By reading this report you will learn:

- Historical perspectives on how emerging streaming services could build their strategy to attract new customers.

- Why over-relying on first-party platform data over-optimizes for retention and diminishes off-platform user acquisition efficacy.

- The impact of lifecycle state on subscription growth and suggested solutions for the evolution of a streaming service strategy from acquisition to retention.

With Disney and Apple recently launching their highly anticipated streaming services – and more to come in early 2020 from WarnerMedia, Comcast and potential other players; read our latest deep dive into how OTT platforms like Netflix can sustain growth in an increasingly crowded streaming market.

In this strategic analysis, Parrot Analytics experts unpack how over-emphasizing on-platform data over-optimizes for retention and – longer term – lowers off-platform user acquisition efficacy, resulting in a lower lifetime value (LTV) to customer acquisition cost (CAC) ratio over time.

Introduction

At the end of Q3, Netflix has now reached over 158 million subscribers globally. However, 2019 has signalled that change is coming. With new competitors on the horizon, towering debt and rumors of domestic inertia, how will Netflix reach its goal of world domination?

In the past, Netflix’s strategy has been clear: spend more, get more, increasing investment in content year-over-year. Netflix spent $12B dollars on content in 2018, expected to spend $15B in 2019. With rapid global expansion as their goal, they’ve entered into exclusive agreements with notable show runners like Shonda Rhimes and Ryan Murphy to secure access to the best content. Despite accumulating large amounts of debt, their strategy has worked to date, growing subscriptions domestically and internationally. In addition to accumulating more than 1,500 hours of original content they won 27 Emmys in the most recent Emmys award show, raising the question: what is winning over subscribers? Quantity or quality? Is quality a distraction? Are consumers subscribing because of the volume of the library or due to the perceived value of programming offered?

Finally, with the largest subscriber base of any SVOD platform globally, Netflix collects significant volumes of user data that is often touted as a unique competitive advantage. Yet, what happens when a platform over-relies on signals from existing users to drive decisions designed to attract new users? After all, new users are – by definition – not on the platform and therefore not included within the signals from existing users. So, while inconsequential in Netflix’s early days particularly with their head start and unique market positioning, how should a platform’s decision-making framework change over time as they increase their market penetration, when potential subscribers are increasingly more difficult to attract?

Here, we unpack how over-relying on-platform data over-optimizes for retention and – longer term – lowers off-platform user acquisition efficacy, resulting in a lower lifetime value (LTV): customer acquisition cost (CAC) ratio over time.

In conclusion, we provide a blueprint for a sustainable growth pathway for Netflix and other SVOD platforms to follow suit.

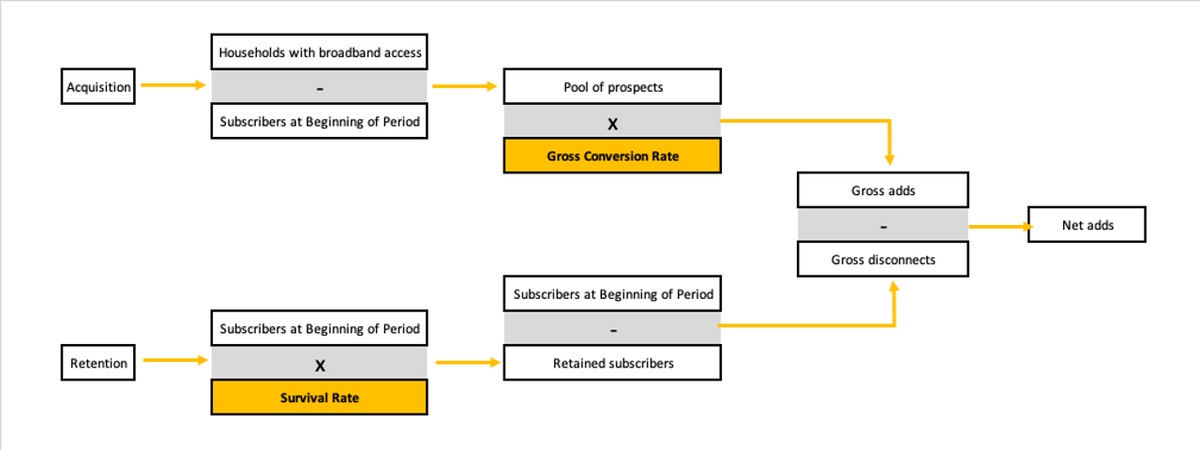

The impact of lifecycle stage on subscription growth

We have previously evidenced that demand for original programming is the strongest indicator of SVOD growth. There are two aspects to the relationship. A large library of original content will amass a large amount of demand for the originals slate. Each incremental title drives value by adding to the total demand. However, only highly in-demand content such as When They See Us, Ozark, and Stranger Things increase the average of demand of the originals slate. For OTT platforms, both the volume of library and the perception of quality drive subscription growth at various stages of the platform’s adoption lifecycle within a given market.

During the early adoption phase, acquiring the most in-demand content that appeals to as many taste clusters as possible is most important. In this initial phase, each new title most likely appeals to multiple off-platform taste clusters, with minimal affinity overlap which is why increasing volume of content is the name of the game. Add more content, get more subscribers. In the growth phase it is harder for a new title to drive acquisition of new consumers. Most consumers that are the low hanging fruit have already converted, so an incremental title must have perceived value for off-platform consumers and yet must also appeal to the current platform base taste clusters to retain them. When platforms rely upon data derived from their current consumer base, they can assess the latter, but not the former.

Internationally, Netflix and other OTT’s have created value during their growth phase by acquiring content that is contextually relevant. Investing in locally-produced content increases the likelihood that it will appeal to both on- and off-platform taste clusters in the market. Once a market is established, it is harder to acquire/create content that will appeal to new consumers they have yet to convert (or previously churned) and maintain their current base. This is why each additional title needs to be a strategic acquisition. Value is added by creating a blockbuster that contains highly in-demand genes and appeals to a wide variety of taste clusters. Conversely, value can be generated by creating multiple smaller titles that have high appeal with select, smaller taste clusters that have not been converted yet. The former is more beneficial from a cost POV with the latter requiring hyper-targeted 1:1 marketing, but we’ll save that for chapter 2.

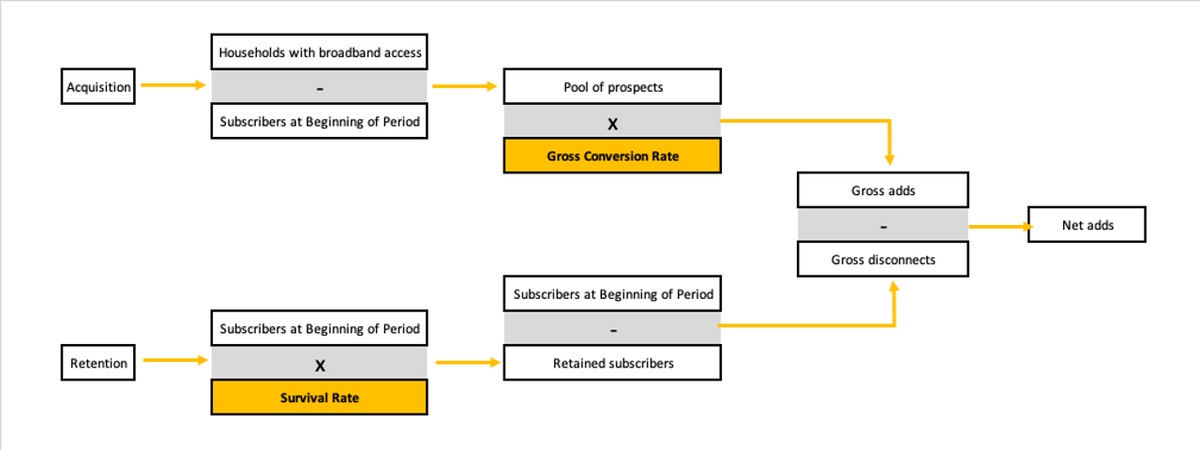

For now, let’s review what the data supports to be the blueprint for OTT growth and content valuation:

