Warner Bros. Discovery is well positioned to retain audience attention as Hollywood’s labor strikes prolong into the late summer and beyond.

Parrot Analytics finds Warner Bros. Discovery is the number two conglomerate in corporate demand share, meaning the company should be able to leverage its highly in-demand library to keep audiences engaged for the foreseeable future.

Furthermore, the rebranded and expanded Max platform is now less than one percentage point from overtaking Netflix at number one in total on platform demand share with US audiences. This data suggests combining Discovery+ with HBO Max is indeed creating one of the premiere four quadrant streamers, at least in the US.

Max is also now host to an increased number of reality and unscripted series thanks to taking on the majority of Discovery+’s programming. This is the kind of strike-proof content that can still provide audiences with new episodes as the WGA and SAG-AFTRA strikes drag on. These shows are also the kind of ‘turn on in the background’ series that keeps users on the platform for longer.

Warner Bros. Studios boasts the summer’s hottest movie, with Barbie on pace to gross well over $1 billion. This movie will likely see repeat viewing once it becomes available on Max.

All this is to say that Warner Bros. Discovery does have short term solutions to Hollywood’s current curveballs. The company still must sort its debt load and handle fundamental issues like shrinking cable households and what to do with CNN.

Bigger picture, Warner Bros. Discovery is less than a year from being able to accept suitors in a merger or acquisition deal. Recent events moving the Microsoft-Activision acquisition forward may ease any future big deals involving Warner Bros. Discovery.

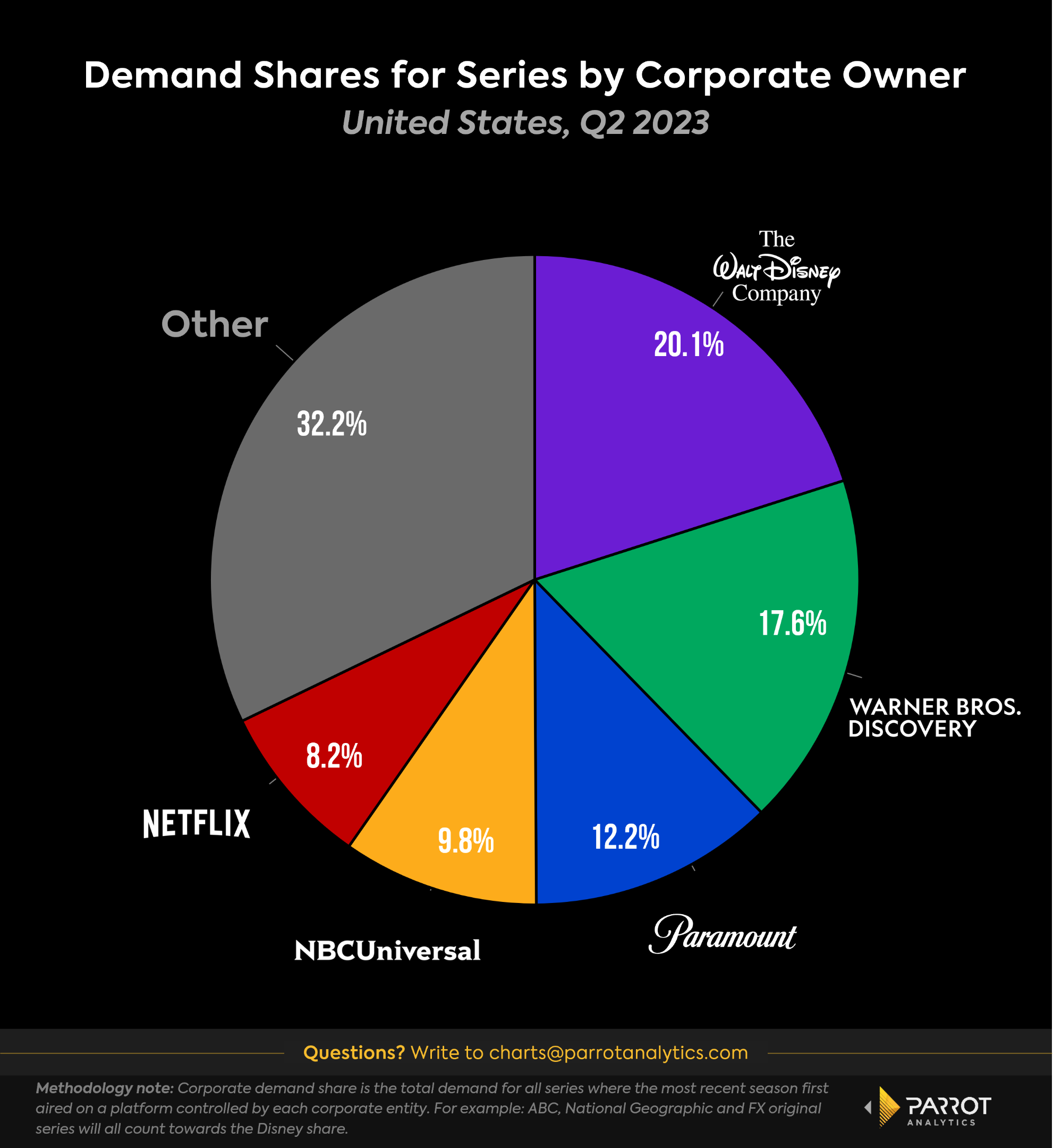

Corporate Demand Share

- Corporate demand share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their own platforms, and can effectively help value a conglomerate’s legacy and library content in aggregate.

