Recently, leading European agency network We Are Family hosted a Kids & Family Marketing Sessions webinar on the topic of children’s entertainment. Our Director of Partnerships, Steve Langdon, was one of the panellists invited. In a 45-minute discussion, the panel covered a range of topics related to Children’s content during pandemic lockdowns, as well as what the post-lockdown future might bring. To help start the discussion, Steve presented some exclusive demand data about Children’s content to the webinar. These insights had a focus on not just how demand for this content has changed, but also how this content travels globally. We’re delighted to share these insights here as well.

Session Video

If you want more than simply the data insights, click here for a video of the full webinar. Alternatively, a transcript is available at the end of this article.

Data insights from the session

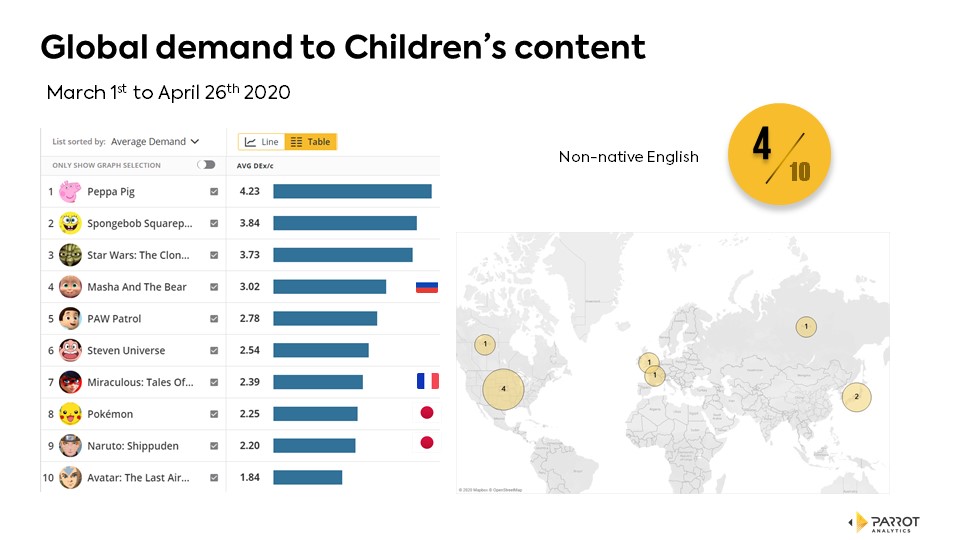

Chart 1:

In this chart, we show the ten Children’s series with the highest global demand during the start of COVID-19 lockdowns. We also show the origin of the ten series, highlighting the wide range of languages represented. Four of the ten are not natively English-language productions, with one series made in Russian, one in French and two in Japanese.

This also showcases the strong worldwide demand for the Disney+ revival of Star Wars: The Clone Wars.

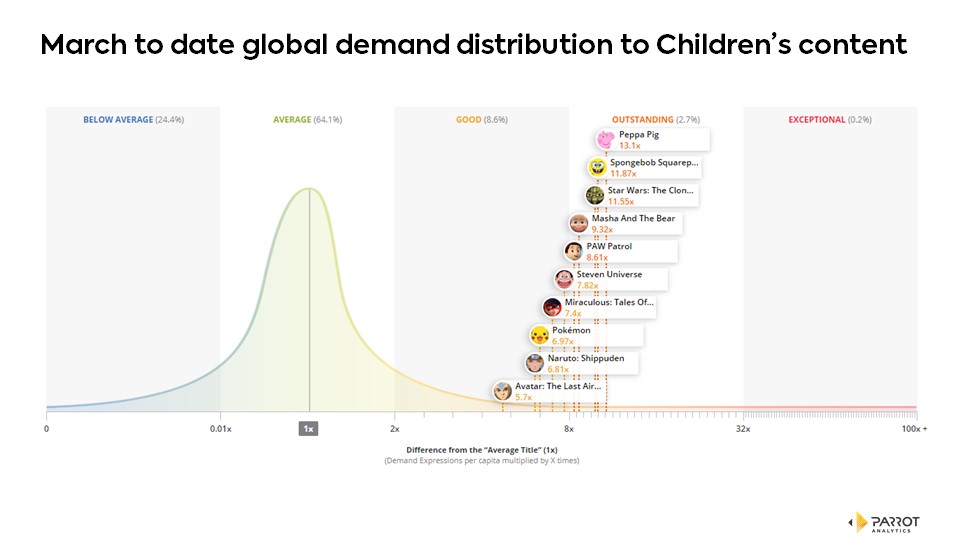

Chart 2:

This chart illustrates how important Children’s content is to the global TV ecosystem. In our database of 15,000+ series, the majority of titles (64%) sit either in the ‘Average’ peak or down from that in ‘Below Average’. Children’s series Masha And The Bear, to pick one example, has 9.3 times more worldwide demand than the average series, making it ‘Outstanding’. Only 2.7% of shows across all genres achieve this rating.

