Determined by global audience demand through Parrot Analytics’ audience demand measurement system, the Global TV Demand Awards are unbiased and driven by data as opposed to the judges and voting committees of traditional award systems. As the event, airing in February 2022, approaches, it is exciting to consider the finalists of the 20 different categories. One of these is Netflix’s Squid Game, a finalist in both the Revolutionary Series category and the Series Debut category.

Squid Game follows a number of financially-unstable contestants as they compete against each other in a highly-staked tournament, playing simple children’s games such as ‘Tug of War’ and ‘Red Light, Green Light’, to win a huge cash prize. However, losing any of the games results in their death. While the show can be seen as shocking or disturbing for its graphic and bloody content, the dystopian drama has reached extremely high benchmarks in terms of its demand - making it a very notable finalist in the coming Global TV Demand Awards.

Released just three months ago on September 17th, Squid Game has reached global recognition and astronomical levels of demand - even breaking the internet in its home market, South Korea. The show has amassed a large social media presence, as well, with the hashtag #Squidgame viewed more than 22.8 billion times. This article will outline the Netflix original’s current levels of demand and possible contextual influences behind its fast success.

Exceptional momentum and potential for franchisability

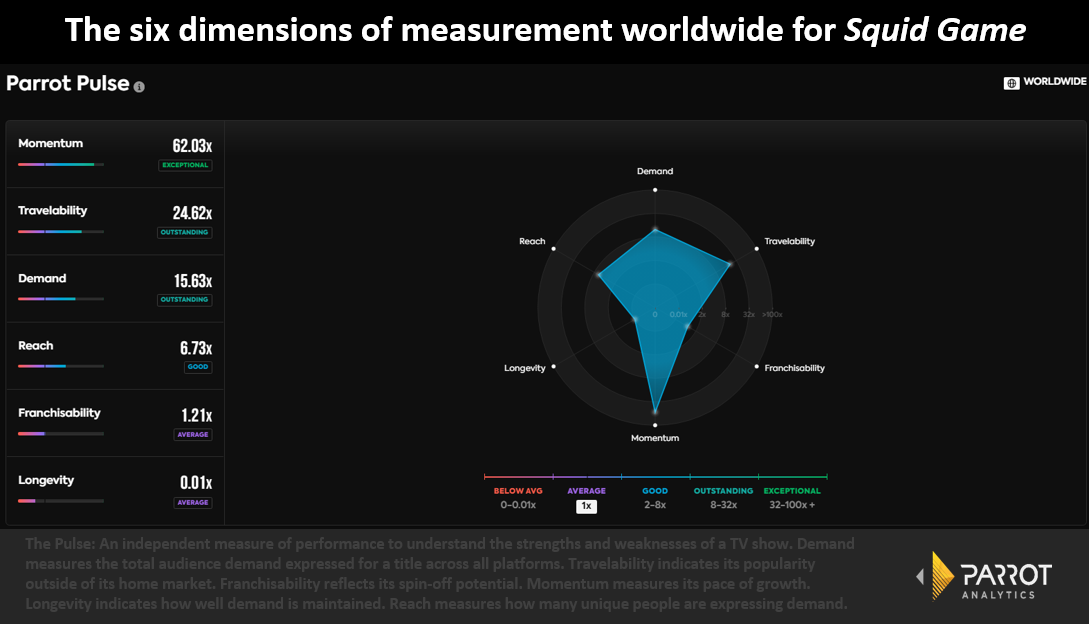

The chart below shows six dimensions of measurement for Squid Game. The level of momentum - which refers to how fast the show’s demand has grown over the past 12 months compared to the speed of demand growth of the average show - for the Netflix original series is at an exceptional level, a notable achievement given that it was released under five months ago. It has 62 times more momentum than the average show worldwide, a level that only 1.56 percent of TV shows have at the moment. Travelability - which measures how popular the show is outside of its home market - is at a high level, as well. Squid Game has 24.6 times more travelability outside of its home market, South Korea, than the average show worldwide.

One interesting point to consider is the show’s franchisability - which refers to the spinoff potential for the TV series. The franchisability for Squid Game, while only within the avergae range at the moment, may have the potential to grow in the future. With its game-show format, the Netflix original series has been shown to effectively convert into an exciting reality series. Youtube creator, Jimmy Donaldson, better known by his channel name, ‘Mr. Beast’, has released his own unofficial version of Squid Game - with real contestants and without risk of death. While the knock-off has indeed sparked controversy around IP and the creator economy, the popularity of Donaldson’s take on the dystopian thriller is very clear and, with the increase in demand for physical reality TV shows, might even point towards viable options for the original series’ future franchisability.

