The structural forces challenging the entire media and entertainment ecosystem have hit Paramount Global harder than any major legacy firm. In a beleaguered industry there may not be another conglomerate as beleaguered as Paramount Global.

The company has lost over 70% of its value since re-merging in late 2019, and a growing number of prominent suitors/vultures have been kicking the tires and circling the wagons. CBS delivering the most viewed Super Bowl in history couldn’t save 800 jobs that were cut just days later.

Paramount Global still owns one of the most valuable content libraries in the business, to say nothing of its iron grip on NFL rights for another decade to come. But the combination of a money-bleeding DTC segment, struggling studio, and exposure to linear TV has made Paramount Global as a whole worth less than the sum of its parts.

The major question facing chairwoman Shari Redstone is whether to combine forces with a larger company, or sell its various assets off piece by piece. Does the future Paramount look like a content arms dealer à la SONY Entertainment? Do any prospective buyers care about Paramount+, the very reason that CBS and Viacom re-joined forces in the first place?

Parrot Analytics created M&A Cheat Sheets at the beginning of the year to assess potential activity in the coming years, with Paramount Global featuring in three of the four matchups.

According to PwC, “The number of TMT megadeals dropped from 42 in 2021 to 24 in 2022 and just 11 in 2023.” Bankers have made it well known they expect deals to recover in 2024 and beyond. However, legacy media M&A has decidedly not paid off for shareholders when it comes to three prominent deals of the past five years.

Company | Acquisition Date* | Stock price change through Feb 26, 2024 | Benchmark** change through Feb 26, 2024 | Netflix change through |

|---|---|---|---|---|

Disney (Fox) | Mar 20, 2019 | -2.1% | Dow Jones: +51.8% | +56.6% |

Paramount Global | Dec 04, 2019 | -72.8% | S&P 500: +62.9% | +93.1% |

Warner Bros. Discovery | Apr 11, 2022 | -65.5% | S&P 500: +14.9% | +68.9% |

* = Acquisition Date refers to when each M&A deal was completed (i.e. not the date the deals were announced)

