Parrot Analytics title movement reports reveal which series have had a serious impact on a market’s audience between July and September 2020.

The key questions investigated in this report include:

1. Which new series (Season 1) had the strongest debut among Swedish audiences?

2. Which debut or pre-existing series gained the most audience attention in Sweden from July to August?

3. Which debut or pre-existing series gained the most audience attention in Sweden from August to September?

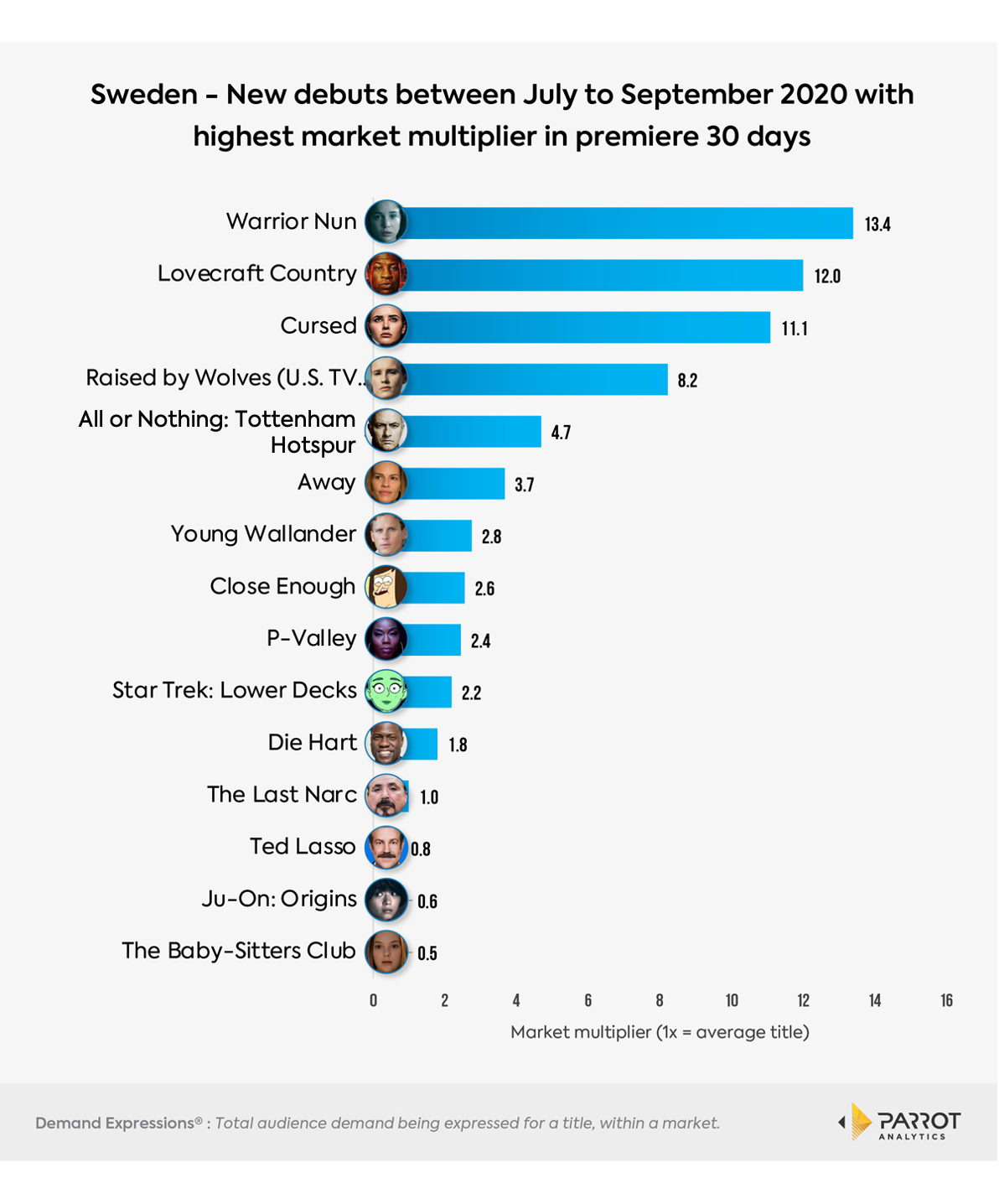

Which new titles had the strongest debut?

