The economic trends and principles shaping the streaming media industry - collectively known as Streamonomics - are transforming the entertainment industry, redefining how audiences consume content and how companies strategize for growth.

This quarter marked a significant turning point for the streaming industry, with most key participants reaching true profitability in their DTC segments. Disney’s swing from a $2.6B streaming segment loss in fiscal 2023 into a $134M profit in fiscal 2024 was a particularly impressive turnaround that Wall Street is rewarding.

Understanding the economics of streaming has never been more important for industry stakeholders. In this analysis we take a closer look at how key streaming economic metrics such as ARPU, churn rates, and regional subscriber breakdowns - which many conglomerates do not publicly release - are impacting the fortunes of entertainment giants worldwide.

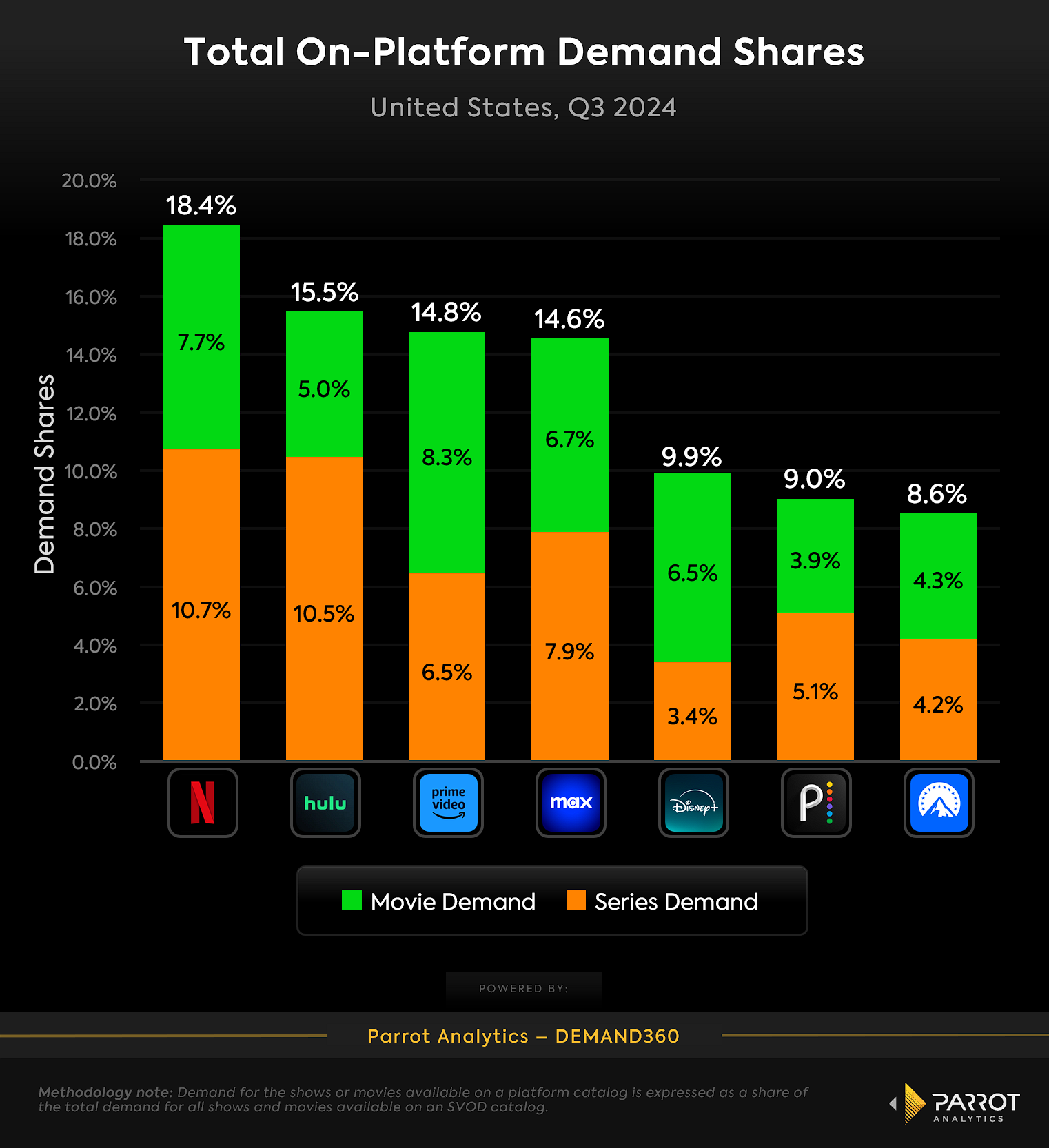

We analyze the major platforms from five media companies that control nearly two thirds of all US demand for TV content: Disney (Disney+ and Hulu), Warner Bros. Discovery (Max), Paramount Global (Paramount+), NBCUniversal (Peacock), and Netflix. We also include demand data for Apple TV+ and Amazon Prime Video, which make up a small percentage of their parent organization's business, but stand out in audience demand share and major awards recognition. This report analyzes their performances, challenges, and innovative approaches as they navigate an increasingly competitive landscape.