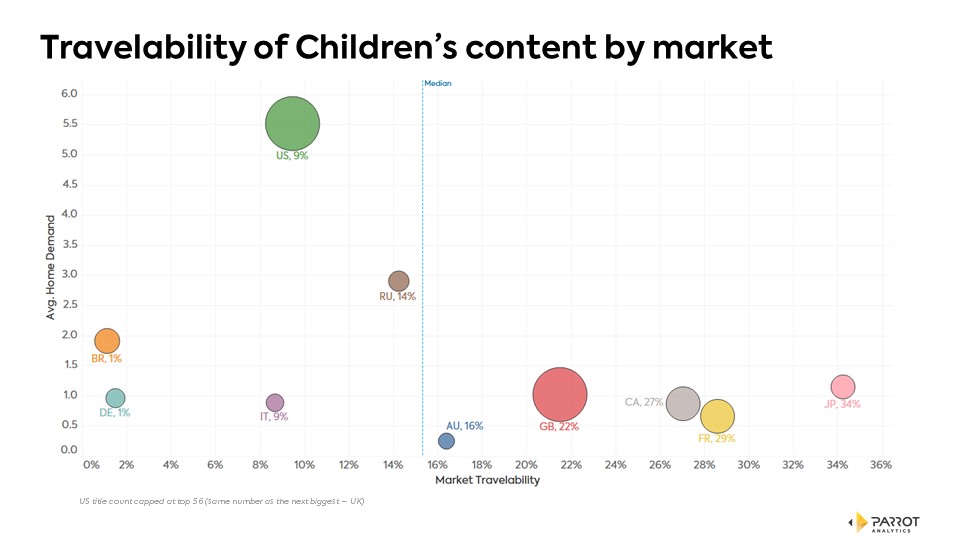

Chart 3:

This next chart shows the travelability of Children’s content by country of origin. Travelability is a ratio of a title’s international demand against the title’s home market demand. This means a show with higher travelability (further right on the chart) is more demanded by international audiences. Children’s series produced in Japan, France, Canada, and the United Kingdom on average travel well to other markets.

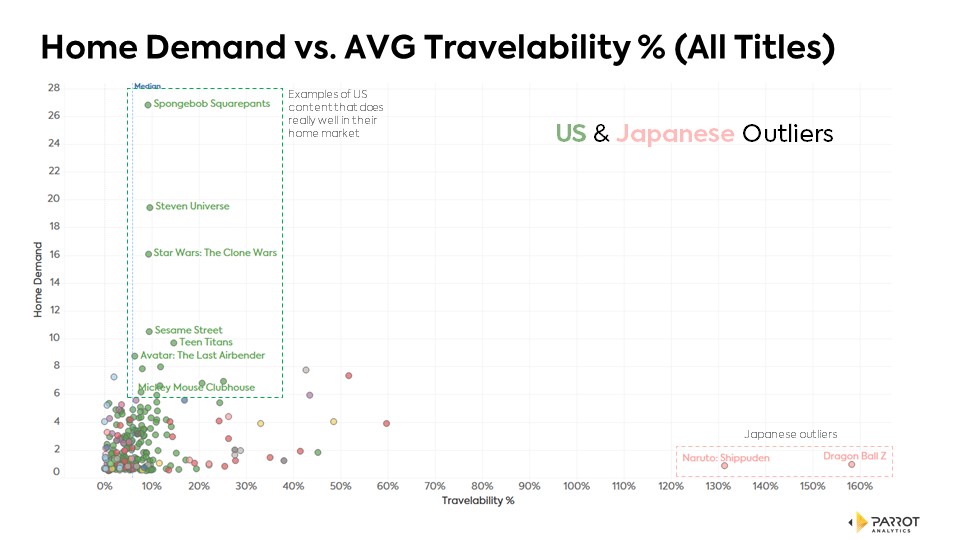

Chart 4:

Next, we move from country-level aggregation to the travelability of individual titles. In the lower right, the Japanese titles Naruto: Shippuden and Dragon Ball Z have 131% and 158% travelability respectively. These are exceptionally high values and very good for distribution around the world. In contrast, the US titles in the upper left like SpongeBob Squarepants overperform so strongly in their home market that their travelability is lessened.

