Earlier this year, Parrot Analytics released their Global Television Demand Report for 2022, which covers the latest market data for subscription video on demand services and trends in audience demand around the world. The report, which can be read by anyone with a DEMAND360 subscription, was discussed in March’s Parrot Analytics LIVE webinar by Parrot Analytics Senior Insights Analyst, Christofer Hamilton, who brought up a number of exciting points about what last year’s television demand data could be telling us about how things might look in the future. One main insight Hamilton discussed was the gradual shift in the share of global demand for original series. While Netflix still holds a large percentage of this share of demand, competition has been growing among other streaming services. Leading on from these insights, this article will cover the current demand for original series and which of these might have the most influence on the shifts taking place right now.

Gradual shifts

While a number of Netflix original series, such as Stranger Things, have seen global anticipation and record levels of demand, the streaming service’s global demand share for original series has been gradually declining over the past few years. In the webinar, Hamilton pointed out how Netflix dropped below 50% in this area to 47.1%, for the first time since Parrot Analytics began recording this data.

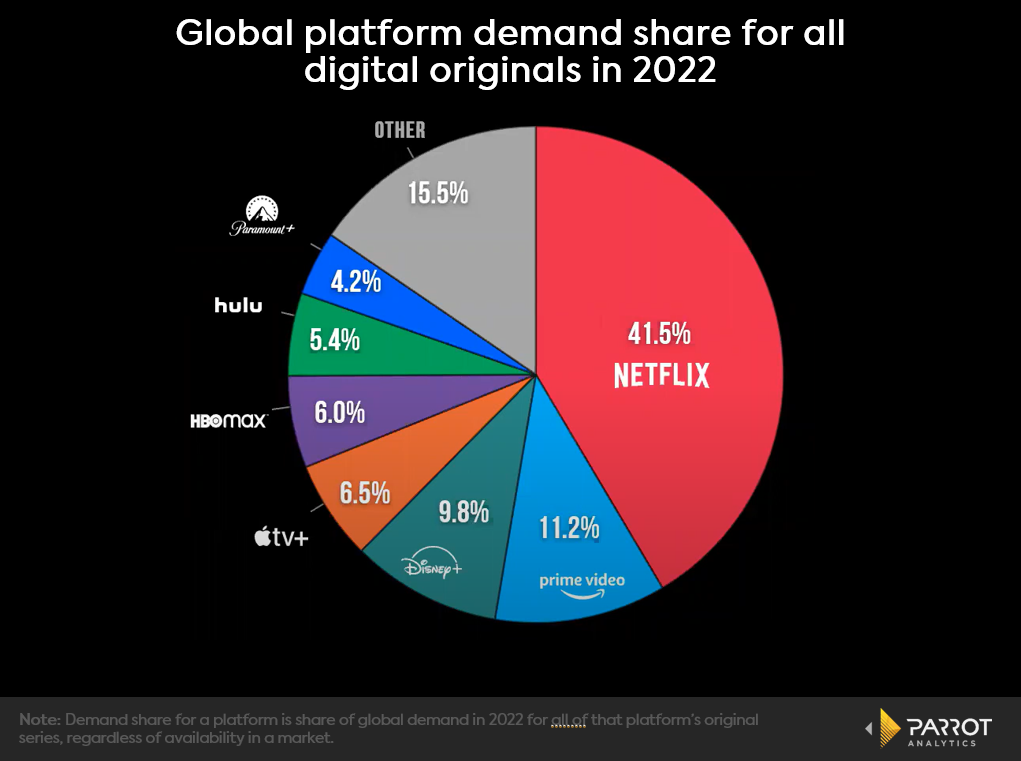

The chart below shows the global demand share for each streaming service in relation to their original television series over 2022. It shows that Netflix’s share dropped even further in 2022 to 41.5%. Hamilton suggested that this could be due to the rise in competition - particularly from that of Amazon Prime Video, which had 11.2% share, and Disney+, which had 9.8% share. Another interesting point Hamilton brought up was the growth in the “Other” category, which, as shown on the chart below, had 15.5% of the share. He suggested that this could be influenced by platforms centered around a specific genre, such as anime or horror. With these points noted, it is interesting to consider what original series are influencing these percentages, as well as which streaming service they belong to.

