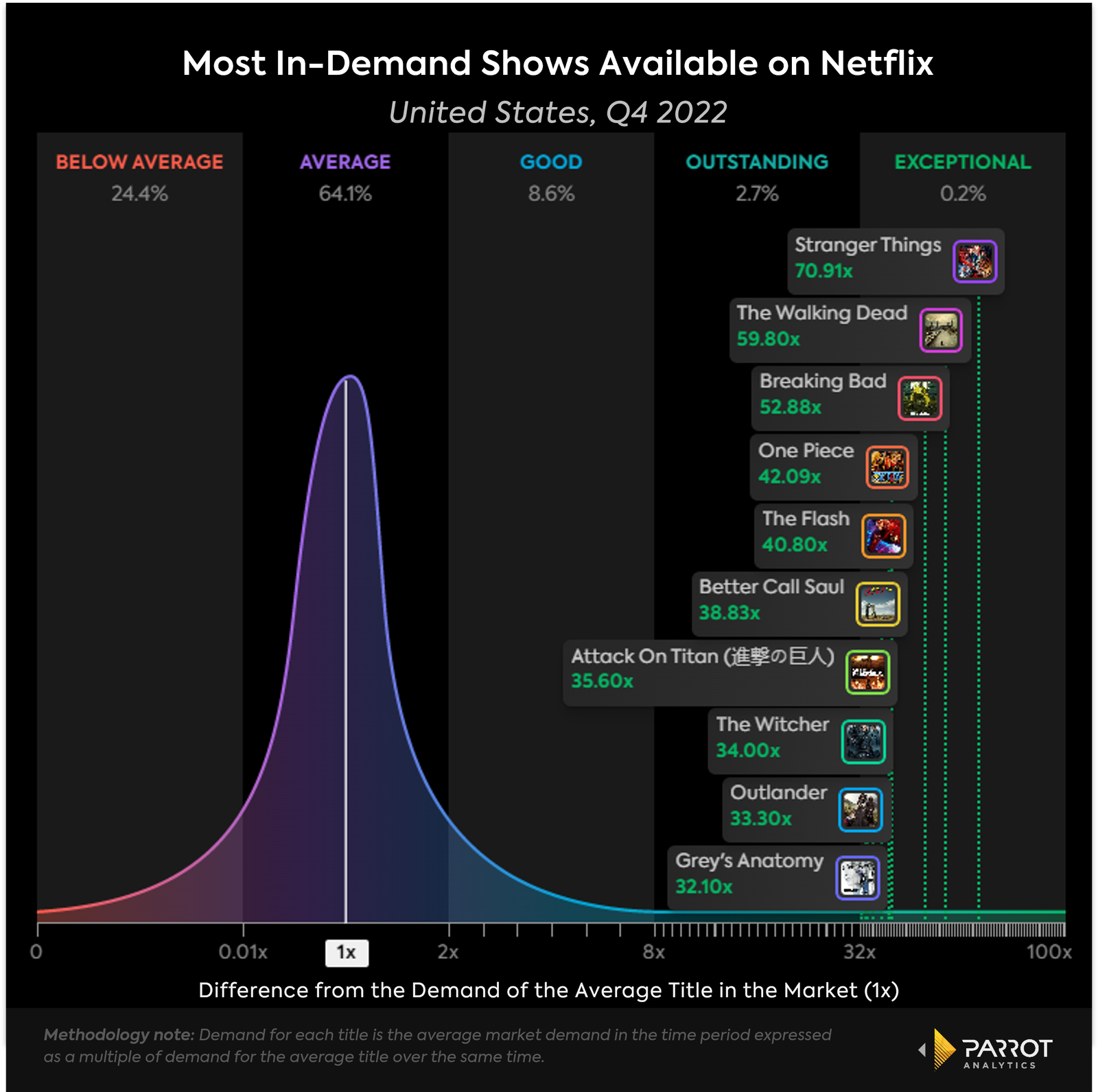

Looking at the most in-demand shows on Netflix for the quarter we see how important licensed content still is to Netflix’s offering. While Stranger Things topped the ranking for the quarter with 70.91 times the demand of the average series, it was coming down from the stratospheric highs of Q3 when it released the last of its long awaited fourth season. The only other Netflix original in the top ten for the quarter was The Witcher which got a boost in attention from both the news that Henry Cavill would be replaced by Liam Hemsworth and the release of a prequel miniseries, The Witcher: Blood Origin in December.

After years focused on building a library of original content with a hefty price tag, the majority of the ten most in-demand titles on Netflix are still licensed from other companies. This is a potential risk. Of the licensed shows in the top ten a majority have ended or have announced a final season. The Walking Dead just wrapped up its final season.

Better Call Saul finished in August and Breaking Bad is coming down from the highs seen during its prequel’s finale. The Flash will premiere its ninth and final season in February and Outlander just announced its eighth season will be its last. If Netflix was hoping to cut back its content spending in a fiscally prudent move it may be facing a gap that could need to be plugged as these licensed series reach their end.