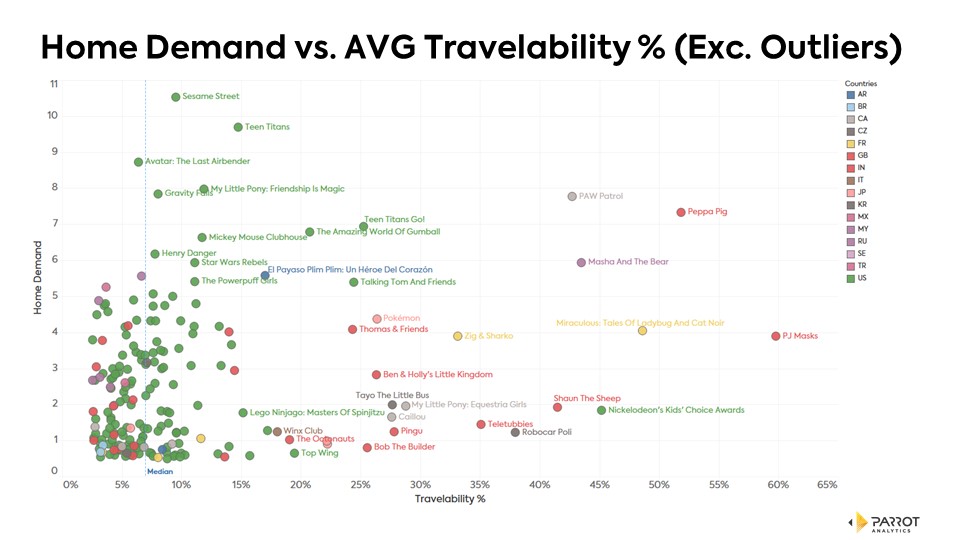

Chart 5:

Finally, we look at the same chart with the outlier series removed. This makes it easier to see that no single country has a monopoly on successful, widely demanded Children’s series. However, we can observe that many British series have both high home demand and high travelability, e.g. PJ Masks. While easy global access to content can help to increase travelability, this finding is not necessarily because British production companies have better distribution strategies. In fact, as demand is platform-agnostic, a show can have high demand even in territories where it is not yet released. This can reveal new opportunities for Children’s content producers and distributors!

TRANSCRIPT OF SESSION

KID & FAMILY MARKETING SESSIONS WEBINAR

April 29th, 2020

MAURICE WHEELER: Hi everyone. Welcome. Thank you so much for joining us. Today is the first of a series of presentations that we're doing as a series of webinars. Today we're talking about kids and family and entertainment. We have an incredible panel joining us today. My name is Maurice Wheeler, I am the managing director at We Are Family. We Are Family is a network of children's kids and families marketing agencies across the whole of Europe. I'll be moderating this session along with my Spanish colleague Borja.

BORJA LÓPEZ-NICLÓS: Hi Maurice, thank you so much. Borja here from Spain, specialist kids and family marketing agent and part of the international We Are Family firm. Welcome, everybody. We've created this series in order to understand how are kids and families responding to this new reality. The unmentionable COVID-19!

MAURICE: I'm going to apologize now for any potential technical problems. We're all obviously relying on our various home broadbands to get us through this. And well done to all of you who've managed to sign up through the HeySummit program, which was sometimes slightly confusing. So congratulations to all of you, you've done a great job so far. Also, there's two of us. So if either myself or Borja freezes or disappears, thankfully we've got backup, just in case.

BORJA: You will all notice that you're on mute so there can be no heckling, but if you have any questions, please do use the Q&A function. Leave a question and we will get to them at the end. The idea is that we have a fairly free flowing conversation from our esteemed guests.

MAURICE: Yeah, so talking about esteemed guests let me start - in no particular order - by introducing Ditte Lucas who is the Head of Brand at Moonbug. Moonbug is a global entertainment company that creates and distributes inspiring and engaging stories to expand children's worlds and minds.

DITTE LUCAS: Very precise, thank you.

BORJA: Here from Spain we have Yago Fandiño, the head of kids content at RTV Corporation. This is public television so nice Yago.

YAGO FANDIÑO: Hello, hello everybody

MAURICE: Welcome Yago. Then last but by no means least, Steve, we've got Steve Langdon who leads the EMEA region for Parrot Analytics. Parrot Analytics really are the world's leading insight and supplier of information around demand for TV content. And Steve and the team over there at Parrot have created some, actually some exclusive data for us. So actually, I'm probably going to come to you first Steve. The entertainment space has changed quite dramatically over the last five to six weeks. We've seen a lot of things happen and from what you're seeing from the data that you have I was wondering if you could talk through, give us a bit of an overview of the of the landscape. We've got some slides here.

STEVE LANGDON: Yeah sure. Everyone hear me?

MULTIPLE SPEAKERS: Yep. Yes.

STEVE: Good. Hello, everyone. Thanks for joining. Yeah, look, firstly, it's good to acknowledge that there's a lot more important things going on outside our front doors than looking at viewing trends. However, there are livelihoods being impacted by what's going on throughout this industry. And that's where we’re trying to help the industry come through this.