Current demand for original series

While licensed content can bring familiarity from audiences and preexisting demand, relying too much on this can bring future challenges and risks regarding control over medium and long term cash flow as owners of franchises and popular shows can request higher licensing fees. This suggests that, when it comes to the success of a streaming service, there might be significant importance in the balance between licensed and original series and films. With this being said, it is interesting to look at the current demand for original series around the world.

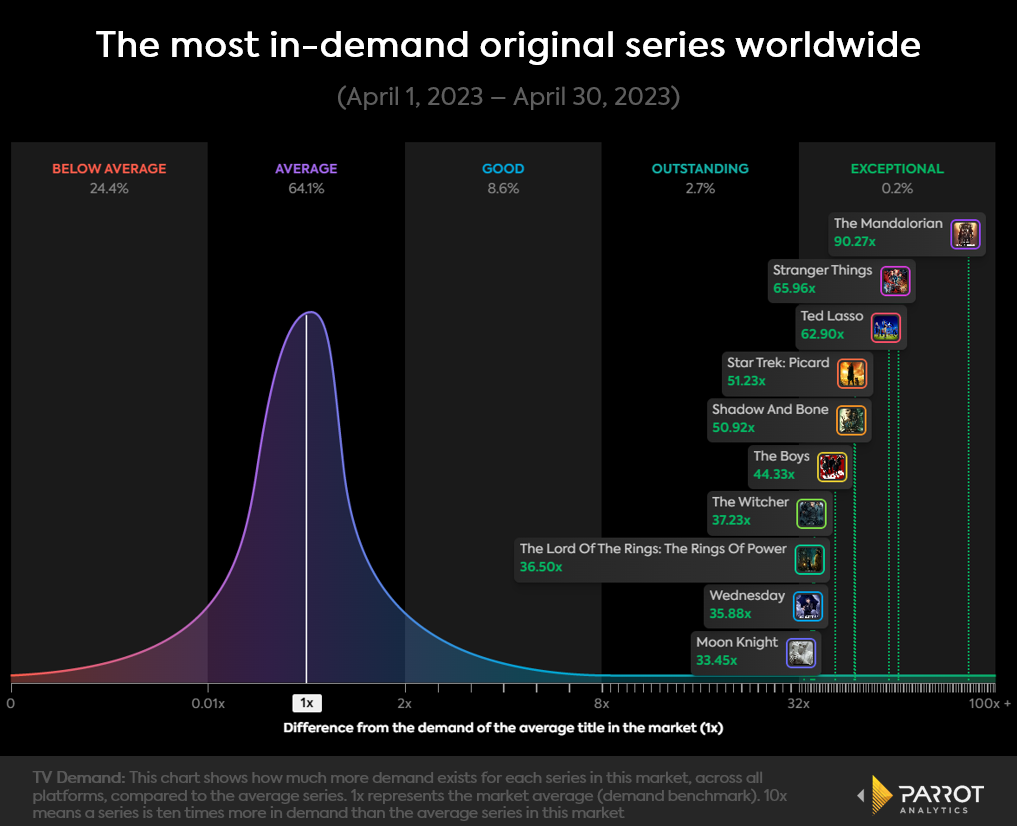

The chart below shows the original series with the most global demand over the past 30 days. These top ten original series all hold exceptional levels of demand and, while Netflix originals had once taken up most of the share of demand for original content, a number of streaming services now represented in this share at present. With the release of its third season at the beginning of March this year, it is understandable Disney+ original Star Wars series, The Mandalorian, is at the top of this chart with 90.3 times more demand than the average series worldwide. Netflix’s Stranger Things and Apple TV+’s Ted Lasso, follow with over 60 times more global demand than the average show. Other streaming services on this list are Paramount+, with Star Trek: Picard, at 51.2 times more demand than the average series worldwide, and Amazon Prime Video, with The Boys, at 44.3 times more demand than the average series worldwide. The diversity in streaming services represented on this chart is another reflection of the gradual shift Hamilton discussed in the webinar, as well as an indication of where this war between streaming services might be heading toward.

