Wondering who is winning in the streaming wars in Russia in Q2, 2021?

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report and to discover the latest content analytics and trends for TV series on cable, broadcast, OTT and SVOD streaming platforms around the world.

Presented below is the section for Russia from The Global Television Demand Report. Enjoy!

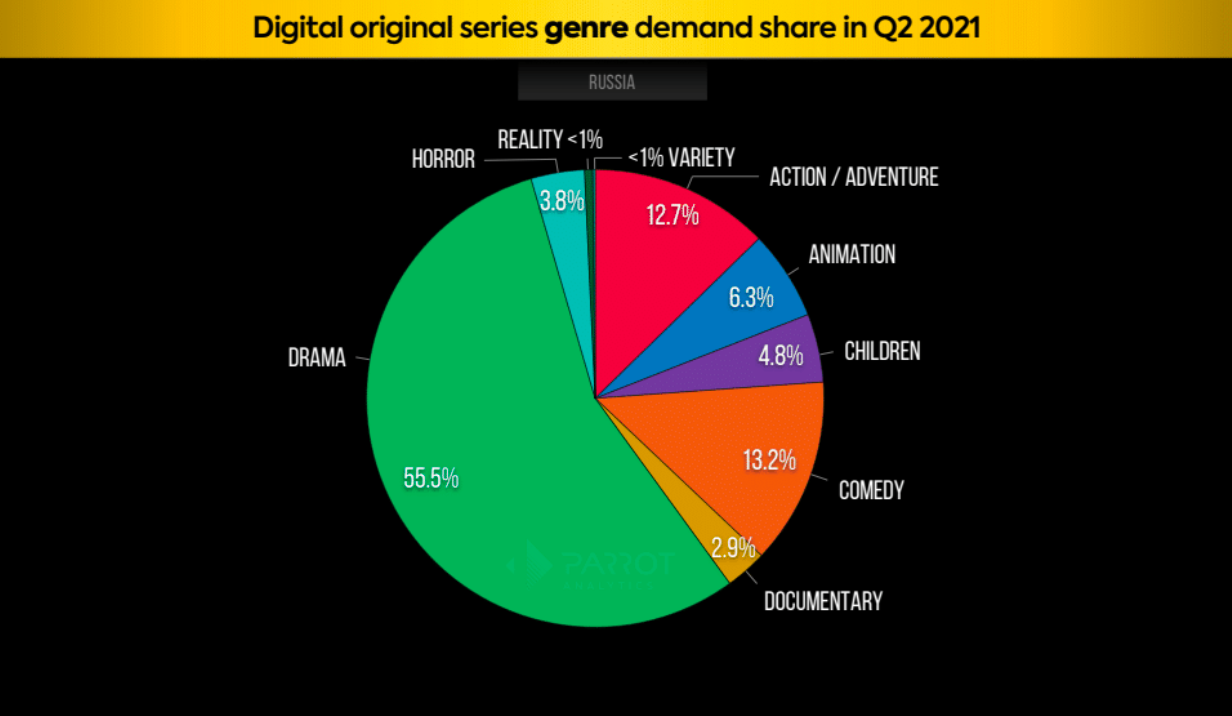

Russia Digital Original Genre and Subgenre Preference

- With a 55.5% share of demand in Q2 2021, Russia was the most drama loving market covered in this report. This is well above the global average share of demand for this genre–48.2%.

- Horror also accounts for a larger share of demand (3.8%) for digital originals in Russia than in any other market in this report.

- Russia is the market in this report least receptive to reality content. The country’s 0.6% share of demand for digital original realities is well below the global average for this genre, 2.7%.