So yes, I'm from Parrot Analytics. We're a company that's been set up to collect a massive audience dataset of how people engage with TV shows around the world. We track about 1.5 billion points of data every day; 200 countries, 100 languages. All the way from social media, how people talk about television, social video what people are watching on the big social video sites and commenting on, research of television shows, and downloading and streaming, or what the industry calls piracy. And kids content is an absolute key part of that. And we have put together some some data for today's session that will hopefully get a few conversations going.

So according to UNESCO, at the moment there's about 90% of the world's enrolled learners who are not able to attend school. As you can imagine, that's had a huge impact on viewing around the world, outside of the relentless news cycle that we're all getting through at the moment. What's been happening? We do have a broadcaster perspective coming up shortly so I'm not going to steal thunder. But essentially, networks with family content like Discovery are showing big gains for linear viewing at the moment throughout the day. Shows that would normally not run in daytime are being moved to daytime because there's so much family viewing going on. In fact, one channel was reporting a 25% increase between 10am and 2pm, which is pretty extraordinary. And the shared experiences are really driving family friendly channels. In fact, BARB even noticed that 9 to 9:30am there’s a peak of ‘unidentified viewing’, what they call ‘unidentified viewing’ in the UK. And that coincides with PE With Joe on YouTube. So it really is extraordinary what's going on.

So, first slide please. [Chart 1, above] Thank you. So, this essentially shows what big shows are being watched globally in terms of overall demand as we see it at the moment. So you can see here you've got the familiar suspects: Peppa Pig, SpongeBob. Star Wars is significant here because obviously series seven of The Clone Wars has launched on Disney+ and it has shot up our charts. The wonderful Masha And The Bear also, at number four holding the Russian flag high. What you can see there and I wanted to point out is you've got four shows there that are non native English. And I've plotted the countries out where those shows are from. Now non English native shows in our database are growing significantly as dubbing and accessibility due to the global SVODs improves. Thank you. Next slide. [Chart 2, above]

So what you can see here is how we plot out how important kid shows are. So you can see an average TV show is at the top of that peak. So on any TV show, and we have about 15,000 in our database, 64% of them sit below average to average demand. So you can see there that kid shows really do hold up what's going on in the TV industry. So the way to read that is that Masha And The Bear is generating 9.3 times the demand of an average show in our database. And remember, we look at 15,000 shows across all platforms across the world. So kids content really does do it. Next slide, please. [Chart 3, above]

Now I could sit here and talk about, you know, how kids content is up, how home learning is up. And it is, we all know that. But what's more interesting is to understand where it's coming from. This shows travelability, which is essentially how demand is benchmarked to a country of release. So you can see that the French and the Japanese and the Canadians and the British are all bringing out children's content that is highly traveling around the world. So it's generating demand in other countries outside of the home country, regardless of whether it's been released or not. Okay? So the content doesn't have to have a release window to generate demand. So extraordinary kind of travelability going on from those countries. Next slide, please. [Chart 4, above]

And here, what we've done is we've isolated those shows that are really kind of traveling really well from kids at the moment. So, the ones on the right at the bottom, they're what we call the outliers. They're the Japanese animes, Dragon Ball and Naruto that are really generating 160% of the demand in home market, which is extraordinary travelability and very good for distribution around the world. The ones on the left are examples of U.S. content that does really well in home market. But maybe the demand is so strong in home that it's difficult to correlate to the traveling around the world. And last slide. [Chart 5, above]

This slide kind of is much more interesting because it breaks down what we're seeing here when you take away those outliers. So, you can see that the yellow shows there are the traveling shows Miraculous: Tales Of Ladybug And Cat Noir and Zig & Sharko, you've got a Canadian Paw Patrol in high travelability there. You've got Masha And The Bear up there and you've got Peppa Pig and you can see PJ Masks, which is an extraordinary show that travels completely gender neutral all the way all the way around the world, and the rain of the British titles that tend to tend to travel really well.

So yeah, I just wanted to give you a bit of an introduction as to where we're seeing… where we kind of differentiate is we kind of look at shows beyond ratings, ratings are a historical view of how a show is done. We try and take all the engagement online, and kind of roll that into how we help companies drive acquisition strategies or distribution strategies. So, that's my introduction.

BORJA: Oh nice, thank you so much. Questions are rising. We are more than 130 people connected. One quick question somebody's asking, which is the kids age you're mentioning in this research, Steve.

STEVE: So, we do not obviously look individually at kids ages, obviously you're looking at preschool, you're looking at school and you're looking at teenage years as well. What we do is we look at adult activity as proxy for children's which is what, you know, every platform does around the world when it attributes a children's view. So we look at how adults are researching TV shows, which they do to find out whether they're suitable for kids, and should they watch them? Obviously, the ‘tubes are massive for kids content and we capture all that. And also, downloading and streaming, so we look at parent profiles. So if you download, say, Chernobyl and Paw Patrol, you're pretty sure that's going to be a parent profile. So that's how we go about doing it.

