The early part of 2023 saw action adventure shows dominating the animation space, with the audience skewing to a younger demographic overall. Despite some minor shifts from the end of 2022, the same animated series are still going strong into 2023 due to unfinished storylines and confirmed green-lights for subsequent seasons.

Action adventure anime remain the most popular globally

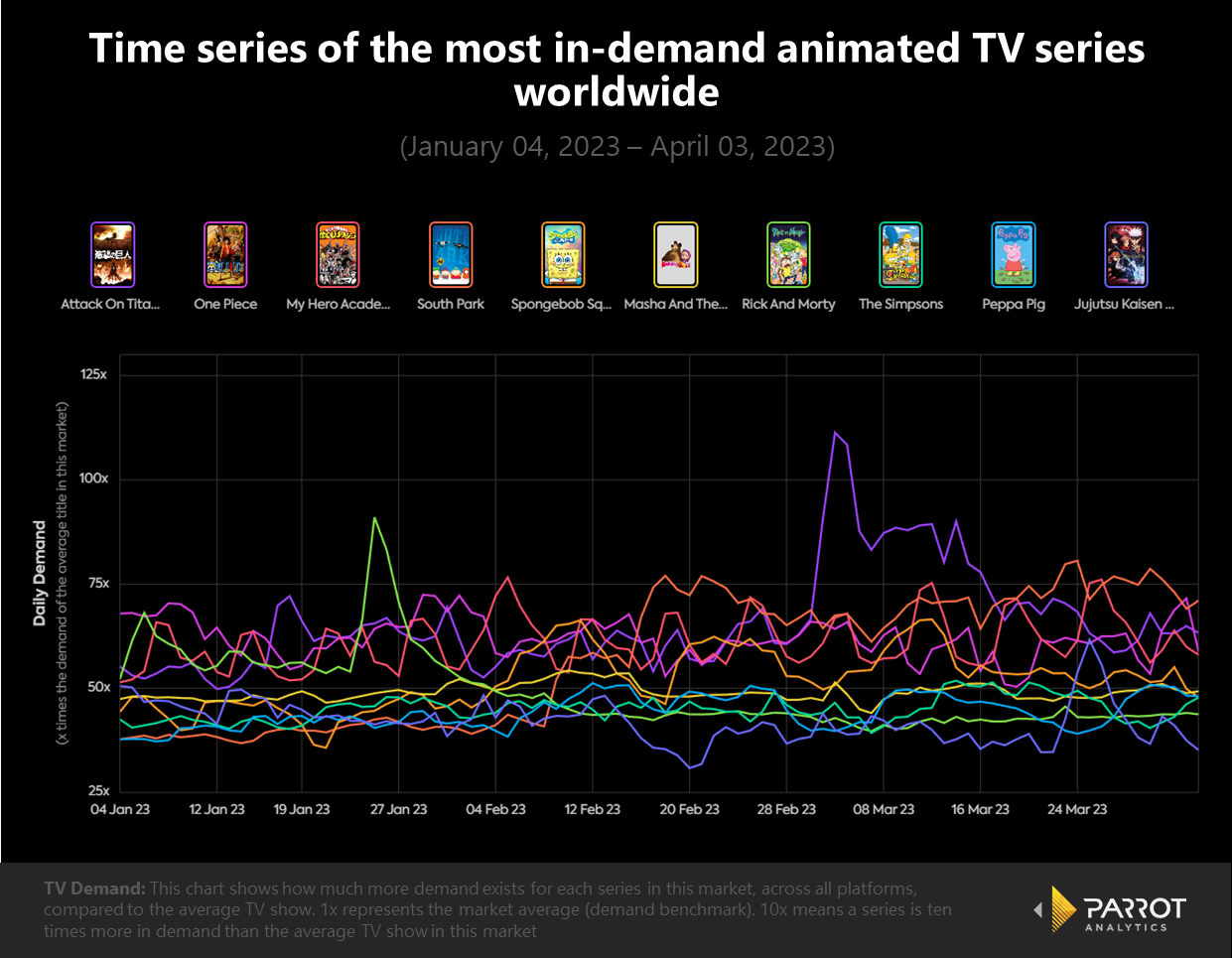

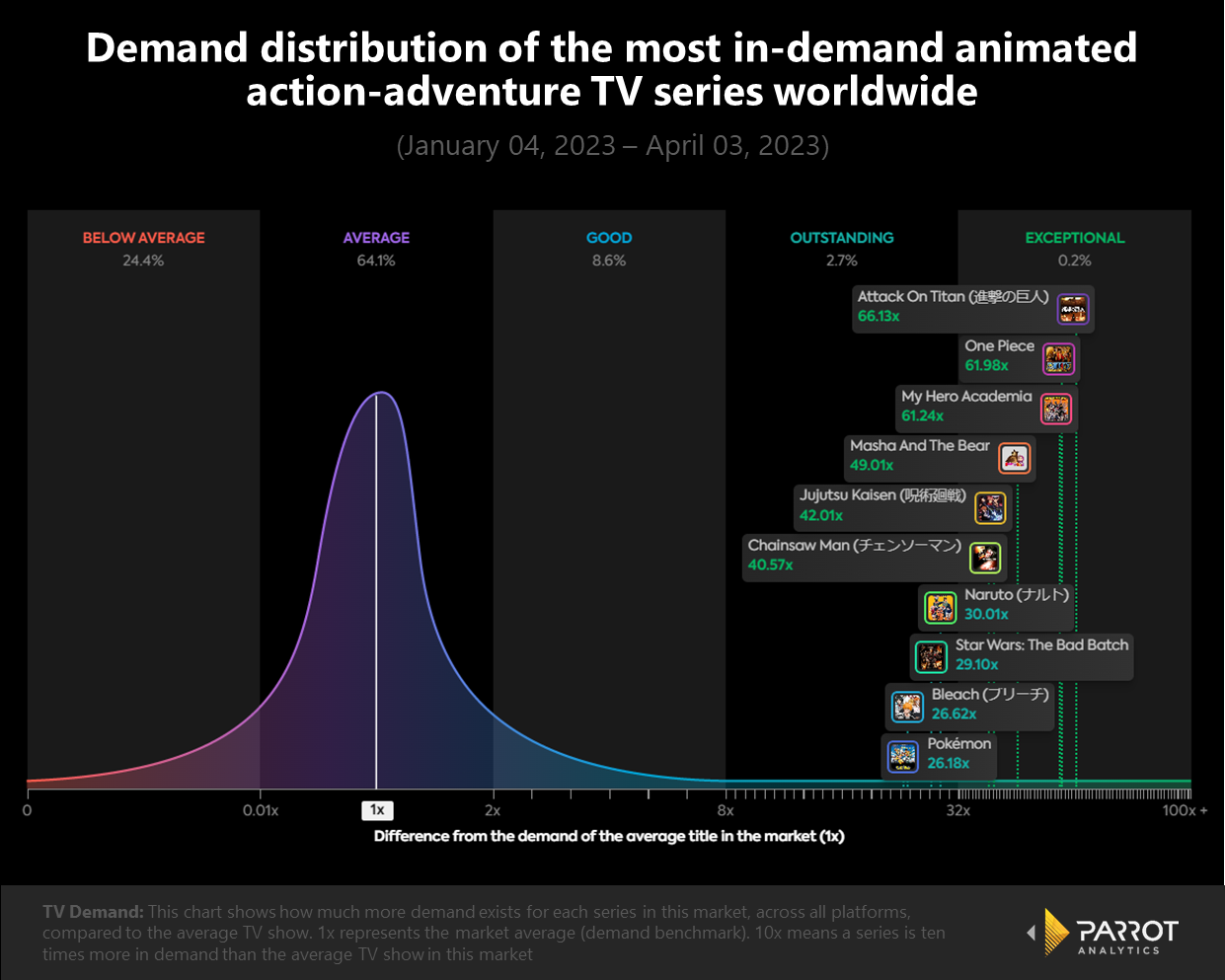

The top three most popular animation are all anime in the shonen and seinen action adventure genres. The biggest success of early 2023 is Attack on Titan, maintaining 66.2 times the average demand for a series worldwide. Incredibly, the debut of the series’ penultimate episode, a one hour special released on March 04, hit a peak of 111.4 times the average demand worldwide. One can expect a similar or even larger peak when the series finale airs in Fall of 2023. Attack on Titan has bucked the trend of most popular animation by featuring horror theming and a darker tone, pushing out more light-hearted anime such as Pokémon.

There is still space for light-hearted adventures however, as One Piece proves by holding the second most in-demand spot with 62.0 times the average demand for a series worldwide. The long-running swashbuckling adventure series continues to pull in views from the typical Gen Z audience (57% of the show’s viewership) and a healthy distribution across other age ranges. One Piece maintains steady demand with a consistent release schedule, unlike Attack on Titan which leverages splashy specials and a disjointed final season to periodically spike in demand.

