Image: Peaky Blinders, BBC

2017 proved to be a battle of the titans with regards to which shows, and which networks, dominated TV demand amongst UK audiences. Audiences were treated to a cornucopia of streaming digital content and digital originals from the biggest players in the industry – most notably Netflix.

With the streaming service providers predictably close-lipped regarding the data behind the popularity of their respective shows it has until recently been more of an educated guessing game to discern which shows, genres, networks, and platforms were the most popular with UK audiences.

The new era of integrated TV data across all platforms

Parrot Analytics, through utilization of its Demand Expressions metric – a global measurement unit based on country-specific demand for television content across all platforms and devices – is “pulling back the curtain” to reveal the most in-demand linear shows, top digital original shows, top subgenres, as well as demand for a selection of TV networks & SVOD platforms in the UK for the last 6 months of 2017.

Game of Thrones and The Walking Dead dominate the overall top 5 TV shows

HBO’s epic fantasy Game of Thrones, which has become an (almost?) unassailable global television phenomenon over the course of its 7 seasons, closed out the year with a massive lead over runner-up most popular show, AMC’s Zombie apocalyptic drama The Walking Dead. GOT garnered a staggering 16.5 million daily average Demand Expressions in the UK – over 5 million more than its closest rival The Walking Dead which drew in just over 10 million.

One of the year’s most highly anticipated sequels, Netflix’s Stranger Things, performed admirably and landed up in the number 3 spot on the UK TV show top 5 list with 5,067,983 daily Demand Expressions.

The ruthless and cunning intensity of BBC Two’s Birmingham-based drama Peaky Blinders (now also under Netflix distribution) saw the Shelby family claw, fight, slash and shoot their way past sitcom superhit The Big Bang Theory to end up in the 4th spot in the UK with a very narrow lead over the much-loved sitcom.

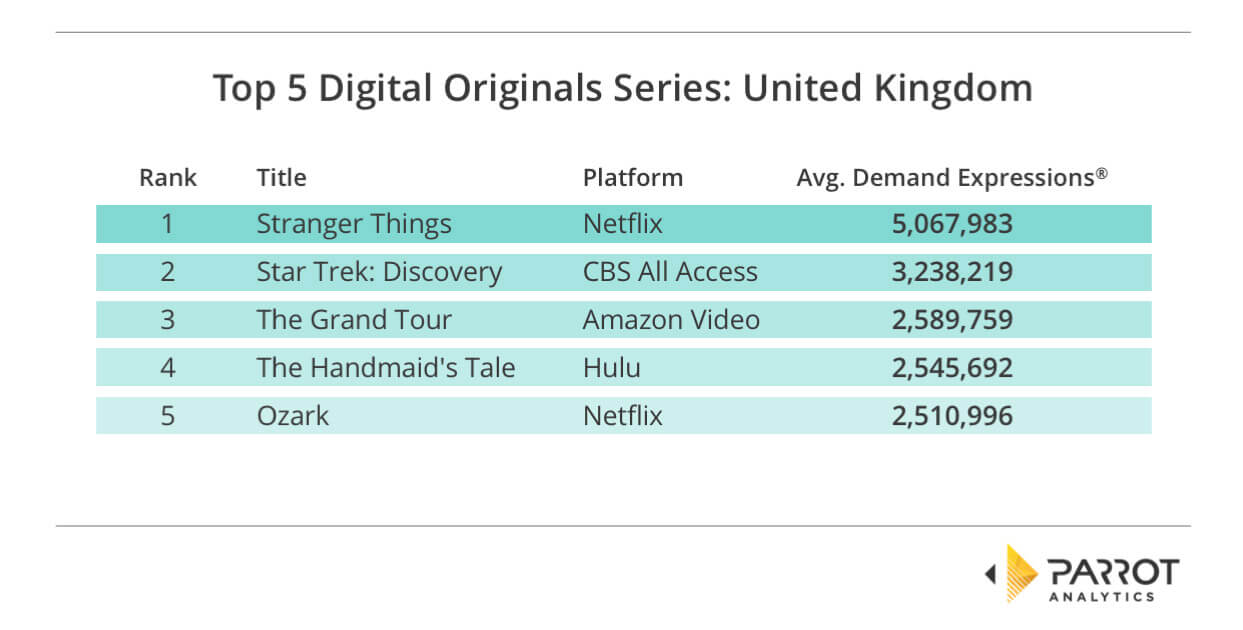

Stranger Things beats out The Grand Tour to finish out in pole position as the top Digital Original Series

When we refine the criteria to the top digital original series in the UK over the last 6 months of 2017, the data demonstrates a much more closely fought battle for market dominance. Stranger Things was the most popular digital original series with a fairly comfortable lead of just over 1.8 million average daily Demand Expressions over its closest competitor Star Trek: Discovery.