BORJA: Okay, interesting.

MAURICE: Steve, I had a quick follow up question, actually. You look at something like PJ Masks, which has got this really good travelability. Is that content or is that distribution? So have the guys at E-One just created an incredibly great show, or do they have an incredibly good distribution strategy?

STEVE: Well, yeah, that's a great question and it kind of goes into what we do. So remember that we do not look at a show, whether it's been released or not in a territory. So as an example, The Mandalorian was released in the U.S. in November. It sure as hell generated massive demand all the way around the world despite not being released yet. So distribution is very important and we understand where shows are currently windowed. But demand is completely platform agnostic. So PJ Masks, it's an amazing show that distribution… is excellent. But even in areas where it's not been released, it generates massive demand.

BORJA: Okay, nice. Interesting, thank you so much, Steve. Would you like to stop sharing the screen, please? So, Ditte, from what you've seen on your distribution channels, how has demand changed for you, I mean demand from the audience? But also, what are the channels themselves after?

DITTE: Yeah. So I mean, we've obviously seen significant change, we've seen the demand is increasing everywhere. It's on AVOD, it's on SVOD, it's on linear, it's across all of our platforms really. And we also interestingly see that of course, global supply is decreasing, which just drives our demand up higher. As production companies are struggling to create content, like live action has pretty much dried up. Animation content is…

[Phone rings]

DITTE: Sorry. My kids have my phone downstairs, apologies.

As it's driving up demand, we see that production companies can't produce live action anymore. We do in turn see that what is proving to be completely Coronavirus resilient is animation. We've probably never been as productive as we are right now, which of course is a happy, sad, happy, sad truth. We're also… we've worked very much. We sort of started working on it as soon as we saw the development in China: How can we prepare ourselves that we're going to have a lockdown situation? We moved everybody home, we made sure that everybody had the facilities required to produce, so we actually have a machine right now that delivers probably more than we ever did.

But this lack of supplies is of course driving our demand up higher. On YouTube specifically, we can see numbers speak for themselves. It’s pretty much across the board for our properties, we're up sort of approximately 20%, a little bit more for some properties, a little bit less for others.

We can also feel it from the conversations with other distribution platforms. We have a lot…we're announcing deals pretty much every week at the moment to sell more and newer shows, because there is such a need for content out there at the moment. And not just content, but there's such a need for content that propagates healthy values and that it has an educational element because that really is the pivot point for parents. So in terms of audience demand, we can see that parents, or families in general, are using entertainment in a completely different way. Entertainment is no longer just entertainment, now it's become a life resource really. And that has been really interesting for us. I think in many ways it’s sort of confirmed Project Moonbug in what we're doing, and that's been pleasing.

But entertainment has morphed into this reality where sure, it's still the entertainment in the home, but it's also inspiration, it's education. So, we see people engaging with and we can see this in the search terms as well of what people are actively searching for, and they're looking for anything that promotes healthy habits. And that's everything from, entertainment wise, stories about helping parents with those difficult situations like eating your vegetables and remembering basic hygiene, all the way into very sort of structured, now what does washing your hands look like? How do you actually do it, to do it right? Other things like exercise of course you've already mentioned Steve, like Joe Wicks has really struck a nerve with all families and as the mother of two girls, I you know, I struggle every day to get them moving! So yeah, we've certainly used in home yoga, we use Joe Wicks because it's become… there's a real need. And yeah, also things like promoting healthy life patterns such as eating and mental health, there’s also this focus on positive mental health, which is also quite pleasing.

MAURICE: And from a - sorry to interrupt you, Ditte - from a size of audience, obviously you've seen your audience numbers, your number of viewers increase. How have you seen obviously, the whole compliance thing with YouTube changing all their rules and regulations around advertising in the YouTube space? I mean, how have you seen revenues adjusting, according to the kind of audience numbers? Have you seen one go up, one go down? Or what's it been for you?

DITTE: Yeah, I mean, it's obviously been a very volatile year with a couple of compliance changes in the beginning of the year. But weirdly, I think that has, as a company, has prepared us better. We probably went into this better prepared than many companies because we already had to lean out production to make sure that we were super focused, to really clarify what do we want to focus on as a company and obviously with a lot of research funded work into what parents rate as valuable to kids such as educational, healthy living: that was, of course, what bubbled to the surface when COVID happened.

But the other thing that we've done is that we've diversified our revenue. Because YouTube, the way that Moonbug operates for the people who don't know is that we buy great content creators from the digital space. And that often means YouTube, because that's where most of the innovation happens. And then we invest into them and help them grow and create stronger properties out of it and turn them into global entertainment brands.

