Parrot Analytics SVOD platform trend reports reveal which SVOD’s digital original series are appealing most to audiences in a market during these three months, dive deeper into how this looks for the dynamic action and adventure genre and shed light on the overall size of digital original series within the entire market.

The key questions investigated in this report:

1. Are Italian audiences demanding more linear or more digital content?

2. Which SVOD’s original series are demanded most by Italian audiences and how is this evolving?

3. In the Action and Adventure genre, which SVOD’s original series are demanded most by Italian audiences and how is this evolving?

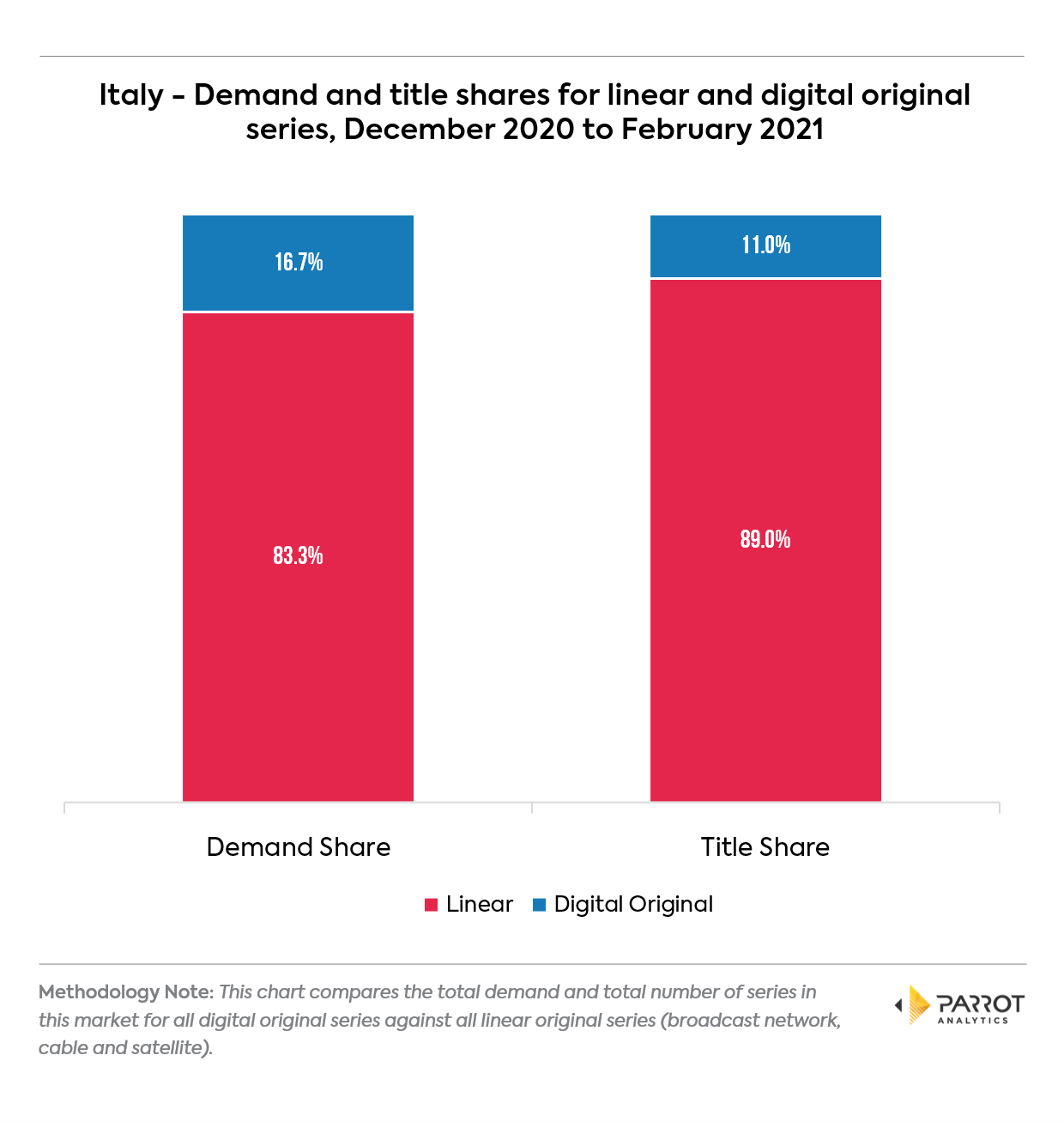

Are Italian audiences demanding more linear or digital content?

• In the Italian market, 16.7% of all demand is expressed for a digital original series. The majority of audience demand, 83.3%, is expressed for shows from linear networks.

