FAST (free ad-supported streaming TV) has been growing and shaking up the streaming world. As this model of monetizing viewer attention is catching on it’s looking like everything old is new again. After all, broadcast TV was the original free ad-supported platform. Today even Netflix is talking openly about bringing ads to its subscription model. FAST platforms which have built their core strategy around an entirely ad-supported model are suddenly looking prescient.

Freevee, Amazon’s FAST platform has noticeably received more attention from its parent company lately. It was rebranded from IMDb TV to the sleeker sounding Freevee in April and has begun expanding into international markets - first to the UK in 2021 and to Germany just this month.

Perhaps one of the best indicators of Amazon’s increased focus on its FAST platform was the announcement that it plans on growing the number of Freevee originals by 70%. In general, with their focus on value, FAST platforms have not been major players in original content. At a price point of $0 it is a lot easier to convince subscribers to sign up without premium original content. Amazon’s commitment to expanding its originals slate could be a signal that competition for viewers in the FAST space will be heating up.

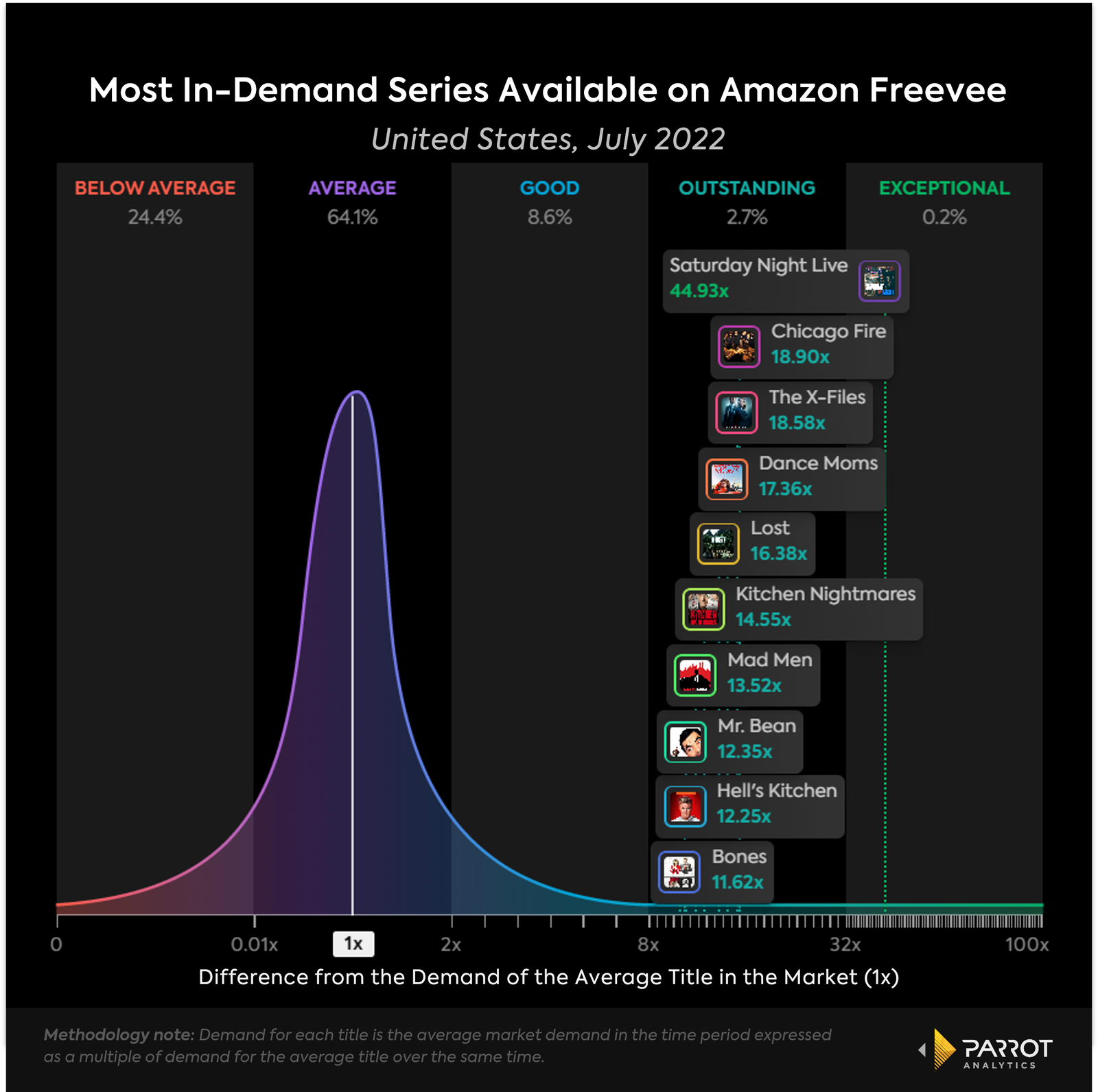

The most in-demand show available to stream on Freevee in July was the ever-popular Saturday Night Live. This show is frequently at the top of most in-demand shows on other platforms like Hulu and Peacock. A deep catalog of nearly 50 seasons of content means that there is plenty of content to spread across multiple platforms. For a platform like Freevee, having a slice of the SNL pie is a valuable asset. Even if only a handful of seasons are available on the platform, the iconic status of its cast and content make its bite-sized sketches infinitely rewatchable.