Netflix

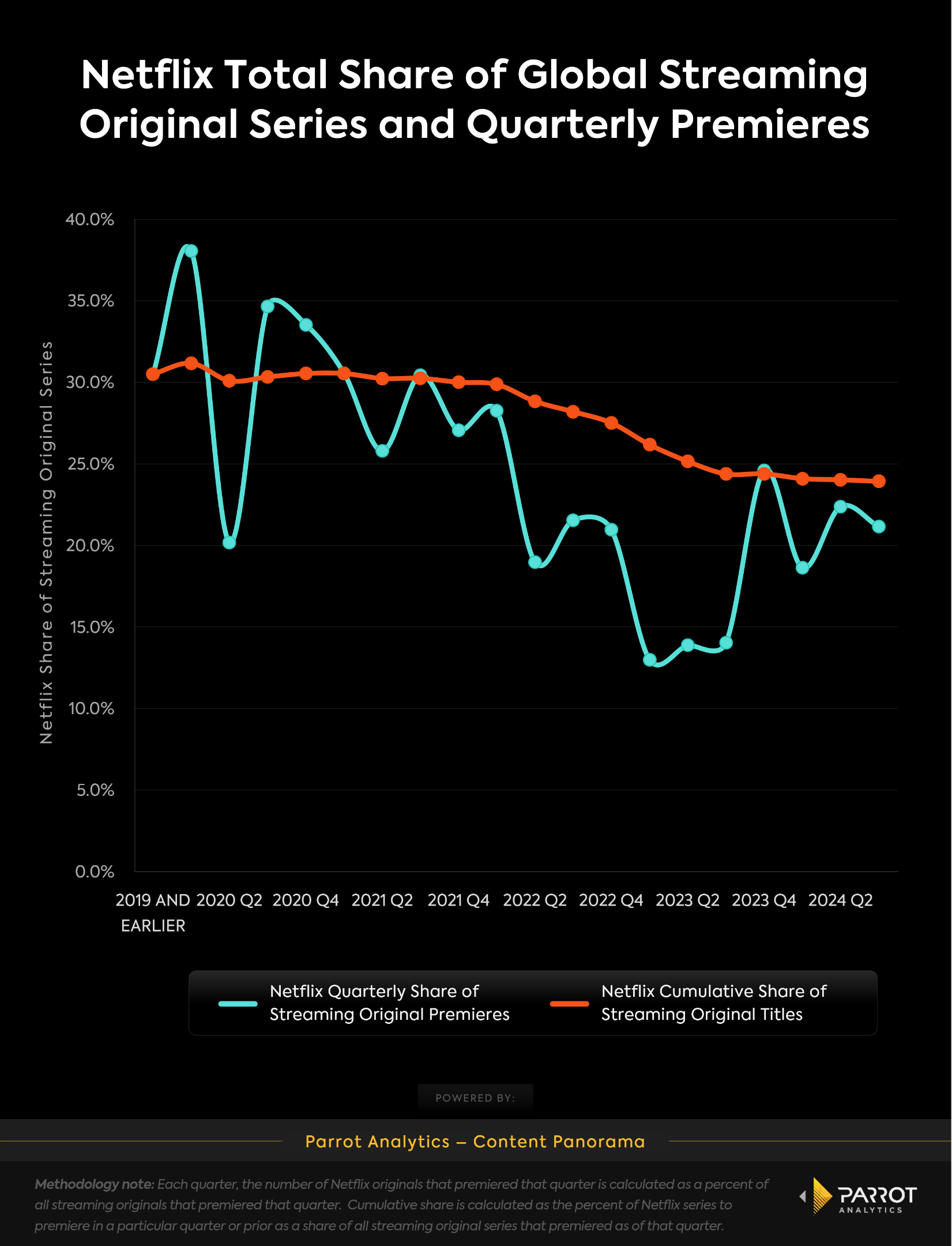

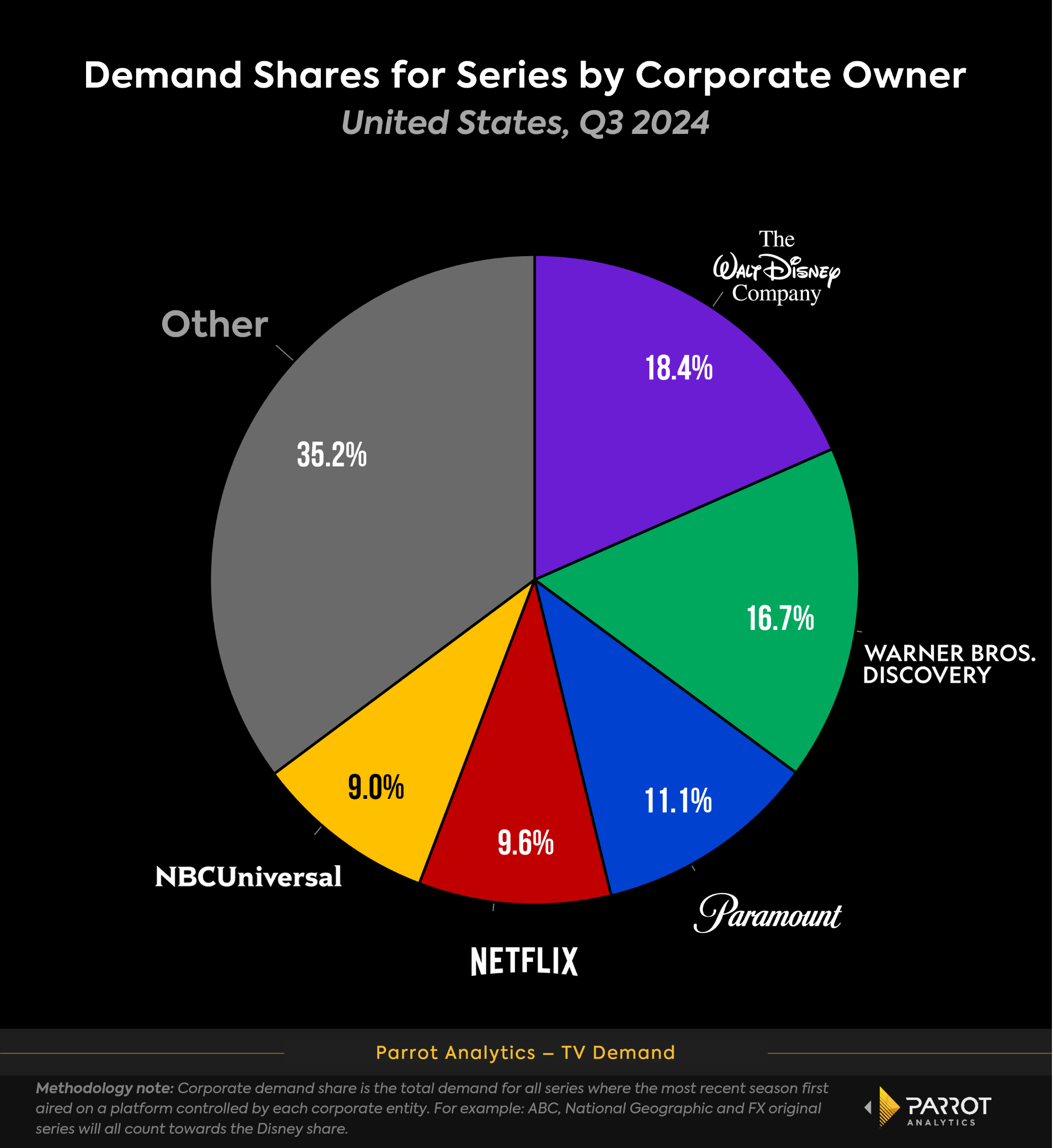

In Q3 2024, Netflix (9.6%) jumped ahead of a legacy studio - NBCUniversal (9.0%) - in Corporate Demand Share for the first time ever. This data assesses the long-term viability of media conglomerates and can help value a TV library. It also demonstrates lucrative long-term licensing potential, should Netflix ever tap into that revenue well.

In just 12 years since its first original "Lilyhammer" debuted, Netflix has built a more in-demand TV empire than NBCUniversal, whose original TV programming dates back to the 1940s. This milestone is a remarkable show of force for the streaming giant.

Fourth Quarter Outlook

Despite posting industry leading gains for the past few years (RIP Great Netflix Correction), Netflix will stop reporting subscriber numbers in 2025. Without subscriber numbers, Netflix will need a new growth narrative to spin to Wall Street. That’s where the service’s growing ad-supported tier comes into play. This represents an avenue to increasing revenue and profit over the long term while providing consumers with pricing flexibility.

It’s a continued segue into the streamer’s more broad appeal era that dovetails nicely with the company’s increasing emphasis on live events. Q4 2024 will see Netflix’s biggest attempts yet at live sports with the Mike Tyson-Logan Paul fight, as well as two NFL Christmas Day games. Beginning in 2025, weekly WWE programming is coming to the streamer.

Netflix will also rely on its roots - blockbuster original programming - in Q4, with its most successful international original finally returning in December. Can "Squid Game" Season 2 live up to the original’s hype and exceptional audience demand while serving as a bridge to other non-English content sampling for viewers? The future of Netflix’s international content strategy may well depend on it.

