At Cartoon Business, Parrot Analytics' Alex Cameron presented a talk on key trends in for animated content. The presentation looks at the state of the animation industry, trends in particular types of animated content, and ultimately how much revenue animation can drive in the streaming era.

Outlined below are some key insights from the report:

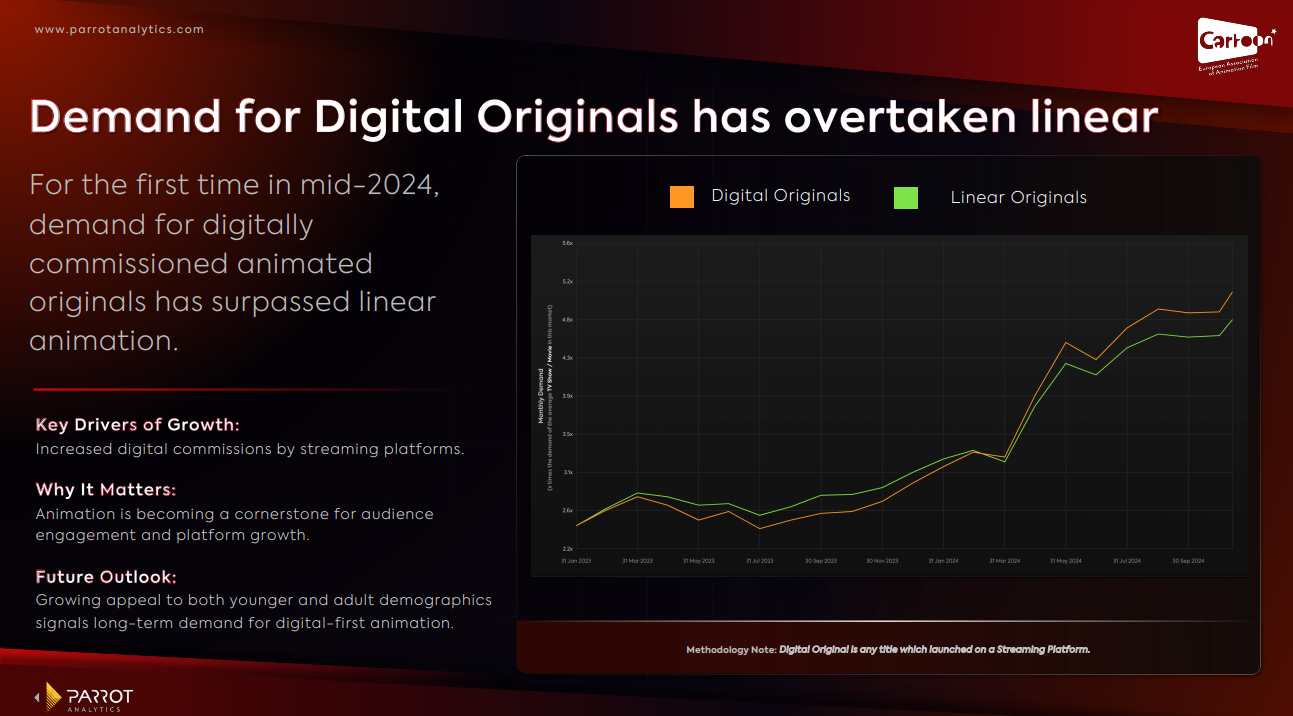

Animation’s Shift to Digital Originals

- In mid-2024, demand for digitally commissioned animated content surpassed traditional linear animation, highlighting the growing dominance of streaming platforms in this space.

- This trend signals that platforms need to accelerate their investment in digital-first animation, particularly to target younger demographics who are driving this shift.