- Warner Bros. Discovery remains in a strong second place in Corporate Demand Share, behind Disney, and well ahead of third place Paramount Global.

- WBD’s Corporate Demand Share increased from 17.2% in Q1 2023 to 17.6% in Q2 2023 — significant movement for a dataset this comprehensive. This puts the company in a strong position to help ride out the coming dearth of new content as the dual labor strikes prolong.

- The company’s most straightforward path to leapfrogging Disney in this category is to join forces with a competitor. A combination with either NBCUniversal or Paramount Global would put either new entity ahead of Disney in Corporate Demand Share.

- Comcast CEO Brian Roberts has made previous failed attempts to acquire both Disney and 21st Century Fox. Will the third time for Roberts finally be the charm when it comes to Warner Bros. Discovery?

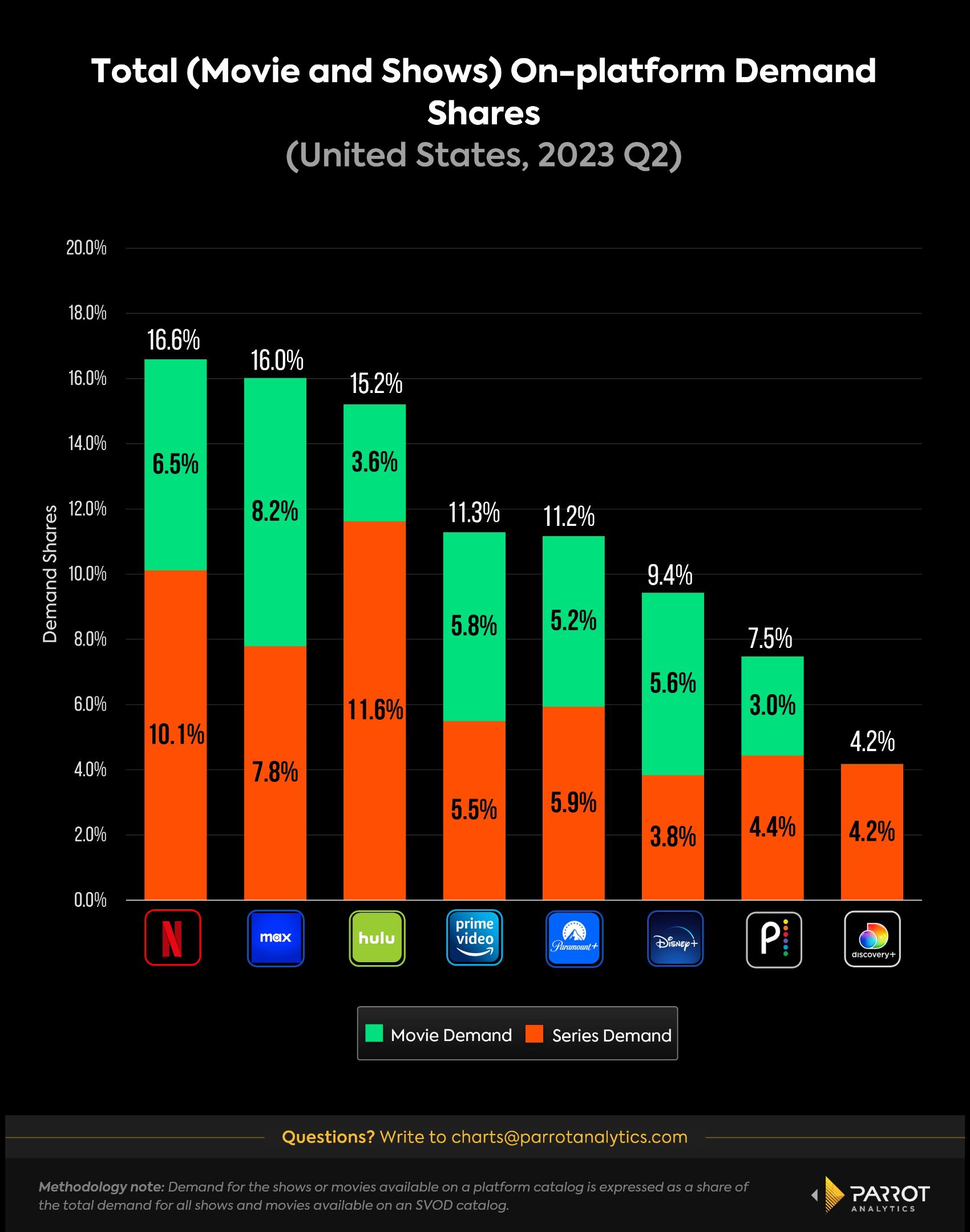

On Platform Demand Share

- While demand for original content drives subscription growth, library content is key for customer retention, an increasingly crucial element of all streaming strategies as the market matures and consumers are offered more choice and easier ways to cancel than ever.