Disney+

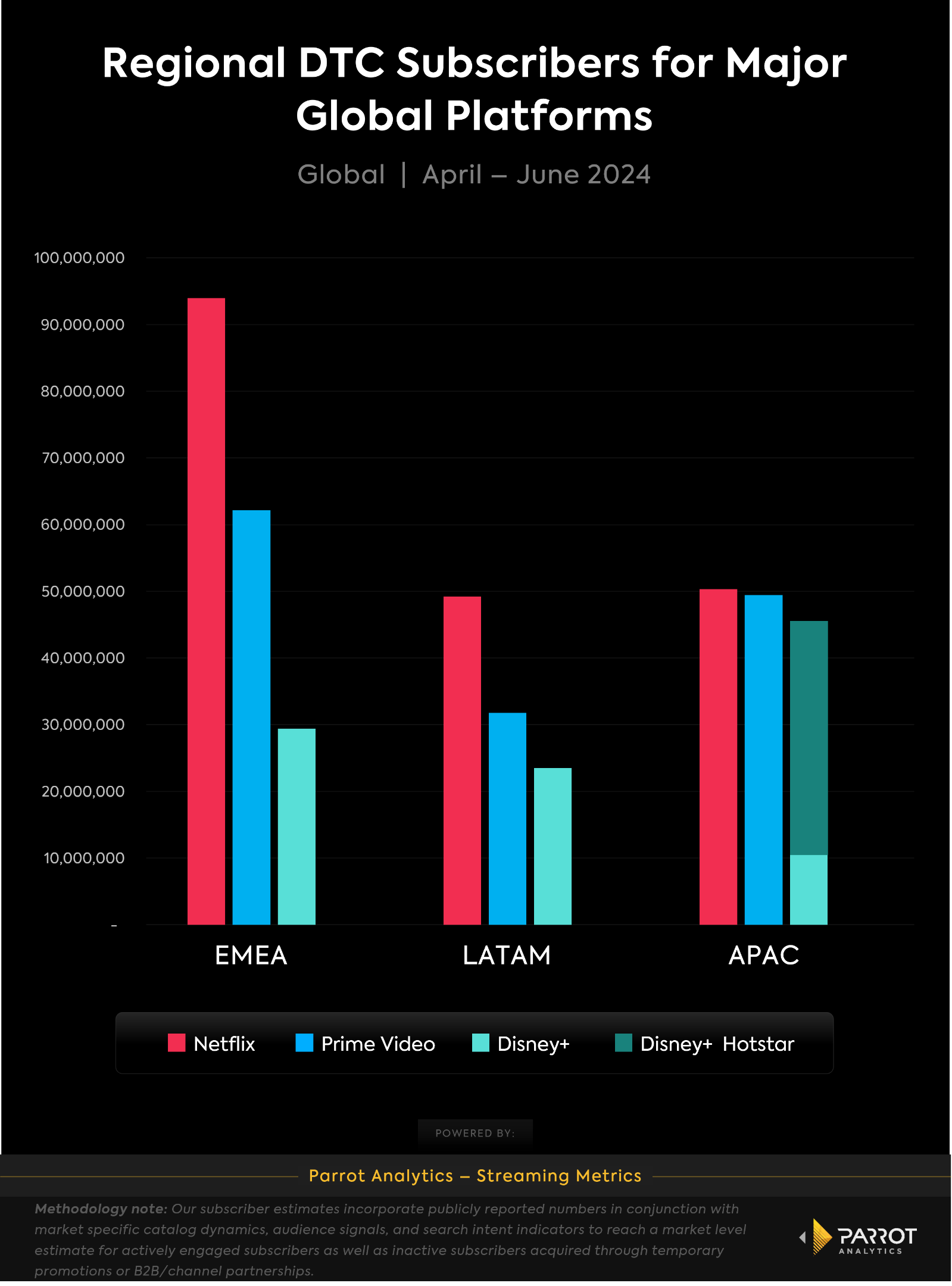

Per Parrot Analytics regional subscriber estimates, Disney streaming lags far behind its major global SVOD competitors Netflix and Amazon Prime Video in Europe, Middle East, and Africa (EMEA) and Latin America (LATAM). Netflix and Prime Video have prioritized heavily investing in local language content over the years, while Disney has focused more on exporting its English language content around the world.

Surprisingly, this tactic didn’t hurt Disney in Q3. On the contrary, the company reported a $321 million D2C profit when including ESPN+ as well as 4.8 million new Disney+ subscribers. That’s a big turnaround from the $387 million streaming loss the company reported in the same quarter a year ago. Clearly, box office hits "Inside Out 2" and "Deadpool & Wolverine", along with recent Marvel series "Agatha All Along" and the integrated Hulu programming are pulling their weight. Disney has more or less cemented itself as a streaming powerhouse that will survive the inevitable industry consolidation.

Fourth Quarter Outlook

The theatrical performance of "Moana 2" and "Mufasa: The Lion King" will help determine what level of Disney+ engagement we can expect in the new year. Following the costly failure of "The Acolyte", "Skeleton Crew" has the unenviable task of righting the Star Wars ship with its precocious cast. Fans are anxious for the upcoming second season of "Percy Jackson and the Olympians", Disney+’s only live-action hit outside of the Marvel and Star Wars franchises. From a content standpoint, Disney has some solid swings on the horizon.

Longer term, however, we’re seeing Gen Z audiences reluctant to engage with ad-supported tiers despite the lower cost. Granted, Disney revealed that 37% of Disney+ US subscribers are opting for the ad-supported tier and 30% globally. But can the younger-skewing streamer convince younger audiences to hop aboard and aid the company’s future-stretching monetization goals?