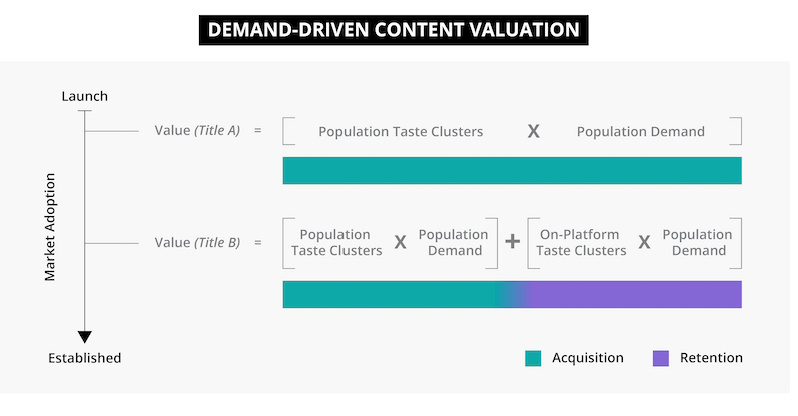

When the goal is to retain subscribers, a title should be evaluated based on the population demand and its affinity to on-platform taste clusters. For the purpose of acquiring subscribers, a title should be evaluated based on the population demand and its affinity to off-platform taste clusters. Optimizing content decisions to drive both user acquisition and retention, on a market-by-market basis is the most empirical way to continuously increase the platform’s LTV:CAC ratio.

