Parrot Analytics SVOD platform trend reports reveal which SVOD’s digital original series are appealing most to audiences in a market during these three months, dive deeper into how this looks for the dynamic action and adventure genre and shed light on the overall size of digital original series within the entire market.

The key questions investigated in this report:

- Are audiences in Chile demanding more linear or more digital content?

- Which SVOD’s original series are demanded most by audiences in Chile and how is this evolving?

- In the Action and Adventure genre, which SVOD’s original series are demanded most by audiences in Chile and how is this evolving?

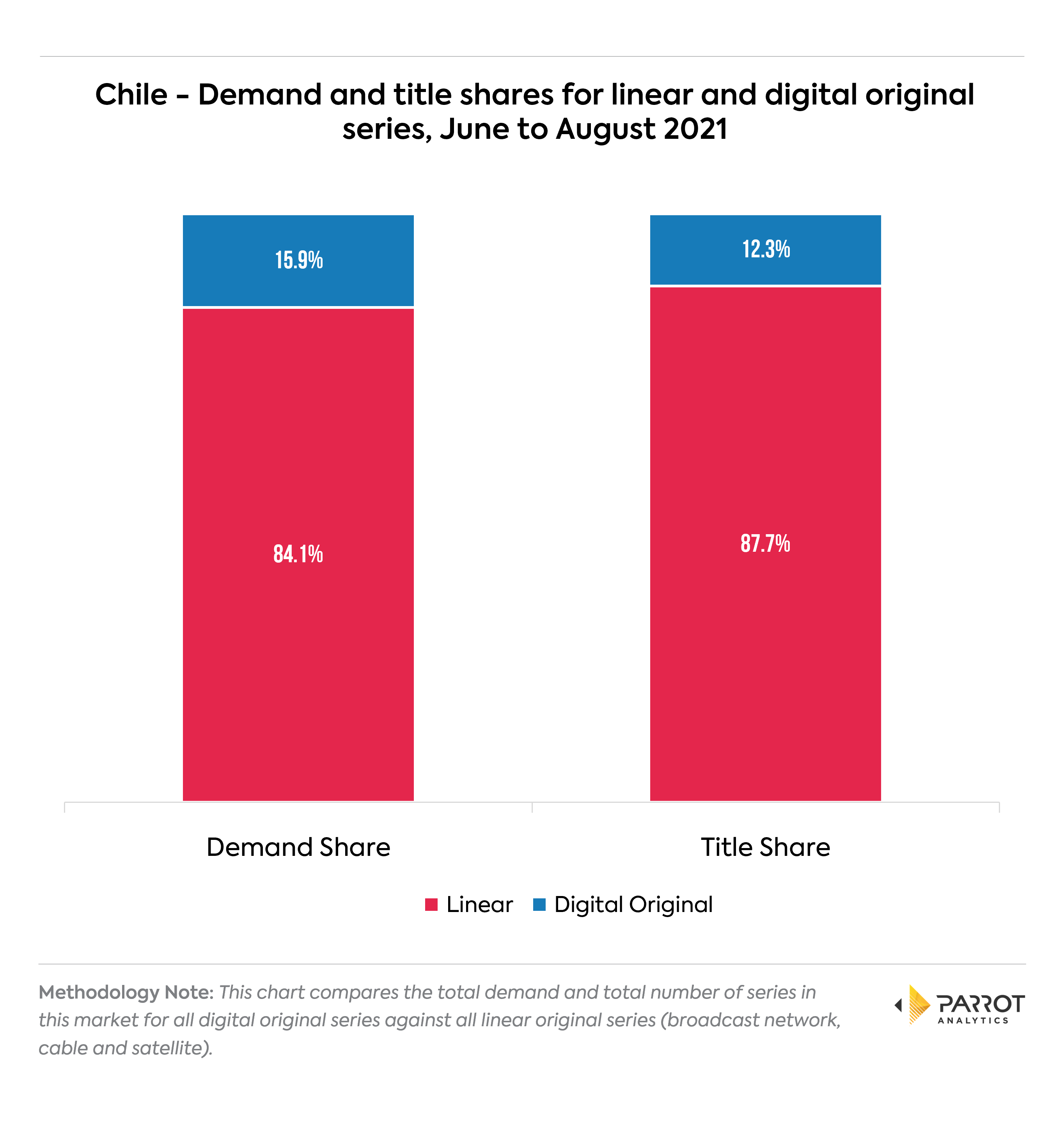

Are audiences in Chile demanding more linear or digital content?