** = Those benchmarks chosen because Disney is part of Dow Jones, Paramount and WBD are part of S&P 500

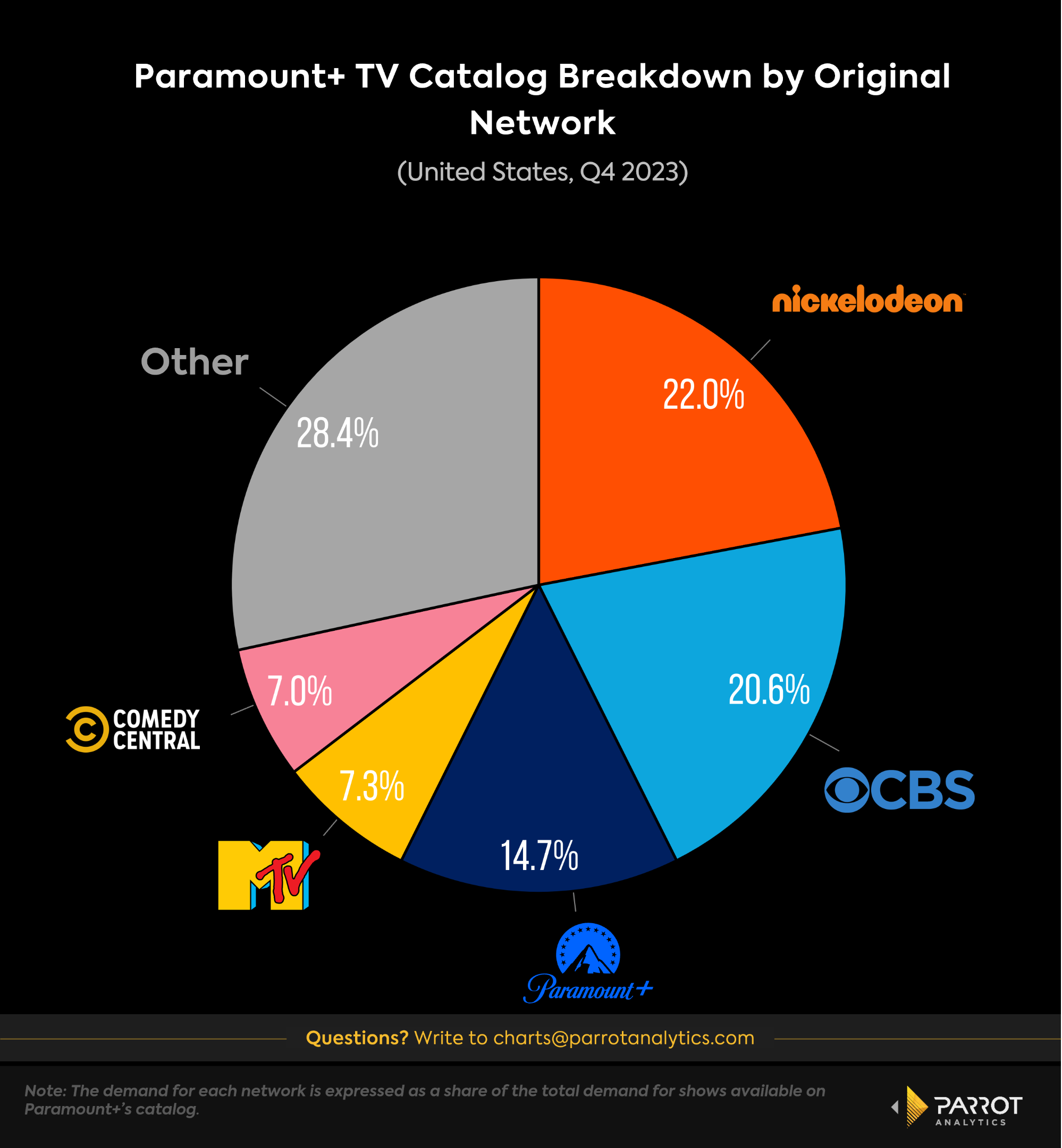

Paramount+ Demand by Original Network

- Breaking down Paramount+’s TV catalog by original network shows the continued value of its linear brands.

- Paramount Global’s three leading cable channels — Nickelodeon, MTV, and Comedy Central — account for more than a third of the demand for TV on Paramount+, while broadcast network CBS accounts for a full one fifth of the demand, and Paramount+ originals stand at at 14.7%.

- However, as linear TV continues to bleed subscribers and scripted TV becomes increasingly de-emphasized, such a reliance leaves the streamer vulnerable.