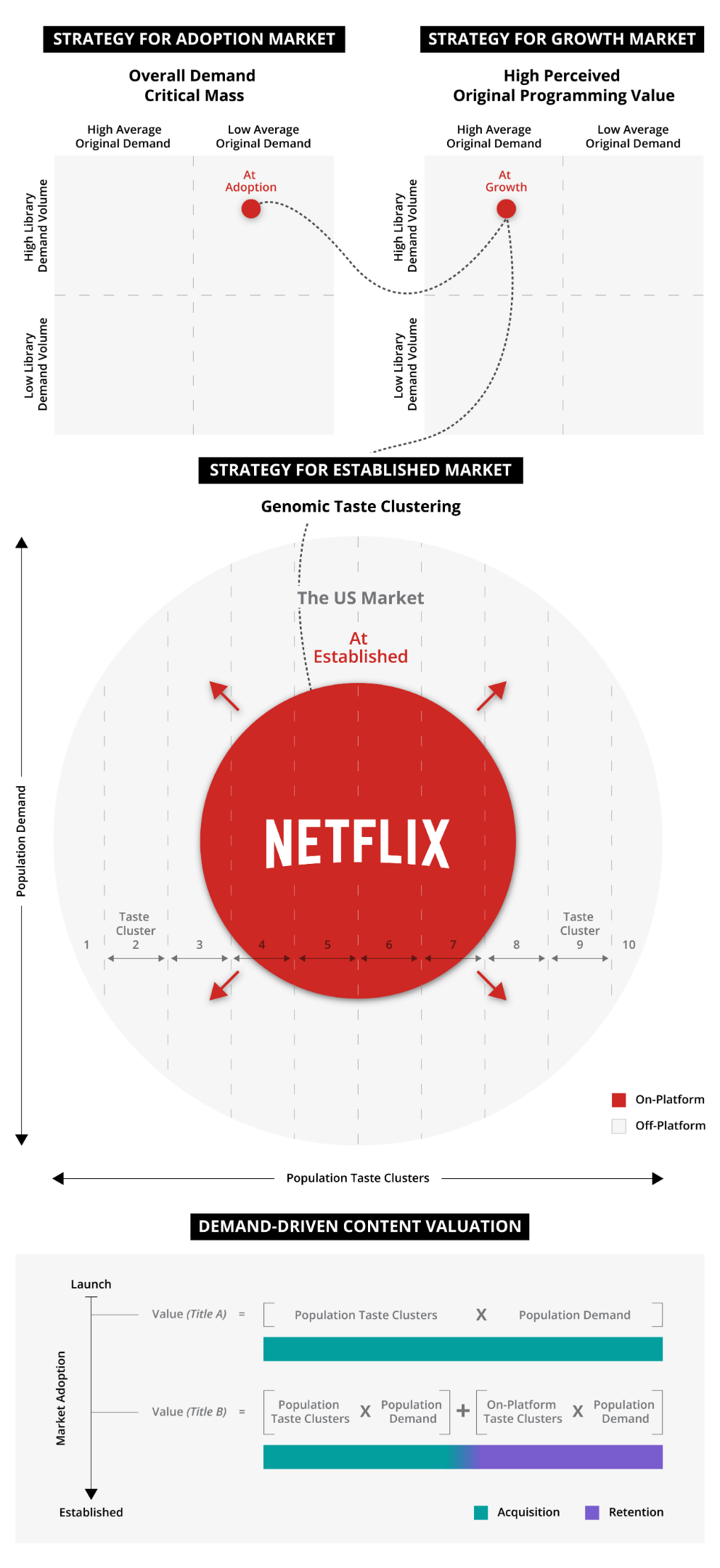

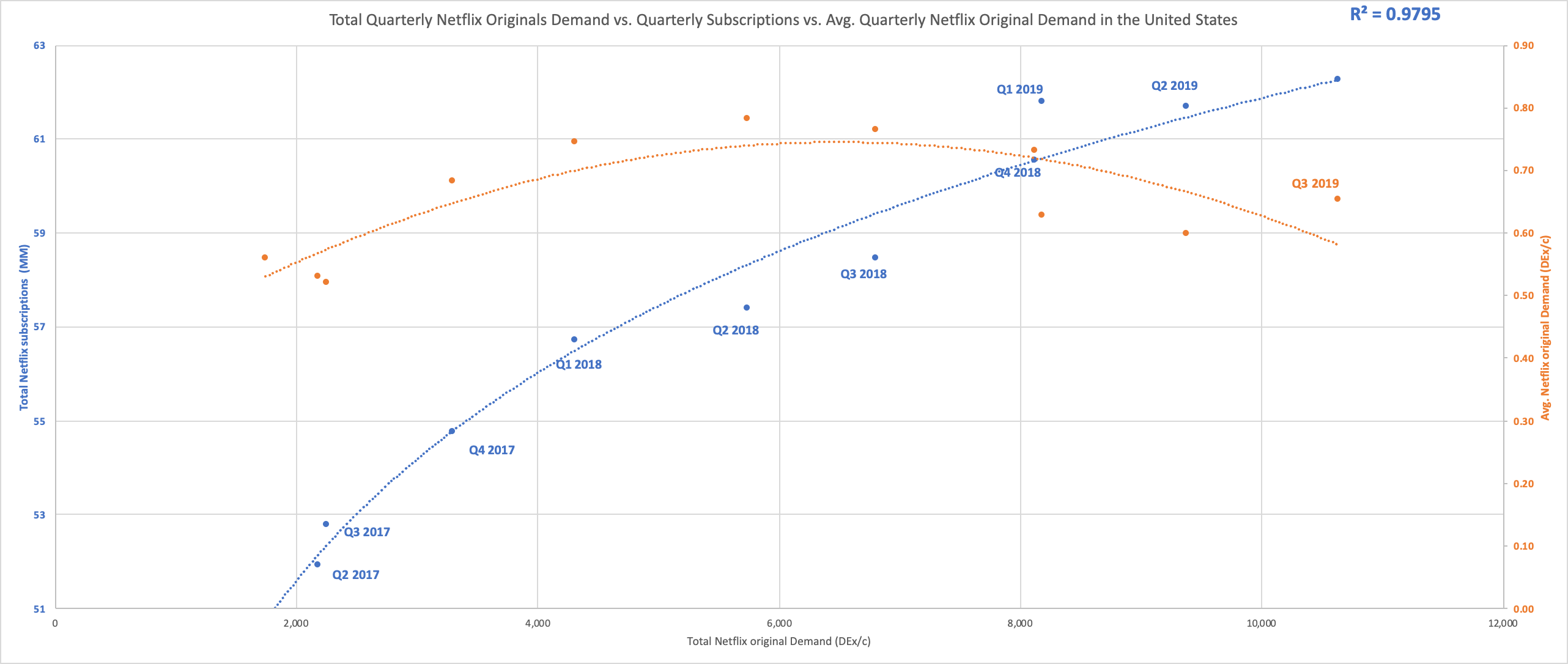

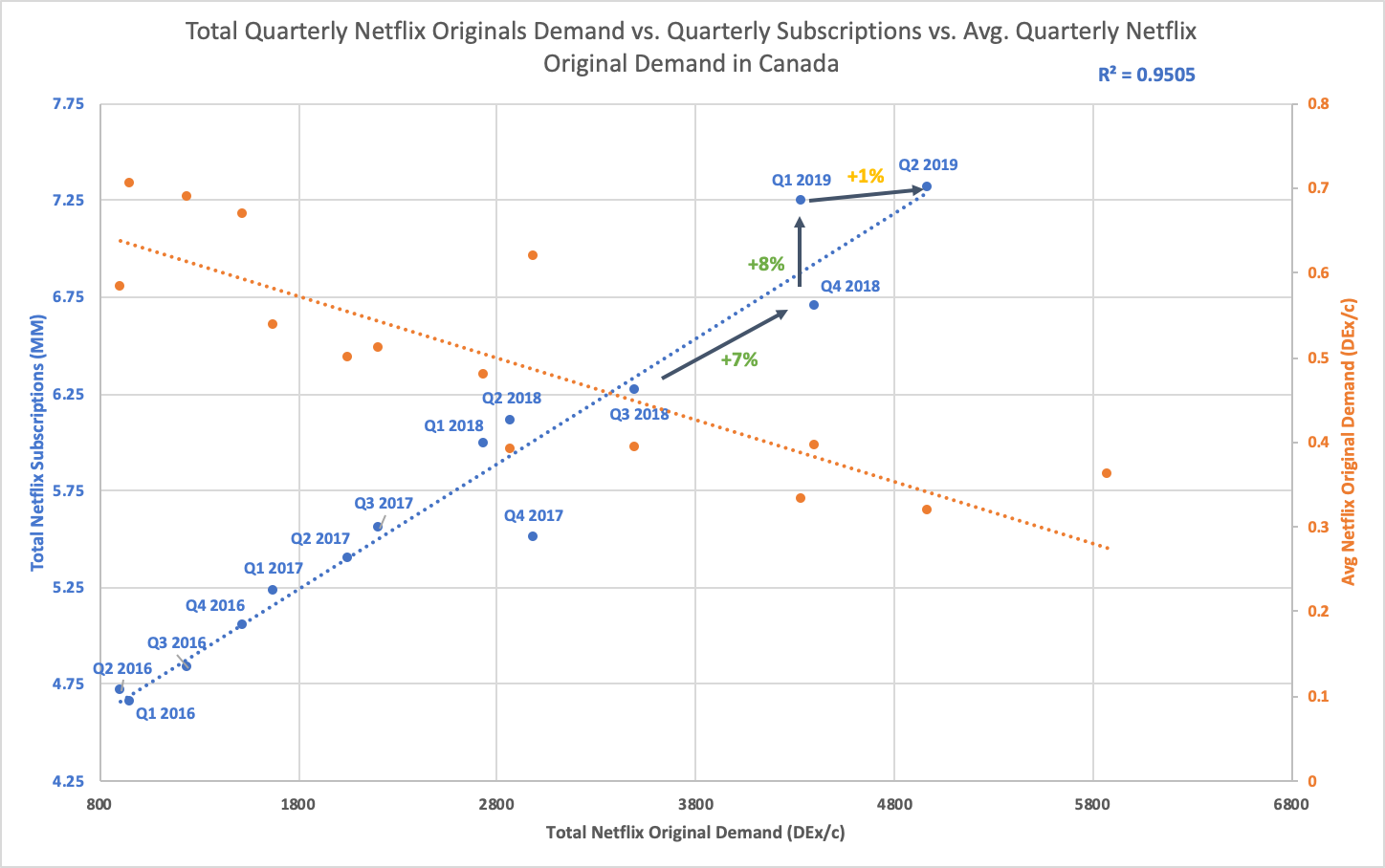

Below, we illustrate how the relationship between library volume (total demand) and perceived value (average demand per title) change over time and the impact on subscriber growth by observing three markets, each market representing a different lifecycle stage for Netflix. Ultimately, Netflix must work overtime over the next few quarters to maintain marketplace dominance. Their next steps must be precise and strategic. In the U.S., stakes are the highest. A few more quarters at this rate and competition begins to threaten their current market share. From here, a demand-based approach to growth must be introduced in conjunction with retention-focused internal data-driven decision making.

Dip in Netflix demand is not a cause for panic in the U.S., yet…

Up to mid-2018, we saw a linear, positive relationship between total and average demand for Netflix originals and subscribers, quarter over quarter. This isn’t surprising. We’ve long theorized for early adoption, more content creates more total demand leading to more subscribers. For growth, quality content drives higher average demand and leads to more subscribers, given the early adopters have been converted already.

Once a market becomes more established, subscription growth becomes more nuanced and retention becomes increasingly necessary, particularly with increased competition. At this phase, growth happens via two methods:

- Creating tentpole original titles that lift the average demand of the platform’s originals slate and appeal to large enough taste clusters that the unit economics of producing them warrants increasingly unprecedented production costs.

- Creating smaller B+ original titles that are designed for specific off-platform taste clusters and are hyper-targeted to them on a 1:1 basis.

In the US, the end of 2018 marked a new phase in the lifecycle for Netflix. In Q2 of 2018, the average demand of Netflix original content hits its apex, resulting in a slow downturn of subscriber growth marking the transition from growth phase to established phase. With the relationship between the demand for Netflix’s original series and their subscriber acquisition firmly established, we could see Netflix’s domestic subscriber growth struggles long before they were unveiled.

A year later in Q2 2019, average demand reached an all-time low, decreasing 5% from Q1 2019 and subsequently resulting in its first subscriber decrease domestically. While the dip is concerning, causing share prices to drop 11% after the Q2 2019 earnings report, it does not signal the end for the streaming giant. Netflix is still the one and only home of some of the most in-demand TV content in the world (and the U.S.). Season 3 of Stranger Things caused average demand to rebound by 9%, which should be reflected in the Q3 subscriber numbers.