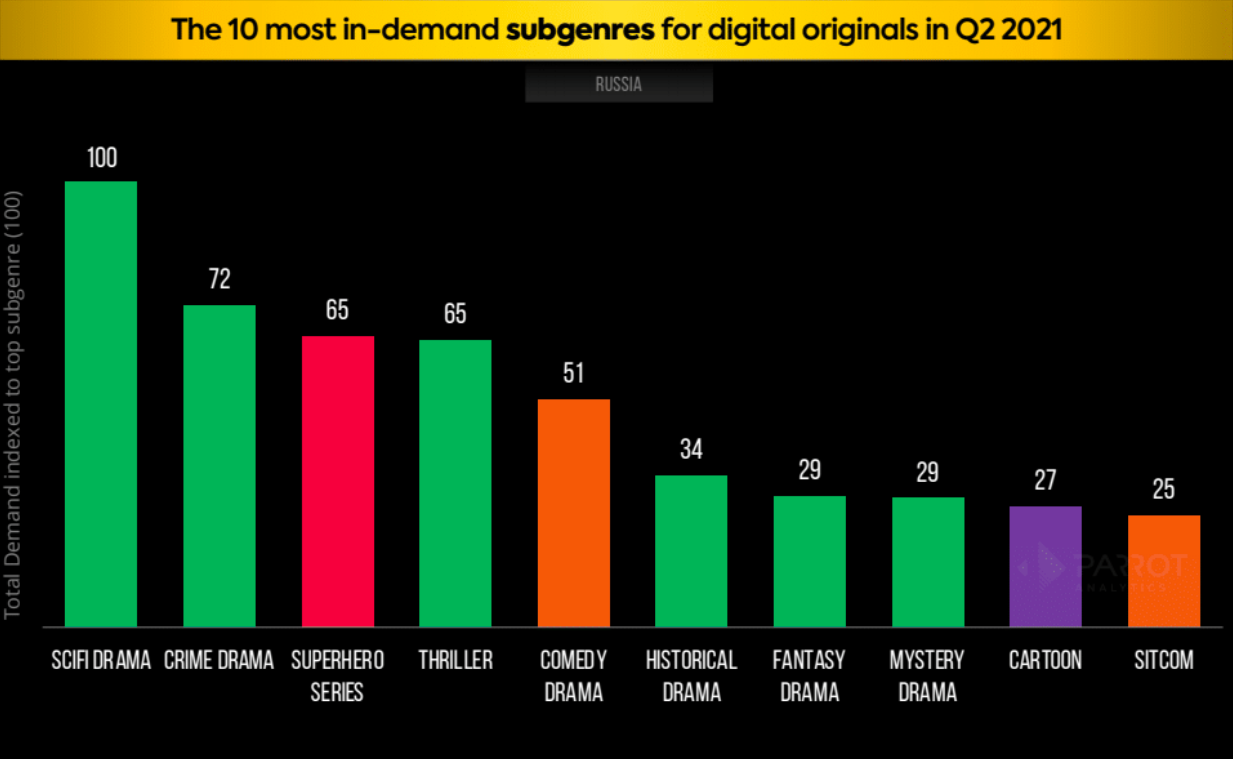

- Russia is one of five markets in this report where sci-fi drama was the most in-demand subgenre for the quarter. It had the largest lead over the second most in-demand subgenre (crime drama) in this market.

- Russia’s love of drama is apparent in the top subgenres for the quarter. Russia is one of three markets in this report with the most drama subgenres in the top 10. Along with Germany and Spain, six of the ten most in-demand digital original subgenres are in the drama category.

