In 2023, there’s nothing more in vogue than 2003. In mainstream pop culture, we see nostalgia for the 90s and early 2000s heading major trends, including the revival of the pop-punk music genre, and the low-rise jeans fashion. With the demand for TV shows and movies, this isn’t any different.

One of the genres that defined the Y2K trends in fiction was the romantic comedy - Romcom, for short. Many classic movies of the genre came out in this period, which is considered the Golden Era of Romcoms.

The mass-appealing genre slowly faded out of style going into the 2010s, in favour of other genres. However, right in time for the 20-year fashion cycle, we may be seeing a resurrection of the Romcom.

In this article, we will investigate the performance of classic Romcoms, as well as current ones, looking for evidence of a potential revival of the genre.

Classics of the Golden Era

The Golden Age of the genre lasted from the 1990s to the early 2000s, when cable television and movie theatres still reigned, and the internet was still in its infancy. Back then, segmented consumption was still in its embryonic phase, and mainstream productions, such as Romcoms, were geared to appeal to the greatest amount of people.

Later, quick developments in the modes of content consumption caused shifts in audience interests, leading to the rise of more niche genres such as teen-dystopian fiction.

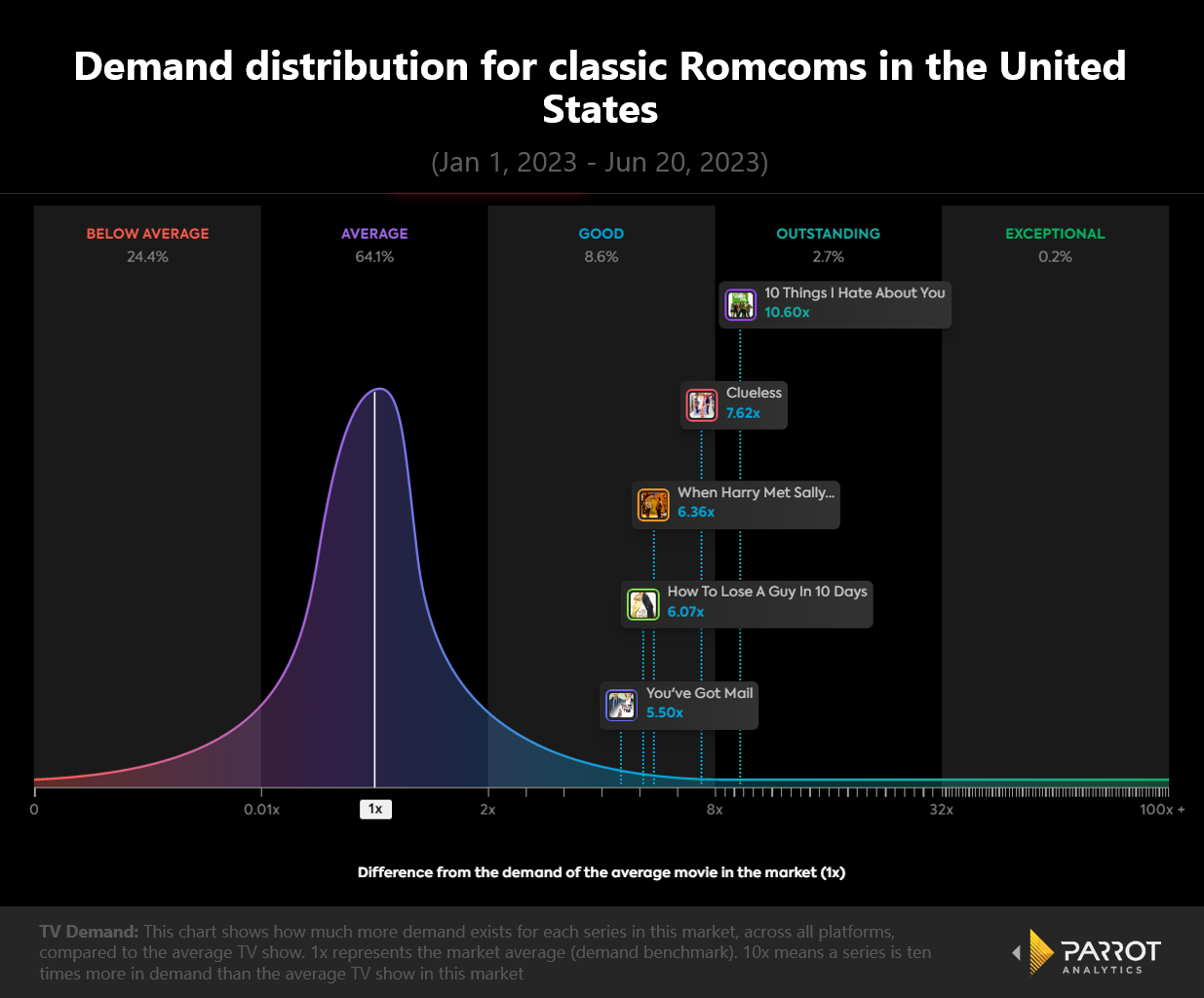

During the Golden Era, there were many movies produced that have since become classics. Among these are How to Lose a Guy in 10 Days, 10 Things I Hate About You, Clueless, You’ve Got Mail and When Harry Met Sally.