- Library content will also be a crucial short-term asset as Hollywood’s labor strikes prolong, with new shows and movies likely to run dry in late 2023 and early 2024.

- There is a clear ‘Big Three’ in terms of general entertainment platforms. This quarter, the relaunched Max platform leapfrogged Hulu for second place. In Q1 2023, HBO Max was in third place with 14.4%, well behind Netflix’s 17.9%. Max (16.0%) is now within one percentage point of Netflix (16.6%) in this category.

- That said, once Hulu (15.2%) and Disney+ (9.4%) are combined, that streamer should easily top both Netflix and Max when it comes to total on-platform demand for content.

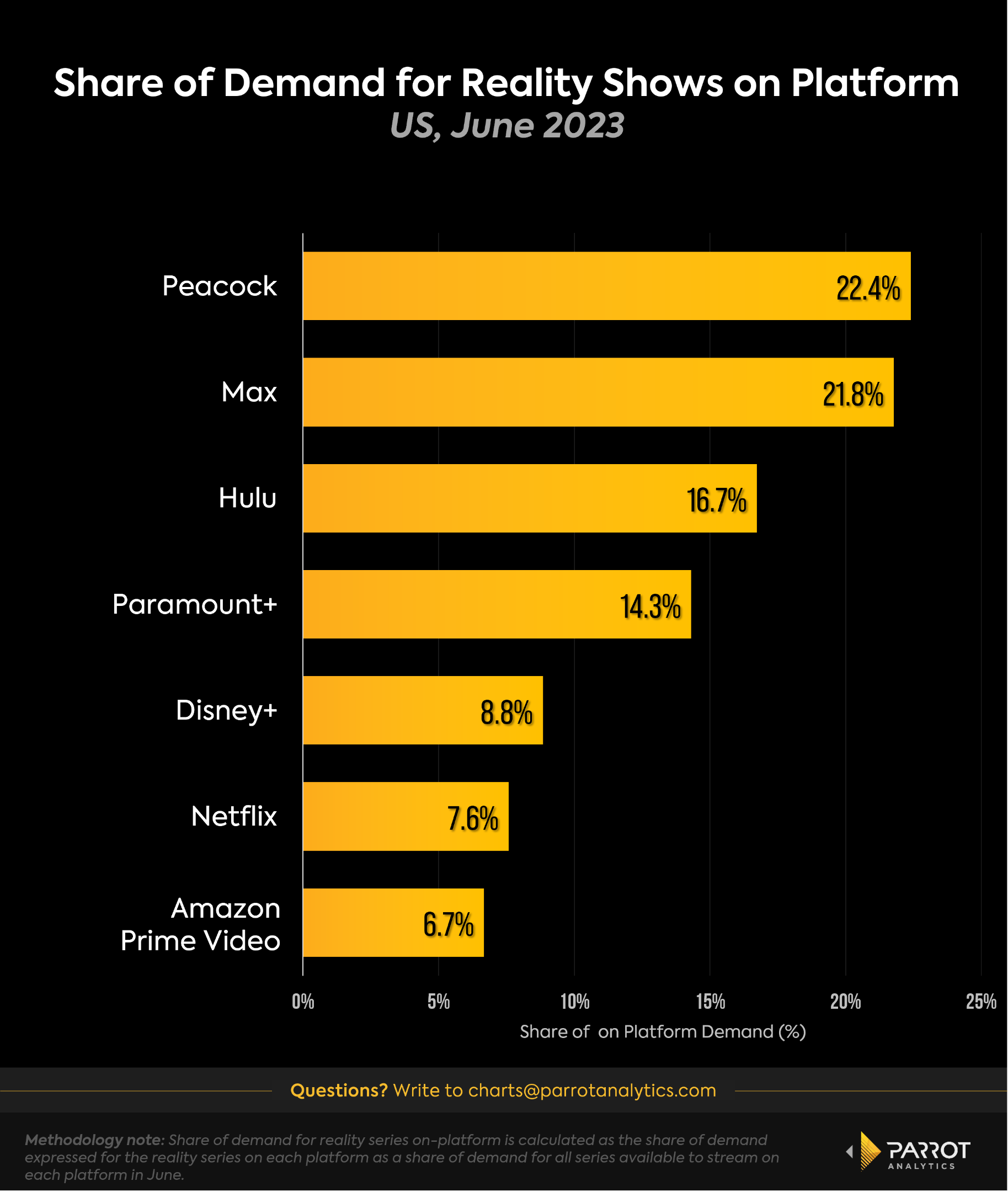

Demand Share for Reality Series

- Of major US SVODs, reality shows made up the largest share of demand for shows available to stream on Comcast’s Peacock at 22.4%.

- Warner Bros. Discovery’s Max came in a close second with a 21.8% share of demand for reality shows on its platform in its first full month after the relaunch.

- This points to one of the major benefits of Warner Bros. Discovery’s recent decision to make a majority of the Discovery+ catalog available on Max. It significantly boosted the platform’s reality offering, a decision that is looking prescient given the ongoing strikes.