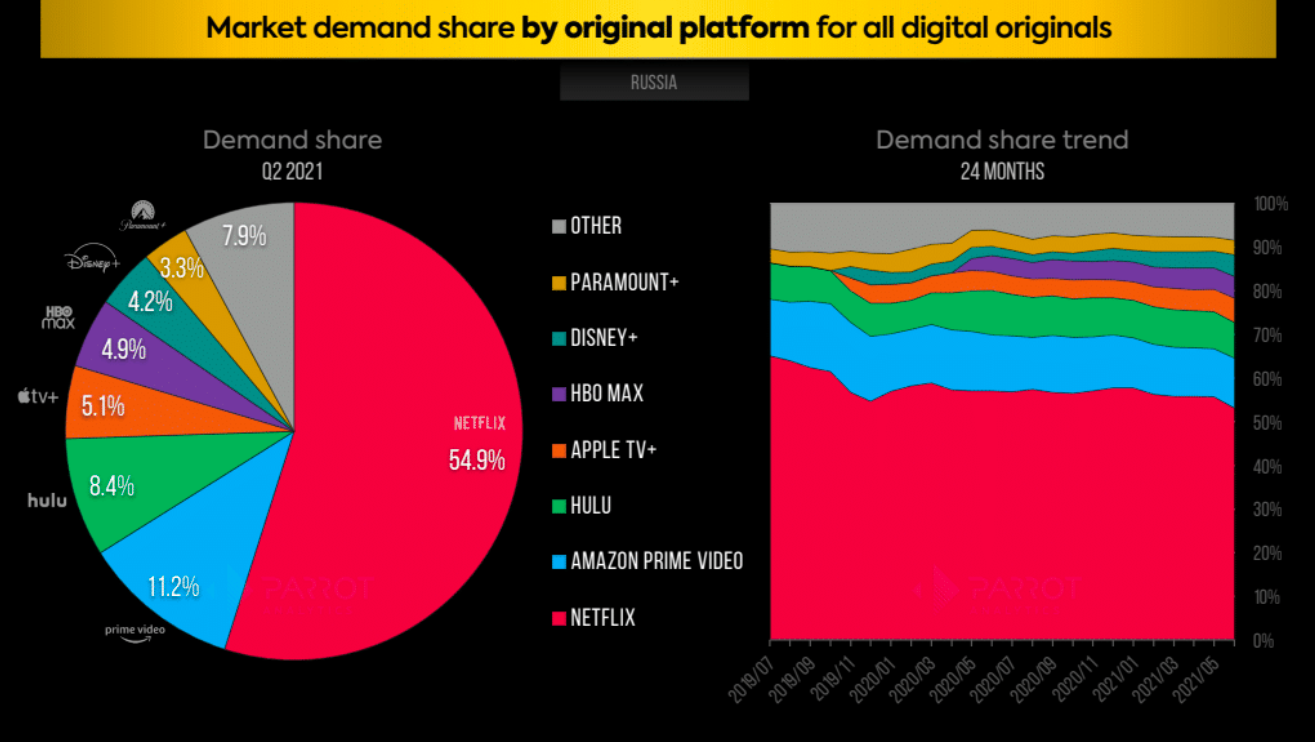

Russia Platform Demand Share and Digital Originals Demand Distribution

- Disney+ accounted for a notably smaller share of demand in Russia than any other market in this report. Its 4.2% share of demand here is well below its global share (7.3%).

- Russia is the most Netflix-loving market in this report. Original series from the streamer accounted for 54.9% of demand for originals here in Q2 2021.

- Original content from Hulu has also done well capturing Russian audiences’ attention. The platform’s originals accounted for 8.4% of demand for original content this quarter. This is the third largest share for the platform in this report and above the global share of demand for Hulu originals (5.6%).