Series with multiple seasons to binge through are clearly a key component of the strategy of a free streamer like Freevee. Nine of the ten most in-demand shows on Freevee have more than 5 seasons (the exception being Mr. Bean). This makes perfect sense given the niche a FAST platform is trying to fill in the streaming landscape. These streamers don’t need the latest content to convince subscribers to cough up a monthly fee but they do need them to stay on the platform watching through content to generate ad revenue. A reality cooking show like Hell’s Kitchen (20 seasons) or classic network drama The X-Files (11 seasons) are perfect candidates for FAST viewers to binge through with ads.

Conspicuously absent from the top ten shows are any Freevee originals. While the platform has promised to grow its originals offering, none of these shows are among the ten most in-demand shows on its platform. The most in-demand Freevee original for the month was Bosch: Legacy, which had 9.6 times the average series demand. This show looks like a strategic synergy play with Amazon Prime Video. It is a spinoff of the Prime Video original, Bosch, so it should draw over existing fans of the original show from Prime Video to its sister FAST platform.

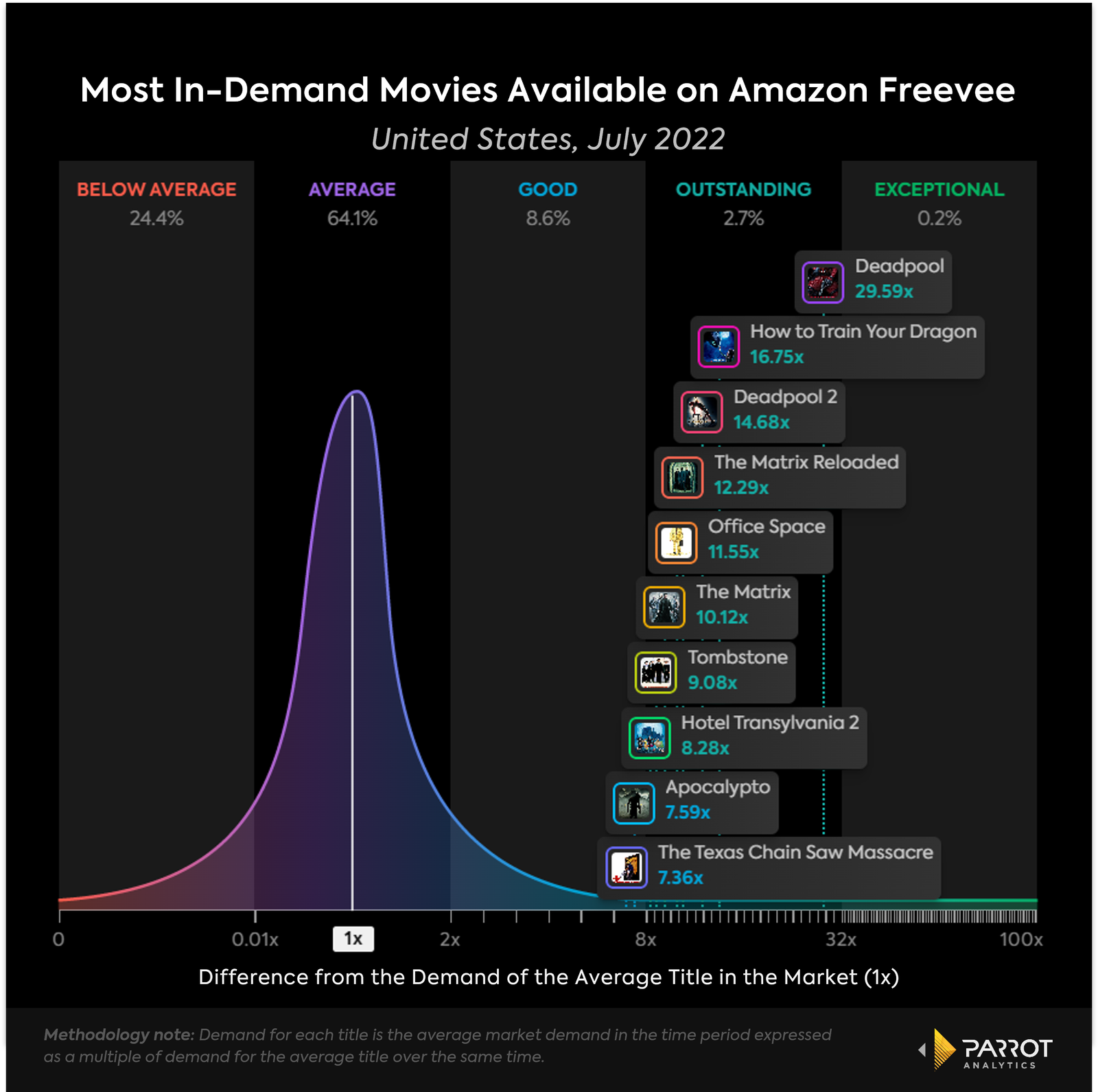

Movies might not seem like a natural fit for an ad-based streamer compared to linear shows with built in ad breaks. However, these films can still draw viewers in while the FAST model provides a new way of monetizing this content. On Freevee, the most in-demand movie available to stream in July was Deadpool, while Deadpool 2 was close behind in 3rd place. Similarly, both The Matrix and The Matrix Reloaded made the top ten on Freevee. While older films make up the bulk of the top movies on Freevee, we may eventually see a Freevee original movie making the cut. Roku’s upcoming original movie, Weird: The Al Yankovic Story has been generating a lot of interest so Freevee may have some ground to make up in the FAST original movie race.