Following the booming success of Korean content in recent years, other countries have been hoping to achieve a similar level of international acclaim for their local content. One market that we’ve been monitoring closely as an origin for globally popular content has been Turkey. We have previously highlighted the regional spike in demand for Turkish content in Latin America. Here we take a look at how demand for Turkish series has been growing in the US and consider whether this is the beginning of a new trend for international content.

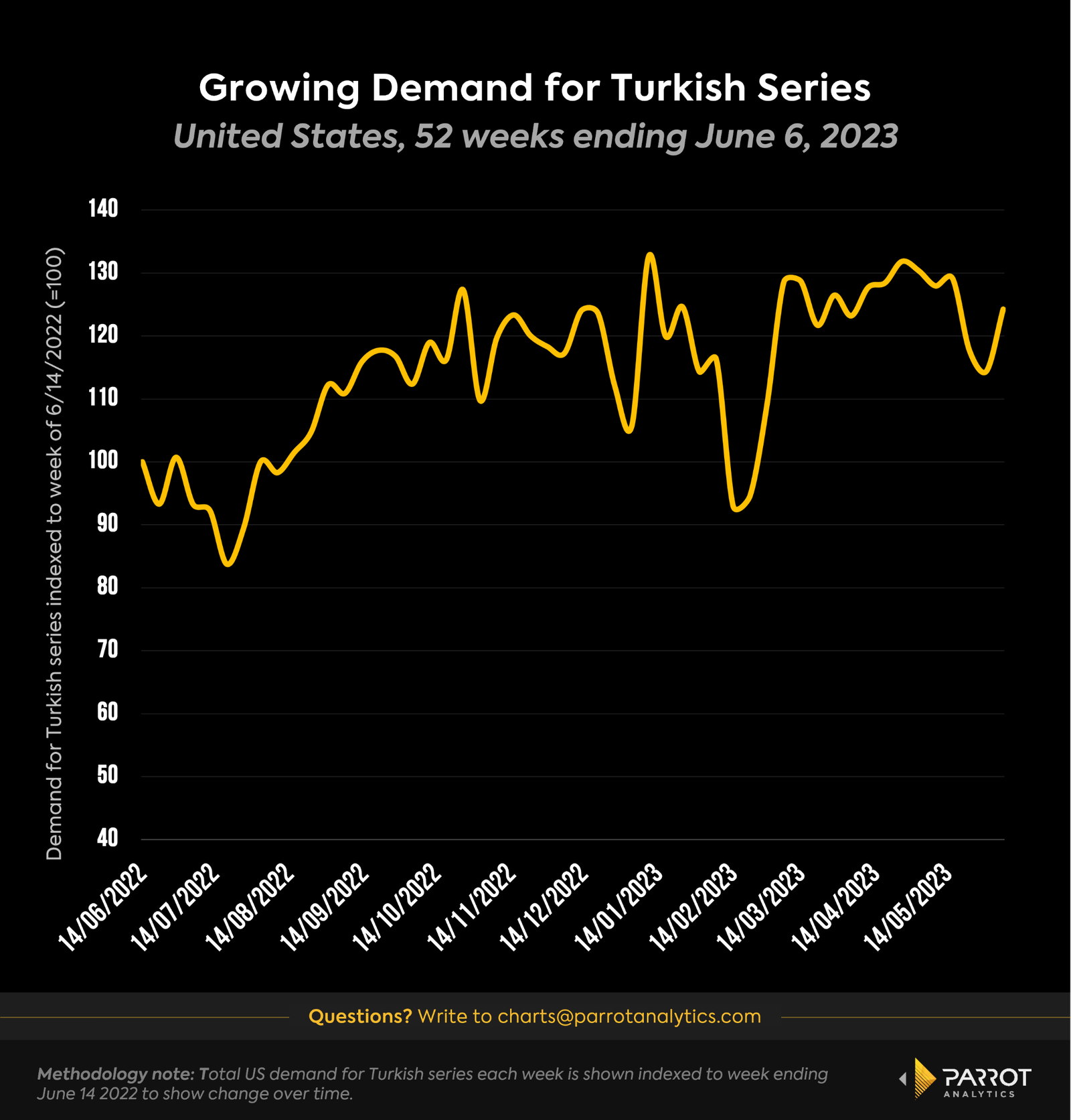

As of June 6th, total US demand for Turkish series was 24% higher than it was a year ago. There was a large rise in demand for these series in the second half of 2022. Although Turkish content still accounts for a small share of demand for international content in the US, this means that there is a large potential upside for continued growth.