First, we will look at which new debuts were most demanded in Ireland. This chart contains 15 titles that had a global Season 1 premiere between July 1st and September 30th. Each series is ranked by its average market multiplier over that series’ first 30 days after the premiere date.

For these three months, the most in-demand debut in Sweden is sci-fi action Warrior Nun from Netflix. In the first 30 days after Warrior Nun's July 2nd global premiere the show averaged 13.4 times the demand of the average title in Sweden.

The second best-received new release among Swedish audiences is HBO’s horror Lovecraft Country. Debuting on August 16th, which continues the narrative of a novel by Misha Green, is 12.0 times (12.x) more demanded than the Swedish market average in the first 30 days after release.

Swedish audiences are loving a good drama! 40% of the top debuts in Q3 2020 were dramas. The third and forth top debuts in this period are also dramas. They are Netflix’s period drama Cursed and HBOMax’s sci-fi drama Raised by Wolves (U.S. Series). Despite not yet receiving an official release in Sweden, Raised by Wolves had 8.2 times the demand of the average series in Sweden in the 30 days following the US release on September 3rd.

The most in-demand new documentary series is All or Nothing: Tottenham Hotspur, which is an Amazon Prime Video sports documentary following the London football club Totten Hotspur in 2019-2020. This show premiered on August 13th and in the 30 following days had 4.7 times the demand of the average series in Sweden.