One of the things that we've seen is that the content has…when you have great content then that’s what's gonna survive. Right?

MAURICE: Yeah.

DITTE: And then we've made sure that we've diversified that and sold it to other platforms. So half of our…more than half of our content revenue is now from all sorts of other platforms. And that again has just helped prepare us for the Corona crisis, that we're completely diversified.

But ultimately what we've seen is that views have gone up, eCPMs have gone down, which has left us sort of at a level playing field in the YouTube space. In many ways you can say that actually now everybody's terrified and nobody's spending on media, but now's probably the perfect time because you've got more eyeballs than ever and it's never been cheaper to buy advertising.

BORJA: Totally, totally agree. Totally agree. So interesting thing you did there. And Yago, from a broadcasting perspective how have you seen consumption of your content change?

YAGO: These past weeks was really a stronger sense of the sign of the times. Why? Because all the things that we believe that is the truth have changes, day by day. The first week when in Spain, in Italy, half the school closed, I believe that was two or three weeks before us. But the week that they closed, the schools are closing in Spain; this weekend we can watch, we can have the perception that the ratings are moving, moving but in very strange way. Why? Because there are more people watching TV and the first step is everybody's in the news channels, watching news on 20…20 hours per day are in the news stream. So Kid’s content move more to… YouTube, on demand etcetera. But day by day, the way of the children content in broadcast is roaming. Roaming and moving. Obviously the time as Steve has said has moved, the morning are more relevant than the afternoon. It's obvious. But the next thing that we find is something that is a bit strange, at least for broadcasters and at least for public broadcasting in Spain, Europe, sorry. We are in EBU in contact every weeks, you have meetings every 15 days to talk about the situation in different public television across Europe. And in all the Nordic countries more or less is the same. First of all is, we need different content. Why? Because as said, as parents we are looking for different content for our children. So the educational content that one month before, probably in this year in Miami, if you were with an educational project through Miami, ‘I have an educational project!’…everybody runs out because nobody wants educational projects. But now the educational project is the key and is that everybody are looking for and it's not only that it’s that they are looking for solutions in different ways. And the solutions sometime is an old-fashioned format and sometimes is something that is 100% YouTube. And this is very strange for us. I will show you only two images, sorry I did not have time you know, to work on PowerPoint, but I have those two screens that I believe that is very, very interesting. Sorry for the quality, but I believe that information is so important that you can understand that. This very example is in Spanish only. In the left one you see in pink, is the ratings of…

MAURICE: We don't see that at the moment.

BORJA: You need to click the image please. It’s not featured in the talk.

YAGO: You don’t see it?

BORJA: No, it seems like it has appeared in another screen.

YAGO: Okay, now?

BORJA: Not for the moment. Try it again, maybe sharing the screen?

YAGO: Let me try again…

One moment please. Well, in this case I like to show you the rating the first days that we are without the school and it's very strange because….okay and now… you can watch it?

MAURICE: Yeah.

YAGO: Okay. In the left side in pink, you see one show that is Aprendemos En Casa. That is our educational programming that creating less than five days. The rest is Disney and Boing, we are talking about Ladybug, we are talking about Doraemon. The biggest shows that you can find in Disney or Boing that usually work amazing. But do you see our work Aprendemos En Casa is near to 8, 8.9 share, 6.08 and 5.0 of share in this moment, is totally different to the share that we can find a normal day. And is not the first day, is week by week is maintaining the data. Last week we make a study of the last three weeks and we found that we have different educational programming, three hours planned, that is the first hour is from six to eight years old, the second one is from eight to 10 years old, and the third hour is from 10 to 12 years old. Okay? This is very important because our usual targeting plan ends at 10 years old. So we don't have, really, audience from 10 to 12 years old. And the data is that from six to eight years old, they're 42% of all the kids from Spain, watching Aprendemos En Casa, from eight to 10 years old is the 40%. And from 10 to 12 years old is the 28% that is very relevant because we don’t have this target usually. So that target is looking for something different.

MAURICE: That's um, I mean, that's incredible I mean, considering I think you said five days to pull together that entire block. So that's an impressive feat.

YAGO: Five days to programming, five different hours of programming daily.

MAURICE: Got you, got you.

YAGO: Say 60 different videos per day. So it's total madness, if you asked me to do the same one month ago, it's impossible.

MAURICE: And Steve, obviously, you know, across the board broadcasters, you know, from a traditional broadcaster perspective, obviously they're seeing their numbers increase. But Steve, what have you seen from SVOD? Particularly things like Disney+, you know, they obviously launched in the US in November, and then they've come through into Europe kind of March type time. I mean, this must have been a perfect scenario for them. All things considered.

