By reading this article you will understand:

- What is “affinity” and how it reveals audience preferences without resorting to traditional demographic research.

- How Parrot Analytics conducts an affinity analysis using the world’s largest first-party consumption dataset.

- How understanding affinity for individual titles or entire catalogs helps inform acquisition, distribution, programming and recommendation strategies.

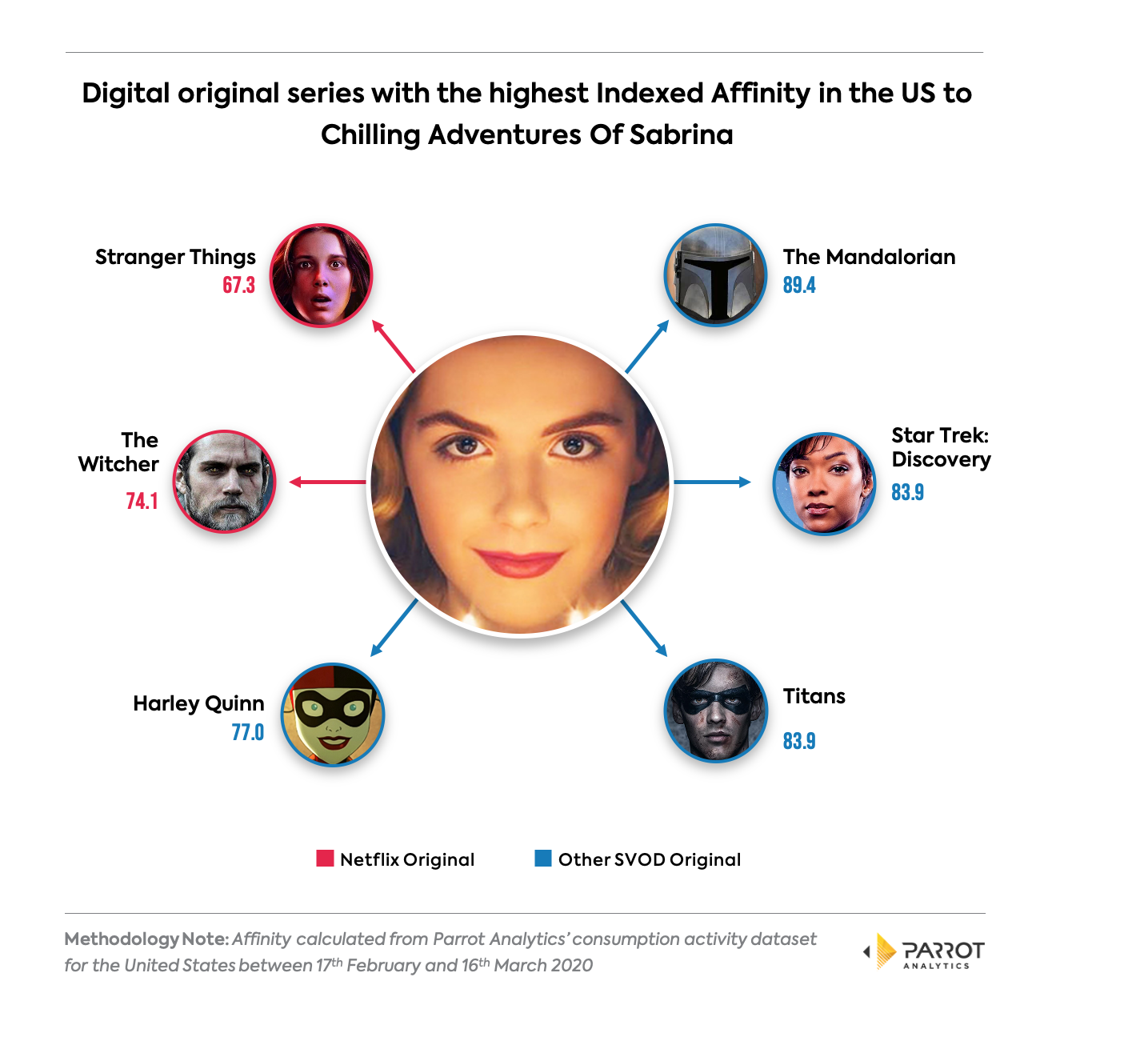

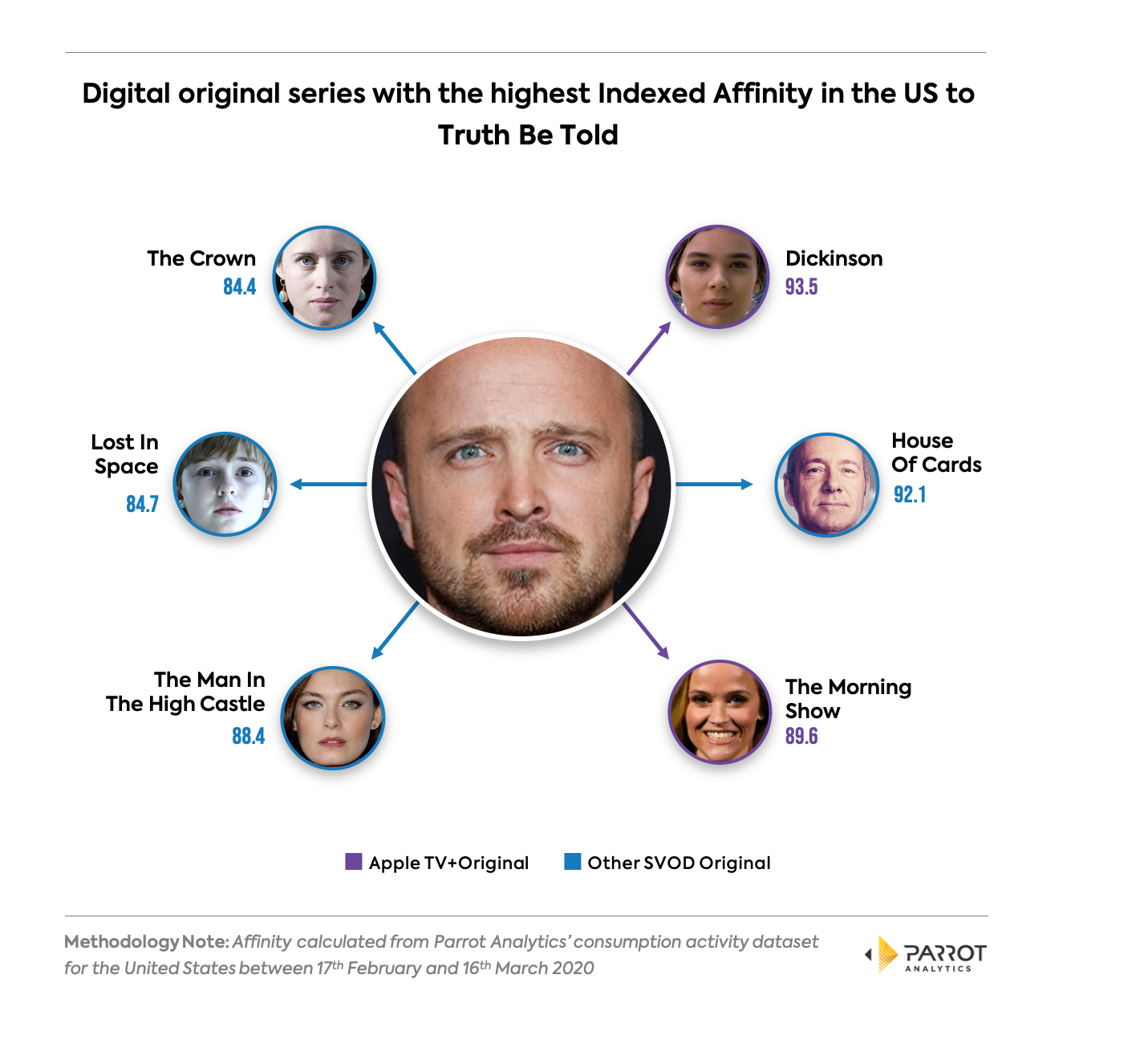

One of the key planks of SVOD strategy is the digital original series. Commissioned or produced by in-house studios, these are exclusive to SVOD platforms and have a well-known role in attracting the interest of potential subscribers. The biggest originals can become tentpoles of a service: think Netflix and the merchandising power of Stranger Things, Amazon Prime Video and awards darling The Marvelous Mrs. Maisel, or Hulu and the political zeitgeist-capturing The Handmaid’s Tale.

While the attention given to these series by audiences can be measured by demand, originals have more roles to play for SVOD services than just attracting subscribers. These roles are especially important for the non-tentpole originals that make up the bulk of each platform’s stable of original series.