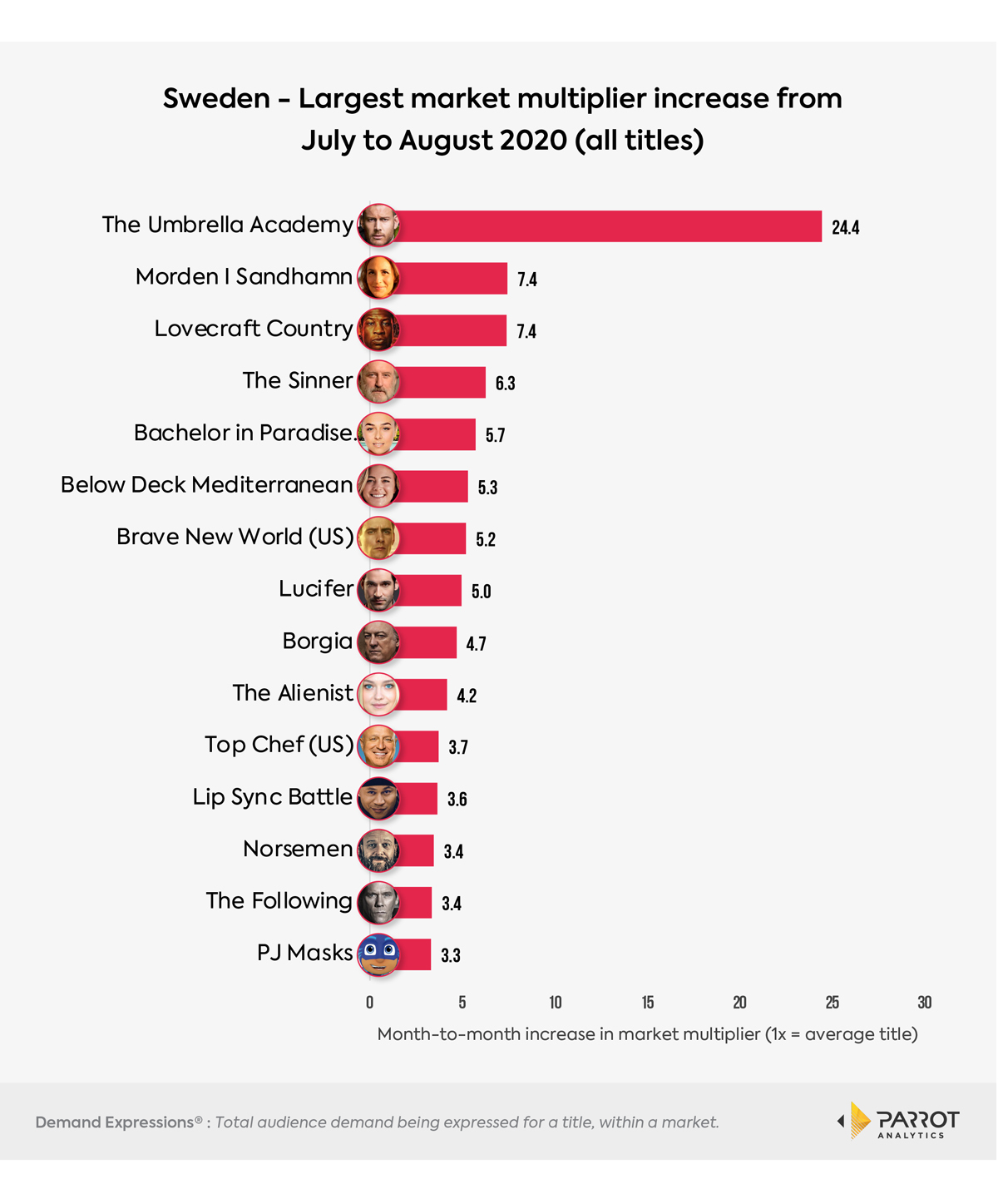

Which existing or new titles gained the most audience attention from July to August?

Comparing demand for each series in July and August 2020, we find that Netflix’s The Umbrella Academy gained the most demand. August’s Swedish demand for the teen drama gained +24x market average compared to July. The increase is due to the second season of The Umbrella Academy, which was released on July 31st. The show is also the fastest growing series for these months.

The second largest growth in demand happened for a local crime drama title set in the outskirts of local Swedish capital of Stockholm, Sandhamn. Morden I Sandhamn which returned to C More on August 3rd and TV4 on August 18th for a 7th season. In Sweden, demand for the show increased by +7.4x the market average from July to August.

The Sinner is a crime drama that originally aired in the USA over February and March, but had the fourth greatest increase in demand between July and August. Showing the impact of Netflix’s reach, the +6.3x market average series increase comes after The Sinner arrived on Netflix on June 19th.

A pair of reality TV shows captured Swedish audience attention moving into August: Bachelor in Paradise Australia and Below Deck Mediterranean. Season 5 of Below Deck Mediterranean released in the US on the Bravo TV network and in Sweden on Hayu June 1st. The travel reality show’s demand increased +5.3x Sweden’s market average series from July to August.