Demand for original series on Netflix

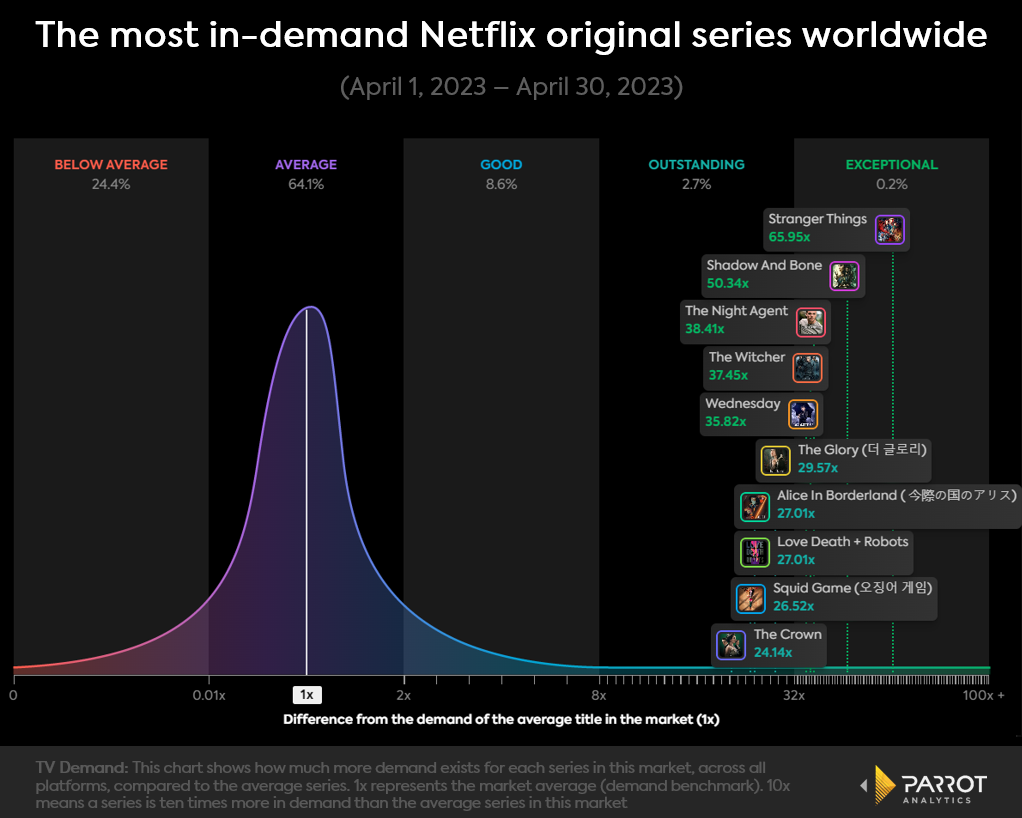

The chart below shows the Netflix original series with the most demand worldwide. As seen in the previous chart, Shadow and Bone and Stranger Things make the top of this list with exceptional levels of demand. The Night Agent, which was released late March this year - and has already been renewed for a second season, is third on this chart, with 38.4 times more global demand than the average series.

With anticipated Bridgerton spinoff Queen Charlotte: A Bridgerton Story to arrive on Netflix on May 4, as well as a number of other new original series to come, such as the fourth season of Never Have I Ever and the third season of The Witcher, it will be interesting to see what, if any, impact this has on the streaming service’s still-large share of the the demand for original series.