My Hero Academia takes the third position by blending demand for the anime and superhero genres. While typically a light-hearted show, the most recent sixth season dipped into the darker side of protagonist Deku as he tangles with a world on the brink of villainy. The series is set for a massive climax as Deku battles Shigaraki, the primary antagonist of the series for the past three seasons - this will most likely see a surge in demand for season 7.

Finally, one more anime breaks into the top 10 in tenth place: Jujutsu Kaisen. Jujutsu Kaisen returns to darker theming, featuring demons, shocking deaths and brutal violence combined with some thriller elements. The series has one leg up on its competitors: it is surprisingly well-received outside of the typical anime markets of The US and Japan. Compared to its origin country, Jujutsu Kaisen saw 114% demand in Brazil and 94% demand in the Philippines. A small peak in demand on March 25 correlated to the release of a preview trailer, building anticipation for when the series returns with season 2 on July 06.

All four anime series are united by their similar demographics. All series have a predominantly male audience (>60%) from the Gen Z demographic (>65%, with the exception of One Piece as mentioned earlier). Crucially, each series also performs better in the US than in Japan, with Attack on Titan in The US reaching 181% of the demand for the series in Japan.

The elephant in the room here, however, is that not a single western action adventure animation breaks the top 10. Even looking at the action adventure genre alone, the only western animation that manages to feature is Star Wars: The Bad Batch - presumably thanks to its franchise association. There is growing interest in western series however, mainly stemming from the high fantasy and superhero genres: The Legend of Vox Machina, Arcane and Invincible. One interesting high-ranking entry is the French animation Miraculous: Tales of Ladybug and Cat Noir which bucks the typical animation trend with a sorely-needed primarily female audience (67.7%).

American animation occupies the adult comedy domain

Western animation instead dominates the comedy space, particularly in adult animation with a satirical bend. The prime example is South Park in fourth place, with 58.3 times the average demand for a series worldwide. The premiere of South Park’s sixth season on February 08 caused a significant jump in demand, where it has since stayed consistently high. The series’ irreverent satire may be the reason for its modern success, tackling sensitive issues in a volatile political climate. South Park retains the audience it grew up with, primarily appealing to a Millennial demographic (32.2%).