Fluctuation in average demand suggests that churn will likely become a larger issue in the coming quarters; however, a single blockbuster title like Stranger Things can lift perceived value even for a quarter. Stranger Things illustrates that with the right tentpole, Netflix can continue to increase their perceived value while also creating smaller titles targeted to specific on-platform and off-platform taste clusters. Creating a blockbuster (and specifically the right blockbuster) is not an easy task. It requires knowledge of off-platform taste clusters to ensure this content has enough genes that appeal to off-platform audiences to compel them to pay $12.99.

Next stop, world domination… with precise global programming

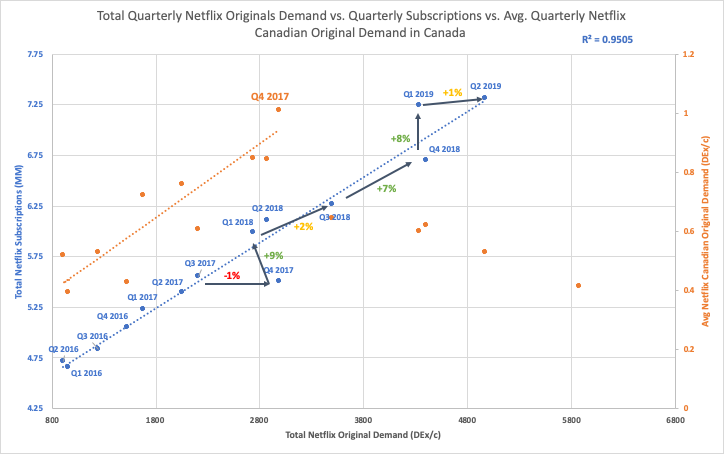

As opposed to the parallel relationship we saw in the U.S., Netflix originals’ average demand and Netflix originals’ total demand have an inverse relationship in Canada.

In domestic growth contexts, the perceived value of original programming is more important than volume of original programming demand. Internationally, we find that the perceived value of local original programming is especially valuable. While international libraries tend to be US-centric when the perceived value of local digital originals is at its highest it translates to the largest growth of subscribers. Canada experienced its largest subscriber growth (9%) following the apex of average demand for originals programming in Q4 of 2017.

For Netflix and other OTT’s to grow in Canada, they must continue to increase their investment in Canadian originals to increase perceived value. At the same time, they must also use the appeal of their American blockbusters (like Stranger Things in Netflix’s case) to maximize growth.

In 2018 and 2019 thus far, the perceived value of Canadian originals has been decreasing with a subsequent deceleration of subscriber growth. Similar to the US, we note that when perceived value (average demand per title) decreases for contextually relevant originals, subscriber growth slows.

Likewise, Canadian audiences expressed more total demand in Q3 2019 (18%), due to season 3 of Stranger Things. This will result in a rebound of subscriptions given Canada is still a growth market for Netflix. However, the increase will be much larger than the 7% plus growth they experienced in previous quarters. For Netflix to gain momentum, investment of high in-demand Canadian content is imperative.

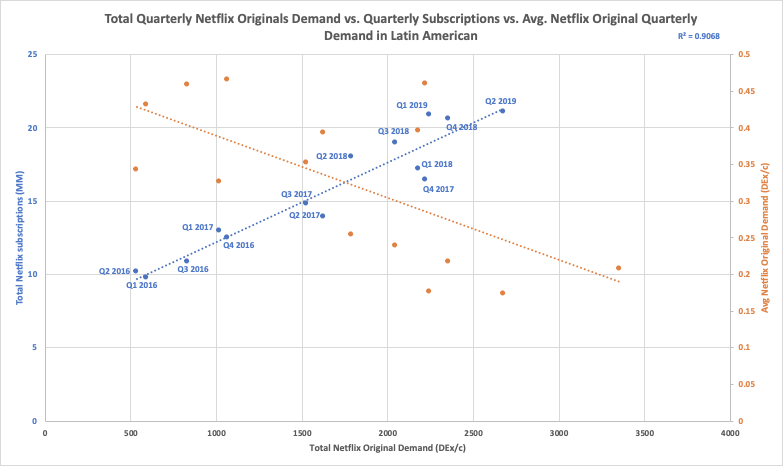

In Latin America, on the other hand, subscriber penetration is estimated at 30%. Still in the early adoption stages, subscriber numbers in Latin America are increasing steadily as total demand builds. For the next few quarters they will continue to see an increase in subscribers based off of total volume of demand.

However, as penetration increases and Netflix transitions into a growth phase, they need to start creating high in-demand Latin American content which audiences will perceive as high value. This will be crucial to their success over the next few years. Recent investments in Mexico and Brazil highlight this. With little to no international competition in many of the Latin American markets, Netflix has a prime opportunity to become leaders in these markets. In their next steps, they just have to keep in mind that while forgivable in the early penetration phase, a declining average demand per title will begin to significantly hinder their growth.

Avoiding inertia in the U.S.

In order for the US to avoid inertia, Netflix must efficiently and effectively enact the appropriate lifecycle strategies. With increased competitive pressure in the upcoming quarters, Netflix’s strategy will be placed under a microscope. As the stakes are raised, the opportunity to lose their lead will become palpable.

New competitors introduce two threats. Firstly, many linear-turned-DTC services are reclaiming their content (i.e., NBC’s takeback of The Office), lowering the per-title catalog demand average and longevity, impacting the sustainability of Netflix’s retention power. Secondly, the entrance of these competitors and the ramping up of other streaming competitors such as Hulu, Prime Video and most recently Disney+ and Apple TV+, requires Netflix content to be more exclusive and higher in-demand than ever before.

Here, the growth strategy we outlined earlier needs to be implemented with precision:

- Creating tentpole original titles that lift the average demand of the platform’s originals slate and appeal to large enough taste clusters that the unit economics of producing them warrants increasingly unprecedented production costs.

- Creating smaller B+ original titles that are designed for specific off-platform taste clusters and are hyper-targeted to them on a 1:1 basis.

This is easier said than done, however. When you see B-grade Netflix original series marketed on billboards and buses, you are seeing an imperfect strategy execution. Titles within category (2) above should only be promoted via affinity- and ML-based acquisition marketing tactics, while the tentpole originals can be mass marketed given the large taste cluster coverage both on-platform and off-platform.