- Over June to August 2021, 84.1% of all demand expressed for series in Chile is for linear series. 15.9% of all demand is expressed for digital original series.

- However, while they hold a 15.9% share of demand, only 12.3% of series are digital originals. This means that the average digital original series has more appeal to Chileans than the average linear series.

- Globally over the same period, digital originals account for 19.4% of expressed demand. The Chilean digital originals market still has some room to grow.

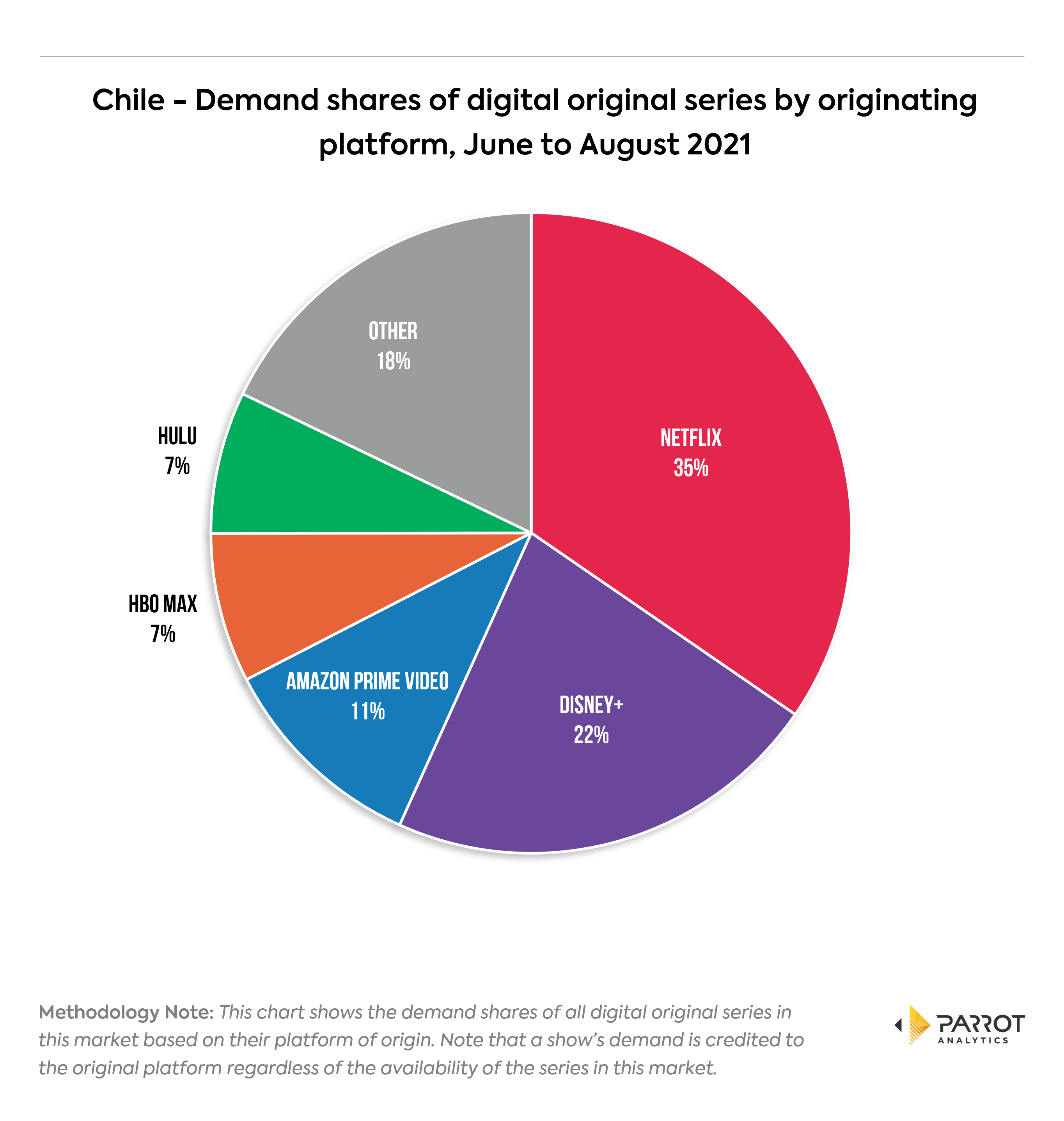

Which SVOD’s original series are most in-demand by audiences in Chile?

- In Chile, the largest share of audience attention goes to series from Netflix. 34.6% of all digital original demand in these three months was expressed for a Netflix original, with Stranger Things the most in-demand of these shows.

- Disney+ originals have the second highest demand share with 22.2%. This is far higher than Disney+’s global share of 8.4% for the same time period, an impressive achievement for a platform that only launched in Chile in November 2020.

- HBO Max’s Chilean demand share of 7.5% is also considerably higher than the global share. In this market it replaces Apple TV+ as one of the 5 most demanded sources of originals. The high level of attention being paid to HBO Max originals is likely due to fact the service’s officially launched in Chile during this period in June 2021. Mare Of Easttown is the most demanded HBO Max original for these three months.

