Image: Only Murders in the Building, Hulu

The television industry has been changing over the last years. One of these shifts is the way TV shows are structured and delivered. Not long ago, the norm was for TV series with longer seasons, typically ranging from 20 to 24 episodes to fit the schedules of network television. More recently, this trend has shifted towards more succinct seasons, often with fewer episodes. This trend reflects changes in audience expectations, viewership patterns, network strategies, and the advent of streaming platforms.

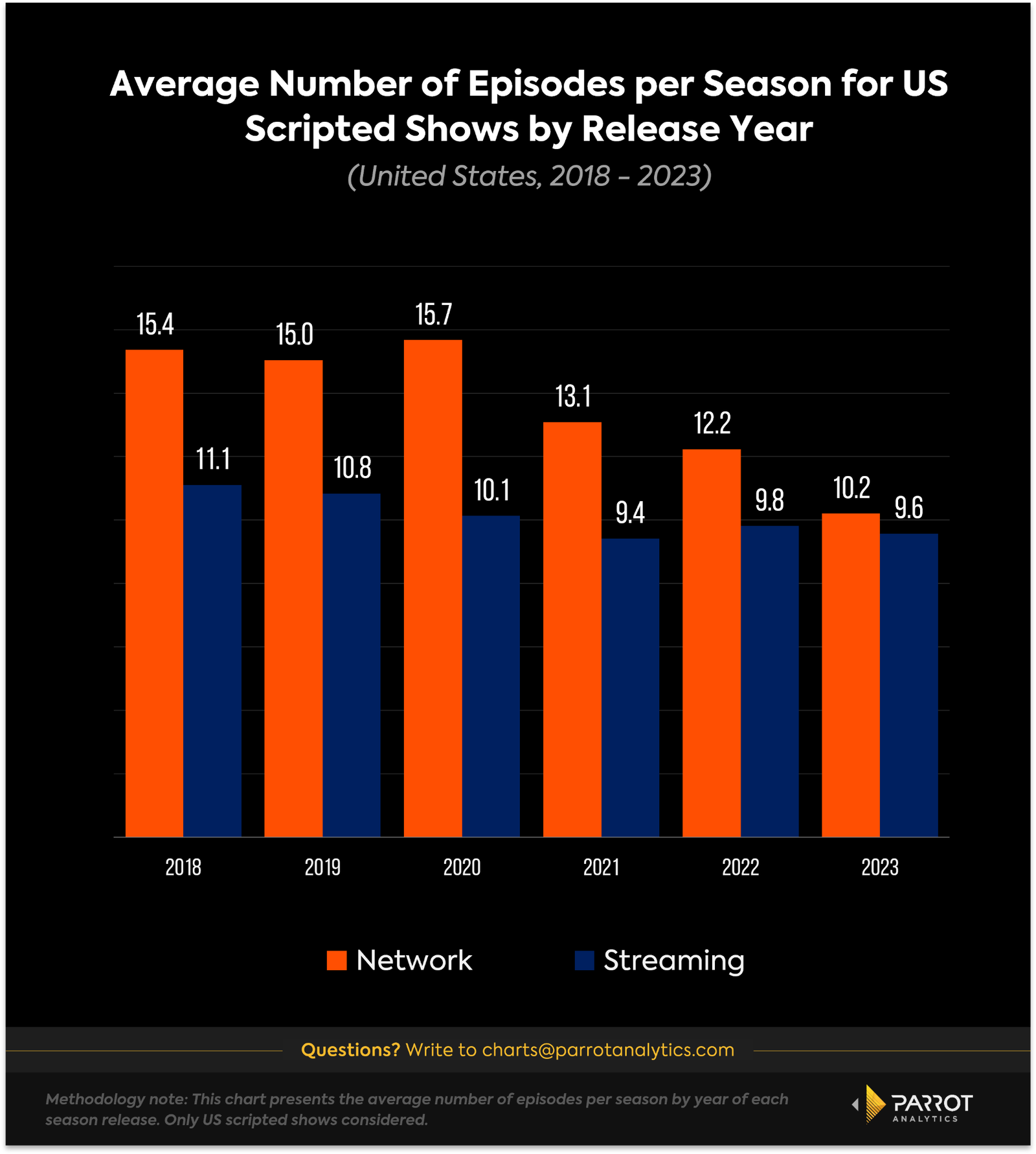

The model introduced by the proliferation of streaming platforms favors more condensed episodes when compared to the traditional network model. However, the gap between the average season lengths of network and streaming shows has narrowed over the last six years. According to Parrot Analytics’ Content Panorama, which provides supply-side information about streaming platform catalogs in multiple markets, the average number of shows per season for network shows decreased from 15.4 in 2018 to 10.2 in 2023, closely mirroring the average for streaming shows at 9.6 episodes in the same year.

This shift reflects not only the growth of streaming TV but also a broader change in viewer preferences. Audiences today seem to prefer tightly-knit narratives, leading to a decline in the popularity of long-running seasons. Data shows a stark decline in the proportion of US scripted shows releasing new seasons with more than 20 episodes, dropping from 19% in 2018 to just 4.5% in 2023.