New dynamics in the Streaming Wars: Strategic retention

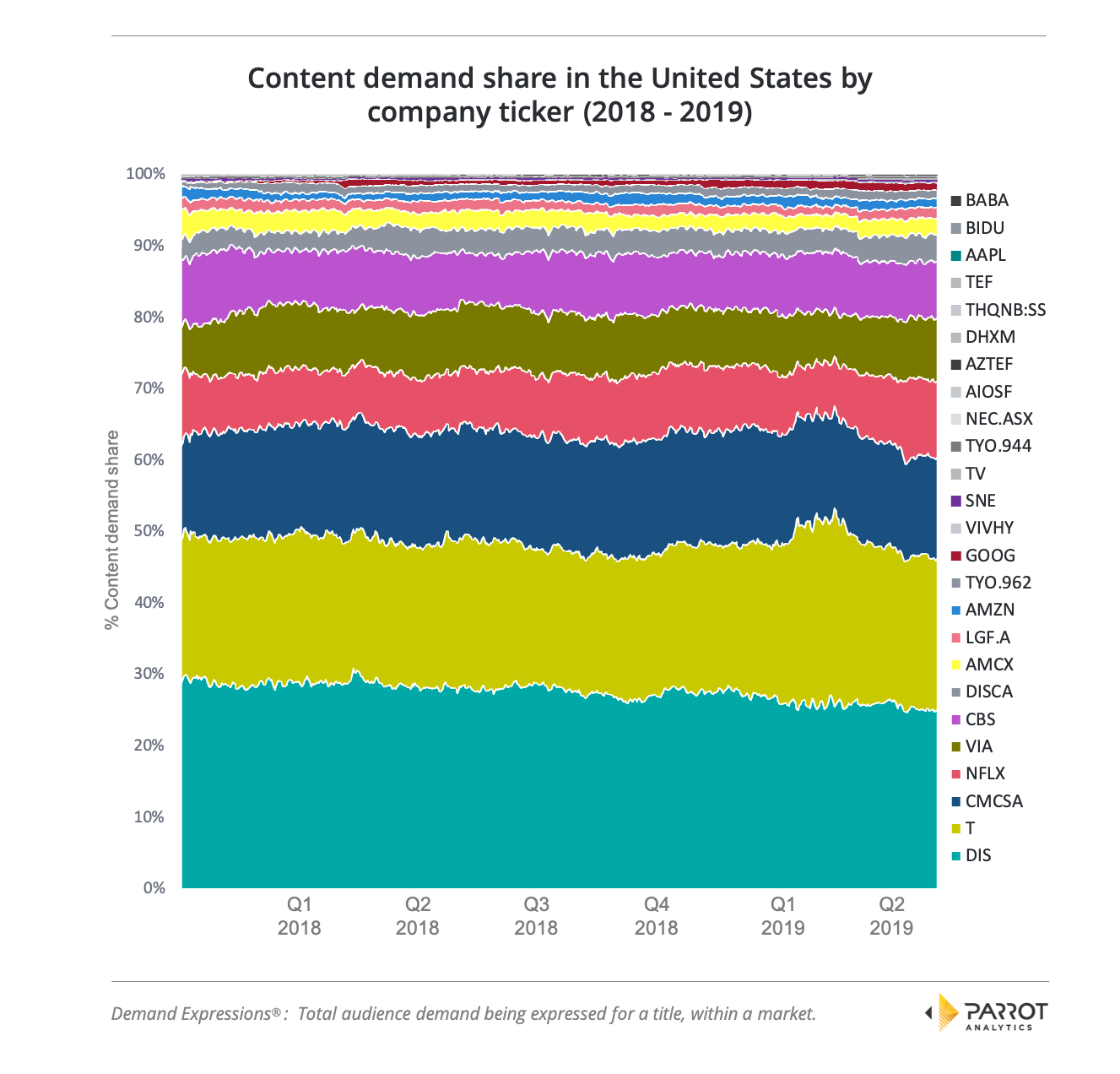

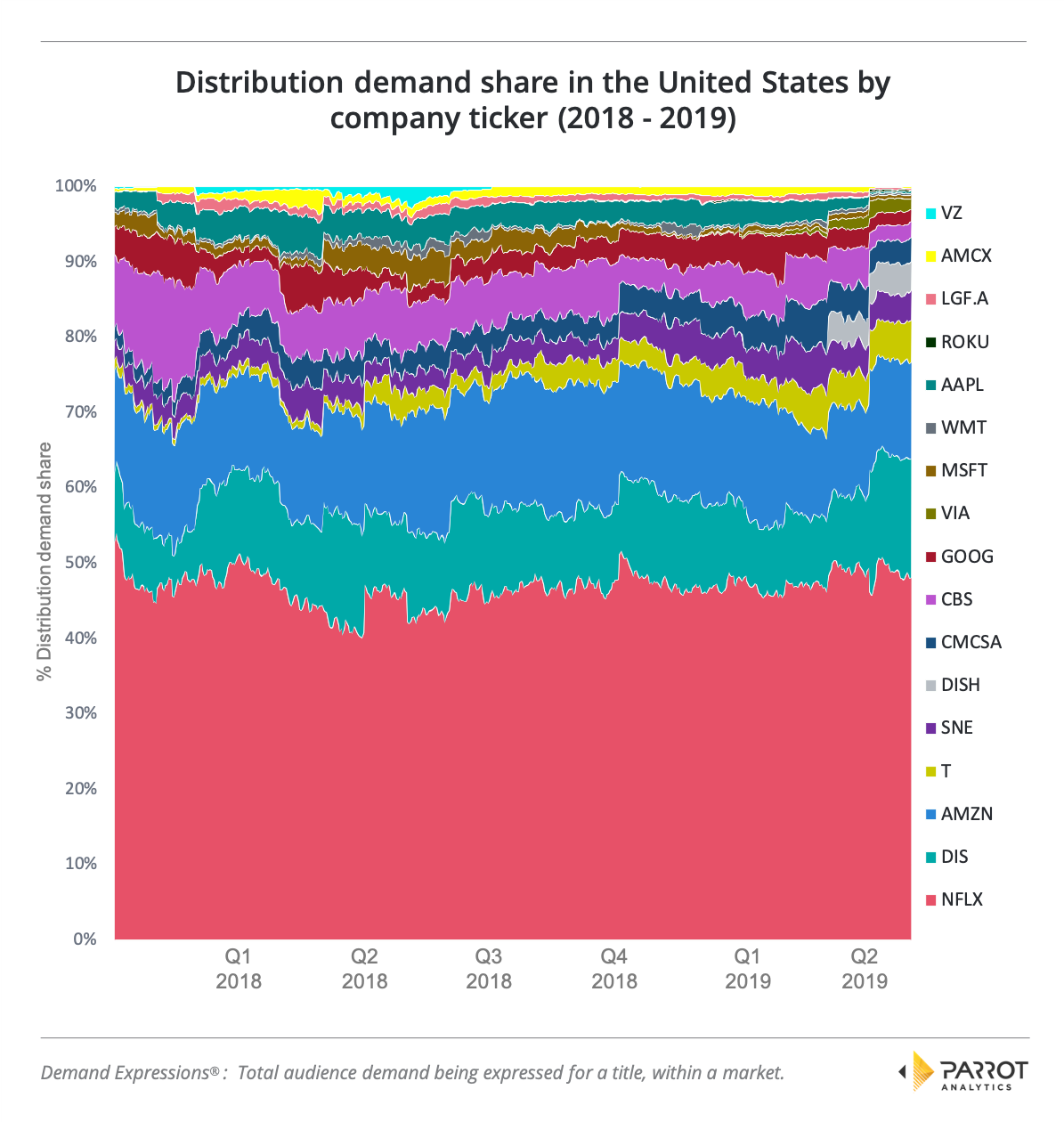

The upcoming 2020 Streaming Wars marks intensifying competition and shifting dynamics. Competitors such as Disney and AT&T are not only producing their own original programming, but also removing their content from Netflix. They are introducing a problem for audiences by spreading beloved content across platforms. Netflix subscribers, who have had access to classics such as Friends and The Office, will certainly experience a loss. Audience pleas drove Netflix to spend $80 million dollars to renew their Friends license for 2019. The threat of removed licensed content can be examined by the difference between Netflix’s total library demand share (i.e., its demand share as a content distributor) and content production demand share (i.e., its demand share as a content producer) as demonstrated in the chart below.

In comparing the charts, it is clear that Netflix dominates the U.S. market as a distributor but is less competitive as a producer. Owning over 40% of demand share of content on DTC platforms, Netflix currently makes up the single greatest portion of demand as a distributor. Yet, the service only produces original programming that captivates 10% of total produced U.S. content audience demand. The potential loss of licensed content can seem daunting, but is it really? If so, in which contexts and why?