Amazon Prime Video and Disney+

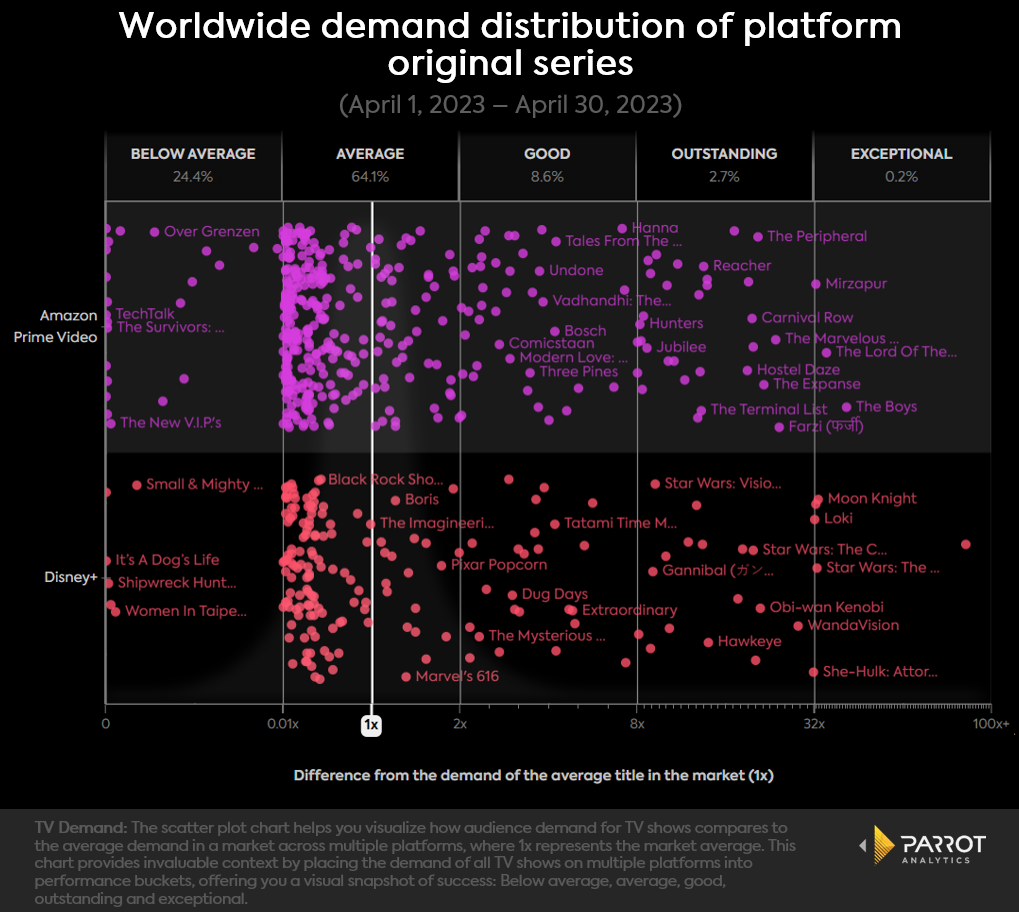

When it came to their original programs, Amazon Prime Video and Disney+ both saw significant rise in their respective shares of demand. The chart below shows the global demand for Disney+ and Amazon Prime Video original series over the past 30 days. Amazon Prime Video’s The Lord of the Rings: The Rings of Power, which was released in September of last year, and The Boys, which aired its third season in June last year, are both at exceptional levels of demand. Indian thriller series, Mirzapur, is also at an exceptional level, with 32.6 times more demand than the average series worldwide. Farzi and Jubilee, also Indian language series, were both released to the service this year and are sitting at an outstanding level of demand.

Regarding Disney+, series within the Marvel and Star Wars universes appear to have the most demand when it comes to original series on the service. However, with new series, such as Crater, The Muppets Mayhem, and Marvel Studios’ show, Secret Invasion, set to air in the coming months, it will be interesting to see how this chart changes over the course of this year.

