Image: Killers of the Flower Moon, Apple TV+

Apple is strategically aiming to expand its influence in the streaming landscape via its service, Apple TV+. After investing heavily on high-profile TV shows such as Ted Lasso and For All Mankind, the company is now investing in blockbuster movies such as Killers of the Flower Moon and Napoleon to draw in discerning viewers.

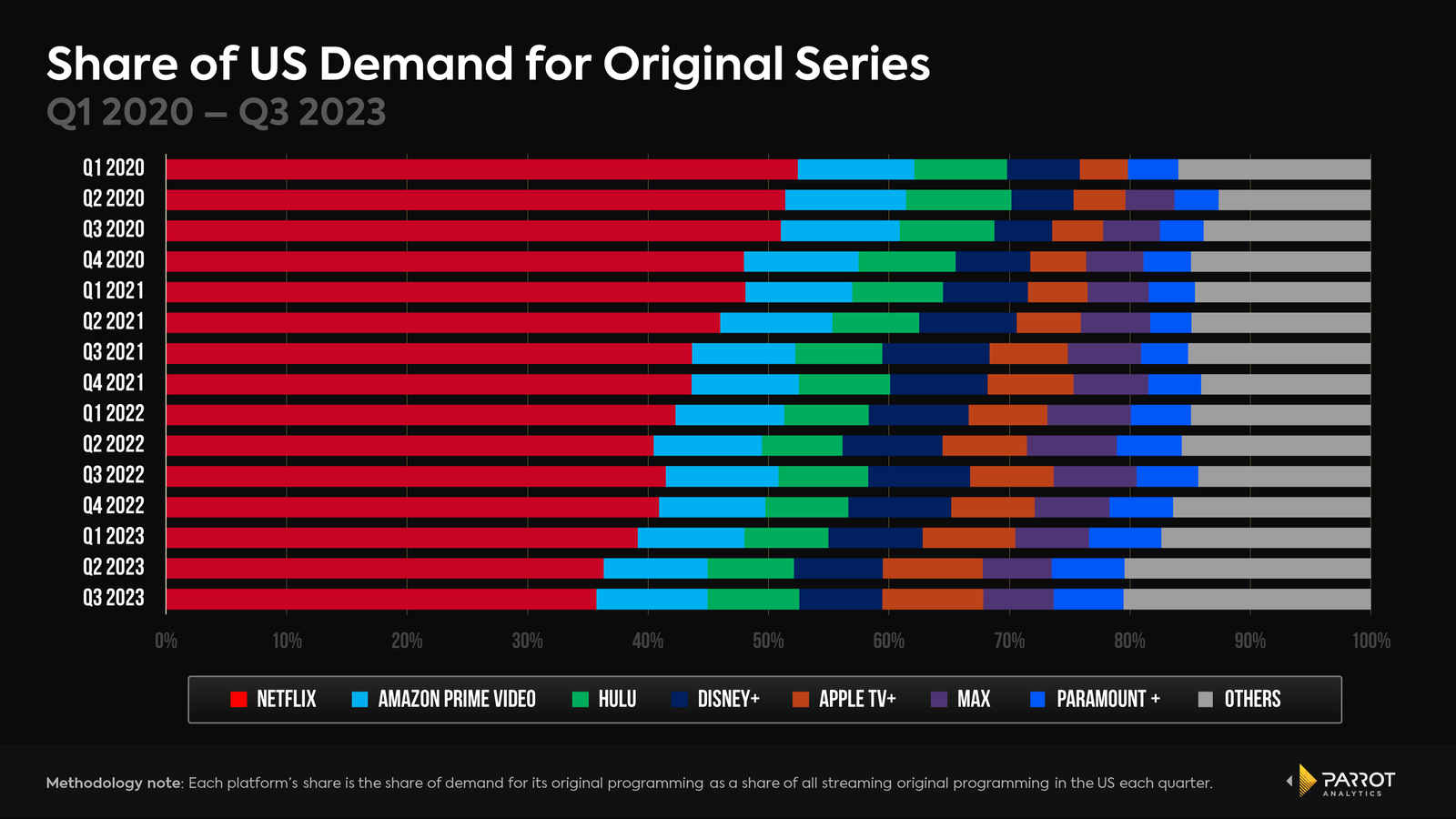

The hallmark of Apple’s streaming approach is a dedication to quality rather than quantity. Apple TV+ has a modest-sized catalog, especially when compared to other subscription video-on-demand (SVOD) services, choosing to focus largely on original content. Despite this, Apple TV+ has made a notable impact, capturing 8.3% of the demand for streaming shows in the U.S. market in the third quarter of 2023—remarkable when considering that its originals constitute just 2.1% of the total number of streaming originals.