All these movies are still extremely popular in 2023, according to their demand performance this year.

Looking at the demand distribution chart, we find that 10 Things I Hate About You had the highest demand over the period, with 10.60x the demand average. The following most popular classic was Clueless, with 7.6x the demand average. When Harry Met Sally was the third most in-demand release, with 6.36x the demand average. Next was How To Lose a Guy in 10 Days, with 6.07x the average. Finally, You’ve Got Mail wraps up the list in fifth place, with 5.5x the demand average.

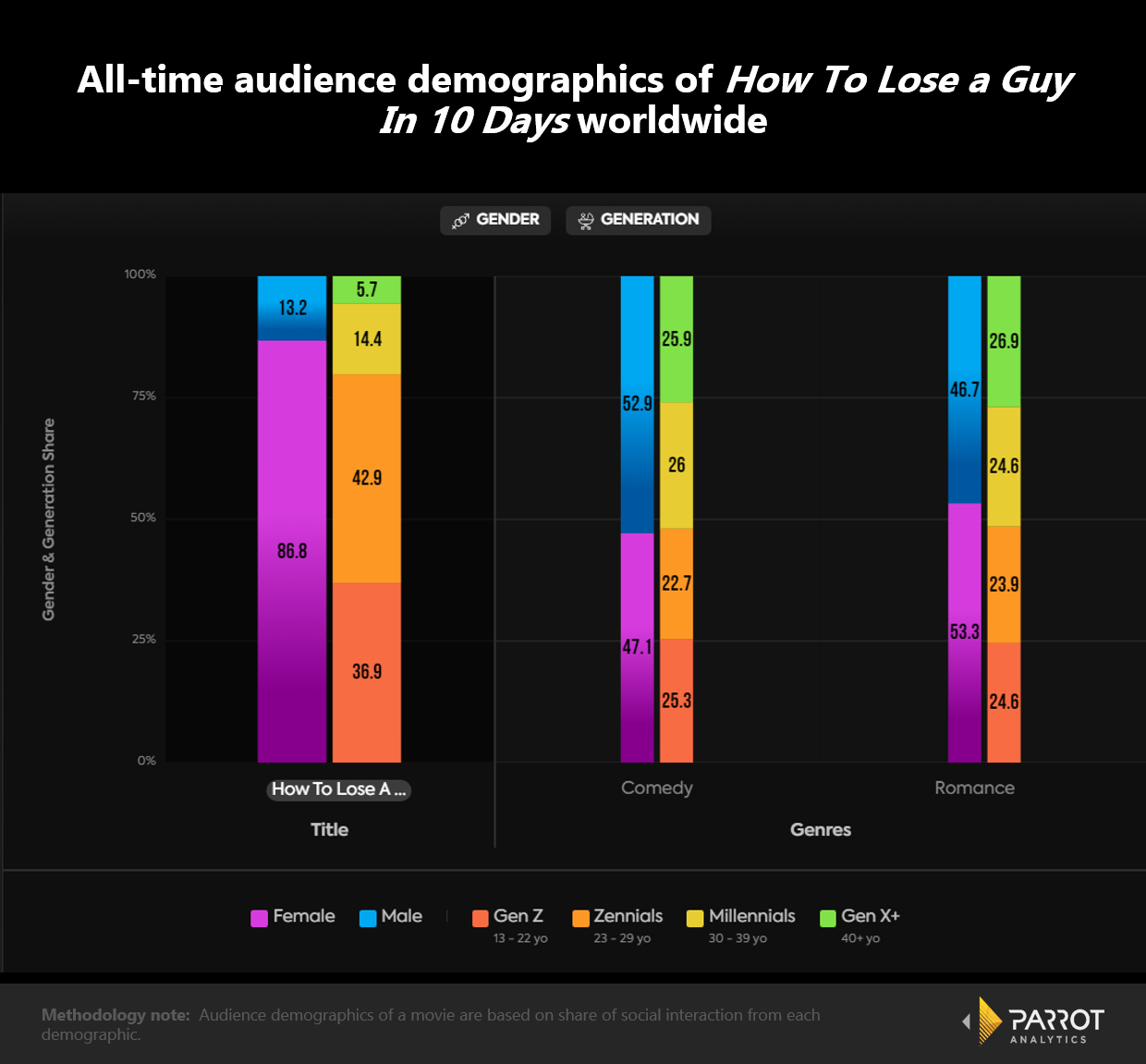

We can further break down the popularity of these movies by looking at audience demographics. For instance, we can take a look at the audience demographics of How To Lose a Guy in 10 Days. The movie, which came out in 2003, is most popular with Zennials - the intersection of Millennials and Gen Z - which represent 42.9% of the audience.