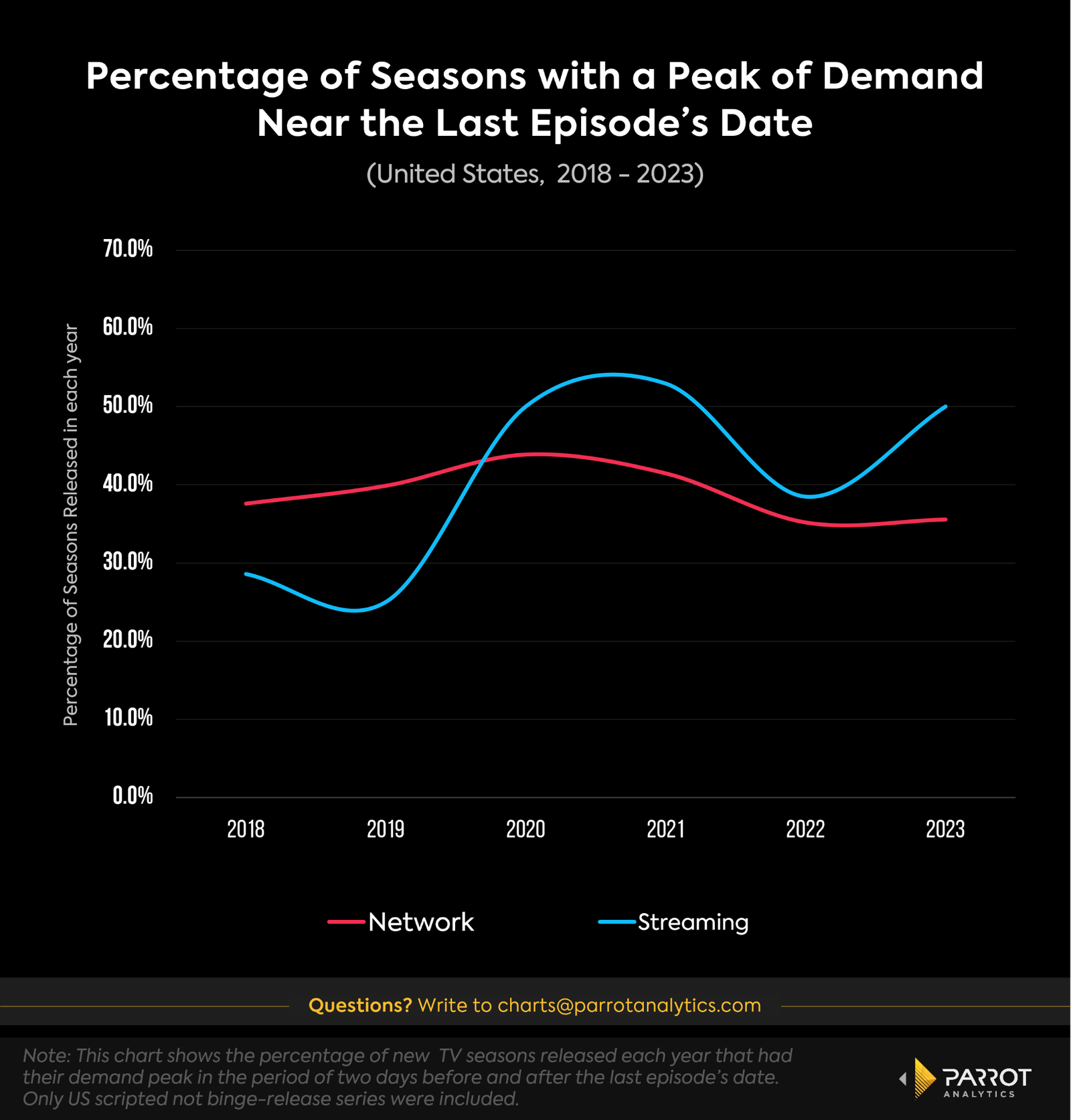

These trends raise questions about how audiences engage with episodically released content. For example, are audiences maintaining interest throughout the season or do they lose engagement midway? Using Parrot Analytic’s demand data, it’s possible to analyze when the peak demand for a season occurs. If it occurs near or at the last episode, it indicates that audiences are maintaining interest until the end of the season.

For instance, the share of network-released shows that saw their peak demand at the season finale has been around 40% over the last six years. HBO stands out, with over 50% of its seasons peaking in demand around the finale, a testament to its ability to captivate audiences consistently. Among the other major broadcast networks, this share ranges between 40% and 45%.

For streaming services (excluding binge-released shows), there's been an uptick in seasons that maintain viewer interest until the conclusion, growing from 30% in 2018 to nearly 50% in 2023. Among other shows, “Our Flag Means Death" (both seasons) exemplifies this trend of high audience engagement through their finales, all released after 2022.

Streaming platforms are adapting their show's storylines and screenplay to make content that holds people’s attention until its conclusion, which includes the use of cliffhangers, and other writing techniques to keep viewers looking forward to the next episode. On the same page, seasons are getting shorter for both network and streaming shows, reflecting a landscape where the competition for the audience's attention gets fiercer.

More details into the demand for specific titles can be found in the Parrot Analytics DEMAND360 platform, while Content Panorama offers more insights into the nuances of content supply across different platforms and markets.