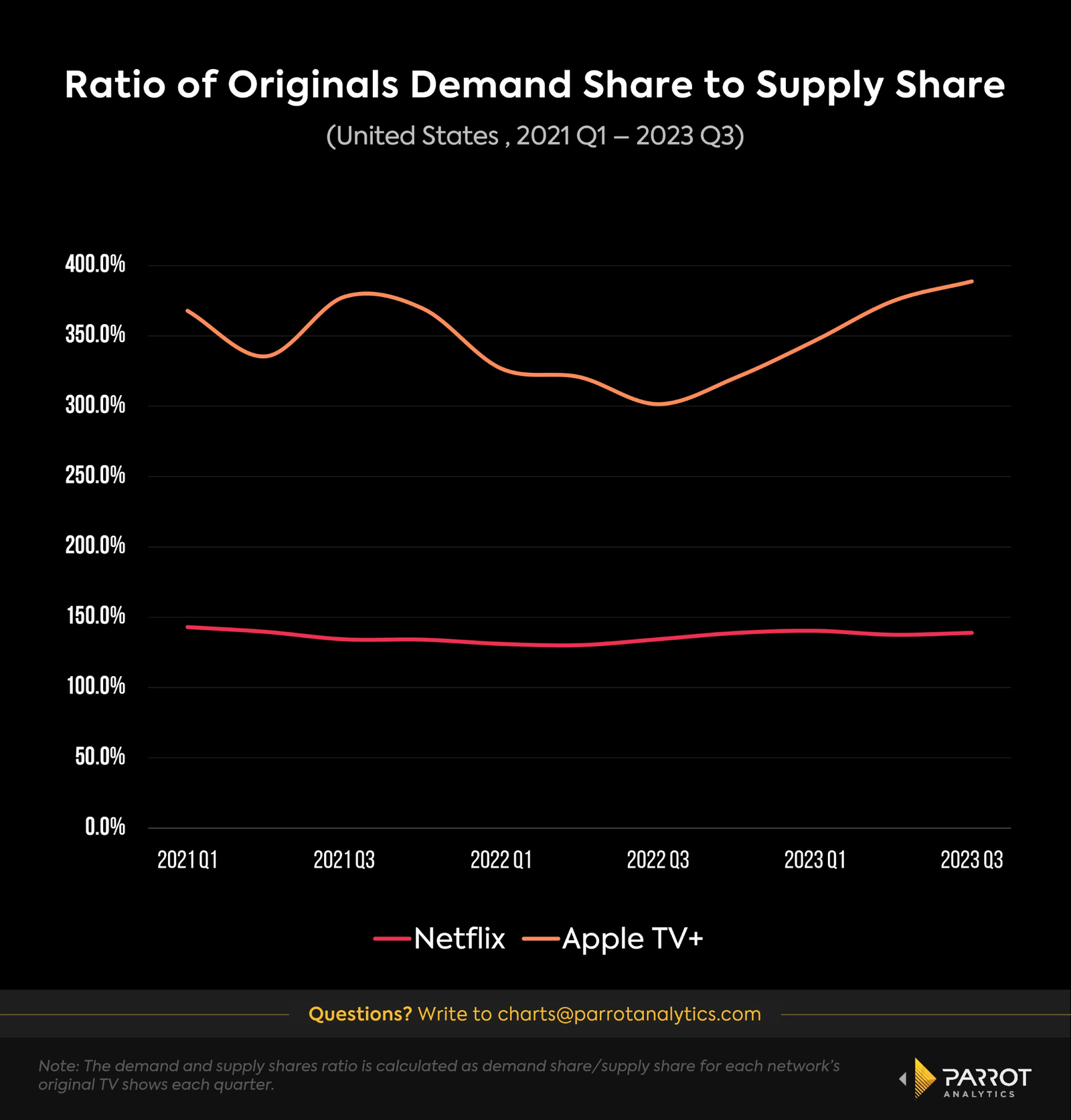

A key metric showcasing Apple TV+'s success is the ratio of its demand share to its supply share. In Q3 2023, this ratio was 388.9%, which means that its demand share was 288.9% higher than would be expected due to its number of shows. This is a significant rise from 301.4% in the same period the previous year. To put this in context, Netflix’s originals have maintained a steady demand share at 138% of its supply share since Q2 2021.

Despite the strong performance of Apple TV+ releases, the service faces challenges, particularly in maintaining subscriber interest over time. Its limited catalog struggles to keep subscribers engaged in the lulls between anticipated original releases. For sustained subscriber retention, a broader array of content, including highly re-watchable franchise titles and sitcoms, is typically beneficial. Apple TV+ is committed to premium programming, much like HBO, which can be highly buzzy but somewhat niche from a general commercial standpoint.

In terms of overall catalog demand, Apple TV+ captures 1.7% of the demand across all SVOD platforms. The success of Apple's original programming suggests a strategic direction for the service, yet expanding its catalog is essential for Apple to grow its subscriber base further.