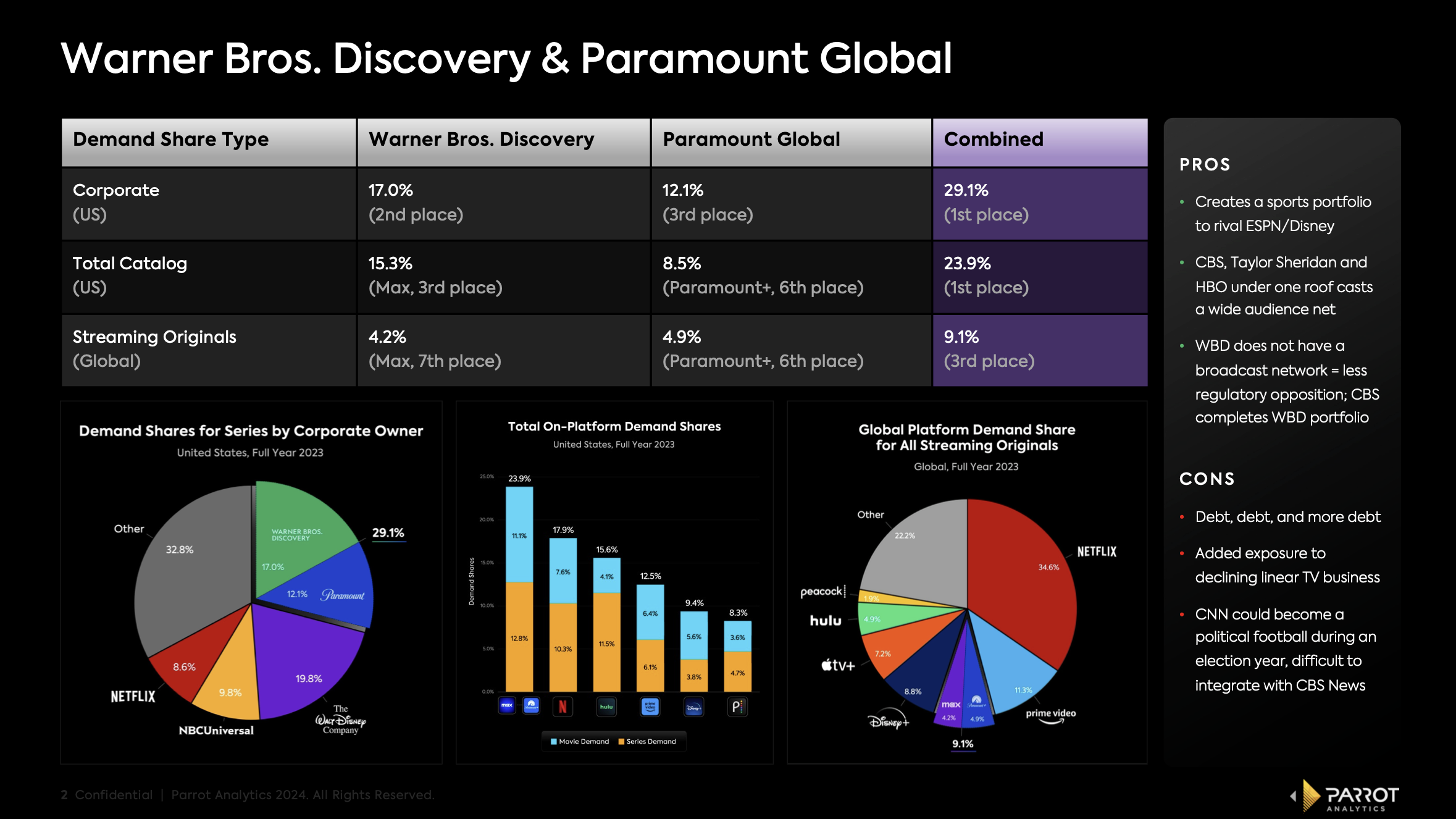

M&A Cheat Sheet: WBD and Paramount

- News broke in December that these company’s principals had met and discussed merging. Wall Street did not respond kindly, and both stocks are down double digits since that report came out.

- However, as Paramount’s value continues to shrink, this may be its best option that doesn’t include selling the company for parts.

- If Paramount were acquired and its sports rights added onto the “Spulu” offering, this would significantly boost the value of a standalone sports streamer, bringing in CBS Sports (i.e. more NFL games) into the fold.

- While Zaslav built his business on cable, it’s unclear whether he has the stomach to further expose his company to the shrinking linear TV business.