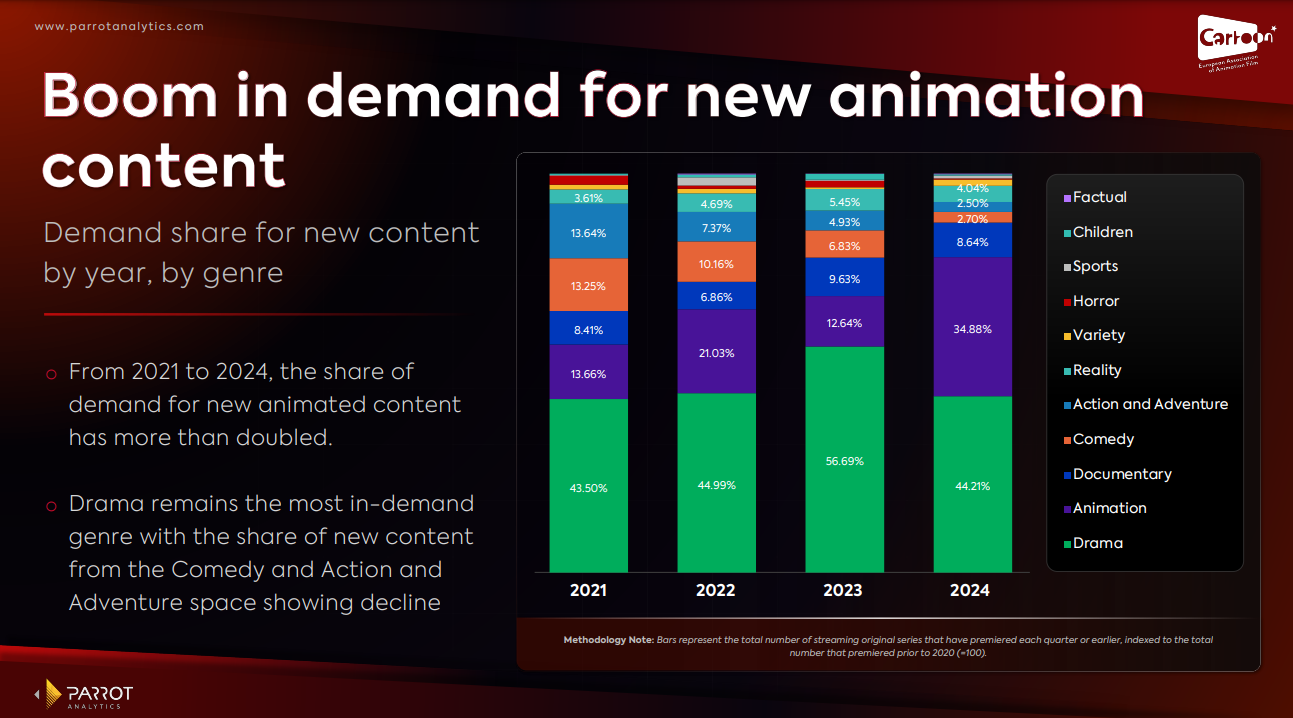

Demand for Animation Surges

- Since 2021, the share of demand for animated content has more than doubled, while traditional genres like Action & Adventure, Comedy, and Drama have seen declines

- This indicates a clear opportunity for platforms to invest more in animation as a way to meet shifting audience preferences and drive engagement.