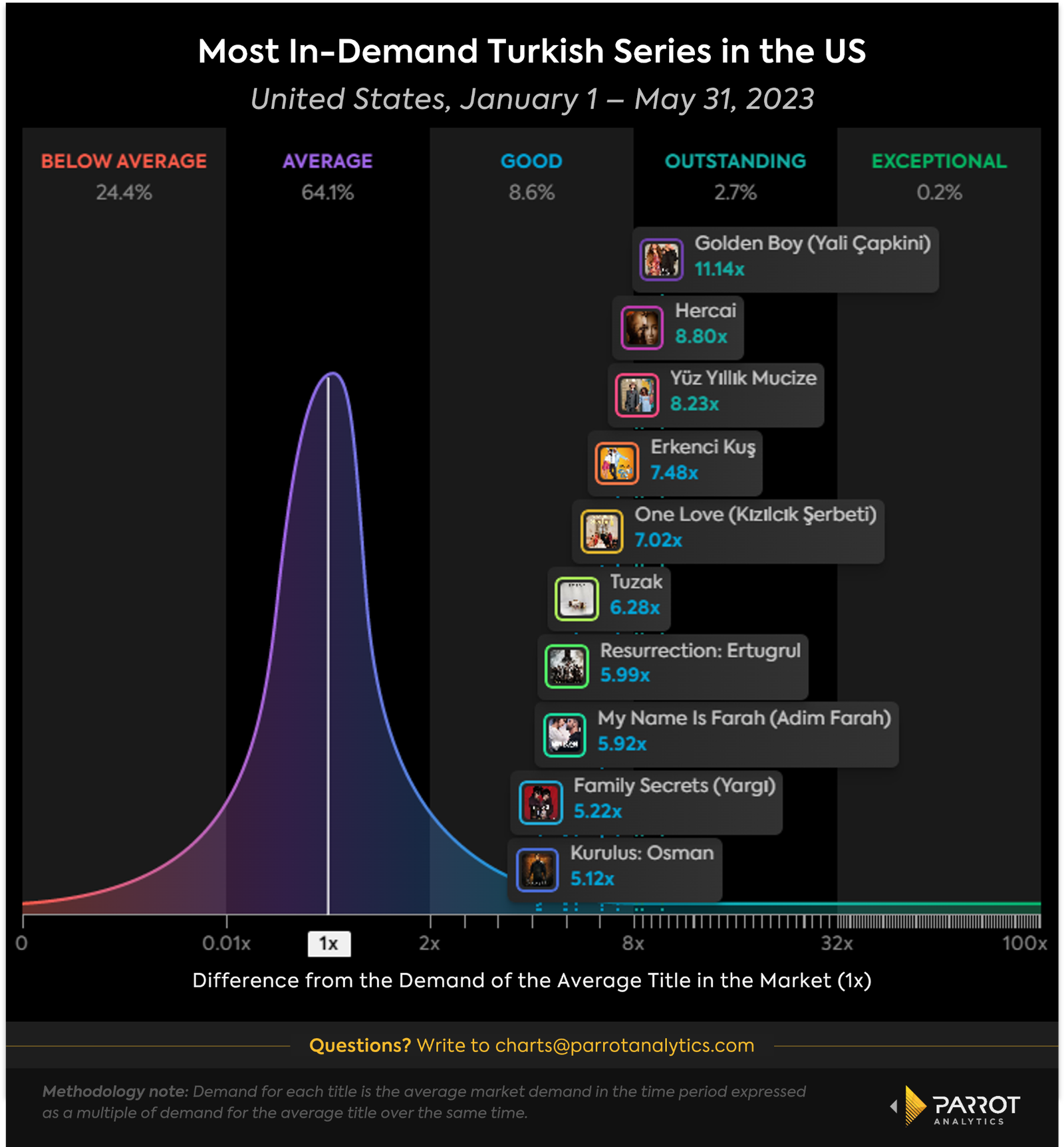

When we looked at US demand for international series last year, the most in-demand Turkish series in the US was Family Secrets (Yargi). At the time, it had 6.4 times the average series demand. So far this year 5 Turkish series have greater demand than the top series did last year and Family Secrets only ranked as the ninth most in-demand Turkish show in the US. This underscores the inroads Turkish content has made in the US over the past year and the new series that audiences here have discovered.

The majority of the most in-demand Turkish shows in the US have been dramas, similar to how K-dramas specifically have led demand for Korean content higher around the world. In particular, several of the top Turkish series are soap operas which has helped win fans in Latin America where telenovelas are a staple of TV programming in the region.

The Tailor(Terzi), which just premiered on May 2nd, shows how competition for these shows is starting to heat up. The show was originally scheduled to air on TV8 in Turkey but then Disney+ picked up the rights to the series to help bolster its standing in Turkey after launching in the market last June. However, it was ultimately Netflix that got the global streaming rights to the show and it premiered as a Netflix original.

The problem for US audiences (and opportunity for distributors) is the limited availability of these shows on platforms in the US. A majority of the most in-demand Turkish series have yet to find a streaming home in America. Hercai is available on Peacock and Resurrection: Ertugrul was just taken off Netflix in April. That means a lot of opportunity is left on the table. Picking up the rights to shows at the forefront of this emerging trend could be a savvy way for platforms in the US to stay ahead of the curve as American audiences continue to embrace more international content. Combining the insight of demand data into what audiences want with Parrot Analytics’ market leading datasets on the availability of shows by market helps identify these supply gaps for platforms and distributors to fill.