The next most representative generation in the audience composition is Gen Z, at 36.9% of the audience, despite having been too young to be aware of the movie when it came out.

The persistent popularity of Romcoms, as well as its stronghold of the younger generations, are positive indications of a potential revival of the genre.

Signs of a revival?

Just like many other popular things from the early 200s, Romcoms might be coming back in popularity. There are some things we can take as signs of a potential revival, particularly by looking at new debuts of the genre this year.

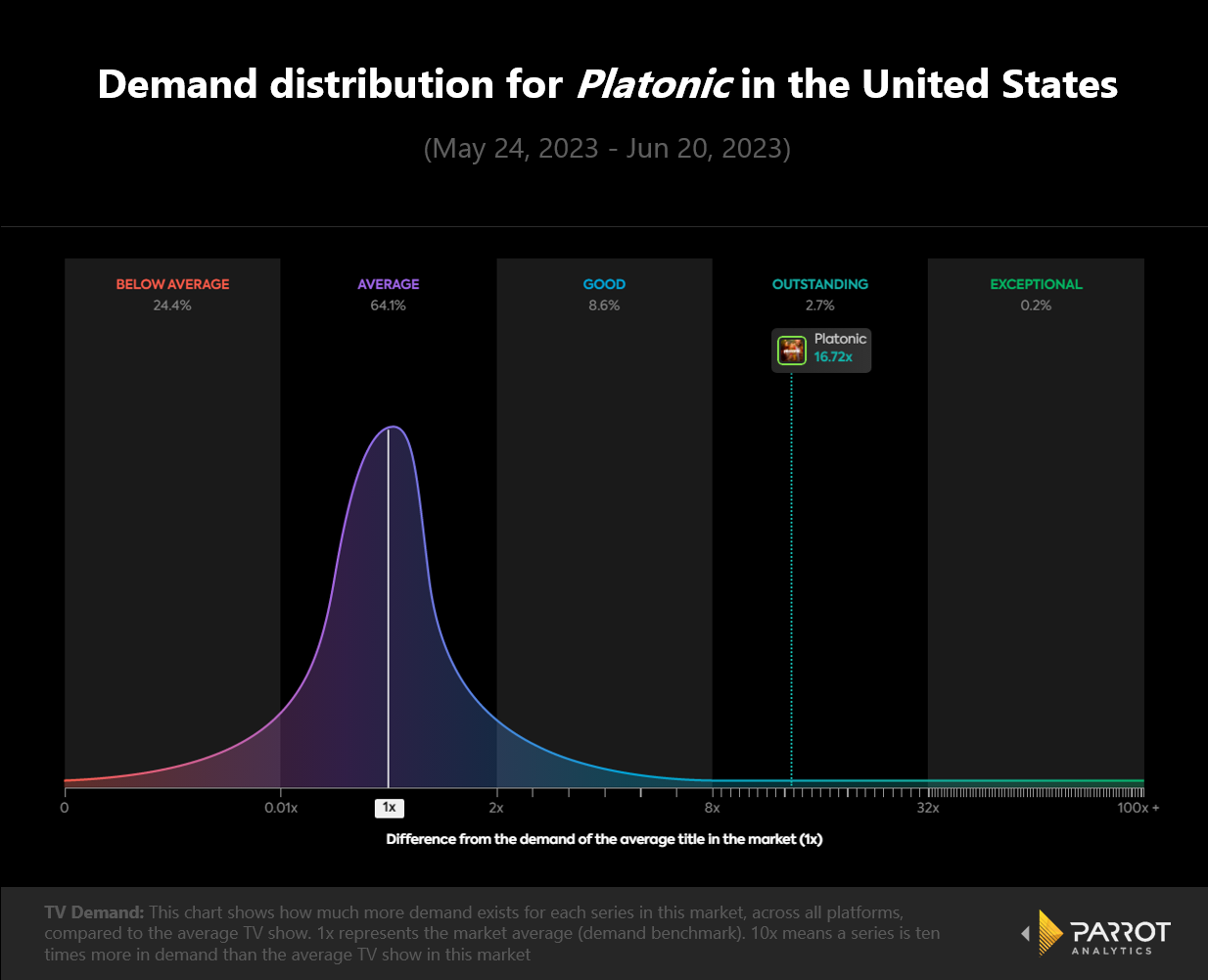

One of the examples is Apple TV’s newly released series, Platonic. The series, which debuted on May 24th, has accumulated an impressive rate of demand since then. According to the demand distribution chart, it recorded 16.7x the demand average since its debut.