Hulu

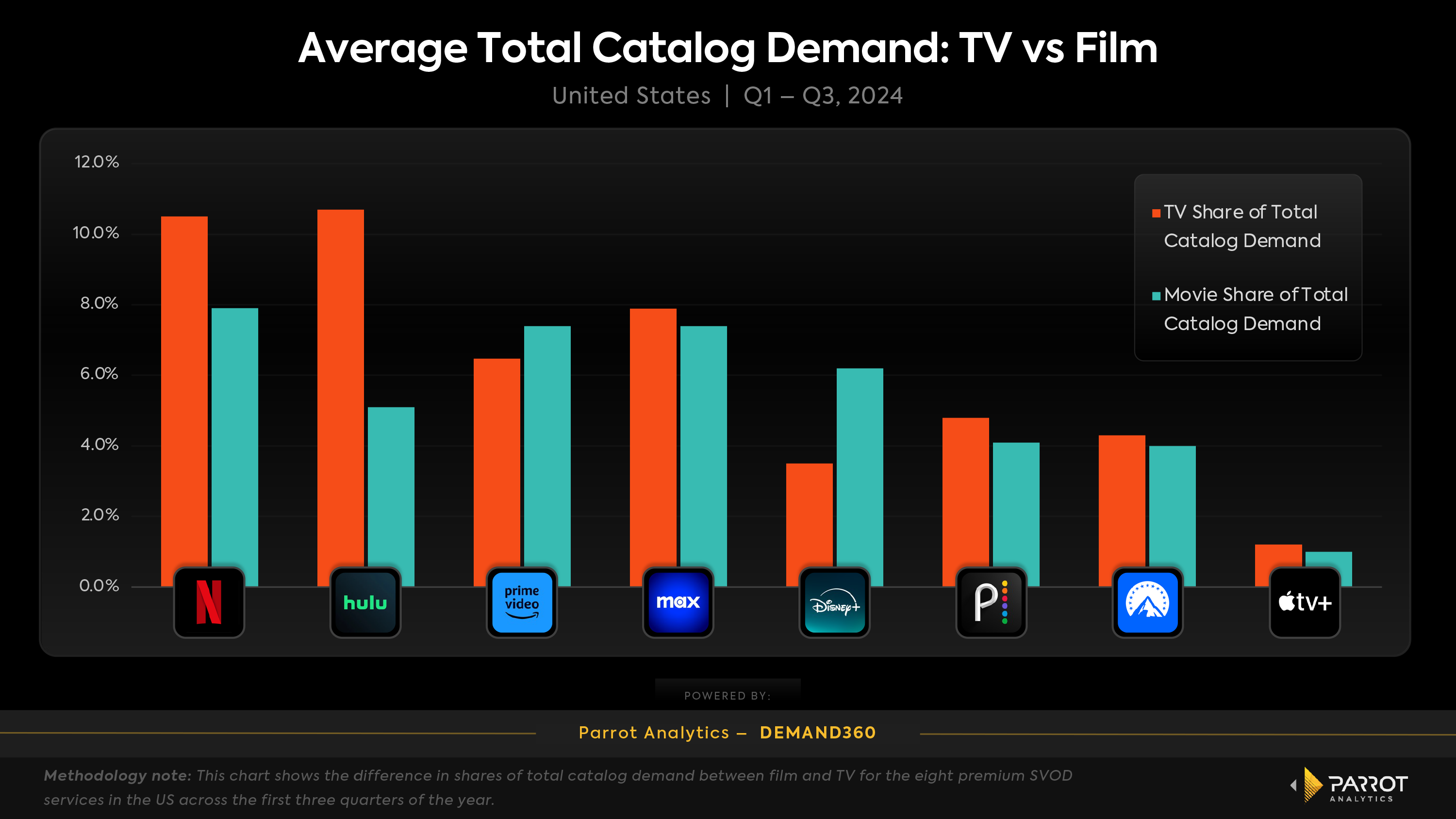

One reason why Disney+’s integration of Hulu is working is because of the complementary programming. Not only does Hulu provide more general entertainment and female-skewing content versus Disney+’s young male centric offerings, but it also balances out the content type. TV programming commands a significantly higher share of audience demand in the US on Hulu than movies, while movies command a higher share than TV on Disney+. The June launch of "The Bear" S3, the July arrival of "Futurama" S12 and the August debut of "Only Murders in the Building" S4 pair nicely with "Inside Out 2" and "Deadpool & Wolverine".

More than 67% of Hulu’s TV demand in the US derives from broadcast and cable series, providing a clear funnel of engagement from linear to streaming. More than 25% of Disney+’s audience demand for TV is generated by original series. Hulu boasts a significantly higher share of non-English programming than Disney+. Again, the two services simply just work well together.

Fourth Quarter Outlook

How will FX’s "Say Nothing" perform on the service after many of the vaunted network’s limited series have drawn praise from critics but not always resonated with general audiences? Will viewers be invested in the final season of "The Handmaid’s Tale" in 2025 given the highly charged political climate? Does the multi-year wait for future seasons of "Shogun" diminish enthusiasm over time? Hulu must contend with a fair amount of content questions in the near and far future.

More important is the fate of Hulu + Live TV, which has remained flat over the last year. Once Disney’s seemingly never-ending buy out of Comcast’s stake in Hulu is completed, the company must decide if it wants to invest the resources necessary to position the vMVPD to compete with YouTube TV or if it should be shuddered to focus on ESPN’s forthcoming OTT offering.