Amazon Video’s The Grand Tour, with 2,589,759 average daily Demand Expressions, accelerated its way into third position by just edging out Hulu’s The Handmaid’s Tale and Netflix’s sleeper hit Ozark which racked up 2,545,692 and 2,510,996 Demand Expressions, respectively.

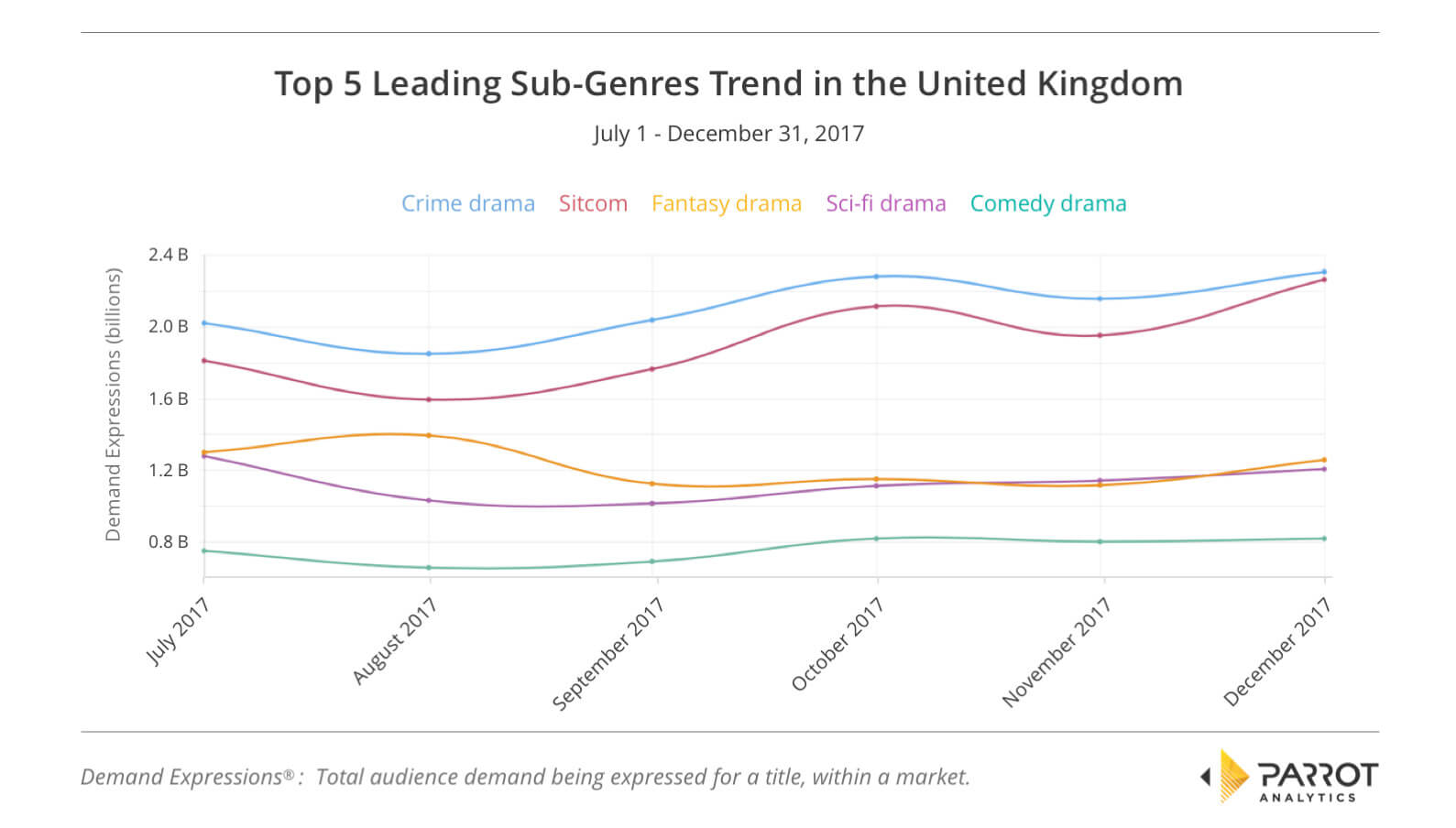

Crime Drama and Sitcom trend highest amongst the top subgenres

Crime Drama started out and carried through the full 6 months from 1st July 2017 to 31st December 2017 as the most dominant subgenre, this was followed by Sitcoms, Fantasy Drama, Sci-fi Drama and Comedy Drama.

The trend graph below clearly indicates just how strong the Crime Drama subgenre resonated with UK audiences, in large part thanks to the success of the top three shows in this subgenre – Peaky Blinders, Gotham and Ozark. Local favourite Peaky Blinders solidified its position as the leader within its genre by garnering over 1 million more average daily Demand Expressions than the dark and brooding Batman origins drama Gotham at #2.

Ozark, with 2,510,996 average Daily Expressions, proved to be a real hit with the UK audience and served as the third major pillar that kept Crime Drama above Sitcom throughout the entire last half of 2017. Of particular note is the fact that Crime Drama trended to its highest point in December, a full 230,000 avg. Demand Expressions higher than how it began in July.

The Big Bang Theory remains the undisputed king of sitcom in the UK

The global appeal of the mega successful Sitcom The Big Bang Theory held true in the UK where it clearly proved to be the firm favorite amongst UK viewers. With 3,950,783 average daily Demand Expressions the beloved comedy, which premiered its 11th season in September, helped maintain the popularity of the sitcom genre in the UK.

The trend graph clearly illustrates Sitcom as a genre trending consistently higher than Fantasy Drama, Sci-fi Drama and Comedy Drama throughout the full 6-month period of this evaluation. The other two big hitting sitcoms that proved most popular with UK viewers were Brooklyn Nine-Nine and Modern Family.

Fantasy Drama and Sci-Fi Drama go head to head through the last quarter of 2017