• Over the same period, the global demand share for digital originals is 18.7%. The -2% difference indicates digital original series still have room to grow their Italian market share.

• However, on a per-unit basis digital original series do overperform. Digital originals make up 11.0% of all titles in this market compared to the 16.7% demand share, meaning that the average digital original series has higher demand than the average linear series.

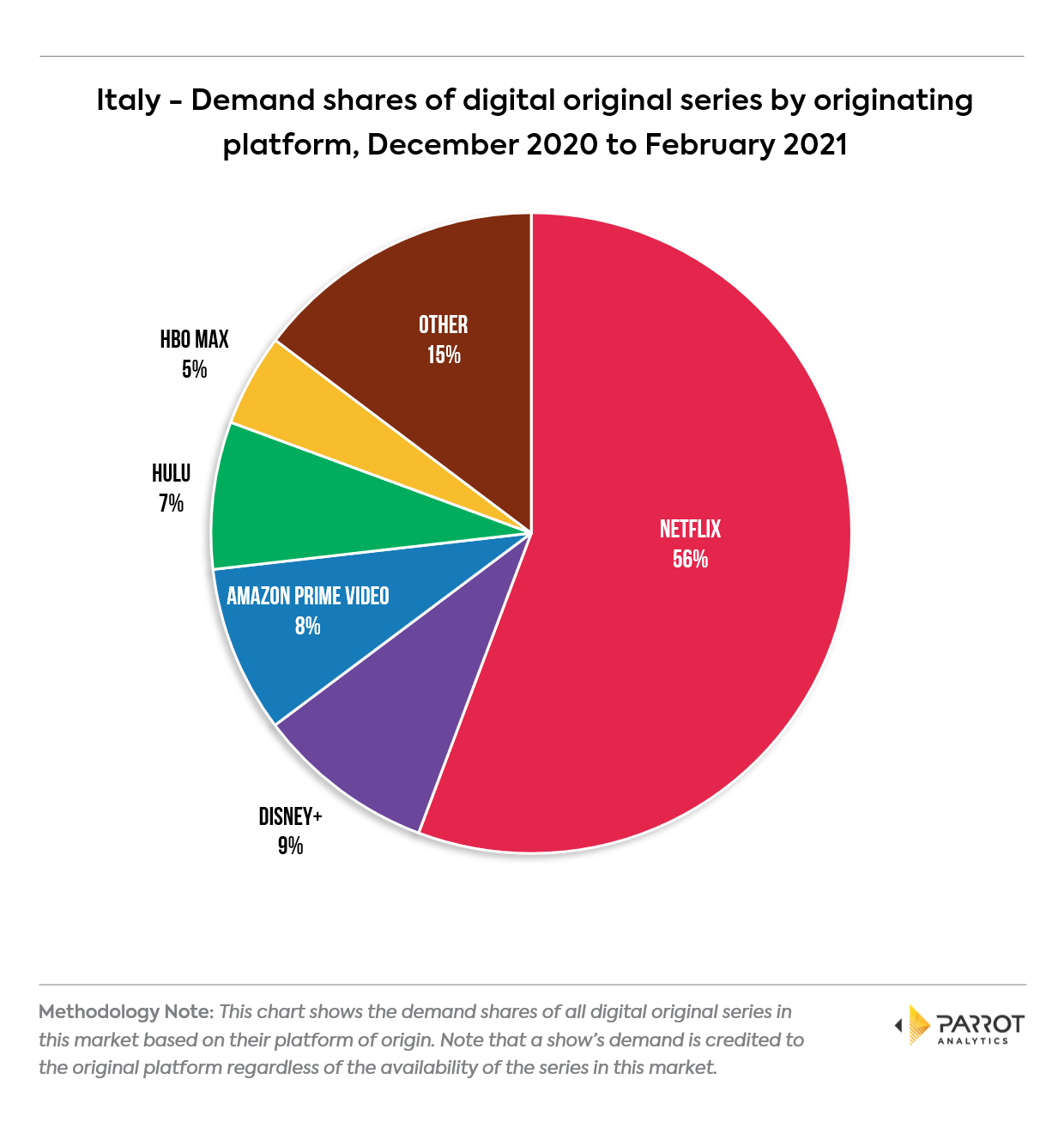

Which SVOD’s original series are most in-demand by Italian audiences?

• Over the three months analyzed, the demand share of Netflix digital original series in Italy is 55.7%. This is +5.6% higher share than the global average share of 50.1%.