To look at the other roles that originals perform in the attention economy, we’re going to going to examine two recent series - Netflix’s Chilling Adventures Of Sabrina and Apple TV+’s Truth Be Told – using affinity analysis.

We’ll start with the Netflix title. Sabrina is a well-reviewed title and a solid hit for Netflix – in March 2020 it was 16.6 times more in demand than the average title in the USA. As a highly regarded specimen of the genre, there’s no question that some Americans who enjoy lightweight horror drama and did not already will have considered subscribing to Netflix as a direct result of the series existing. Some of them will have done so.

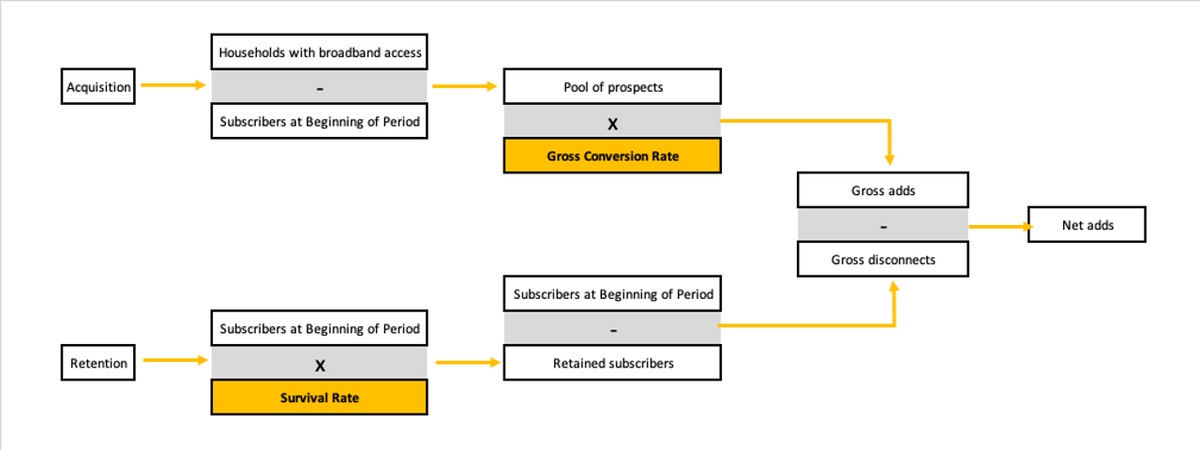

The critical question that Netflix and other services are trying to answer accurately is having subscribed for this show, will they now stay Netflix subscribers? We can use affinity analysis to find out.

A quick guide to affinity analysis

The goal of an affinity analysis is to determine how much overlap there is between the audiences of series.

Let’s say that we have 100 people who watch Show A in the USA. If 20 of those 100 also watch Show B, and 10 of those 100 also watch Show C, then the affinity of Show A to Show B is twice as strong as the affinity of Show A to Show C. Note that these groups are not exclusive so the same person could be one of the 20 and one of the 10.

Put simply, the higher affinity means that a viewer of Show A is more likely to also watch Show B than Show C.

So how do we get this information? Parrot Analytics has an industry-unique dataset of consumption from the daily tracking of free streaming/downloading we perform as part of our television demand measurement. We can run market-specific analysis on this consumption dataset to see the relationship of a show to any other show, provided of course that there is enough streaming/downloading activity! For example, this means that we cannot get affinity directly for pre-release series as there is nothing released to stream or download! (Note that we can still do this indirectly using genome modelling, however!)

As affinity analysis is based on actual consumption data for consumers in this specific market, we are confident it is an accurate way to answer this question.

If Chilling Adventures of Sabrina is bringing in Netflix subscribers, is it also helping to keep subscribers?

Let’s now bring in some real affinity data. Chilling Adventures Of Sabrina Season 2 was released on Netflix in the United States on January 24th. We’ll look at affinity for shortly after that, from mid-February to mid-March, to find what other digital original series the people who consumed Sabrina then moved on to consume.

For ease of comparison, the affinity is indexed. The digital original series with the highest affinity to Sabrina is given an Indexed Affinity of 100, with other series having an Indexed Affinity based on that.

We find that of the digital originals with the highest affinity to Chilling Adventures Of Sabrina, the top Netflix original, The Witcher, only has the 5th highest affinity. People who consume Sabrina are more likely to go on to consume a series from a different service than to go on to another Netflix series. This is an interesting answer to our question: Sabrina is not keeping people subscribed to Netflix as well as a show where the highest affinity are all Netflix titles.