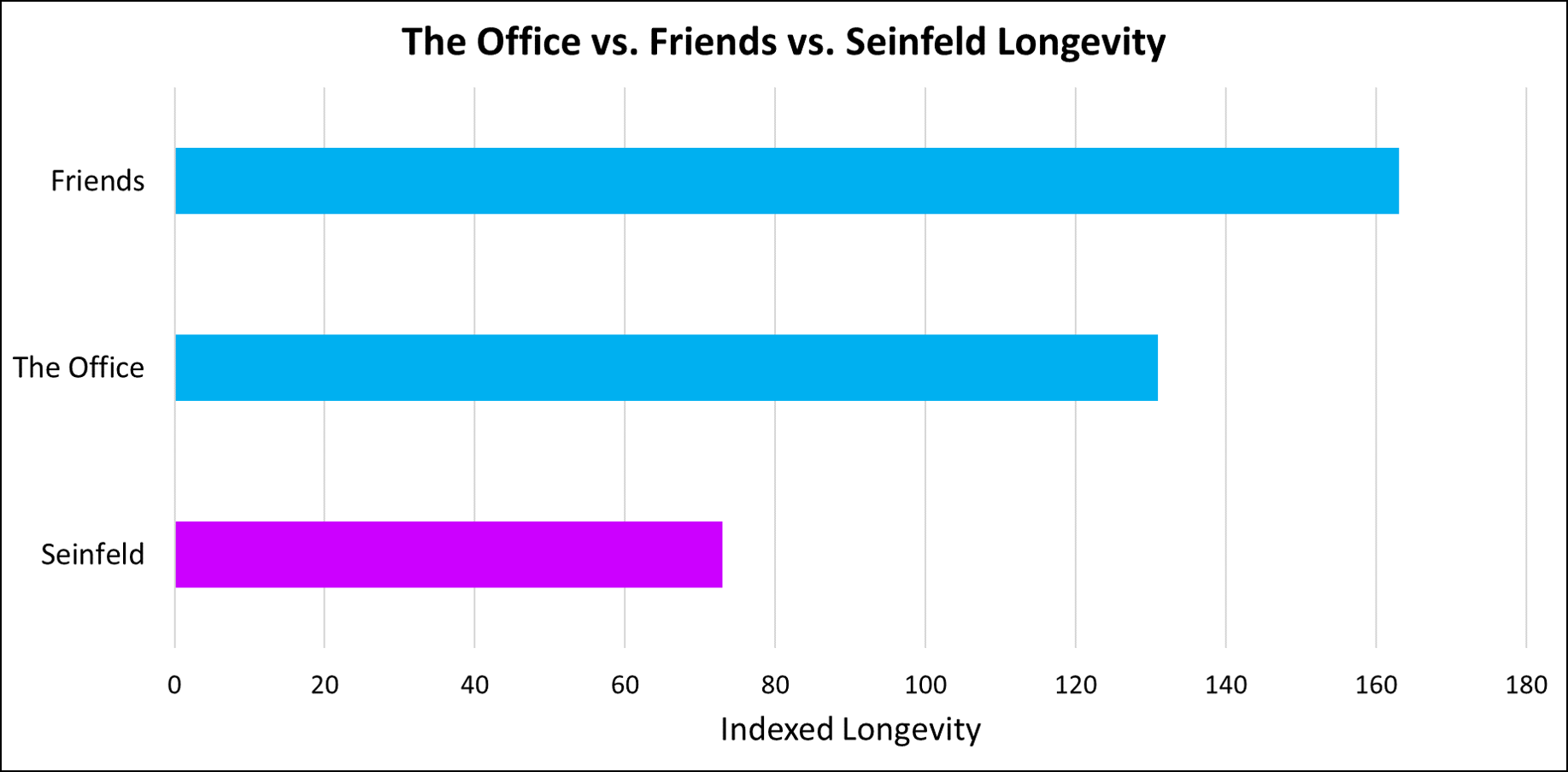

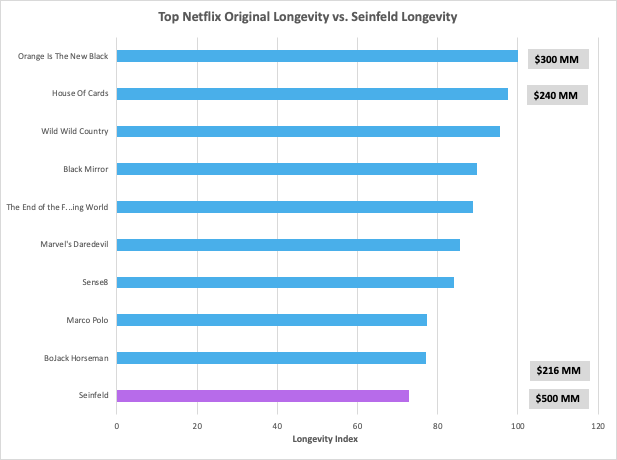

In further examining the value of Netflix’s licensed content, demand data reveals that licensed content has an impact because of its longevity (one of Parrot Analytics’ content analytics metrics is a longevity index). The Office and Friends are evergreen titles which have long-lasting demand. Consumers often rewatch their favorite scenes multiple times and with 85 and 99 hours of content respectively it provides ample opportunity to engage consumers. When Netflix loses evergreen licensed content, the impact is predicated by the worthiness of its replacement. Thus, Netflix’s decision to spend $500 million dollars licensing Seinfeld is likely not justified. Compared to Friends, Seinfeld’s longevity is less than 1/2.

The choice becomes even more questionable when we compare the longevity of Seinfeld to that of Netflix originals, factoring in cost and exclusivity. The cost of producing multiple seasons of an original title such as Orange is the New Black, House of Cards, or BoJack Horseman is smaller, the content is more exclusive, and these titles are all more evergreen. Considering that Seinfeld’s finale occurred in 1998, its longevity is still impressive.

On the other hand, the $500 million spent on Seinfeld is expensive given that at best it is expected to impact retention for only another five years. This is the result of Netflix over optimizing its internal data for retention, not weighing market demand signals and overpaying for current consumer value and that’s assuming Seinfeld will retain consumers well enough to account for the opportunity cost of new subscriber growth deceleration.

When Netflix had a weak slate in Q2 their licensed content did not result in a net positive gain. However, when one of their most broadly appealing titles launched season 3 we saw their average demand lift (driving the lift in total subscribers). And while the basic math shows Seinfeld at $2.7MM an episode is far lower than the episode cost of Stranger Things, we have established the empirical relationship between the average demand per original title and new subscriber growth; resulting in a large subscriber growth opportunity cost.

Licensed content supports retention after the adoption stage where it contributes to a critical mass of demand volume needed to retain current subscribers. For licensed content to produce maximum value as an investment it must do the following: appeal to existing taste clusters of subscribers, drive high demand and have high longevity. Original content, however, can drive both retention and subscriber growth as the platform continues to scale up; with the added bonus of more attractive long-term unit economics.