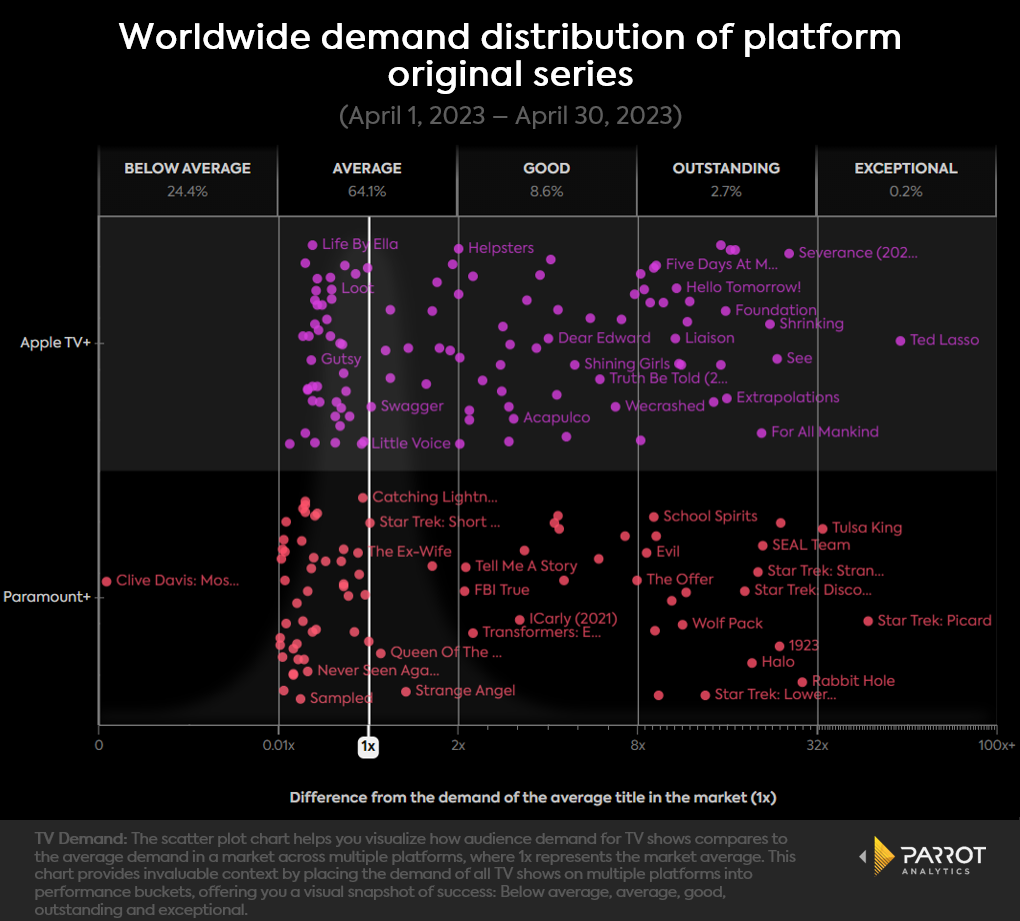

Apple TV+ and Paramount+

In the webinar, Hamilton also pointed out the success rate of Apple TV+ and Paramount+ and explained that, considering the average demand for their original series from the year, a high number of the original series they had aired over 2022 reached an exceptional level of demand. Ted Lasso from Apple TV+ and Halo from Paramount+ are good examples of this.

The chart below shows the global demand distribution of Apple TV+ and Paramount+ original series over the last 30 days. For Apple TV+, Ted Lasso still sits comfortably at the exceptional level, with 63.2 times more demand than the average series worldwide. Moreover, the Apple streaming service saw a number of new releases this year, Hello Tomorrow!, Extrapolations, and Liason, which are all sitting within the outstanding section at the moment. In addition to this, comedy drama, Shrinking, which stars Harrison Ford and Jason Segel, aired on Apple TV+ at the beginning of this year and is sitting close to an exceptional level with 25.63 times more global demand than the average series.

As for Paramount+, Star Trek: Picard, with 51.0 times more global demand than the average series, and Tulsa King, with 33.8 times more global demand than the average series, are both at exceptional levels of demand. School Spirits, Wolf Pack, and Rabbit Hole, where all released to the streaming service this year and all are all at an outstanding level of demand. Rabbit Hole, in particular, which had 29.9 times more global demand than the average series over the last 30 days could be one to keep an eye on, considering it was released just over one month ago.

A competitive future?

While Netflix has an extensive catalogue of shows in every genre and some record-breaking hits over the years, the effects of competition are becoming visible in the gradually changing market share. With Disney+’s successful continuation of the Star Wars and Marvel franchises, Amazon Prime Video’s Lord of the Rings adoption, and the unique new releases from Apple TV+ and Paramount+, it will be interesting to watch this share in the coming years and see the impact original content could have on the success of a streaming service.