Americans who enjoy Sabrina may subscribe to watch just Sabrina, but then not move on to another Netflix series. Having finished the series they do enjoy and not having moved on to another, this group is high risk to churn.

If a significant proportion of the audience for Sabrina on Netflix follows the pattern described above, then Netflix may decide it is uneconomical to continue paying for more season, especially if the show is expensive. Crucially, this could be the case even if demand and/or viewership metrics for the show remain high. When you hear of shock SVOD original cancellations that take observers by surprise, factors like this could be the cause.

Let’s look at the same analysis for a different original from another SVOD.

Truth Be Told is likely promoting retention for Apple TV+

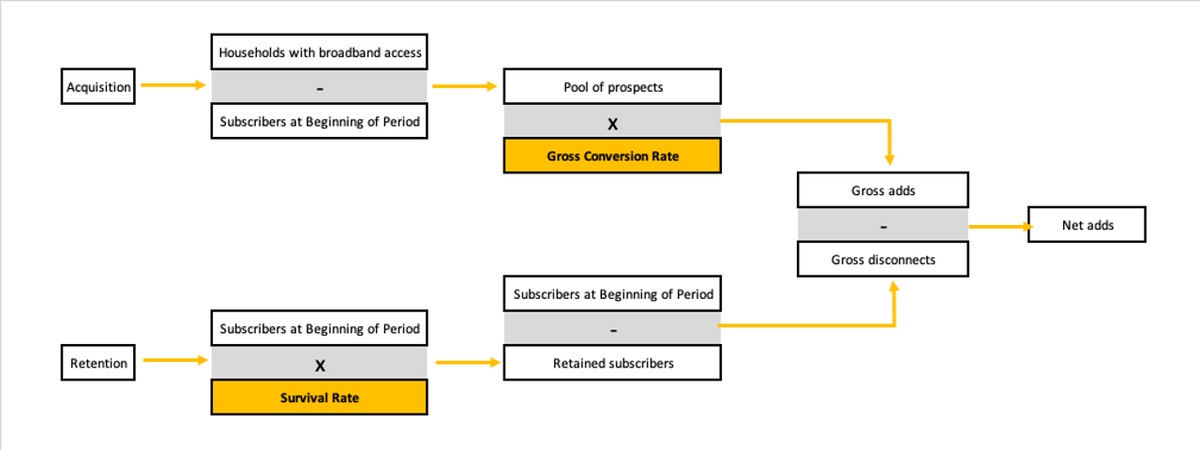

We ran an affinity analysis for Apple TV+’s Truth be Told, which aired weekly ending on January 10th. This analysis was for the same time period we used for Sabrina and was also for the United States.

In contrast to Sabrina, for Truth Be Told the first and third highest affinity series are original series from the same platform, Apple TV+. The single highest affinity series that people who consume Truth Be Told are most likely to also consume is Dickinson. The most likely pattern is when Truth Be Told viewers finish the series, they move on to another Apple TV+ show: a pattern that generally accompanies lower churn rates. Thus, this is an indication that Truth Be Told is promoting retention for the Apple TV+ platform.

The CW network is a strong candidate for Sabrina’s US second-run rights

At the start of this article, we said that original series performed many roles for SVOD platforms. As well as attracting and retaining subscribers, there is another role that’s going to become increasingly important as time goes by.

The oldest digital original series are starting to mature out of their initial deals. Series that were first released in 2013, 2014, 2015 are starting to come out of exclusivity deals. Third-party production companies and SVOD services themselves are starting to have an increasing number of older digital original shows that are becoming eligible for second run rights on linear (cable/broadcast) networks.