Staying ahead of new competitors: Dominating originals

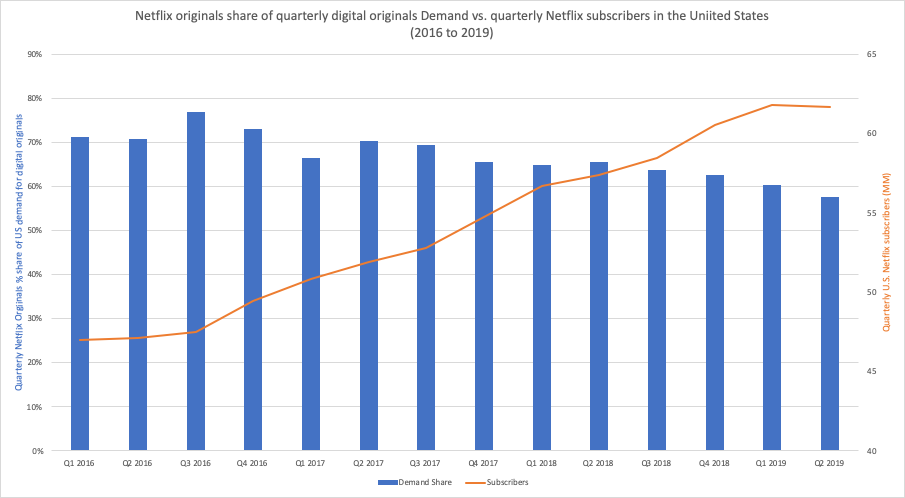

In 2017, Reed Hastings was quoted to say sleep is Netflix’s biggest competitor and while that may be a hyperbole, it is undeniable that anything that diverts attention away from Netflix is a competitor. The crowding of the content ecosystem is already placing pressure on Netflix’s ability to capture the same proportion of U.S. audience attention. Despite the increase in total library demand and subscribers, Netflix has been slowly yet steadily losing its share of demand.

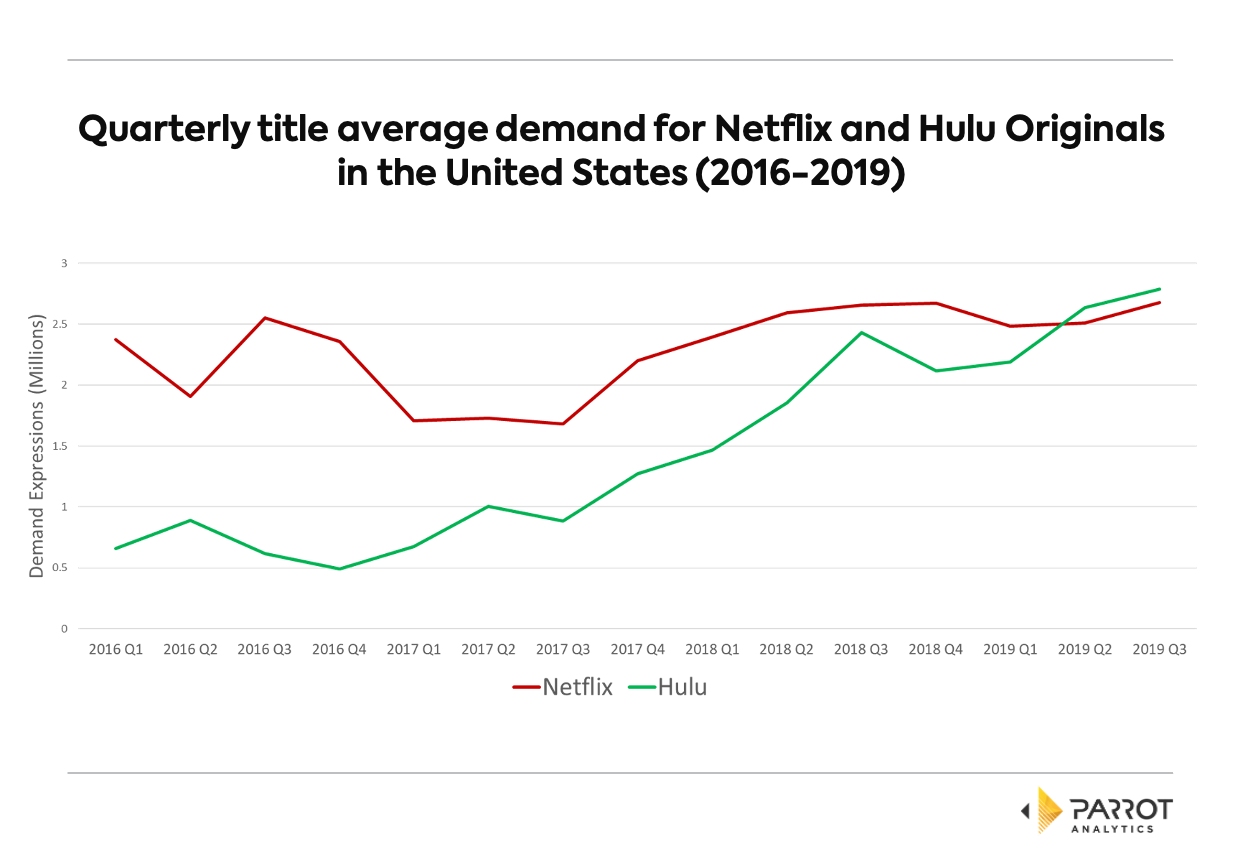

As seen in the chart below, where the 47 million U.S. subscribers in Q1 of 2016 corresponds with Netflix originals owning over 70% of the total demand for domestic OTT original programming, the 61 million domestic subscribers in Q2 of 2019 corresponds with Netflix originals now owning under 60% of the total demand of all domestic OTT platform original programming.

The declining demand share despite increasing subscribers reflects the impact of competitors such as Hulu and Amazon Prime Video. Although Hulu does not have nearly the same volume of demand, Hulu’s original programming’s perceived value (i.e., average title demand) has caught up to Netflix. In Q2 2019, Hulu surpassed Netflix and has maintained that lead into the third quarter. Hulu’s originals such as The Handmaid’s Tale, Harlots, Castle Rock Future Man and I Love You, America are leading the platform to step ahead of Netflix. It is clear that Netflix will need more tentpole content to sustain the perceived value of its original programming. This is where the majority of their domestic content investment should go towards.

Scaling-up: Diversifying and acquiring multiple taste clusters

As we saw with the impact of Stranger Things in Q3 2019 domestically and internationally, a single blockbuster has the ability to change the tides for Netflix. However, creating a high in-demand blockbuster that appeals to both on- and off-platform taste clusters is difficult in general and near impossible to repeat consistently with only on-platform data. The successful creation of these blockbusters requires a precise understanding of all population taste clusters and knowledge of the most in-demand genes that appeal to as many taste clusters as possible. Parrot Analytics quantifies population appeal through our Content Affinity systems.

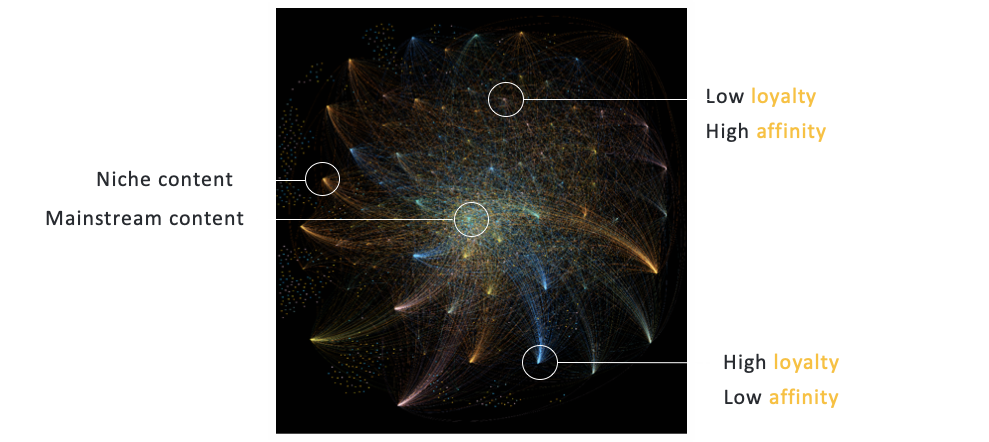

Each node below represents a title in the entire content ecosystem as tracked by Parrot Analytics capturing content across mediums (SVOD, AVOD, linear, cable as well as content that does not air on any medium). The distance between each node represents the affinity between the content. When we map out the sequence of consumers’ content consumption, we are able to create impartial and thus more accurate relationships between content.