• In the same period, 9.0% of all Italian digital original demand is for Disney+ originals. DIS WW is 5.3%/IT 9.0 Disney+ over-performs in Italy compared to the worldwide share of 5.3%. This difference is likely due to Italy being one of the earliest launch markets for Disney+ (arriving in March 2020), giving the service more time to penetrate the market.

• Reflecting a global trend driven by increasing activity in the digital original space, 14.7% of demand is for series from other platforms. Series driving demand for this segment include TIMVision’s Skam Italia and Apple TV+’s Ted Lasso.

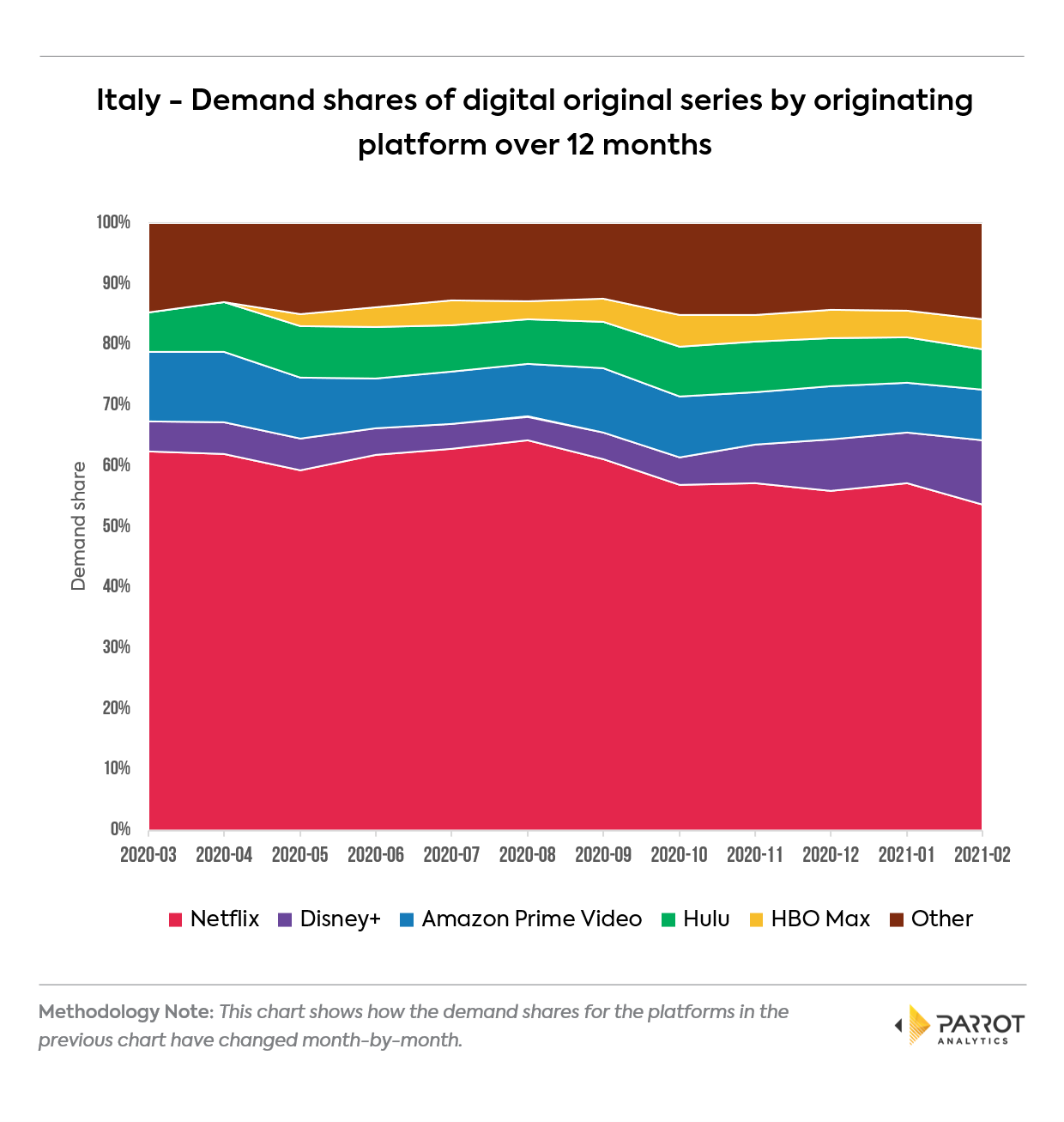

The next chart shows how the demand shares for these five platforms have evolved over the past 12 months:

• The demand share trends show the global launch of HBO Max impacting Italian demand. HBO Max original series like Raised By Wolves have high demand, although as HBO Max itself is not yet available Italians currently access them on other platforms like Sky Go.