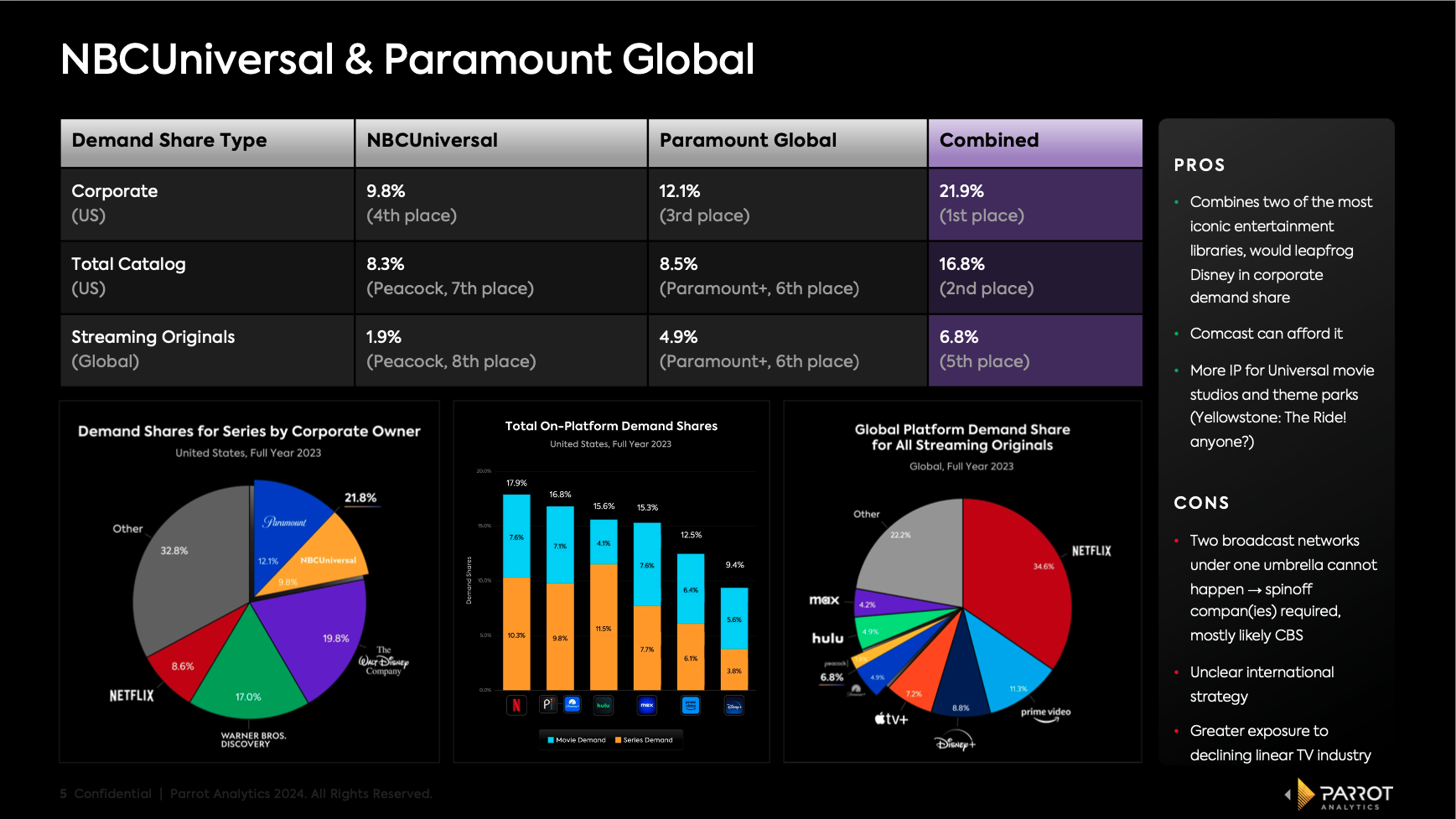

M&A Cheat Sheet: NBCUniversal & Paramount Global

- There has been renewed speculation of a potential platform merger between Peacock and Paramount+, especially since both were left out of the upcoming ‘Spulu’ sports streamer. Would something like this lead to an even bigger deal?

- The most obvious red flag to this merger is the fact that both companies own a Big Four broadcast network, and one would have to be spun off in order for the merger to go through.

- NBCUniversal joining forces with Paramount Global would leapfrog Disney as the number one company in terms of corporate demand share.

- It’s unclear what the company’s international strategy would be. Paramount+ and Peacock combined still only account for 6.8% of the global demand for streaming originals.

- This merger would also give Comcast even more exposure to the shrinking linear TV business.