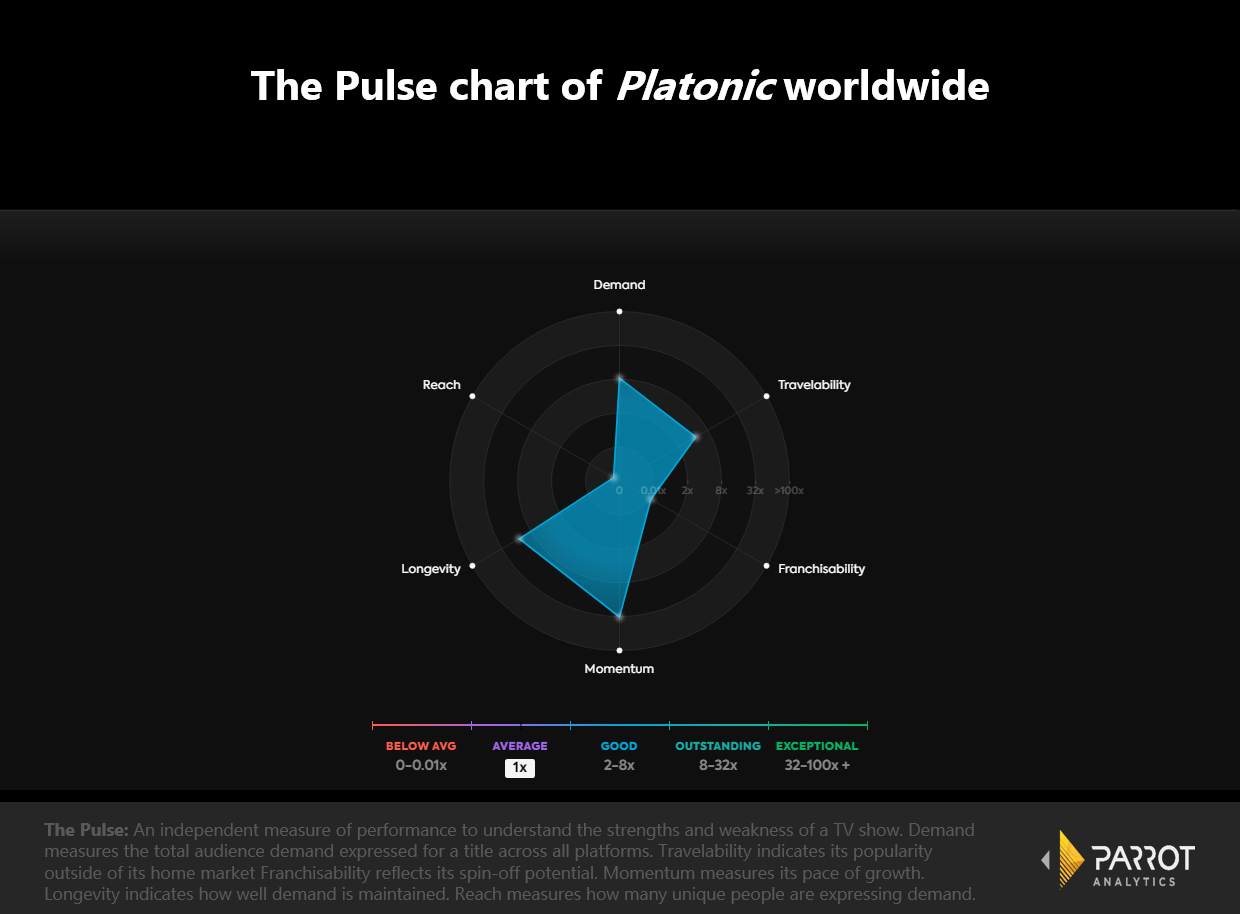

Furthermore, the series Pulse chart demonstrates an exceptional rate of momentum for the show, at 32.8%, despite its struggles with Reach and Franchisability.