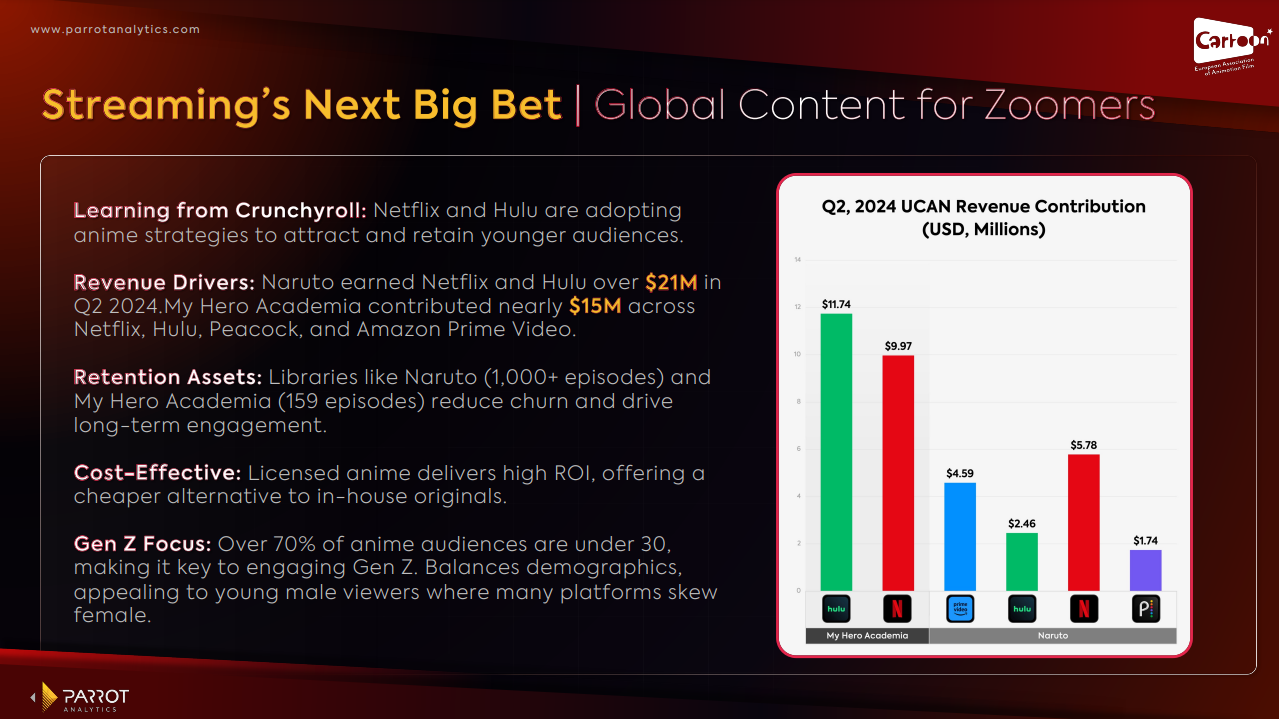

Licensing Animation for Growth

- Licensing popular anime titles like Naruto and My Hero Academia has proven to be a highly effective strategy for platforms like Netflix and Hulu, offering high returns on investment while reducing churn.

- The growing popularity of anime among younger audiences makes it a cost-effective strategy for platforms aiming to engage Gen Z.