STEVE: Yeah, all things considered. Yeah look, there's two points on that. Firstly, firstly, what an extraordinary stat, that educational program was, well done Yago, that's amazing. Firstly, on pent up demand, and then on the shows, yes, there was a lot of pent up demand for Disney+, and particularly in France. In France it was meant to launch on I believe, on March 23rd, it didn't actually launch until April 7th because they believed it may overthrow the bandwidth requirements of the country. We actually saw increased momentum in demand. So remember, we track all the shows within the catalog and we showed that within France it was actually growing in demand not decreasing before that launch. So, the lockdown had French viewers very hungry for the shows that were going to be on Disney+, and it may have even helped the launch to delay it a couple of weeks which is quite extraordinary.

Secondly, The Mandalorian is a glorious show to launch a brand new service with, there is no doubt about it. It had a huge fan base, sky high pent up demand around the world. We saw it pirated a lot around the world; didn't really seem to impact the launch numbers of Disney+ . A meme generator’s delight and it topped our global charts for a month. Now remember that that only launched in the U.S., and the Netherlands, but it generated demand all the way around the world, for the show and therefore, for the platform that it was launched on. So we're not surprised at all to see the success of Disney+, it’s an extraordinary effort. And the pandemic has certainly helped their signups.

However, the key for all these SVODs: Disney+, Netflix, HBO Max, Peacock, all of them, will now be retention. What do viewers view as worth paying for after they've gone through a tentpole show like The Mandalorian? And how do you go about adjusting your catalog for local tastes, which we know is so important from country to country? How the Netflix go about retaining the 15.7 million additional subscribers they brought on in Q1, which they themselves say is going to be a struggle. So a rising tide rises all boats, but we'll see what boats rise the most at the end of this.

BORJA: Fascinating. Staying with you, Steve, what do you think the future looks like once this current bubble of activity has finished. What will be the legacy of this lockdown? Which is your, your…

STEVE: Wow, that's a big question, the legacy of the lockdown. Look, I don't think we can any of us predict what's gonna exactly happen next. However, let me go through what the data kind of tells us what's happening here.

I think the legacy is probably going to be changed viewing habits. I think maybe we'll see increases in family shared viewing, which will be a positive outcome from this, like new habits that have been gained by families sitting together and watching shows might solidify. So, actually might help everyone come together in a family. The SVODs will no doubt ride this wave, but it will fade and we'll see how the retention strategies hold up, particularly when it comes to kids. Right now, there's producers and distributors making key decisions about what goes ahead, show-wise, and what doesn't go ahead. Some shows are very seasonal, some are fit to schedule. So a lot of people are getting work cancelled. However again, kid shows may be not quite as impacted by that.

I completely agree with Ditte about animation. I think animation is about to get its chance to shine in schedules and catalogs. With all the animation that’s still in production, the only thing really still in new production in the world, because cloud setups can do it all remotely. So I think it's good for animation.

I also think that acquisition wise, we need to look very closely at filling gaps, children's gaps with imported shows. As our data is proving, non native English content beautifully dubbed, universal in appeal and colour for kids, I think is a key opportunity.

MAURICE: And Ditte, from your perspective. What do you see the future bringing for us? And I guess the question is, you know, what do you think it will deliver and what do you hope it will deliver? Hopefully, they'll be the same but sometimes they're not.

DITTE: Yeah, so what do I hope it'll deliver first? I certainly hope that it will deliver, or that it will retain this heightened focus on educational content or healthy value content. I hope that we, as content creators, can keep our eyes on the ball on this because entertainment is an important part of kid’s lives and it becomes sort of a cultural reference for them, for the rest of their life. So I think we have a great responsibility, and I think this crisis has really forced that conversation a bit.

I also hope that sort of on an organizational level, I've been quite I've been quite pleased to see how we have been able to completely embrace every single employee and I think that's true for companies all over the world. That we've had to be really, really focused on the individual to make sure that we can thrive as a company. So things like, what are people's life circumstance? What's their mental wellbeing? How can we work together as a group apart? So I hope that we'll be able to, that we'll see some shifts in the way that we work when we go back to the office. I hope there will… I think that we will be much more flexible as organizations to accommodate individuals.

BORJA: Interesting.

DITTE: What do I think will happen? So first of all, you know, I'm obviously nervous that we're all so keen to get back out there that it's going to be business as usual before we realize it. But I do think that in terms of content that the role of entertainment within the family has shifted. I think that entertainment has become a more integrated seamless part of the way that we communicate with others, both one to one and as groups. And I hope that we will be able to keep the positives, to keep the positive parts of that. But I think entertainment generally has had an uplift in… I think parents have really understood the value and potential of education.

MAURICE: Ditte - sorry to interrupt you, Borja. But Ditte, you obviously had a specific … you've almost been engaging with parents in a slightly different way now, you've had more of an educational element in your tone and some of your social posts, and some of the content you're producing as well.