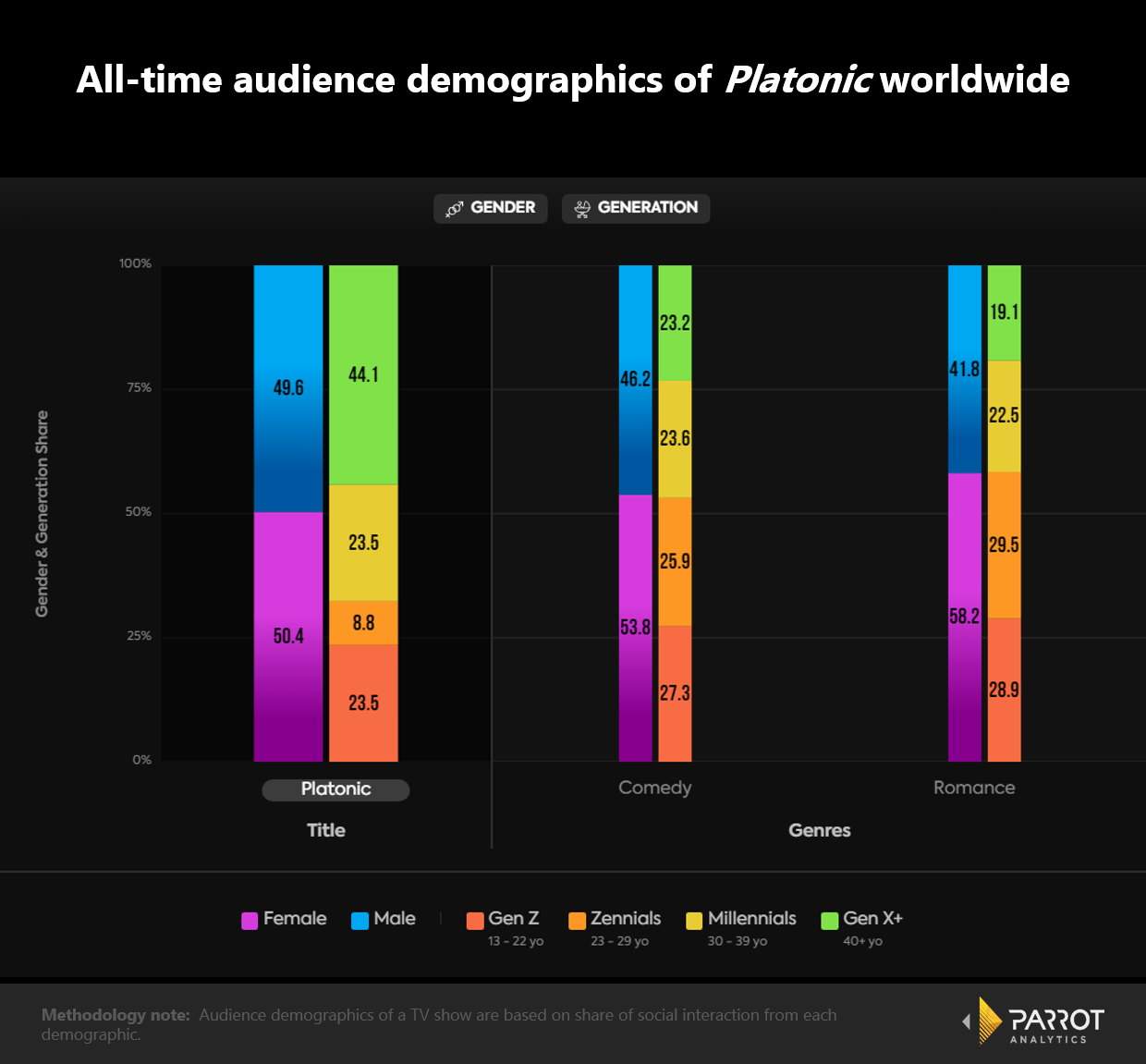

Finally, taking a look at the audience composition, we find that, although the biggest percentage of the audience is Gen X - 44.1% - the younger generations combined still represent more than half of the audience. Together, Millennials, Zennials and Gen Z round out 55.8% of the audience.

The skew to a young demographic is a definitive indication that there is a renewal in interest for the genre, as this is a different audience than the one for which the classic features were made.

Another example is Murder Mystery 2, which stars Romcom veterans Jennifer Aniston and Adam Sandler. The feature came out in March and is a sequel to the 2019 movie Murder Mystery, starring the same actors. The five-year gap between the two movies begs the question: did the producers see any indicators that now was the time to release the sequel due to an increased favourability towards the genre in the market?