Max

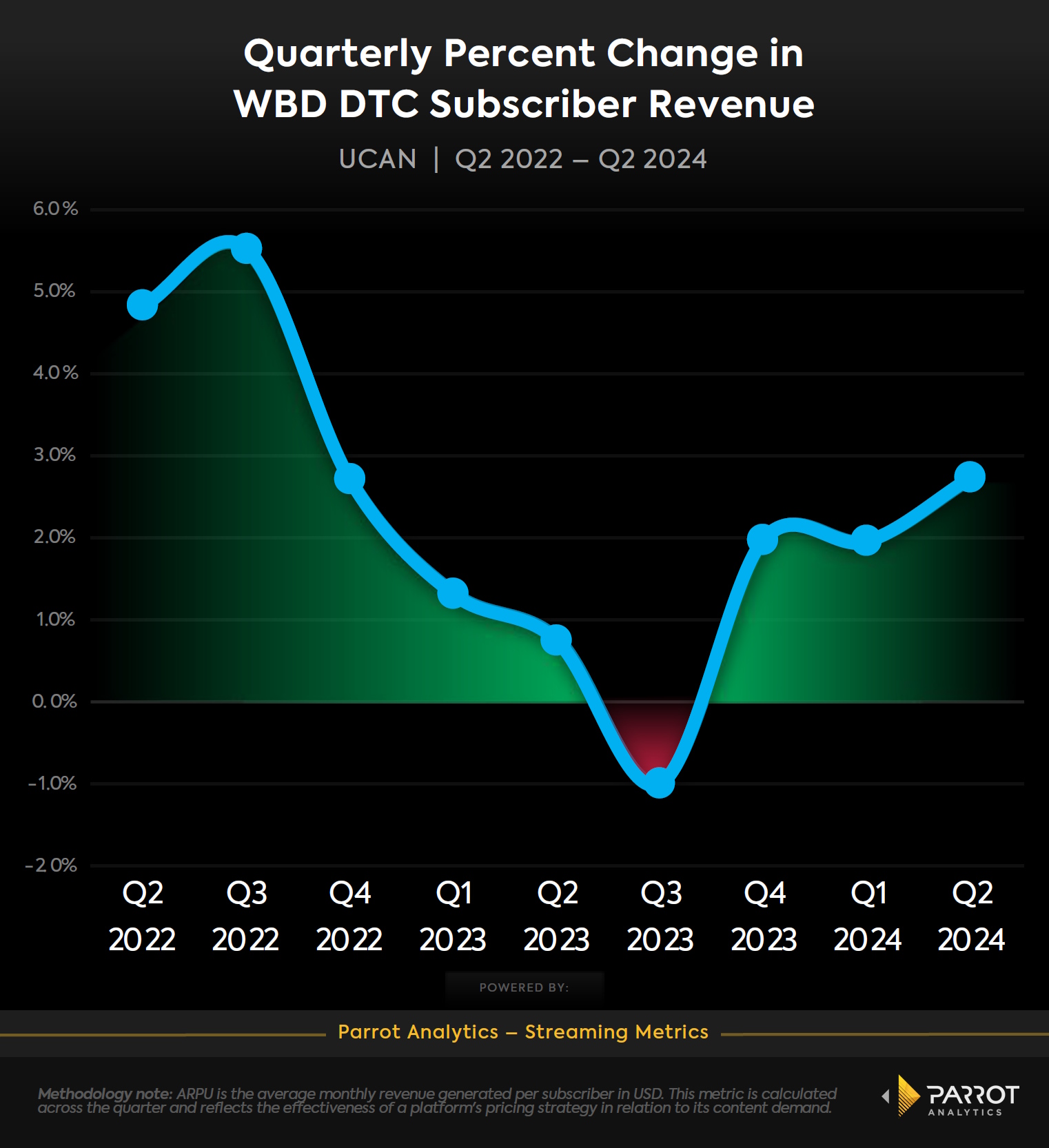

Warner Bros. Discovery reported the industry’s largest global subscriber gains in Q3 2024. That said, WBD’s OTT performance remains mixed when it comes to streaming economics. According to Parrot Analytics’ Streaming Metrics model, revenue growth for the company’s streamers has been inconsistent.

After launching in April 2022, WBD’s streaming revenue growth rate increased in Q3 2022 before falling for four consecutive quarters. This coincided with a decline in both UCAN and global subscribers over the same time. While the streaming revenue growth has rebounded, UCAN subscriber growth has been frustratingly flat. Further analysis reveals that revenue from HBO and Max subscribers makes up 88% revenue for the company’s DTC UCAN segment as of Q2 2024, with Discovery+ accounting for the remainder.

Fourth Quarter Outlook

WBD will launch Max in APAC in Q4, which should set the stage for immediate global subscriber growth. However, these subscribers will likely deliver a lower ARPU than those from UCAN or EMEA. With a new federal government setting up shop in early 2025, CEO David Zaslav is already speaking into existence a friendlier M&A environment. WBD is very much on the fence of being a company that should try to go it alone, or consolidate.

Revenue growth, cost cuts, and demand for HBO series offer some optimism for profitability, but fundamental questions remain about WBD's endgame. The need to diversify revenue sources beyond cable remains critical, as legacy models become increasingly unsustainable in a streaming-driven world. WBD’s path forward will depend on its ability to leverage its content library, expand globally, and navigate challenges tied to Pay TV and debt obligations.

Paramount+

Believe it or not, Skydance-Paramount was only announced at the beginning of Q3 2024. This deal represents a fitting microcosm of recent entertainment trends, shifting ownership of one of Hollywood’s iconic institutions into the hands of one of the nation’s wealthiest families, whose fortune comes from Big Tech. Incoming CEO David Ellison will bring a welcome fresh face to the ranks of conglomerate leaders, and he will be the youngest major media head by well over a decade.