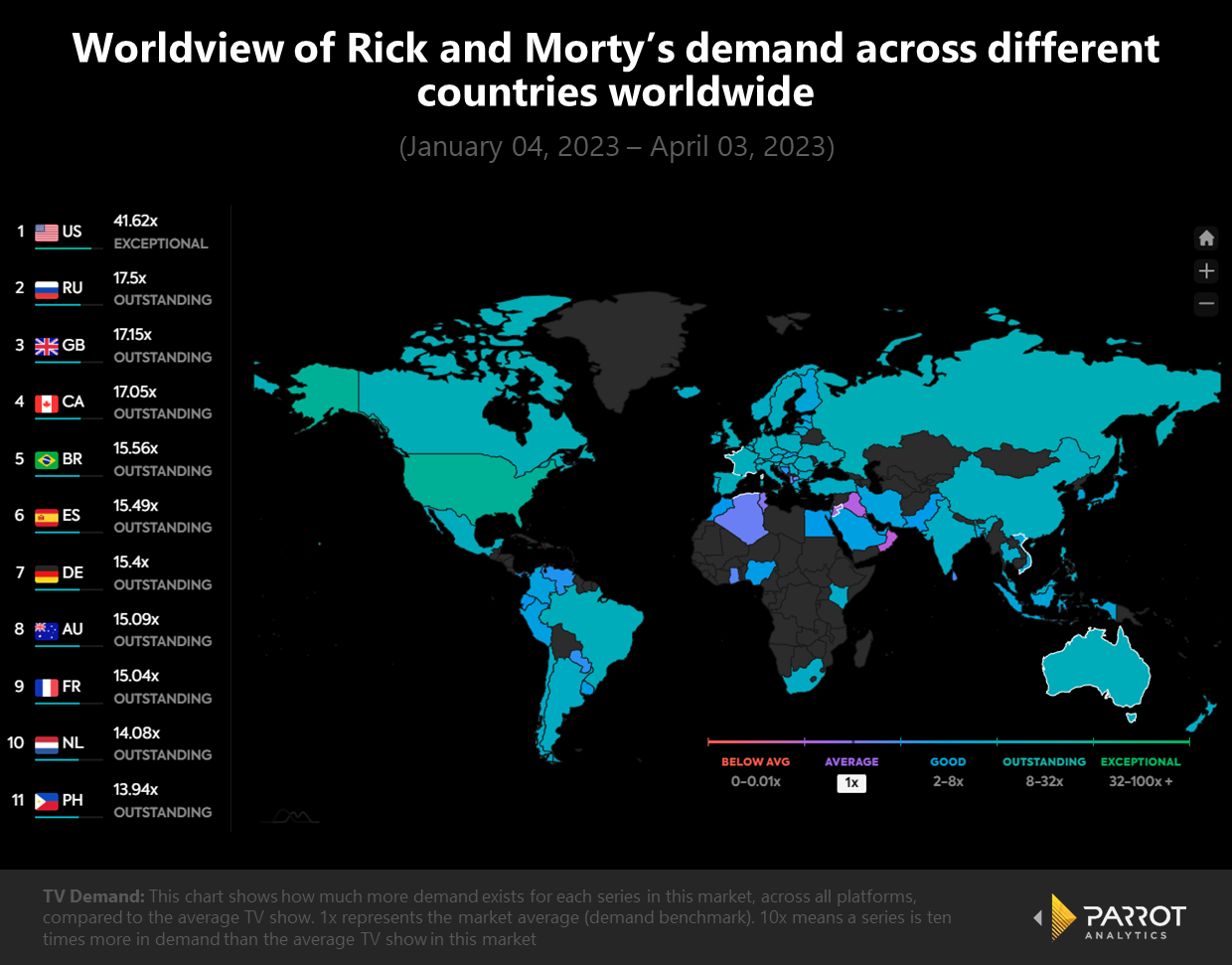

Rick and Morty as a newer show instead appeals primarily to a Zennial audience (38.3%), perhaps due to its more internet-humor style. The series held its own in seventh place over the early part of 2023, with 48.7 times the average demand for a series worldwide. However, its demand was highly irregular with a peak of 91.0 times the average demand on January 25. This surge was most likely due to the controversy surrounding Justin Roiland (Solar Opposites, Koala Man), the show’s co-creator and lead voice actor. It remains to be seen whether Roiland’s departure from the show will affect future demand.

The Simpsons continues as a mainstay of animation, sitting in eighth place with 45.1 times the average demand for a series worldwide. Like South Park, The Simpsons owes its longevity to its satirical humor, keeping the show relevant. However, the show’s prestige also allows it to attempt ambitious promotional moves. For example, the recent Death Note inspired segment from The Simpsons’ “Treehouse of Horror XXXIII” episode was heavily marketed and drew in an online audience to boost the series’ ratings.

While satirical comedies like South Park and The Simpsons are generally restricted to being popular in their home markets or markets with a similar culture, Rick and Morty has more flexibility. Rick and Morty’s second biggest market is Russia, for example, with 42% of the demand the show experiences in The US. This may be due to the space theming of the show, but further exploration into this oddity may reveal ways to market adult animations in a greater array of markets. On a similar note, the female audience is still largely untapped for adult animation, with all three series mentioned primarily targeting male audiences (>60%).