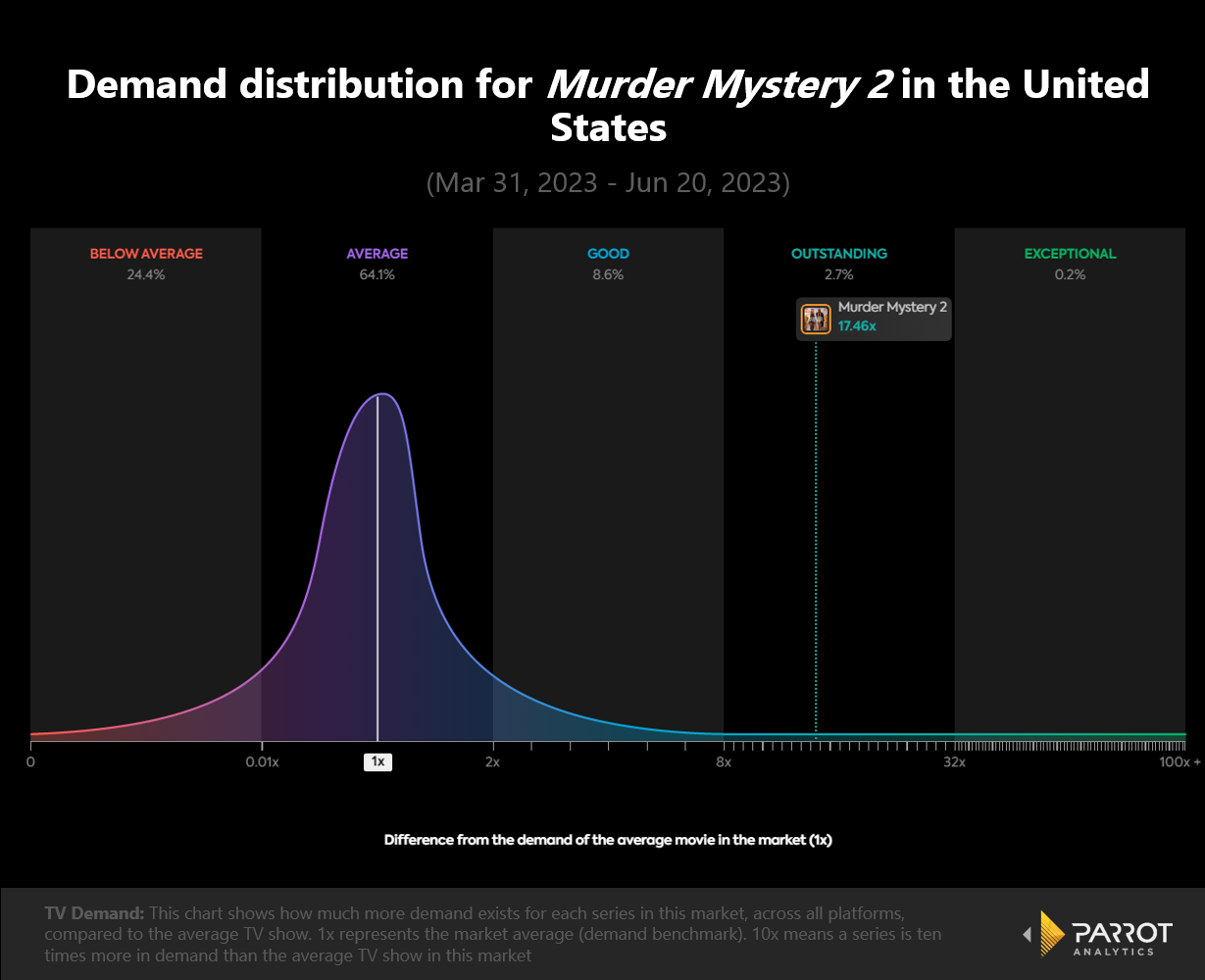

According to demand distribution data, Murder Mystery 2 garnered 17.4x the demand average since its debut. Additionally, we can compare the performance of the original and sequel in the weeks following its premiere using the time-shift chart.