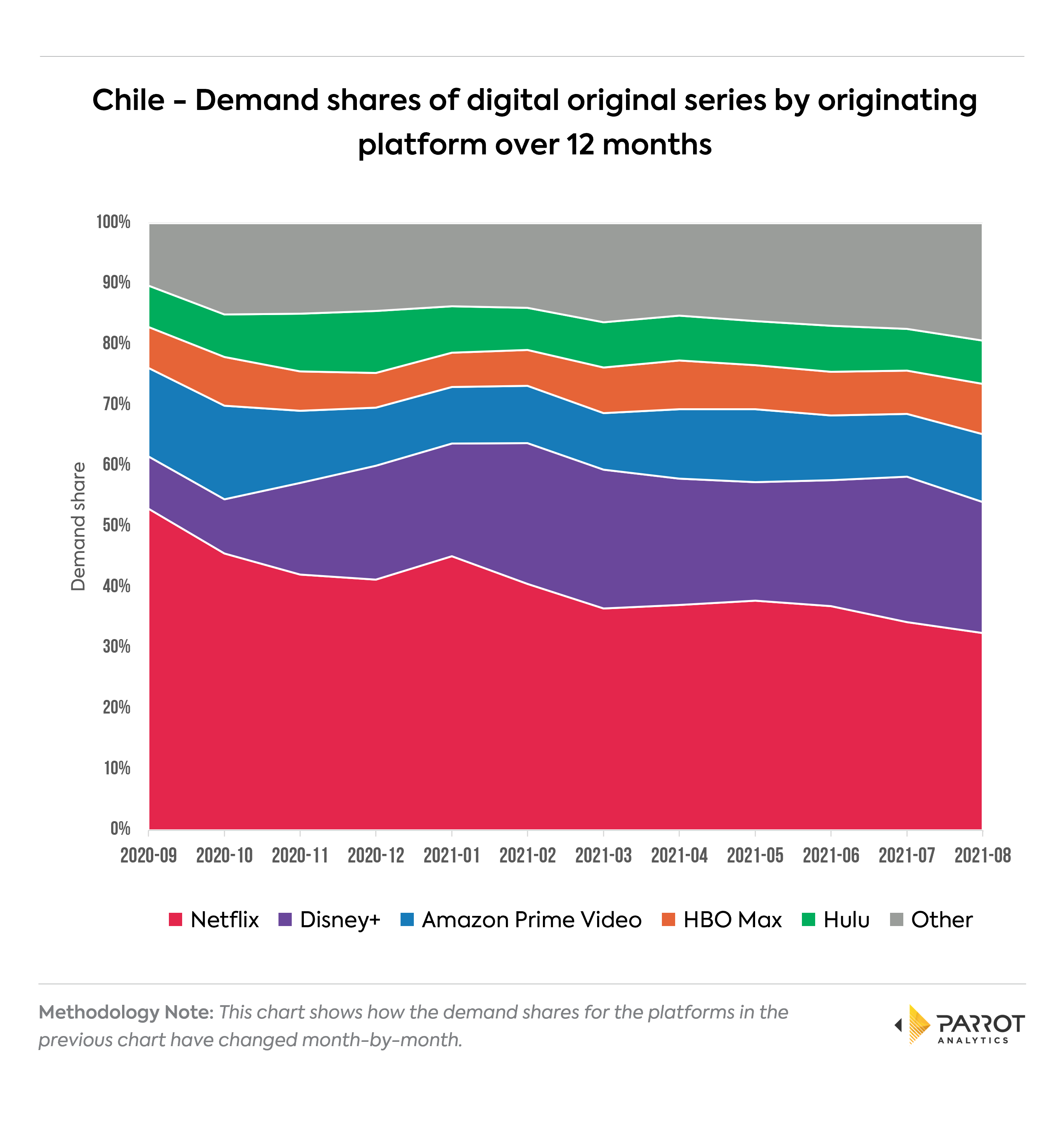

The next chart shows how the demand shares for these five platforms have evolved over the past

12 months:

- Chile’s main trend in the overall digital original space over the past 12 months is the growth in demand for Disney+ originals. Demand for Disney+ originals more than doubled from October 2020 to December 2020 after the Chilean launch of the service. A steady stream of high demand originals like Loki and Wandavision has kept the share stable since.

- To accommodate the new attention being paid to Disney+, the Chilean shares of demand for Hulu, Amazon Prime Video and Netflix have all declined since September 2020.

- The share of demand for HBO Max originals increased by a full percentage point after the service’s Chilean launch in June 2021, going from 7.3% in May 2021 to 8.3% in August 2021.