Children’s animation crosses borders with simple storytelling

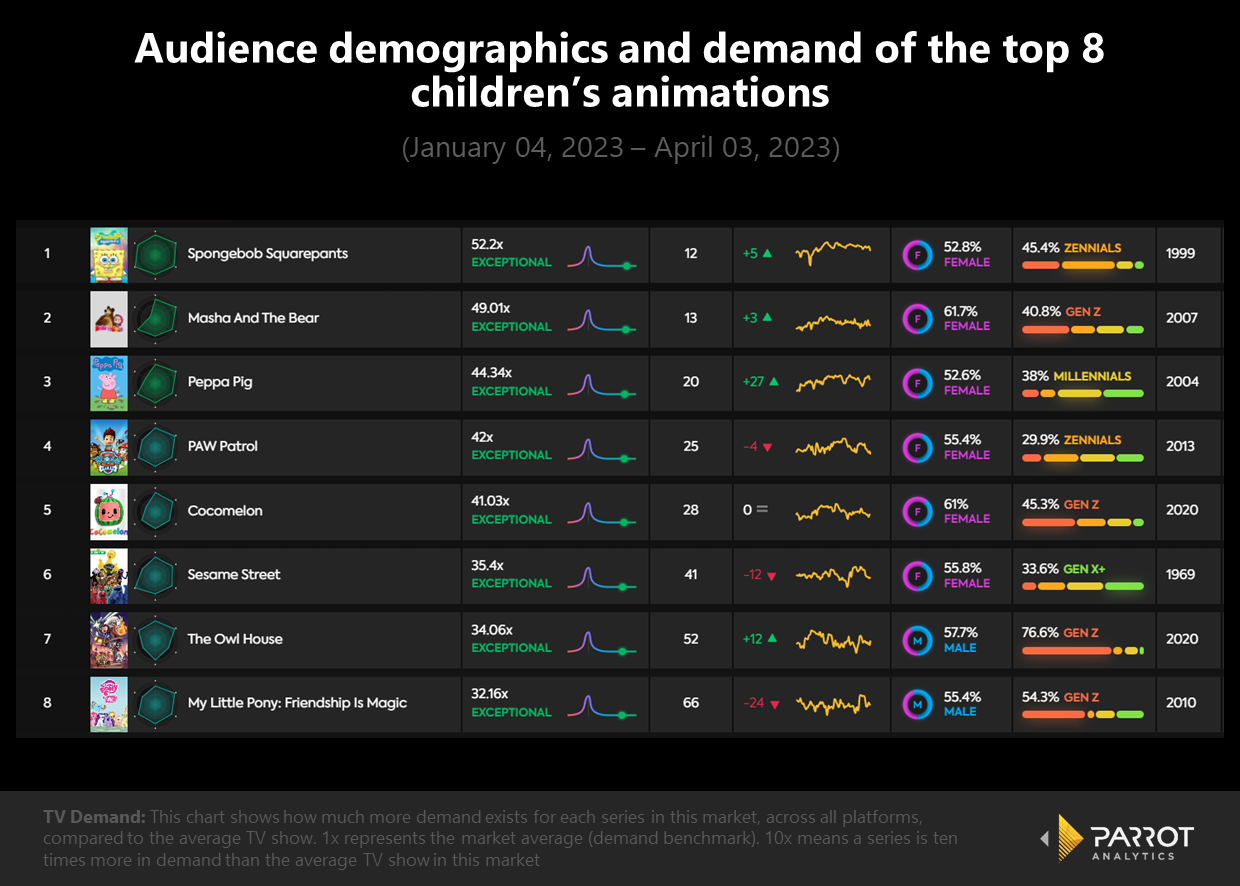

Spongebob Squarepants is the modern example of squash and stretch animation, employing exaggerated emotive poses and slapstick humor to hook its audience and appeal to international markets. Most likely thanks to this, Spongebob remains once more in the top 10 at fifth place, with 52.2 times the average demand for a series worldwide. Two peaks in demand over the early part of 2023 correspond to new episode air dates for season 13, while an additional peak correlates to the announcement of a new Spongebob Squarepants movie with Sandy Cheeks as the star.

The sixth place belongs to the most watched preschool series in the world, Masha and the Bear. As the only Russian animation in the top 10, Masha and the Bear stands out. Its popularity may be due to accessing markets ignored by other animations: Russia, Ukraine, Italy, Algeria and Türkiye, to name a few. However, the more likely reason is the show’s accessibility on YouTube which allows pre-schoolers to watch the series on loop. This would also explain the incredibly low Reach of the series: Masha and the Bear reaches just 0.43% of the average title’s audience.

Peppa Pig upholds the UK’s legacy of producing outstanding children’s television, sitting in ninth place with 44.4 times the average demand for a series worldwide. Interestingly, the audience for Peppa Pig is depicted as being primarily Millennials and Gen X (72.7% combined). Of course, this is most likely due to parents in those age brackets watching the show with their kids and discussing the series online. A similar phenomenon can be observed for Bluey in which 32.5% of viewers are Millennials.

All three children’s animations travel well into international markets, with some surprising results. Peppa Pig, for example, is popular in the Chinese (87%) and Russian (82%) markets, potentially due to its traditional family values. More crucially, however, children’s animation appears to break the male-dominated audience demographic of other animation genres, with all three aforementioned series achieving a near even split between male and female audiences.

The popular animated series in the first quarter of 2023 reveal a desire for more action-adventure series, potentially due to their popularity in the large male Gen Z demographic. Finding a new angle into this demographic could require finding new themes that appeal to male teens. Horror has proven to be a popular subgenre in this space, with Attack on Titan and Jujutsu Kaisen as prime examples. Perhaps alternate takes on the horror genre such as sci-fi horror or gothic horror could be a much needed twist on the trending formula.