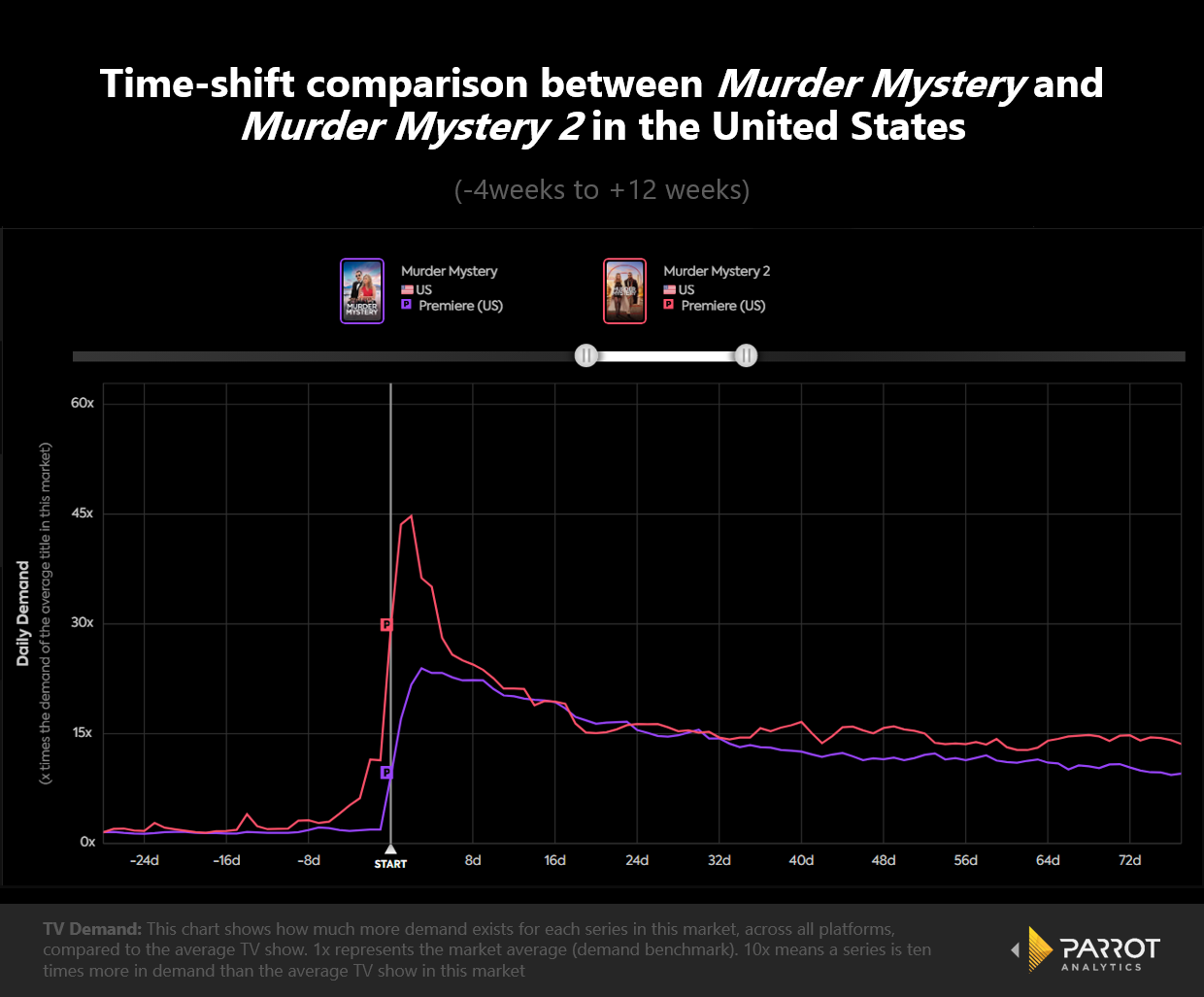

Here we can see that it has performed better overall than the original, peaking at 44.7x the average, compared to 23.9x the average for the original.

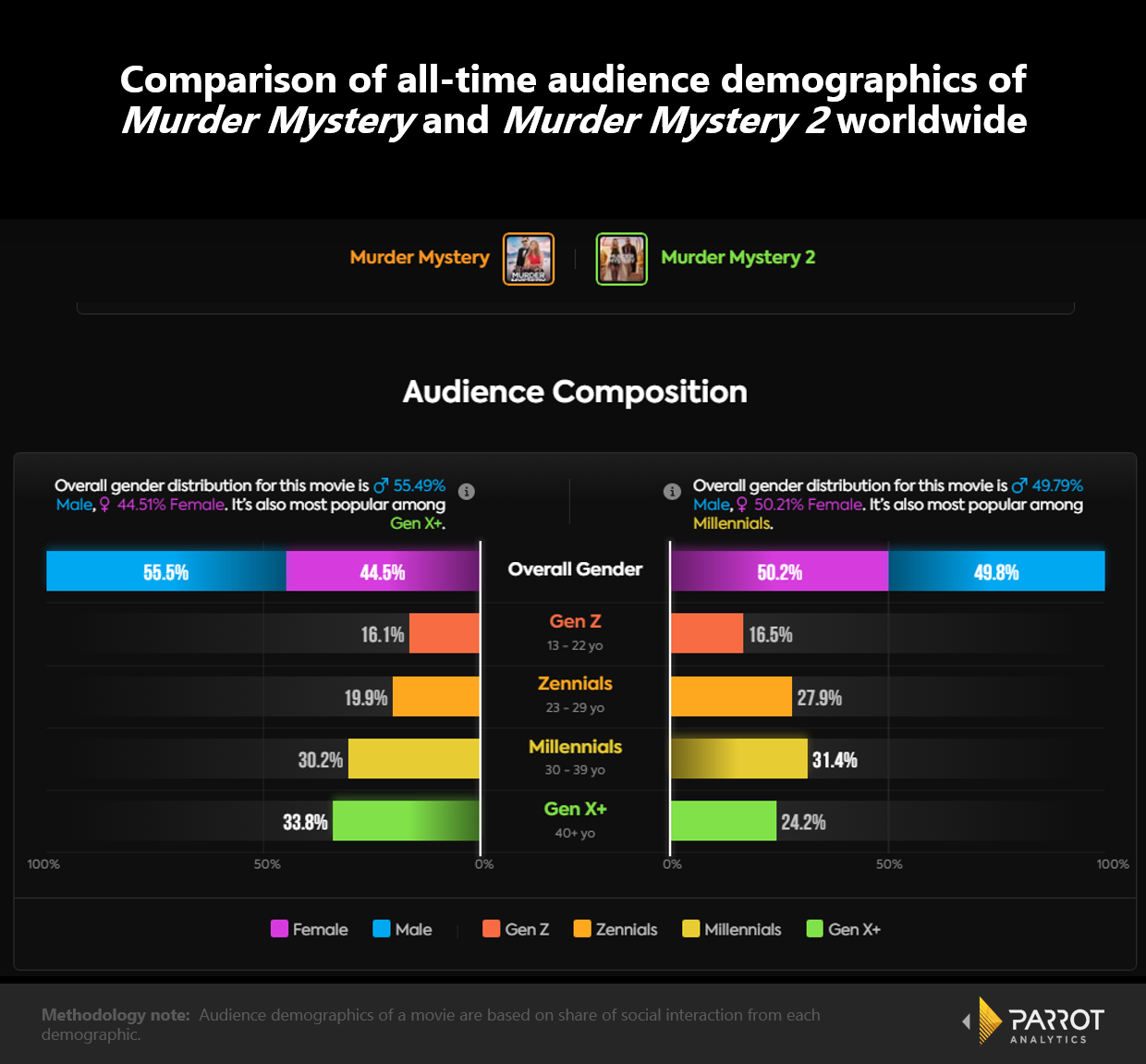

We can also compare the audience composition of both movies. The data indicate that the audience for Murder Mystery 2 is slightly younger, with 24.2% of the audience being Gen X compared to the original’s 33.8%.