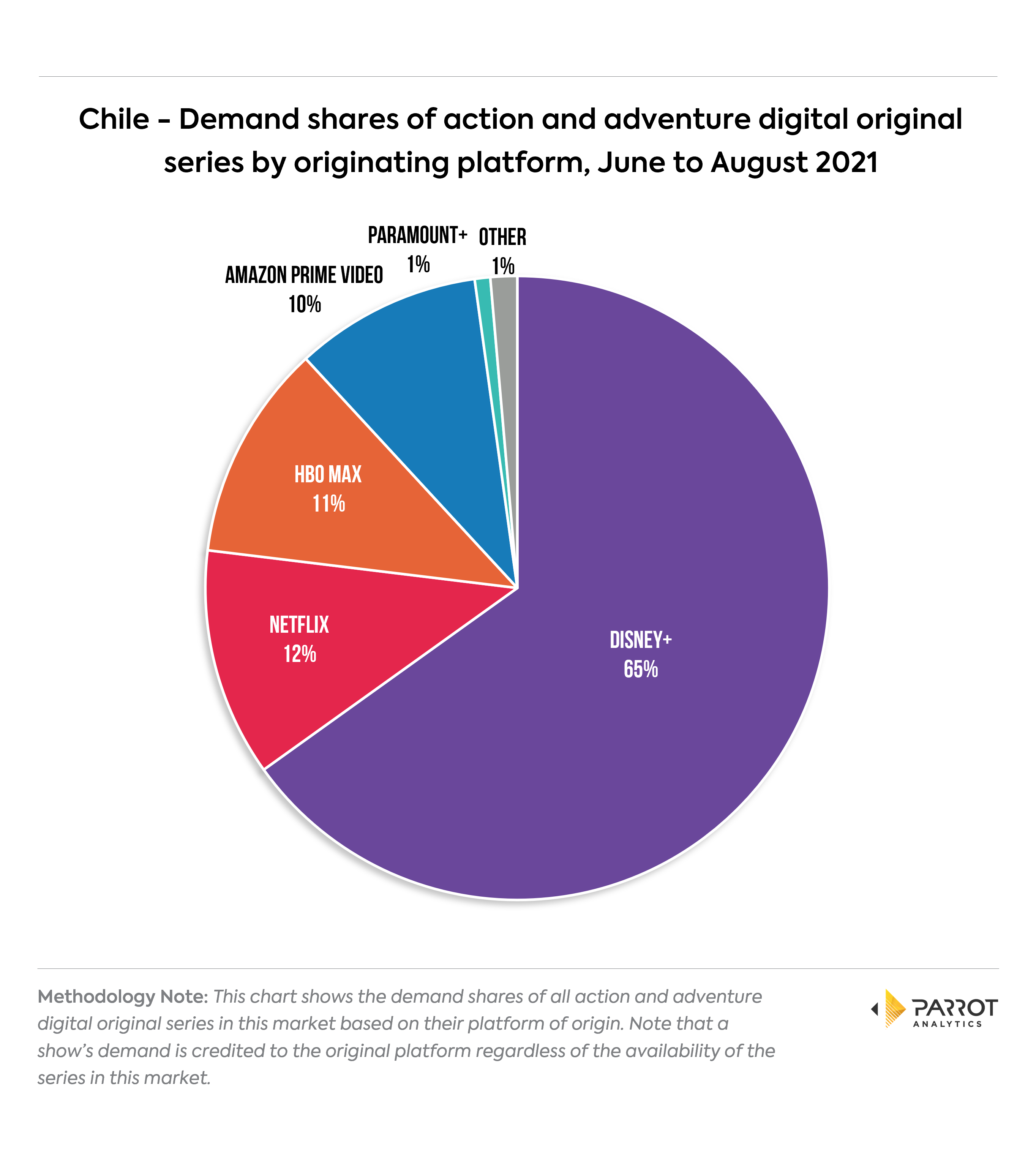

Which SVOD’s Action and Adventure original series are demanded most by audiences in Chile?

- While Disney+ is performing well in the overall Chilean digital original market, in the action and adventure genre it’s fair to say the service is dominating. 65.1% of all demand for digital original series in this genre is expressed for a Disney+ original.

- Disney+ is the leading SVOD for originals worldwide over June to August 2021, but even so the

Chilean demand share is +29.3% higher than the global demand share of 35.7%. - Four of the five most in-demand action and adventure digital originals in Chile are from Disney+. The exception is Amazon Prime Video’s Invincible.