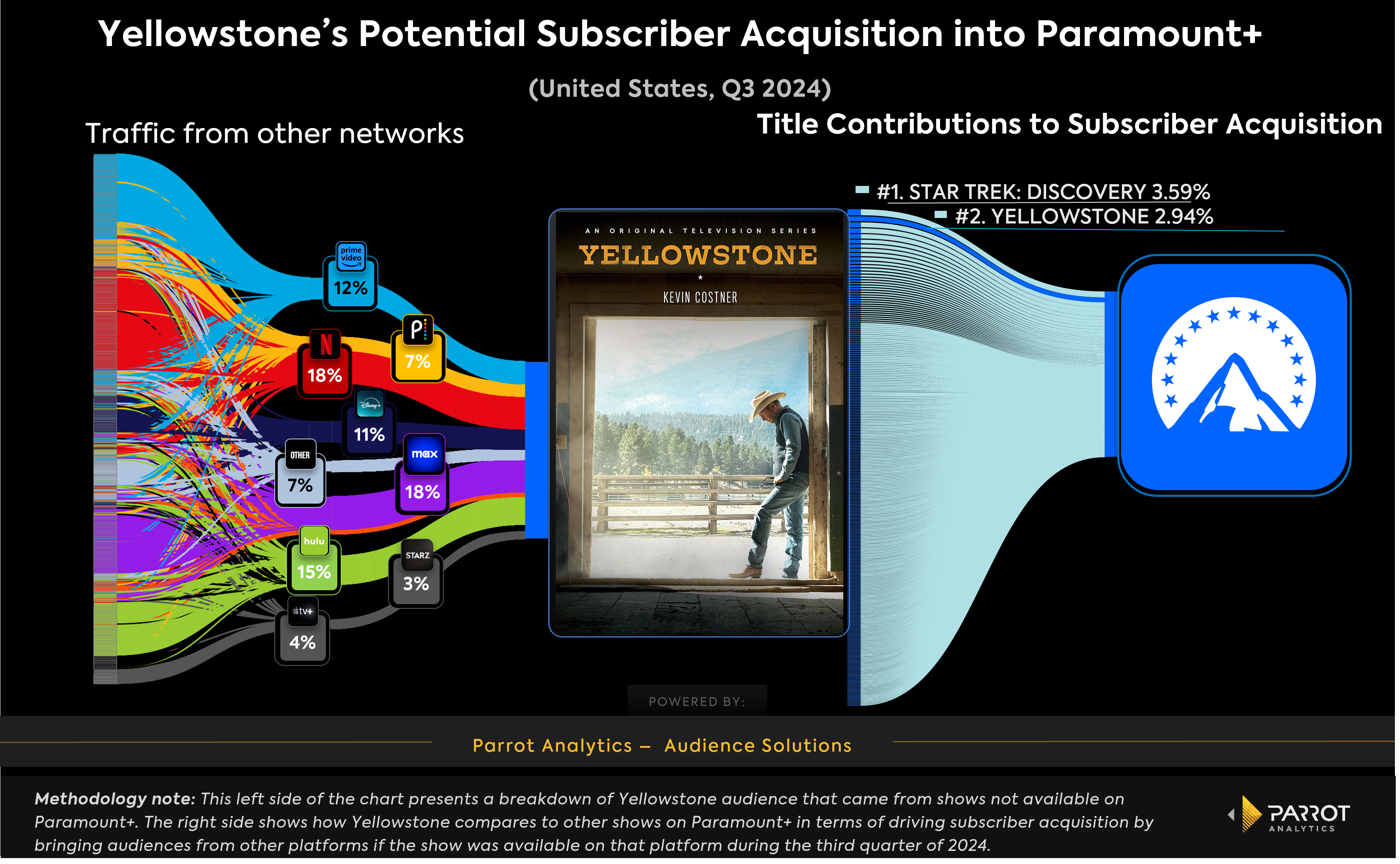

Paramount+ is far behind industry leaders in scale, but it has steadily grown since rebranding from CBS All Access in 2021. The company’s streaming originals have achieved notable success. In Q3 2024, Paramount+ originals accounted for 4.7% of global demand share with only 2.0% supply share. This 2.29x demand-supply share ratio trailed only Apple TV+ (2.92x) for the quarter. Paramount+ may have untapped value in original content, including hit franchises like "Star Trek" and creator Taylor Sheridan’s numerous series, which consistently drive subscriber engagement and acquisition.

Fourth Quarter Outlook

This earnings season has seen legacy media CEOs reevaluate their linear assets and vast content libraries, publicly signaling strategic shifts in an ever-evolving landscape. Paramount’s strengths in original content and licensing potential provide valuable assets as streaming and Pay TV converge. However, the incoming Skydance team will need to revitalize blockbuster IP. While Star Trek has excelled on Paramount+, it hasn’t had a theatrical release since 2016, and the Transformers and Mission: Impossible franchises have limited upside. Expect new ownership to refine Paramount’s streaming strategy, balancing in-house exclusivity with licensing and strengthening competitive positioning - with closer ties to the NFL and fresh IP initiatives.

Peacock

Corporate demand share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their own platforms, and can effectively help value a conglomerate’s legacy and library content in aggregate. For the first time ever, Netflix has overtaken one of the legacy studios in this category. Netflix has steadily cut into NBCUniversal’s fourth place position of late, from trailing by -0.9% in Q1 2024, to -0.3% in Q2 2024, to now leading by 0.6% in Q3 2024. In other words, there is more demand for Netflix’s original TV catalog - which started in 2012 - than that of NBCUniversal - whose original TV programming dates back to the 1940s.

Now, Peacock still managed to add 3M new subscribers in Q3 ("Love Island USA" is a smash hit). But its domestic focus - Peacock is only available in six markets - has kept its subscriber total (36M), its quarterly revenue (between $1 billion and $1.5 billion), and profit (it’s the only major streamer to lose money on paper this past quarter) among the basement of premium SVOD competition.

Fourth Quarter Outlook

Peacock narrowed its losses in Q3 2024 compared to the year prior, but still isn’t a profitable streaming service. Comcast has a diversified enough business to not be as impacted by the decline in pay-TV as Paramount Global and Warner Bros. Discovery, but it can’t subsidize streaming losses forever.

According to Parrot Analytics’ Streaming Metrics, since hitting an all time high back in Q4 2022, Peacock’s ARPU has fallen in the quarters since. Part of this may be due to the service’s rapidly growing ad-supported tier, which drags down ARPU temporarily but provides more long-term monetization upside. The streamer doesn’t command as significant costs as its rivals given the company’s apathy towards international expansion. But some sort of strategic partnership may be necessary for greater scale.