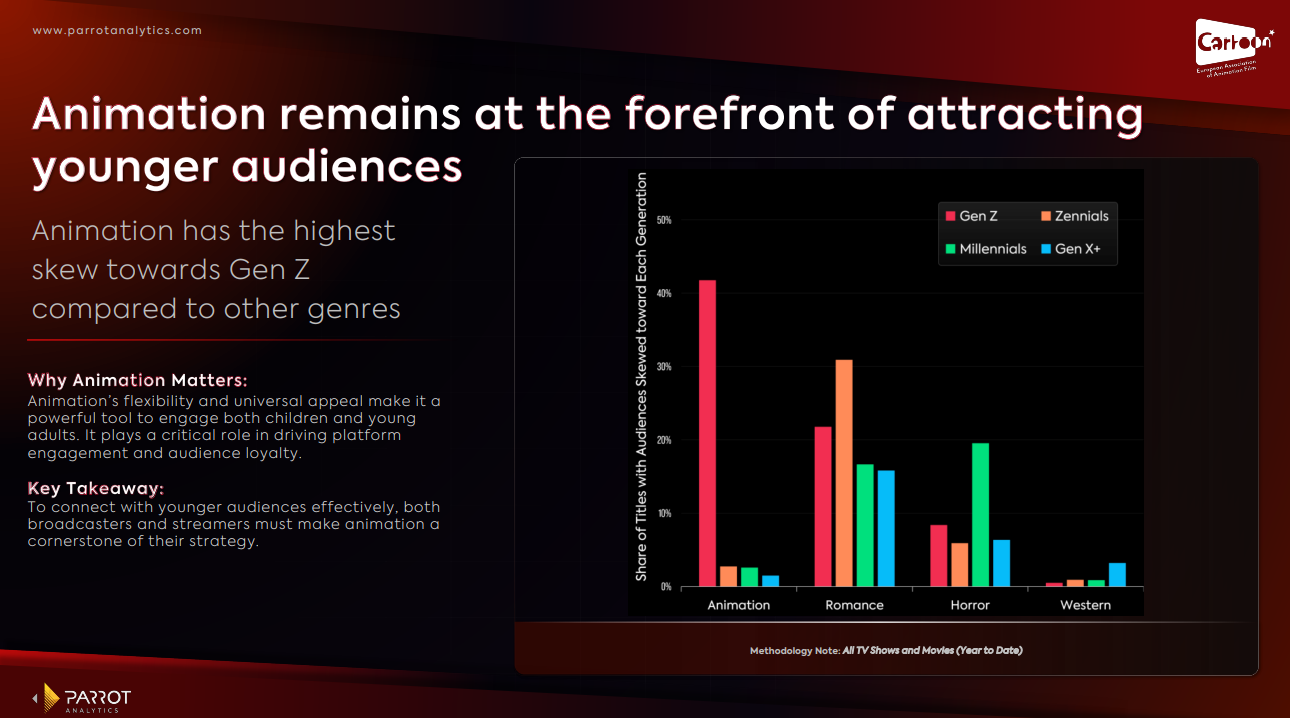

Animation's Growing Appeal to Gen Z

- Animation remains a powerful tool for engaging Gen Z, who represent a significant portion of the audience consuming this content. More than 70% of anime viewers are under 30, making it essential for platforms to prioritize animation as a cornerstone of their strategies to retain younger audiences and build long-term loyalty.

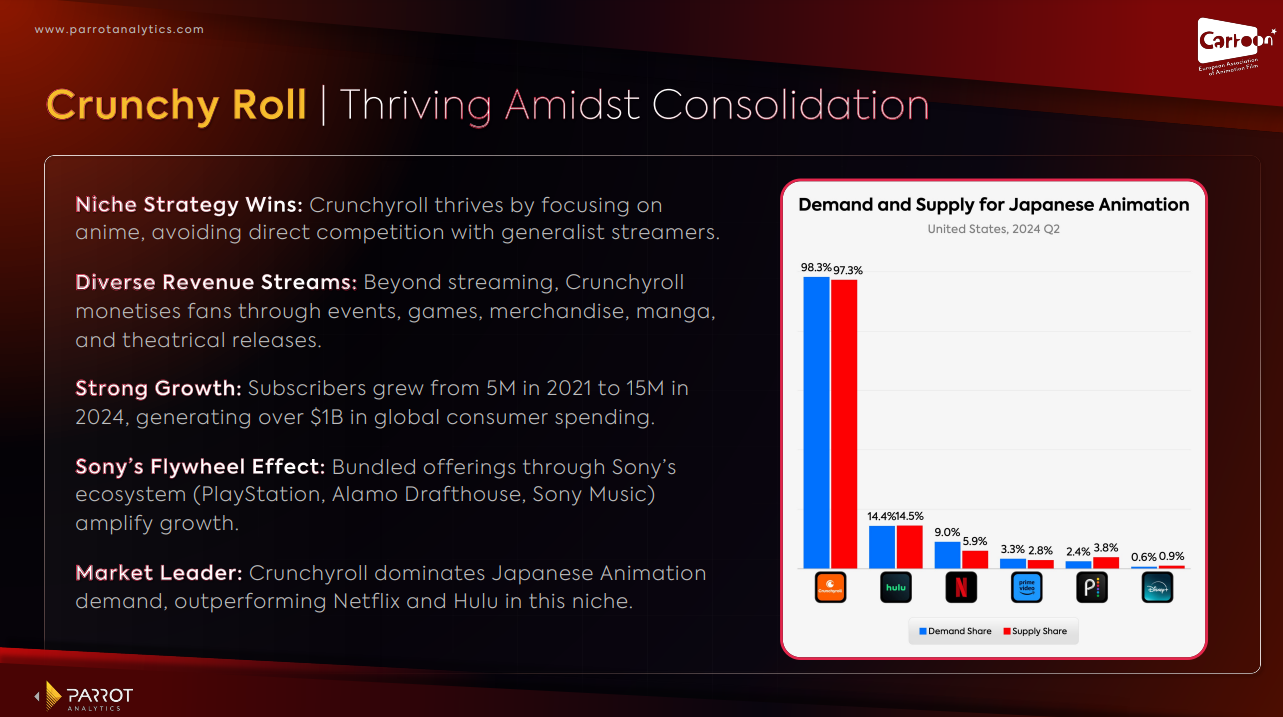

Crunchyroll’s Success in the Anime Niche

- Crunchyroll’s success, which saw its subscriber base grow from 5 million in 2021 to 15 million in 2024, demonstrates the value of focusing on niche content like anime.

- By avoiding direct competition with generalist streamers and offering a diversified revenue model—including events, merchandise, and games—Crunchyroll has become a key player in the anime space.

By aligning content strategies with the rapidly evolving animation landscape, entertainment executives can position their platforms to capitalize on this growth genre. These are just a few of the insights featured in the full report.

Download the full report here to explore additional insights into the global value animation.

To know more about Parrot Analytics' full suite of entertainment analytics and content valuation products, visit the link here.