• The demand share for Netflix series is currently declining in Italy. From a high of 64.2% in August 2020, the share drops to 53.7% in February 2021.

• The share of demand for series of other platforms is trending the opposite direction, moving from 12.8% to 15.8% in the same time.

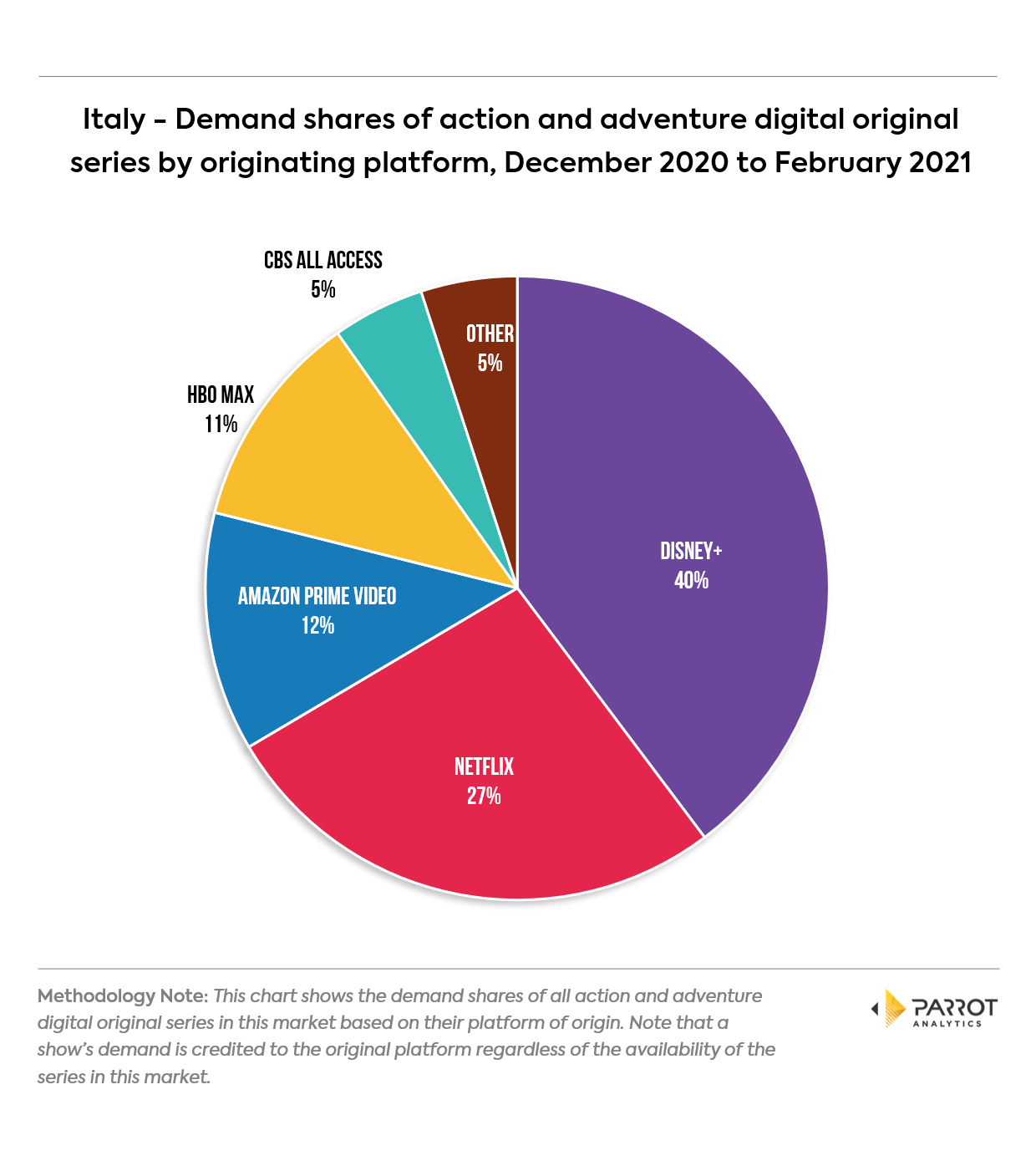

Which SVOD’s Action and Adventure original series are demanded most by Italian audiences?

• Italy’s high demand for Disney+ original series is even more pronounced in the action and adventure genre. The global share for Disney+ action and adventure is second largest at 25.5%, while in Italy the share is +14.2% more at 39.7%.

• The high demand for Disney+ series means that all other platforms have smaller demand shares in Italy than they do worldwide over the same three months.

• The share for Netflix series is affected most, being -4.3% smaller than the worldwide demand share of 31.1%.

