Mr. Bean, ITV

The winter holidays are not only a time for family, festivities and presents: For many people, watching traditional Christmas and New Years’ TV shows is just as important. The holiday period is often a great opportunity for audiences to catch up with all the shows that they have heard about over the year, but did not get around to watching at the time.

Using Parrot Analytics global demand data, we can see which shows benefited the most world-wide from these holiday audience trends. By seeing which shows rose most in demand, we can track which titles are the true holiday favorites and which 2017 shows people chose to catch up with.

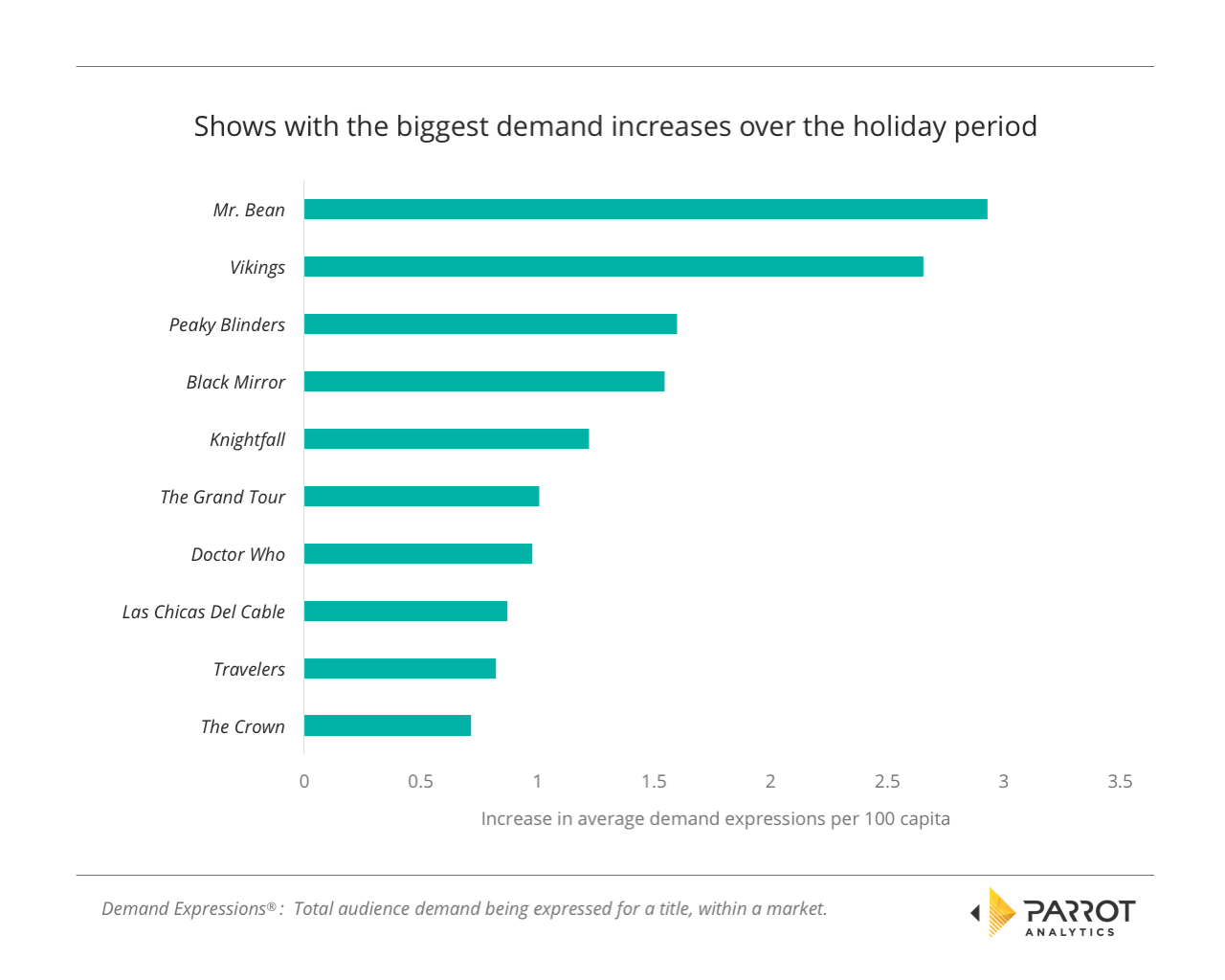

The TV shows with the biggest holiday increases

For the majority of people around the world, the holiday period ran from Friday December 22nd to Monday 1st January 2018. To ensure a fair baseline for comparison, the average demand for every show over the first two weeks of December 2017 was found. This was then compared to the average over the holiday period and the shows with the biggest increase in average demand identified.

The show that had the biggest increase in average demand from the early December baseline is one that may be surprising to many readers, but is obviously very familiar to audiences around the globe. This show is Mr. Bean, the Rowan Atkinson-starring comedy that debuted on Britain’s ITV all the way back in 1990.

However, on reflection Mr. Bean lends itself perfectly to worldwide holiday viewing. The emphasis on physical comedy and facial expressions and a near-absence of dialogue means the show travels well, with few cultural and language barriers to enjoyment. At the same time, the show has a gentle nature to it that meshes well with the spirit of the holidays; it can be enjoyed by the whole family. And perhaps most importantly, it’s a funny show! The data is very clear here: Mr. Bean is the king of holiday TV.

For currently active shows, the best performing network is the History Channel; the second biggest increase in demand is for their drama Vikings, which was airing season 5 over December, while their new crusades drama Knightfall premiered December 6th and had the fifth biggest increase.

The third biggest increase in demand is for BBC’s Peaky Blinders, which had its season 4 finale on December 20th in the UK, but this aired later during the holiday period in many other countries. The much-anticipated new Doctor reveal during the Christmas Special of Doctor Who also made an impact worldwide, with the seventh biggest demand increase.

Many of the remaining shows are Netflix originals or Netflix co-productions. The most successful of these is the dystopian sci-fi show Black Mirror in fourth position, which released a new season on December 29th and was clearly binged by many people before 2018 arrived. Las Chicas Del Cable and Travelers also benefited from worldwide Netflix releases during the holiday season. The Crown’s entire second season was released slightly earlier on December 8th, so the increase of demand for this show from early December to the holiday period means that it was a favorite choice for many people to watch, perhaps inspired by the real Royal’s activity over that time.

Finally, rival streaming service Amazon also had a popular holiday show with the new season of The Grand Tour increasing in demand enough during the Christmas break to be the sixth highest show on the list.