Very little distinguished the two subgenres with the biggest shows on television towards the last quarter of 2017. Game of Thrones, Preacher and Supernatural spearheaded the Fantasy Drama subgenre which trended highest in August but then dropped down to a near-identical track as the next-most popular subgenre, Sci-fi Drama.

Buoyed by the success of smash hits Stranger Things, Star Trek: Discovery and Westworld, Sci-fi Drama tussled for third position only to be outperformed right at the end of the year to finish narrowly below Fantasy Drama.

Comedy Drama began and ended the year in 5th position consistently trending lower than every other subgenre in the top 5. All three top-performing comedy drama titles – Orange Is The New Black, This Is Us and Ballers – did not manage to break past the 2 million daily Demand Expressions mark.

Netflix holds highest demand per digital original

When we turn our attention to which SVOD generated the most demand throughout the UK, Netflix remains the most popular, consistently trending higher throughout the last six months of 2017 than Amazon Video.

As an interesting comparison we’ve also included ITV in this analysis; Amazon Video started the trend higher than ITV with just under 200,000 daily platform title-average Demand Expressions at the start of week 26, but plunged to its lowest point just 7 weeks later.

Interestingly, ITV charts the same course, beginning week 26 under the 150,000 daily platform title-average Demand Expressions mark and falling almost perpendicularly to Amazon. From there, the average demand for both platforms follows a similar trajectory, with Amazon Video dropping below ITV throughout weeks 37 to 40.

From week 47 we see a sharp and steady surge in demand for Amazon as it climbs to end the year out following the build-up to, and release, of season 2 of The Grand Tour. Whilst ITV did not enjoy as dramatic a rise in demand as Amazon towards the end of the period, it did also end the year on a higher note by topping out well over the 150,000 avg. Demand Expressions per title mark.

Overall the three platforms and networks examined ended 2017 off on a high note with Netflix holding almost double the demand over the other two analysed in this study.