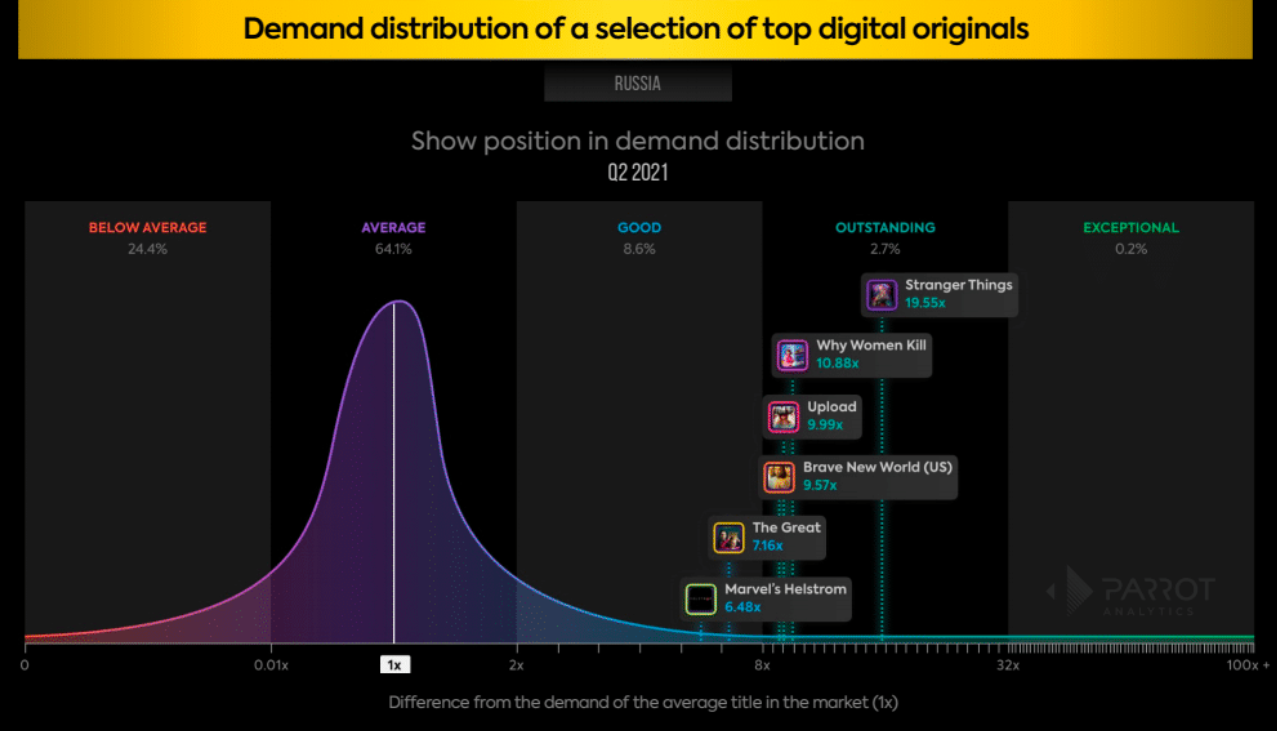

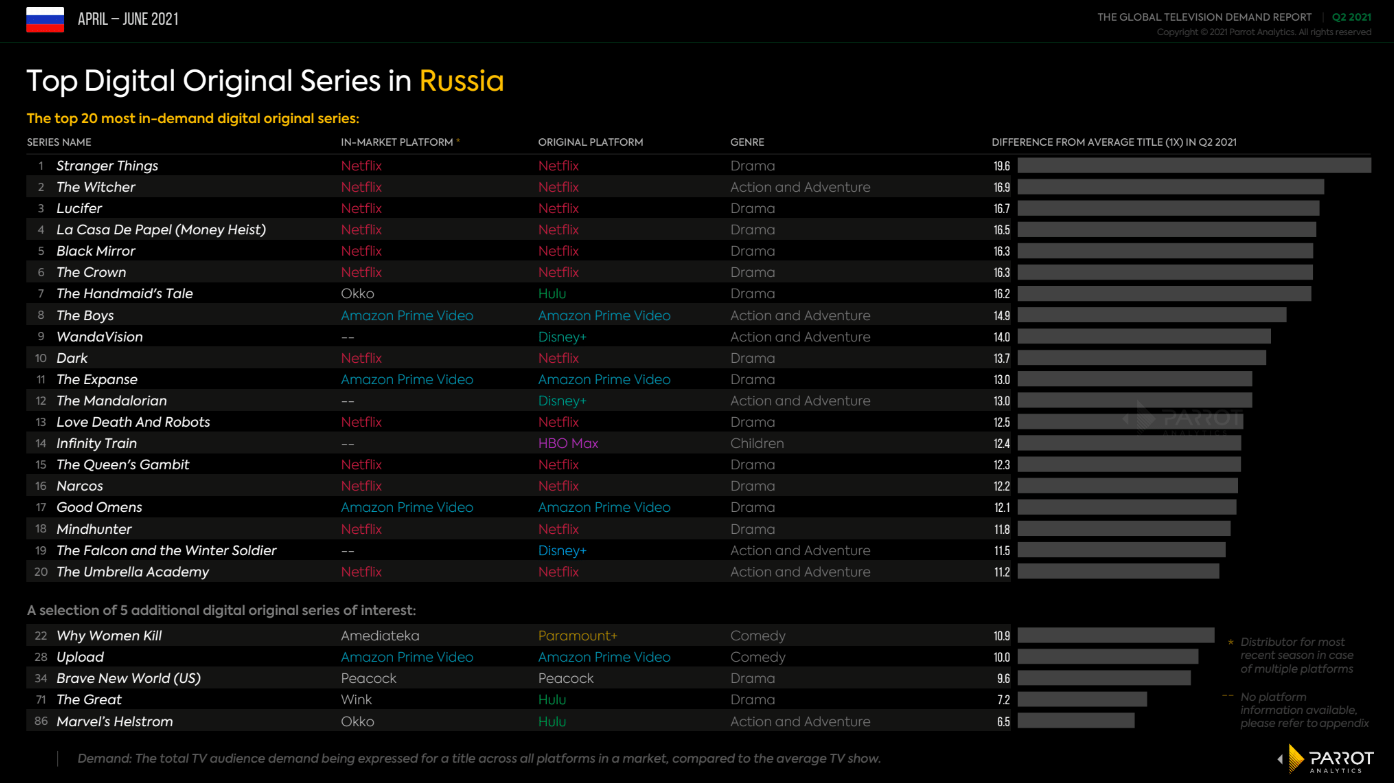

- Russia, along with Spain and the United States, was one of three markets in this report where Stranger Things was the most in-demand digital original in Q2 2021. It had 19.6 times the average series demand in Russia.