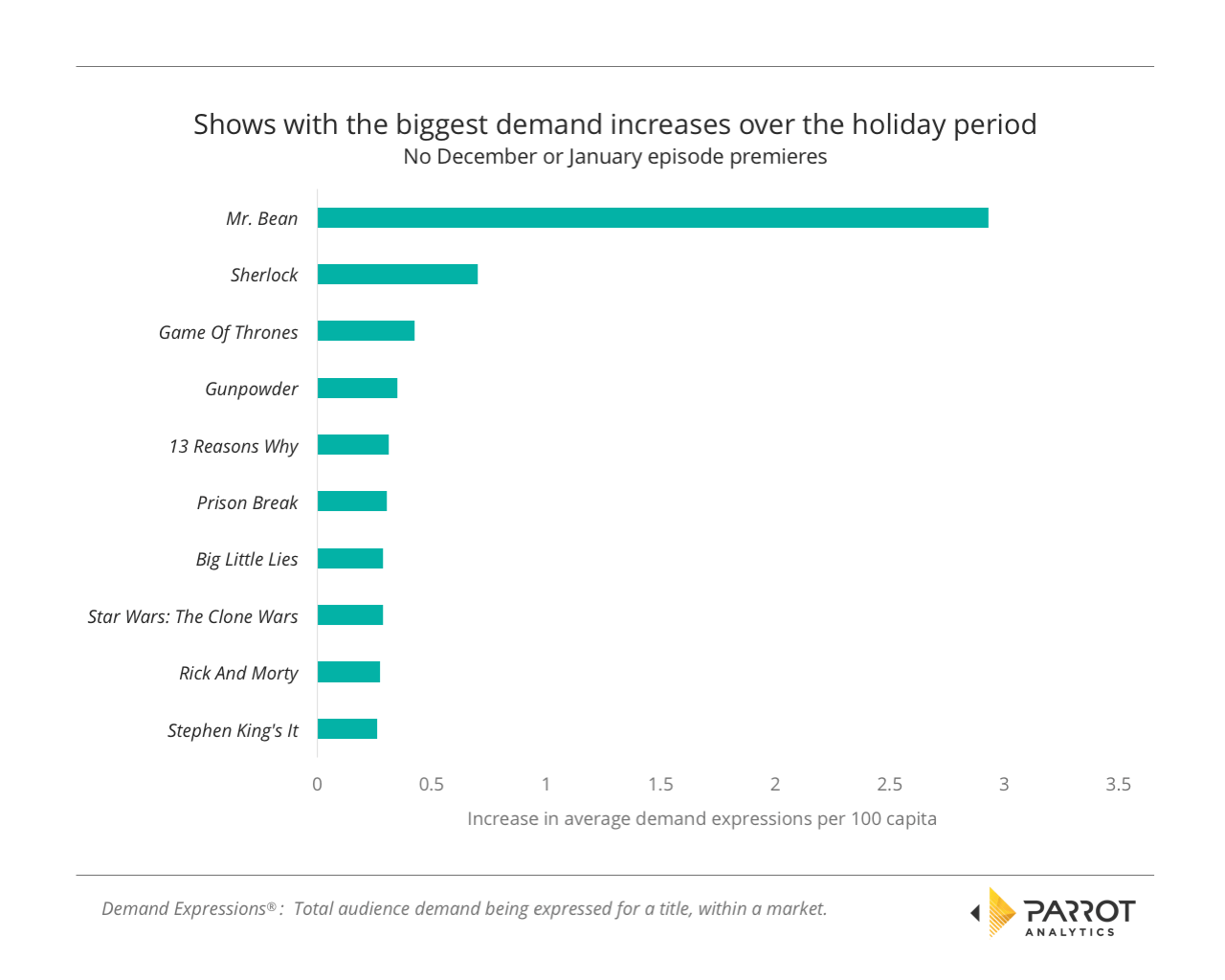

Inactive shows with the biggest demand increase that are not currently active

The previous chart favors shows that were actively releasing new episodes. Therefore, to get a different view of the data, we now exclude all shows with any release activity in December. We also exclude shows with upcoming activity in January 2018 to make sure we are not including any pre-release demand hype for those titles.

Mr. Bean also tops this list, as this show has not released new episodes recently nor has it plans to do so soon. Our analysis further shows that British shows take first and second place on this new list; although the BBC did not release a new season of Sherlock this year, this title had the second biggest increase in demand on this list. It seems people still see the holidays as a great time to watch Sherlock, even if there are no new episodes. Global audiences also took the opportunity to watch the BBC’s Kit Harington-starring historical drama Gunpowder, released in October.

Speaking of the Game Of Thrones star, we can also observe that lot of people decided – possibly after visiting family who are fans! – that the holiday time off was the perfect time to finally catch up with HBO’s fantasy epic.

13 Reasons Why’s subject matter is not very festive, but Netflix’s dark teen drama was also a popular choice for catch up viewing. It is joined on the list by two other high profile 2017 dramas that people caught up with over the holidays; Prison Break from FOX and Big Little Lies from HBO.

Popular films this year also influenced what people chose to watch over the holidays: The release of a new Star Wars film inspired fans and kids to re-watch The Clone Wars animation, while people also wanted to check out the ABC classic Tim Curry miniseries version of Stephen King’s It after the movie adaption was the horror hit of the year.

Finally, Adult Swim’s animated comedy Rick And Morty seems to be the show of choice for those who wanted to escape Yuletide cheer for a dose of hilarious nihilism.

Whatever you watched over the holidays, we here at Parrot Analytics hope you’ve had a great start to 2018!