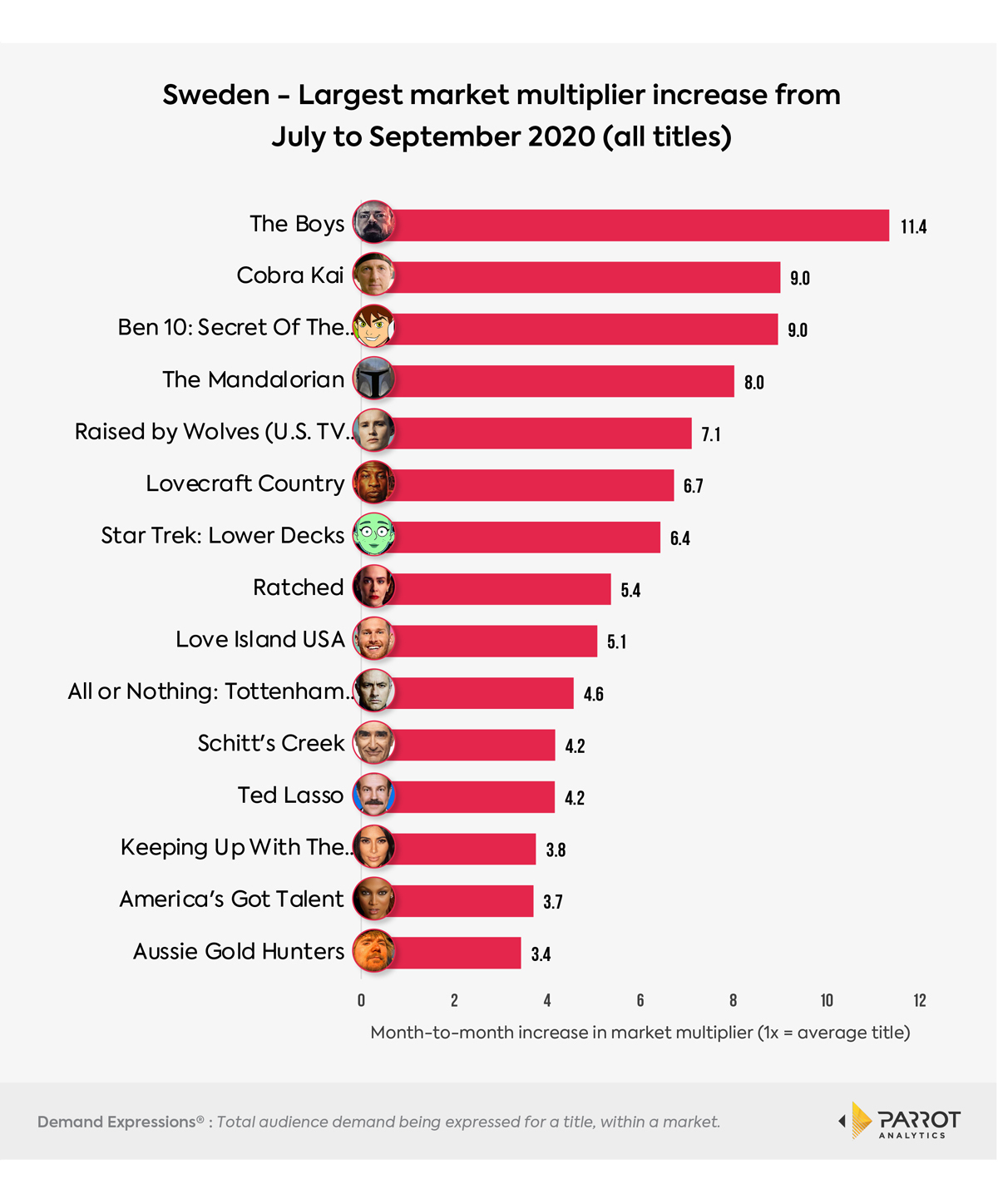

Which existing or new titles gained the most audience attention from August to September?

Moving to the August to September 2020 period, Amazon Prime Video’s series The Boys saw the largest increase. Following the show’s premiere on September 4th, it gained +11.4x market average demand in Sweden from August’s demand.

Tied in second place for largest month-to-month demand increase at +9.0x the market average are: Netflix’s Cobra Kai and the children’s show Ben 10: Secret of the Omnitrix. The global premiere of Season 1 and 2 of Cobra Kai took place on August 28th, again showing the impact of Netflix's accessibility in Sweden.

Disney+’s mega-hit sci-fi action series, The Mandalorian, also found favour with Swedish audiences. Baby Yoda and the rest of the platform’s launch on September 15th in Sweden gave the show a +8.0x market average demand increase from August to September 30th.

Following closely are HBOMax’s Raised by Wolves and HBO’s Lovecraft Country. Lovecraft Country had the 2nd greatest demand growth amongst all titles across all three months. It is likely that Lovecraft Country garnered pre-release demand between July and August and then sustained the Swedish audience attention, rising steadily +6.7x the market average demand between the releases of its 4th and 7th episodes in September.

Another popular new debut, Star Trek: Lower Decks from CBS All Access, showed the sixth highest increase in demand from Swedish audiences. The adult animation show was released on August 6th in the US with an unconfirmed date of release internationally for global Star Trek fans. Despite the lack of official platform access in Sweden, Star Trek: Lower Decks grew quickly in-demand with an increase +6.4x the Swedish market average demand.

This report is intended as a high-level overview of the most impactful series in this market. For deeper investigations, your monitor subscription gives you access to title-level demand data for tens of thousands of titles across dozens of markets.