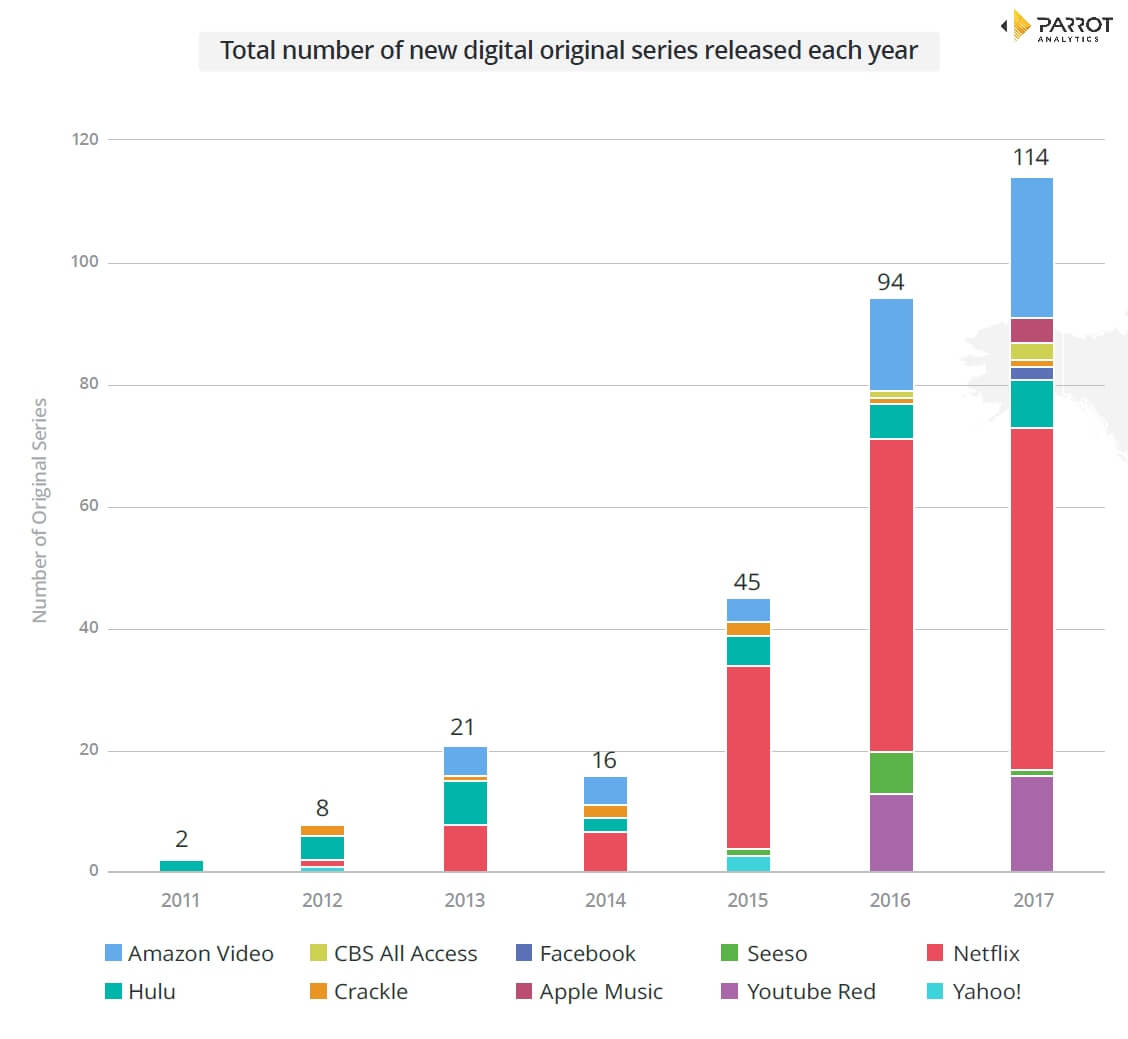

Looking towards Q2

With the end of the first quarter of 2018 already on the horizon, one thing has been made abundantly clear by the top SVOD platforms: The content will keep on coming and viewers are going to have a buffet of blockbuster shows to choose from. Here a quick look-back over the last couple of years, this graph clearly demonstrating the yearly increase in digital original series production volume:

Whilst most of the industry commentary at this point remains speculation as to which shows to look out for and which are earmarked for noteworthy success, Parrot Analytics will continue to research, collate and publish relevant data-driven insights that tell the true story.

For more information, check out the most up-to-date United Kingdom television industry overview.