Finally, we can take as the last piece of evidence of the genre’s revival the popularity of Romcoms series from foreign languages. Our current globalized media space allows for the dissemination of content from virtually anywhere. Language barriers and production budgets are no longer complete impediments for foreign language content to reach and captivate audiences all over the world.

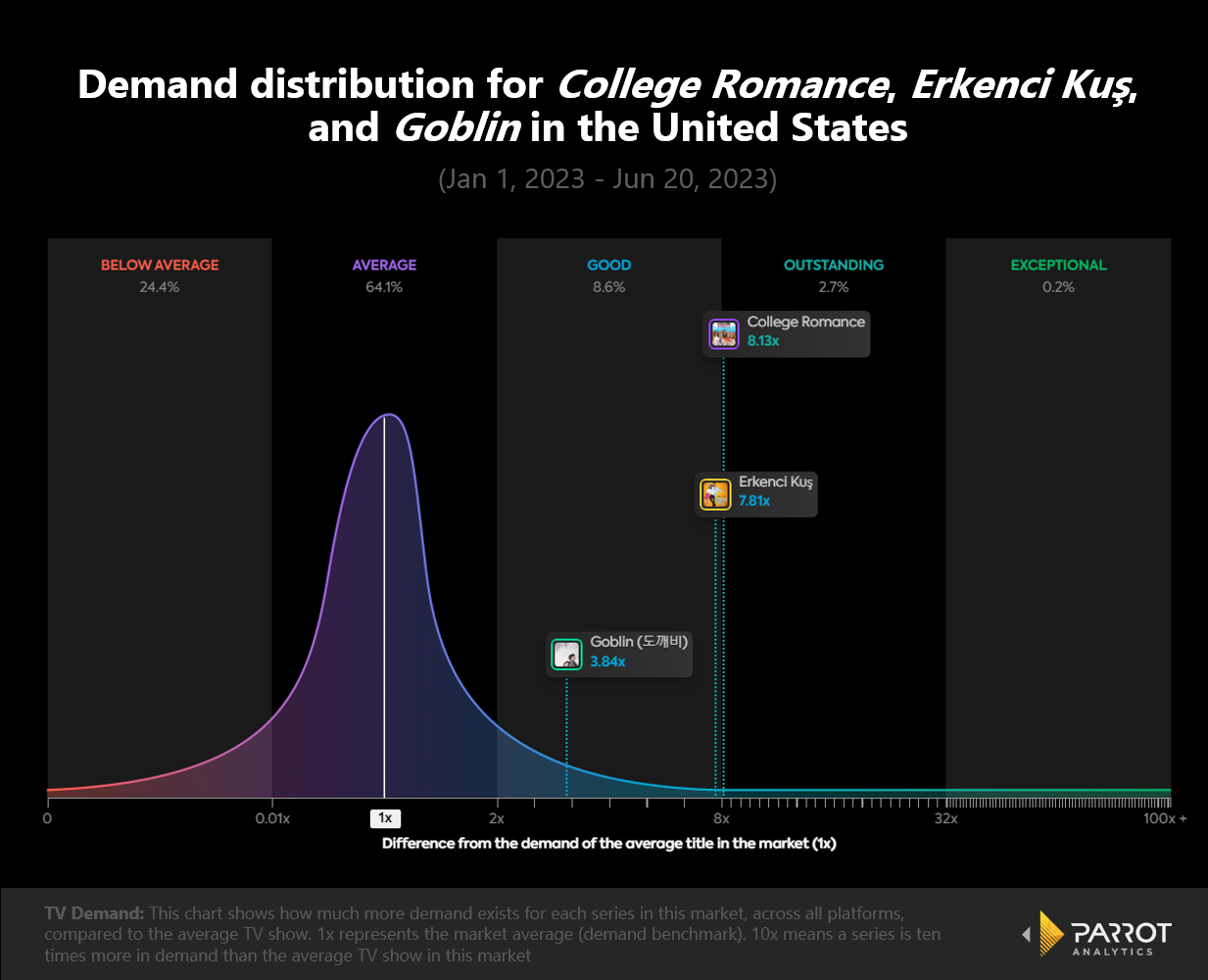

Some examples of this go to India’s College Romance, Turkey’s Erkenci Kus, and South Korea’s Goblin. In 2023, College Romance accumulated 8.1x, while Erkenci Kus scored 7.8x and Goblin had 3.8x the demand average.

Overall, between the overwhelming popularity of classic Romcoms with younger demographics, as well as the great demand for new releases in the genre, there seems to be strong evidence that the Romantic Comedy is making a comeback, and we will be watching how this trend develops in the future.