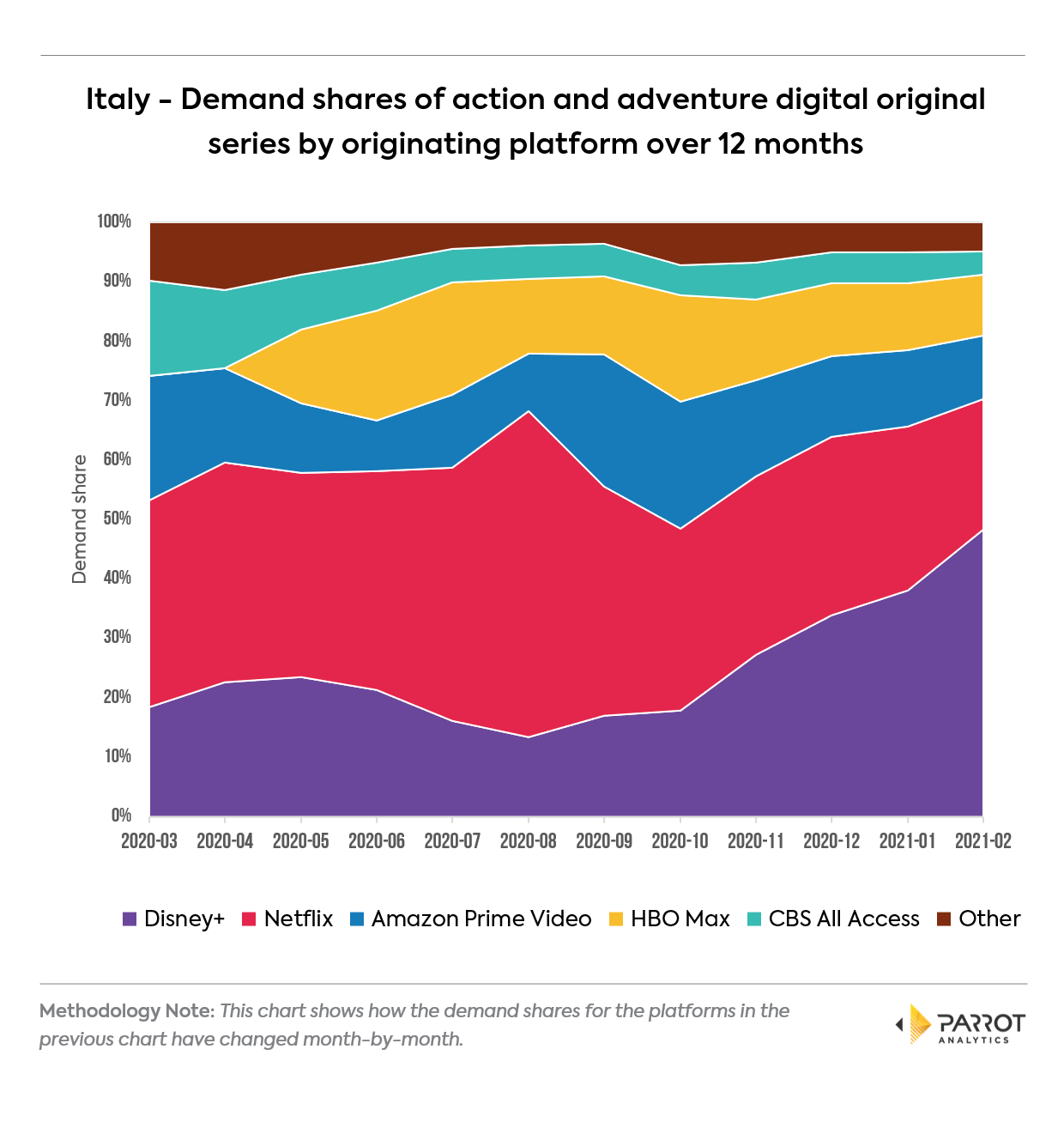

The next chart shows how the action and adventure demand shares for these five platforms have evolved over the past 12 months:

• The 12-month trend shows how rapidly the Italian demand share for Disney+ action and adventure series grows towards the end of 2020. The Disney+ demand share more than doubles from October 2020 to February 2021.

• This is driven largely by season 2 of The Mandalorian followed by the debut of Marvel series WandaVision.

• The trend shows how the demand increase for Disney+ series has squeezed the Netflix demand share in this genre. Due to the COVID-related delay of The Witcher S2, Netflix has not had a tentpole series in this genre since The Umbrella Academy in August 2020.

For more information, check out the most up-to-date Italy television industry overview.