DITTE: Yeah, so we've, similar to Yago, we've also created sort of a bit we call the Learning Corner, which is a very sort of educational, specific offering to parents. Again, to respond to this need from parents because not only do you need…you need time to do what you need to do. But you also need your children to be positively engaged and to learn something during that time. So we've created the Learning Corner where we're using out of work educators. Obviously, our aim, our focus is the very youngest kids, the one to eight year olds. So it's been very preschool focused to do singalongs and do storytimes and do different educational activities but using these educators who now suddenly find themselves with lots of time and a desperate need for a medium to connect with kids. And of course, we have reach in the billions every month. So it's been a really powerful tool to get it out there to parents. And of course, other things that we've done; we've done a lot of little tactical things, we've made sure that all of our educational content is compiled into relevant compilations and made very easy for parents to find.

It's been on many levels, we've created content that that specifically addresses some of the needs of course. We've sort of tried to respond to the need as we've seen it. We saw a 45% increase in our learning videos from February to April. And that is obviously parents searching specifically. And in fact, when we compared ourselves to other brands we see that that for instance, our Little Baby Bum brand, which is currently our biggest asset in our portfolio. When you look the curve of how demand has increased, we've increased over 20% per month, month on month. If you compare that to something like Peppa Pig we've also seen an uplift but less dramatic. If you then compare that to Ryan's that's been completely sort of a flat experience, so you can really tell how it's parents throwing their hats where they see educational or learning benefits to their children.

BORJA: Finally Yago, TV production is being disrupted for a lot of TV shows, you know, and some have carried on better adapted to the way they produce, as you've said. Do you think this will change how TV shows are made in the future?

YAGO: Sure, sure, sure. Because we are living a lot of changes. We are living in some way a culture shock. A business culture shock and a social culture shock. By one hand, all the biggest entertainment elements like public broadcasters, like the big American companies etcetera, we need to find new ways more agile to produce and to develop content in short time. And one of the things that everybody are living now is, oh, what is really irrelevant to make your business, to make your job? Because there are a lot of things, a lot of process, a lot of bureaucratic, especially in public broadcaster. That is a problem when you're trying to be as agile as the society needs. So I believe that in terms of productions, we need to create some new mechanism to producing in a agile form.

For example, one of the biggest problems that we have in the last weeks is we have all the television sets closed and it's impossible to open it. So the easy way to create content is impossible. So we need to create content more in a classic way. And classic YouTube is real YouTube, the origins of YouTube, as we are making now! Is you talking in front of a camera of your computer, of your mobile but with noise with about audio etcetera. So you need to be more focus on what is quality and what's the quality that the people needs. I will try to show you by example and…you can see this?

MULTIPLE SPEAKERS: Yeah, yes.

YAGO: This is example talking about quality. This is four samples of shows that we are using, of videos that we are using in Aprendemos, our educational program. As you see you can see a very simple animation screen, you can see daily life style educational video, like pro YouTuber low in the left and all this style YouTuber that this is a teacher, we're trying to explain you how to make a mathematical operations. And these four samples are quality of sample, this four samples works and it's quality content. Obviously, in terms of how we usually talk about quality the visual is a total anathema. For example my technical people, when try to watch the videos that we are using in broadcasts, they are totally mad. How is possible that use these videos as is not high quality, is not audio quality, have noise, have a bad shot, but it works. It works because it's the content that the people are looking for because they need it. So we need to understand what is the quality that the people are looking for that and it's something that this happens in YouTube space, and in TikTok and Instagram, spaces that is more open to new creativity. But in terms of broadcast, we need to rethink what is important thing by sampling in the case of clan that is a success story. We are the success channel for kids in Spain, from the last 10 years. But we are focusing animation, and that’s great but it’s a problem when you need to create new content because you don’t have the muscle ready to create. So we need to reinvent how to create this content. How to develop new ways to create content. And by example, we make…this is very simple. You see this, the image?

BORJA: You should share the screen Yago please, it’s not shared for the moment.

MAURICE: Also in the spirit of timing, one minute left Yago.

YAGO: Okay no problem, no problem. At the end, we are talking that we need to create new format, an easy way to create new format, agile. We need to rethink what is quality. And what are the partners that we need to achieve to our audience at way we relevant to for society in terms of public broadcasters that a work not about waiting is about relevance and we need to be more focus in the individual because the big projects are impossible if you don’t have a lot of individuals that are really believe in that.

MAURICE: Thank you. Really interesting, the whole conversation around the changing perception of quality and what that means to broadcasters I think is really, really super interesting and I think that’s one of definitely I think one of the long-term effects is their perception of what that means and what it needs to be.

Anyway, we could talk for another hour just on that one topic. Thank you, that’s all we have time for today.