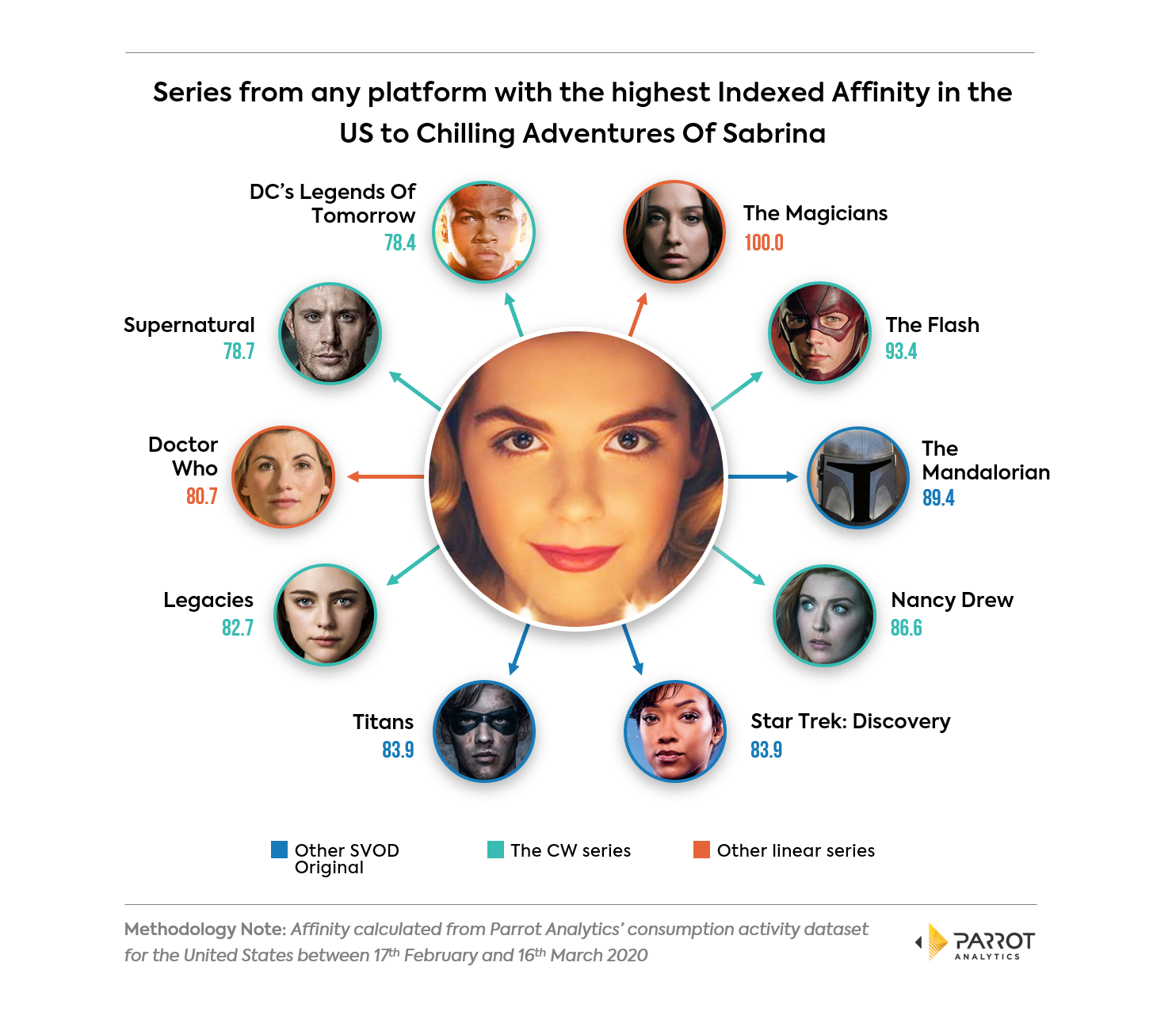

Let’s look at the affinity for Sabrina again, but this time for all titles and not only digital originals.

From the digital original titles with high affinity to Sabrina, three are also in the all-title top ten: The Mandalorian, Star Trek: Discovery and Titans. Reinforcing our finding earlier, no Netflix originals are in the top ten series with the highest affinity to Sabrina.

Examining the linear titles with high affinity, it is apparent how many of the highest affinity series to Chilling Adventures Of Sabrina are from broadcast network The CW. Of the ten shows with the most affinity in the USA, 60% are from The CW. This includes both the the second and fourth highest affinity titles, The Flash and Nancy Drew.

Of course, Chilling Adventures Of Sabrina only debuted in late 2018 and so exclusivity deals likely preclude second-run activity for some time yet. However, if the show’s producer’s Warner Bros Television was in a position to look at potential networks for a second-run airing, then The CW would be a natural place to start.

Conclusion

Affinity analysis is a powerful way to look at the relationships between content. Based on market-specific consumption data, affinity can shed light on questions like why an SVOD would cancel a seemingly hot title and the upcoming hot issue of digital original second-run placements.