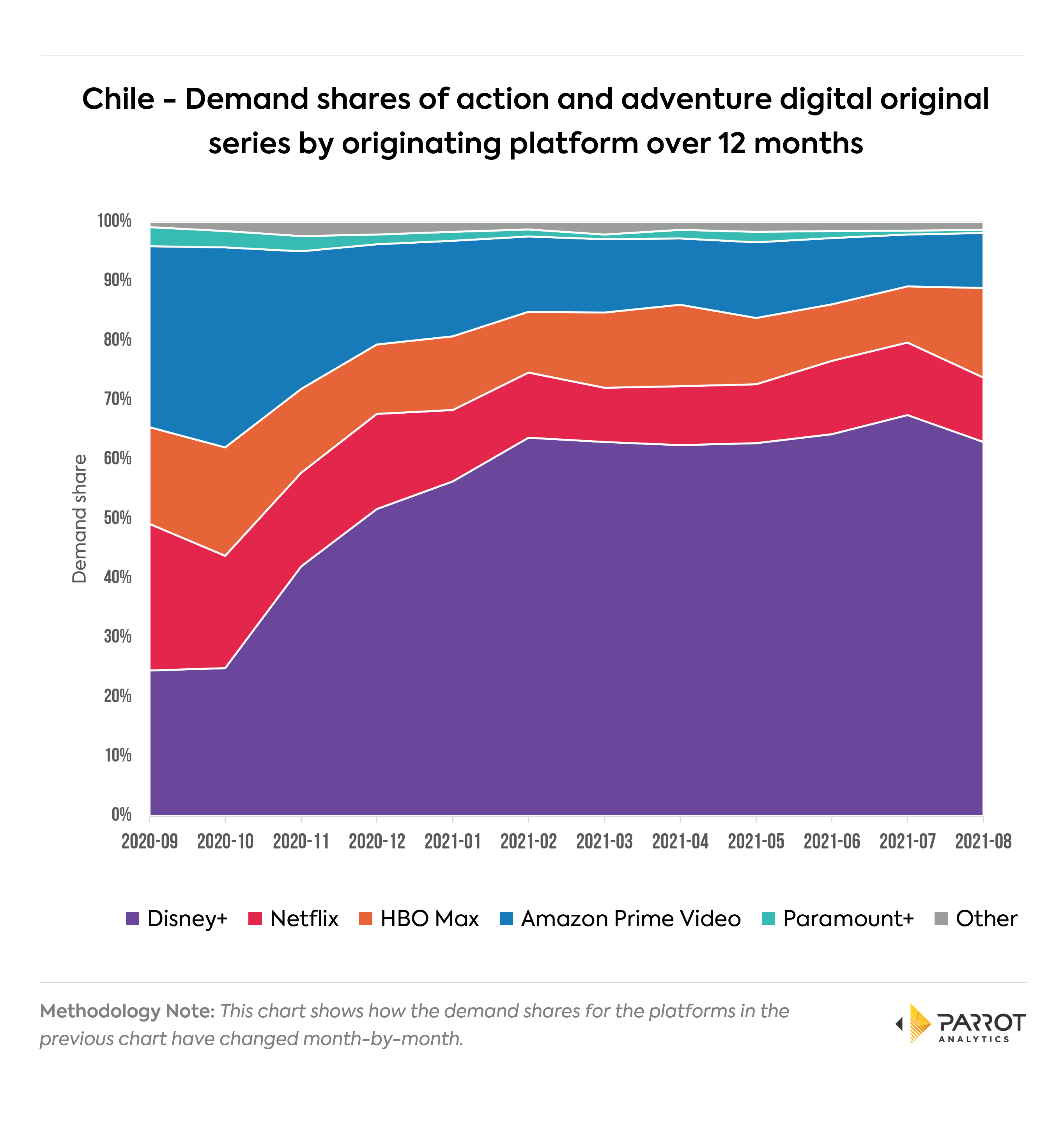

The next chart shows how the action and adventure demand shares for these five platforms have evolved over the past 12 months:

- As seen in the overall market trend, the launch of Disney+ to Chilean audiences in November 2020 has drastically affected the action and adventure digital originals space.

- Before the official launch, Disney+ originals only had around 25% demand share.

- The Disney+ dominance in Chile may be limited. While Netflix has struggled to release tentpole series in this genre recently, new seasons of outstanding action and adventure series like The Witcher are coming. However, it seems unlikely that Netflix can return to the ~50% action and adventure demand share in Chile it held in 2019.

This report is intended as a high-level overview of demand for SVOD original series in this market. As originals are a key driver of subscriber acquisitions, DEMAND360 Enterprise users can compare these series with custom filters, timeframes and more in the Demand360 platform. To unlock access to these features, enquire about Enterprise subscription details here: https://www.parrotanalytics.com/contact.