- Hulu’s The Great, based on the life of Russian empress Catherine the Great ranked higher in Russia than in any other market in this report. It had 7.2 times the average series demand and shows this market’s love of historical drama.

- Marvel’s Helstrom, performed well in Russia with 6.5 times the average series demand. While an action/adventure series, Helstrom has strong horror themes as part of Marvel’s Adventure into Fear franchise. Russians’ love of horror content likely helped the show succeed here.

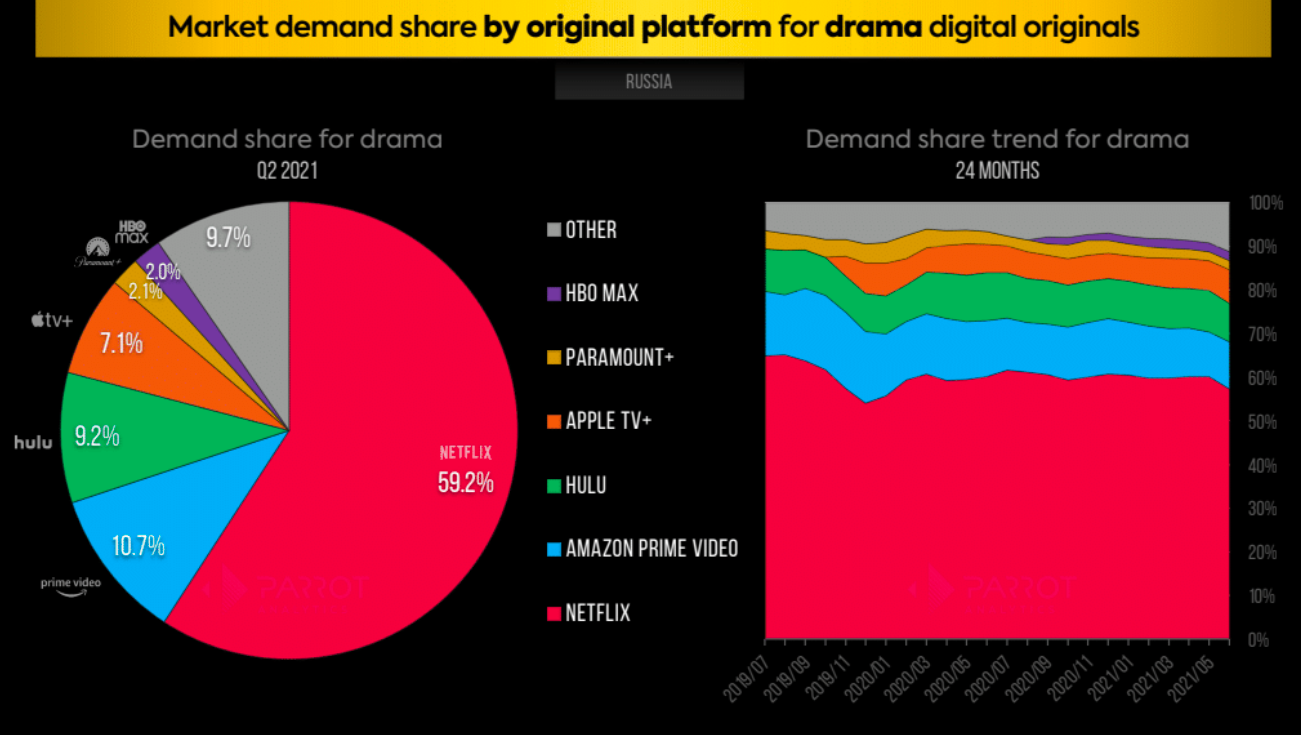

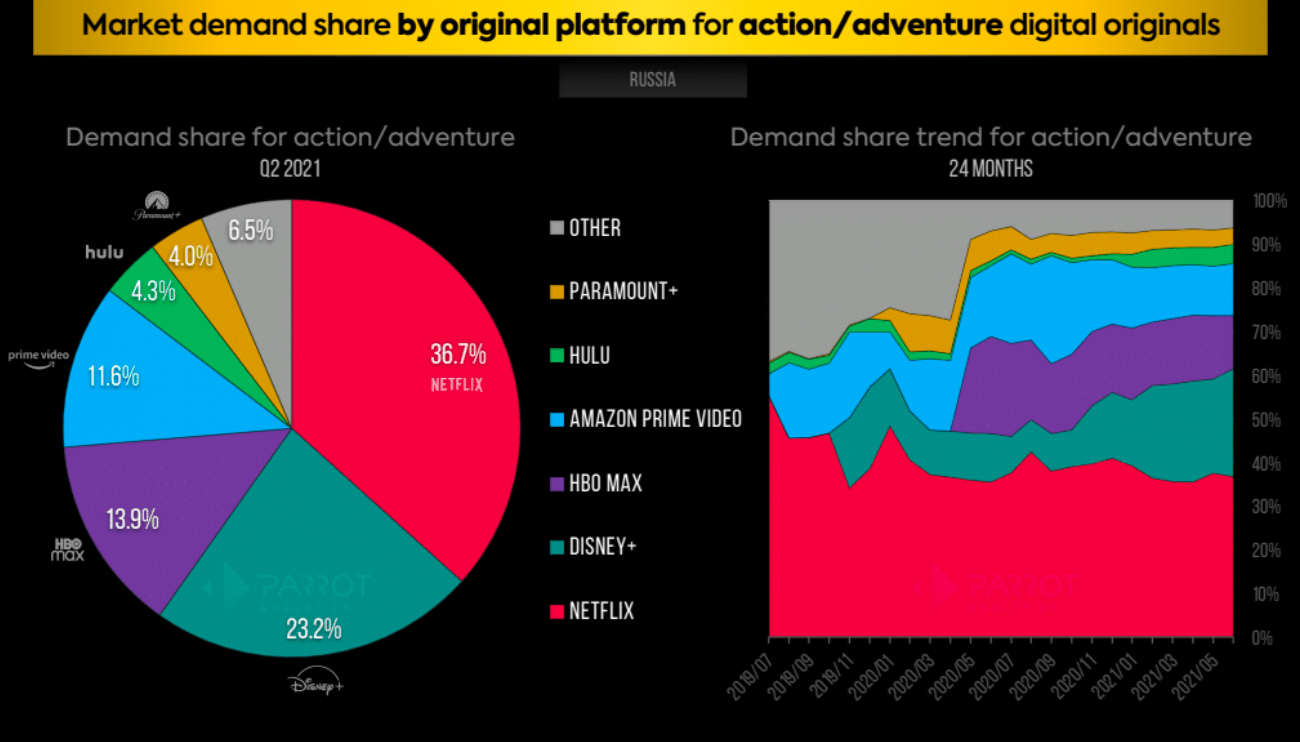

Russia Platform Demand Share for Drama & Action/Adventure Digital Originals

- 59.2% of demand for digital original dramas in Russia was for an original series from Netlfix in Q2 2021. This is above the global average share of demand for the platform’s dramas–53.9%.

- HBO Max accounts for a 2.0% share of demand for drama originals in Russia. This is one of the smallest demand shares for this platform’s dramas in this report.

- Russians gave 10.7% of demand for drama originals for an Amazon Prime Video original. In this report, Amazon Prime Video had a smaller share of demand for drama originals in only Spain (9.2%).

- Russians gave a smaller share of attention to action/adventure originals from Disney+ than any other country in this report. The relatively small 23.2% of demand for Disney+ originals may be driven in part by the fact that the platform has not yet announced plans to launch in Russia.

- Conversely, originals from Netflix made up a larger share of demand for action/adventure originals in Russia than in any other market covered in this report. 36.7% of demand for action/adventure originals in Russia this quarter was for a Netflix original.

- Amazon Prime Video’s 11.6% share of demand for action/adventure originals in Russia was lower than the platform’s 15.3% share of global demand in this genre.

Top Digital Original Series in Russia

Here are the top 20 most in-demand streaming original series in Q2 2021 across all platforms in Russia:

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report.