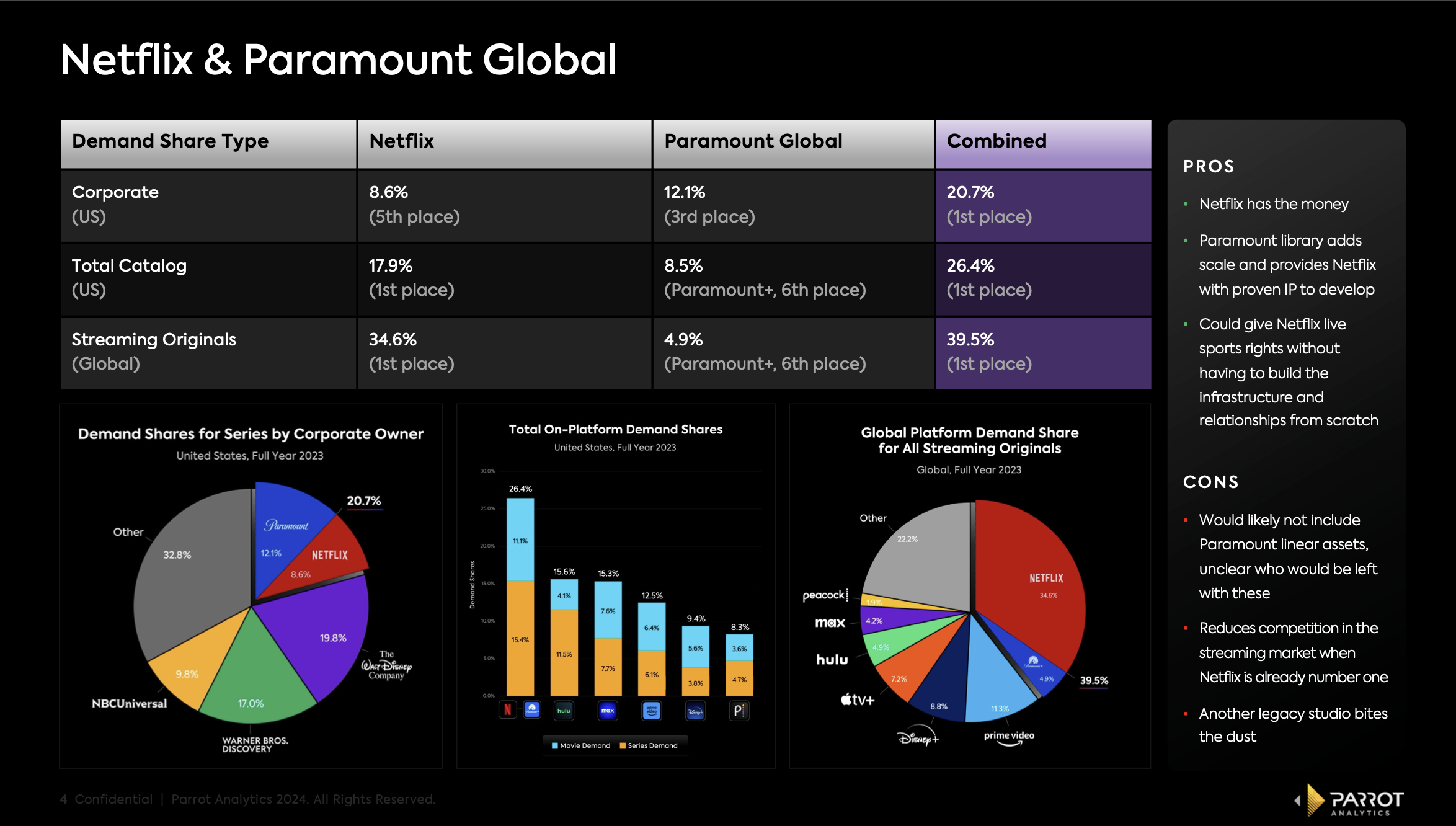

M&A Cheat Sheets: Netflix and Paramount Global

- The most obvious reason this might happen is Netflix has the financials to make it work.

- That said, Netflix would likely only be interested in the studio business/library ownership, and the linear networks’ future would remain uncertain.

- Netflix is already the number one streamer in every category of audience demand, and adding the Paramount library would put it in first place in corporate demand share as well.