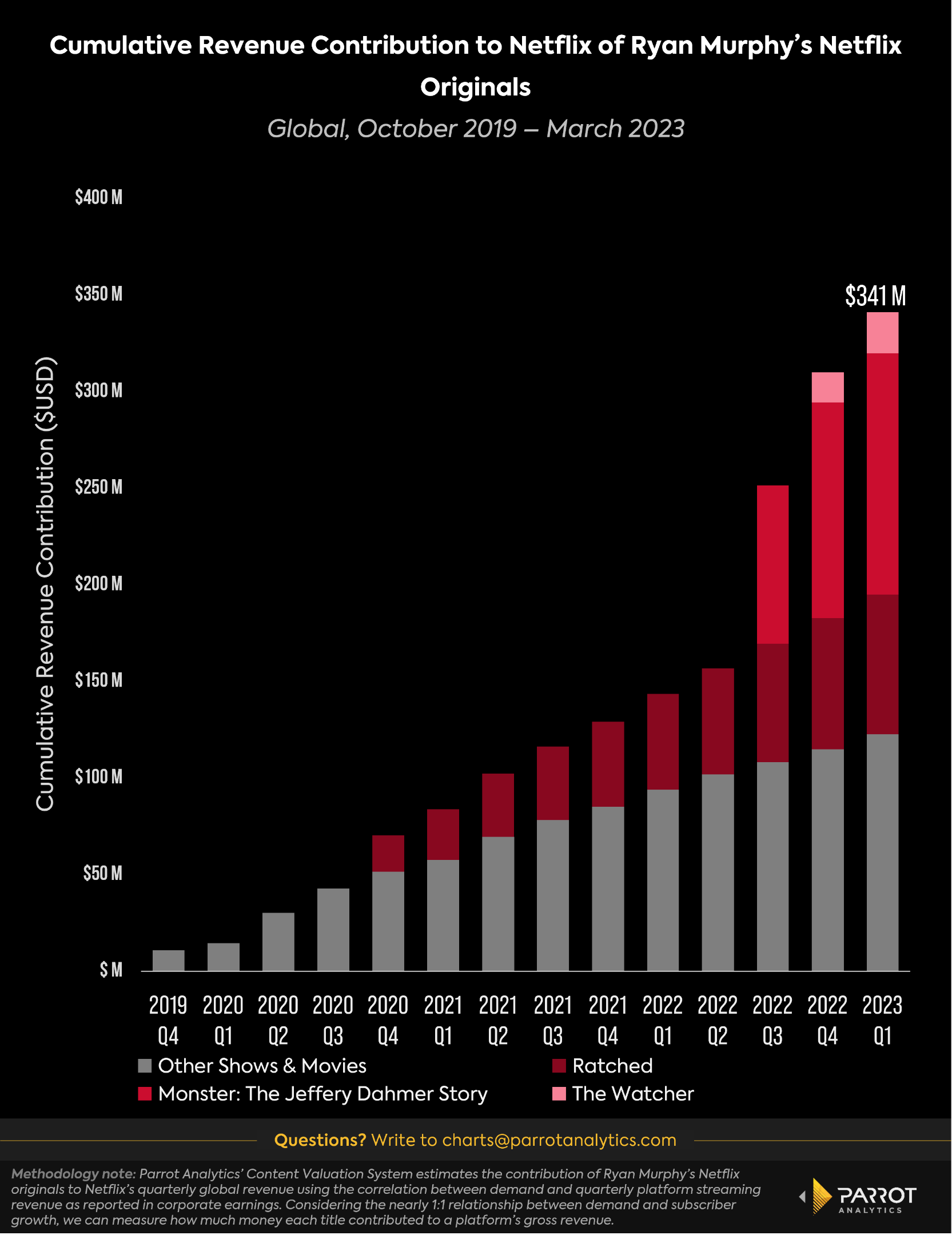

As of Q1 2023, Parrot Analytics’ Content Valuation System estimates that the impact of Ryan Murphy’s work for Netflix has been a $341M contribution to the platform’s global revenue. This number considers the cumulative contribution of Netflix original shows and movies produced by Murphy to the company’s quarterly global revenue, spanning from his first Netflix original,The Politician to his most recent release for the platform, The Watcher.

To give context to this number, Netflix struck a 5-year agreement with Murphy in 2018 for a reported $300M. As Ryan Murphy reaches the end of his 5-year commitment with the platform it is still up for debate whether Netflix will consider this deal a financial success with 20/20 hindsight. On the one hand, the estimated $341M in revenue that Ryan Murphy’s titles have already contributed to Netflix means that these titles have generated enough revenue to cover at least the headline cost of the deal. However, several outstanding questions remain before we can make a call on how good of a deal this ultimately was for Netflix.

For starters, it is unlikely that the terms of the contract included production costs for those shows and movies in that top-line number. Even if all the costs associated with making this content were baked into that $300M, the margin of return to-date is pretty slim. With several new seasons planned, it also remains to be seen how much additional revenue these titles will generate for Netflix and how long the platform holds the rights to these titles.

One important note is that not all of these titles fall under the scope of the $300M contract. For example Netflix announced a two season order for Ratched in 2017, before inking the mega-deal with Murphy. Still, looking at the total revenue contribution to Netflix of all his shows helps us quantify the value this partnership has delivered for the streamer.

While the top line number is important, it is even more eye-opening to dig into how exactly Murphy’s body of work for Netflix reached this number. For example, despite being one of the most recent releases, Monster: The Jeffery Dahmer Story is already responsible for 37% of the revenue Ryan Murphy titles generated in only three quarters since it premiered. It was this show that pushed the cumulative revenue number over the $300M mark in Q4 2022.

If we look at Ratched which premiered at the end of 2020 we can see how time is an important part of the equation when tallying up the total revenue a title contributes. With a single season that premiered in September 2020, the show has continued driving value for the platform each quarter and, as of Q1 2023, it accounts for 21% of the total revenue generated for Netflix by Ryan Murphy titles.

We can expect to see a similar growth over time for the most recent of these releases, The Watcher. Monster: The Jeffrey Dahmer Story, Ratched, and The Watcher had the most in-demand global premieres of these titles and together account for 64% of the revenue generated by Ryan Murphy’s body of work for the streamer as of Q1 2023, highlighting how top-heavy Murphy’s output for Netflix has been.

Even though it looks like Netflix’s partnership with Ryan Murphy has at least recouped the headline cost of the $300M deal, putting it under the microscope like this makes it clear it was mostly due to the impact of a few hits. This raises the question of whether the company could have made more targeted investments that generated nearly as much revenue with fewer titles and a much smaller price tag. In all fairness to Netflix, this hits-driven model is standard throughout the entire entertainment ecosystem.

However, as the industry shifts to become more data-driven in its decision making, Parrot Analytics’ Content Valuation System can not only attach a dollar value to how much a title contributes to a platform’s revenue but also answer questions like: How much value is a title forecast to contribute in the future, with or without additional seasons? How exactly does a title drive value for a platform - through subscriber acquisition or retention? and Is a title helping to retain subscribers that are at a high risk of churning?