Global Demand for Squid Game

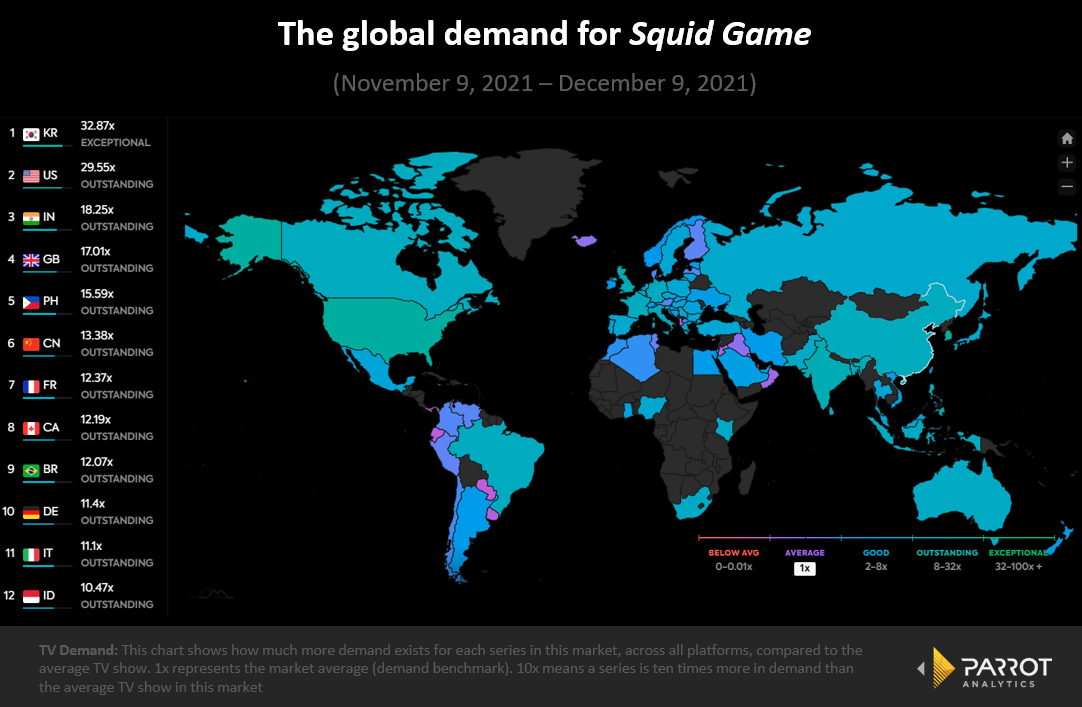

As mentioned earlier, travelability for Squid Game outside of its home market is at a significant level. The chart below outlines the nations with the highest level of demand for the series. South Korea, where the show was produced, has an exceptional level of demand for Squid Game, with 32.9 times more demand than the average show worldwide. The United States is close behind this, with 29.6 times more global demand than the average show - an understandably high level of demand, considering the Netflix series had reached the number one on the country’s streaming charts in under a month after its debut.

Growing Demand for Foreign Language Content

The widespread demand for Squid Game, as well as the speed at which that demand grew, could be pointing towards a worldwide appreciation of foreign language content. Netflix, Squid Game’s home streaming service, has found great success with non-English television shows and films. For instance, French mystery thriller, Lupin, which was first aired on Netflix in January of this year, reached 70 million households within the first month of its release. This was significantly higher than other well-preforming original shows on the streaming service, including English series Bridgerton, which reached a projected 63 million households, and The Queen’s Gambit, which had reached 62 million households. This being said, when looking at the positive reception and fast success of both Squid Game and Lupin, Netflix’s active investment into foreign programming since 2015 could be one of the streaming service’s greatest advantages.

With its record level of demand in such a short space of time, Squid Game is indeed a title to keep an eye on in light of the Global TV Demand Awards, which air in February. This exceptional level of demand also speaks to the show’s future. Having been officially renewed by Netflix for its second season, the current success of this sometimes disturbing, but thoroughly entertaining and thought-provoking, dystopian drama might only be the beginning.