Consequently, this creates a holistic map of population taste clusters not limited by platform catalog or medium. Affinity provides a view into the natural clustering of consumers’ taste for titles. Titles that cluster towards the edge of the network of titles represent niche content. Titles with more connections to other titles are engaged with frequently by consumers and have high appeal for consumers of surrounding titles.

OTT platforms can use Parrot Analytics’ content affinity systems when valuing titles for either acquiring or retaining subscribers. When the goal is to retain subscribers, titles should be evaluated based on their population demand and affinity to on-platform taste clusters. For the purpose of acquiring subscribers, titles should be evaluated based on their population demand and affinity to off-platform taste clusters. This reinforces the content valuation system introduced above:

Therefore, OTT platforms can make informed decisions about the content genes that reach multiple taste clusters. They can also leverage Parrot Analytics’ ability to accurately size taste clusters to drive marketing decisions. By sizing taste clusters and proportionately advertising via 1:1 targeting, they can mitigate cost and maximize marketing ROI. More on cross-channel marketing ROI measurement and demand-driven acquisition marketing in the second part of this series.

The lifecycle of OTT platform strategies for title choice

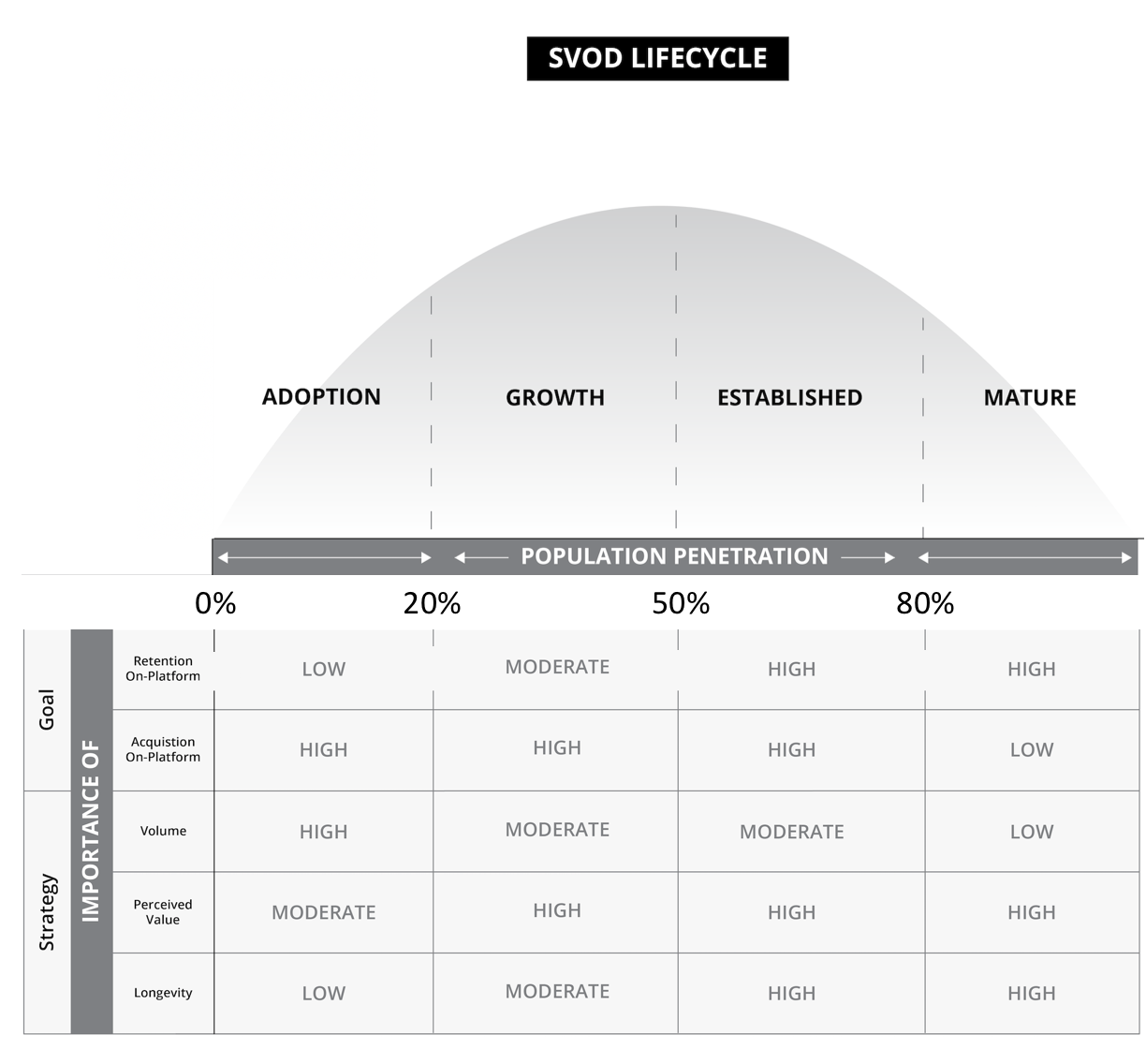

We surmise that due to the progression of platform adoption, the best strategy for title acquisition or production depends on a platform’s adoption lifecycle:

At early adoption the volume of original content demand is key to drive subscriber growth. As a platform continues to mature, with increasing adoption, the goal of the platform shifts. Now that the platform has established a base of subscribers, it not only aims to acquire new subscribers but also seeks to retain these existing subscribers. Once a platform achieves a growth phase, a portion of this total library should include evergreen content to create a base to sustain subscribers in the future. Yet, the perceived value of the original content (average original title demand) still supersedes the volume of demand generated by originals in order of importance.

When approaching the established phase, the strategy for retention and acquisition becomes more nuanced. At this point, growth is about scaling. In order to continue to grow, neither volume of original demand, perceived value, or longevity alone can drive title production and acquisition. Instead, additional titles should be evaluated based on the size and number of taste clusters they reach, the market demand they generate, and the degree to which they tap into on and off-platform populations. Using genomic taste clustering, platforms can more accurately target niche taste clusters and tap into more diverse taste clusters maximizing the efficiency of its growth and retention. This approach works for both tentpole evaluation as well as the creation of taste-cluster targeted smaller titles.

Netflix acknowledges the impact of their strategy in earlier phases of lifecycle domestically, reaping the benefits of focusing on original programming early on and then obtaining licensed content. Julia Alexander, a journalist at the Verge reports that Reed Hastings stated, “Over six years ago we got into original programming, betting that the licensed program would be more difficult to come by, and that maybe the sources of content to license from would be under different levels of strain. That has paid off.” He continues to say “It’s been very important to the business to continue pushing down that road. More international, more global, more original film. We think we’re betting in all the areas of content that consumers love.”

However, Netflix has yet to embrace the strategic imperatives that are now necessary given the changed market conditions. Winning domestically is not just about “more”, or betting in all areas of content consumers love. Chapter 2 will demonstrate the potential impact of genomic taste clustering for Netflix.

Stay tuned.