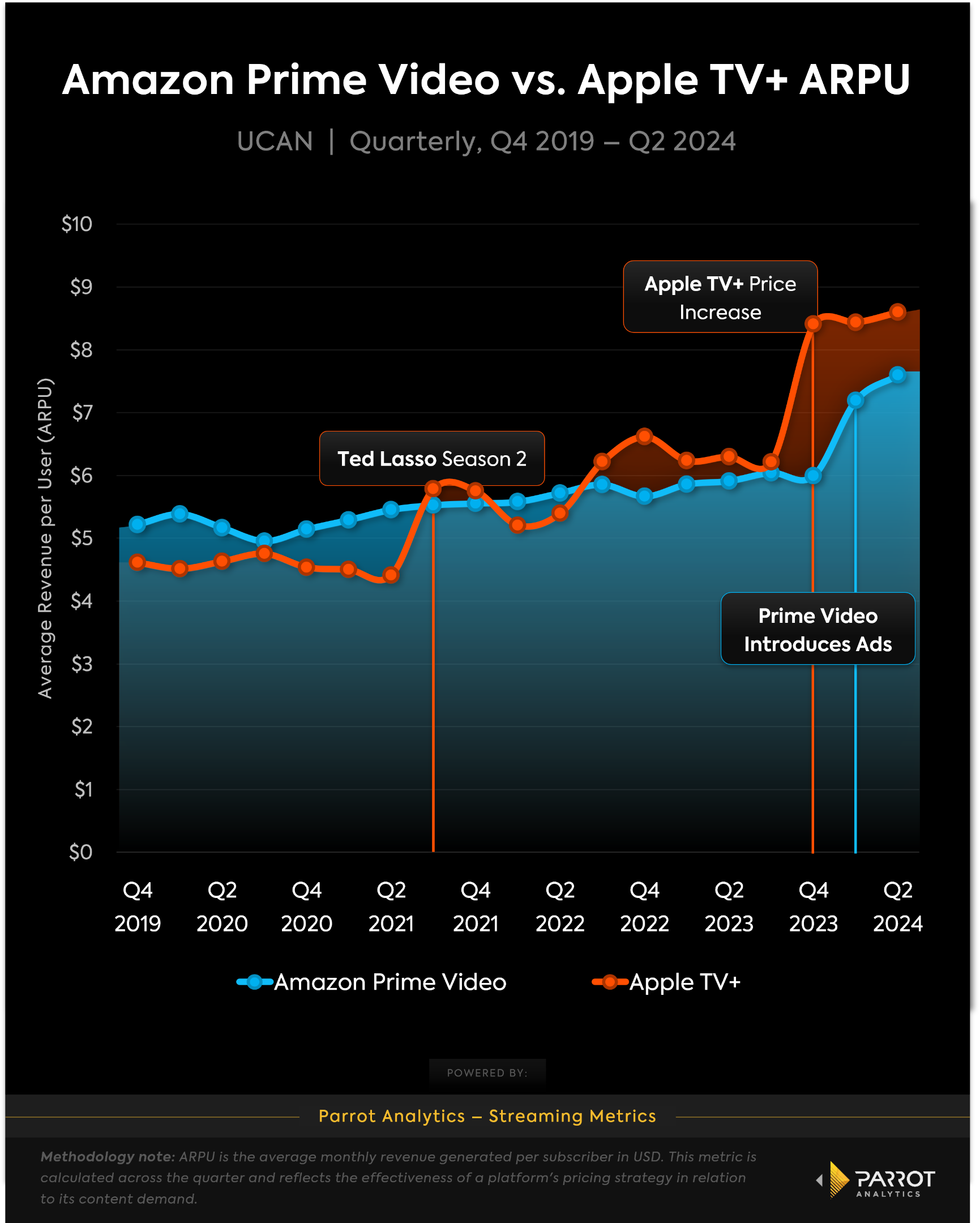

Apple TV+

Apple TV+’s major price hike has driven the most significant jump in ARPU and revenue, despite leading to an immediate uptick in churn. Apple saw a notable increase in revenue in the quarter in which these changes were implemented. Specifically, a 33% increase in quarterly UCAN revenue in Q4 2023 after its price hike. While the 43% price increase for Apple TV+ led to increased churn, it helped the platform better monetize its subscribers like a traditional SVOD business model and resulted in a substantial jump in revenue.

Apple TV+ was likely able to pull this off without a mass exodus of subscribers because it ranks third in original demand share at 8.8%, trailing just Amazon Prime Video (9.4%) and Netflix (36.2%). The bulk of "Presumed Innocent"’s demand fell in Q3 while "Ted Lasso" and "Masters of the Air" remained popular choices on the platform.

Fourth Quarter Outlook

Limited series "Disclaimer", "Bad Monkey" Season 1 and "Shrinking" S2 hit Apple TV+ in Q4 while "Silo" S2 is right around the corner. All four shows, along with "Ted Lasso", rank among the top five most in-demand series available on the streamer thus far through Q4. With "Severance" S2 arriving in January, Apple TV+ is enjoying a strong run of original content.

But with a US library that is nearly 4,000% smaller than Netflix’s, Apple TV+ must consider licensing larger blocks of external programming in order to extend user engagement. The longer a subscriber spends within a given digital ecosystem, the better churn rate that platform generates which improves the lifetime value of that customer. Apple’s star-studded premium originals have garnered acclaim and affection from its loyal audience. But more broad appeal is needed to ignite greater growth.

Amazon Prime Video

Amazon Prime Video has seen significant ARPU gains in the last year, led by pricing changes and hit seasons of flagship shows like "Rings of Power" and "The Boys". The "Lord of the Rings: Rings of Power" returned to success in its second season, peaking as the second most in-demand show worldwide across all platforms during its run.

The third season of "Thursday Night Football" is off to a roaring start - viewership is up 36% versus just two years ago, and Prime Video is getting more favorable matchups. Amazon’s ad revenue, which includes Prime Video, is seeing benefits from the streamer’s conversion to ad-supported as the company was a 19% increase year-over-year.

Fourth Quarter Outlook

Prime Video's strategy goes beyond content differentiation - it signals a bold commitment to becoming a one-stop destination for diverse global audiences. Firmly positioning itself as a top 2-3 global streamer alongside Netflix and Disney+, Amazon’s investment in high-octane original series such as "Jack Ryan" and "Reacher" - shows that might have thrived on CBS a decade ago - reinforces its core "Dad TV" appeal. Beyond scripted content, Prime Video’s growing focus on sports streaming is setting the stage for it to lead in this rapidly evolving space.

With the acquisition of NBA rights starting in the 2025-26 season, alongside an expanding live sports portfolio that includes the NFL and MLB in the U.S. and the NHL in Canada, Prime Video is challenging traditional broadcasters and staking a claim for long-term dominance. The NFL’s current media rights deal allows an opt-out in 2030, and it’s clear Amazon executives are gearing up to expand their footprint beyond "Thursday Night Football", potentially securing a larger share of the league's lucrative media rights in the years to come.

Conclusion

As the streaming wars intensify, each platform is pioneering new ways to attract and retain subscribers - be it through groundbreaking original content, strategic partnerships, or ventures into live sports.

The shifts and trends highlighted in this report underscore the dynamic nature of the industry. Understanding these movements is crucial for stakeholders aiming to capitalize on emerging opportunities in this digital era. Welcome to the future of entertainment driven by Streamonomics.