By reading this article you will understand:

- How the popularity of anime signifies today’s world of globalized content that transcends national and linguistic barriers.

- Whether the demand for anime is being driven by a glut of anime titles or by shifting audience preferences.

- Where in the world outside of Japan anime is most in-demand and how that presents an opportunity for creators, buyers and distributors of content.

Back by popular demand, just in time for Ani-MAY, we are revisiting our frequently requested report on the global landscape and opportunities for animation and doing a focused deep dive on Japanese anime.

This genre once may have been considered niche, but in reality it helped innovate today’s world of globalized content by transcending national and linguistic barriers. In the early days, anime fans in the US had to read printed translation booklets to understand the anime which was in Japanese. Today however, advances in simulcast and subtitling technology have made it infinitely easier for audiences to access and understand the anime content they demand.

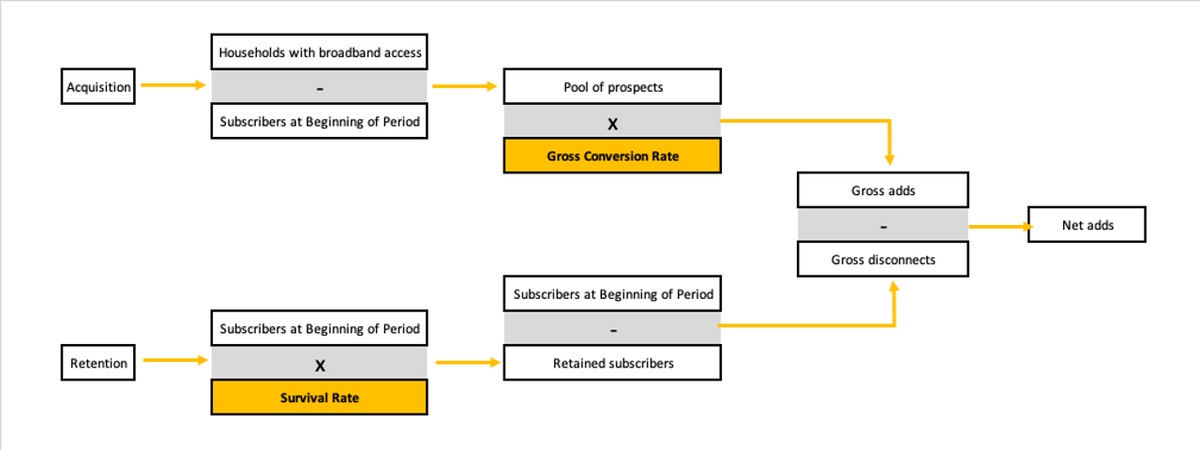

Below you can see why platforms, producers, and programmers cannot afford to dismiss anime as a niche offering - fans certainly aren’t. Anime accounted for nearly 5% of demand from global audiences in the past year. This makes it the 3rd most in-demand subgenre globally, behind only sitcoms and crime dramas. It attracts a greater share of audience attention than perennially popular sci-fi drama and school-aged children’s content. Japanese anime holds its own alongside these established staple genres and merits investment to match the attention global audiences are already giving it.

The Anime Glass is only half full (actually more like two-thirds):

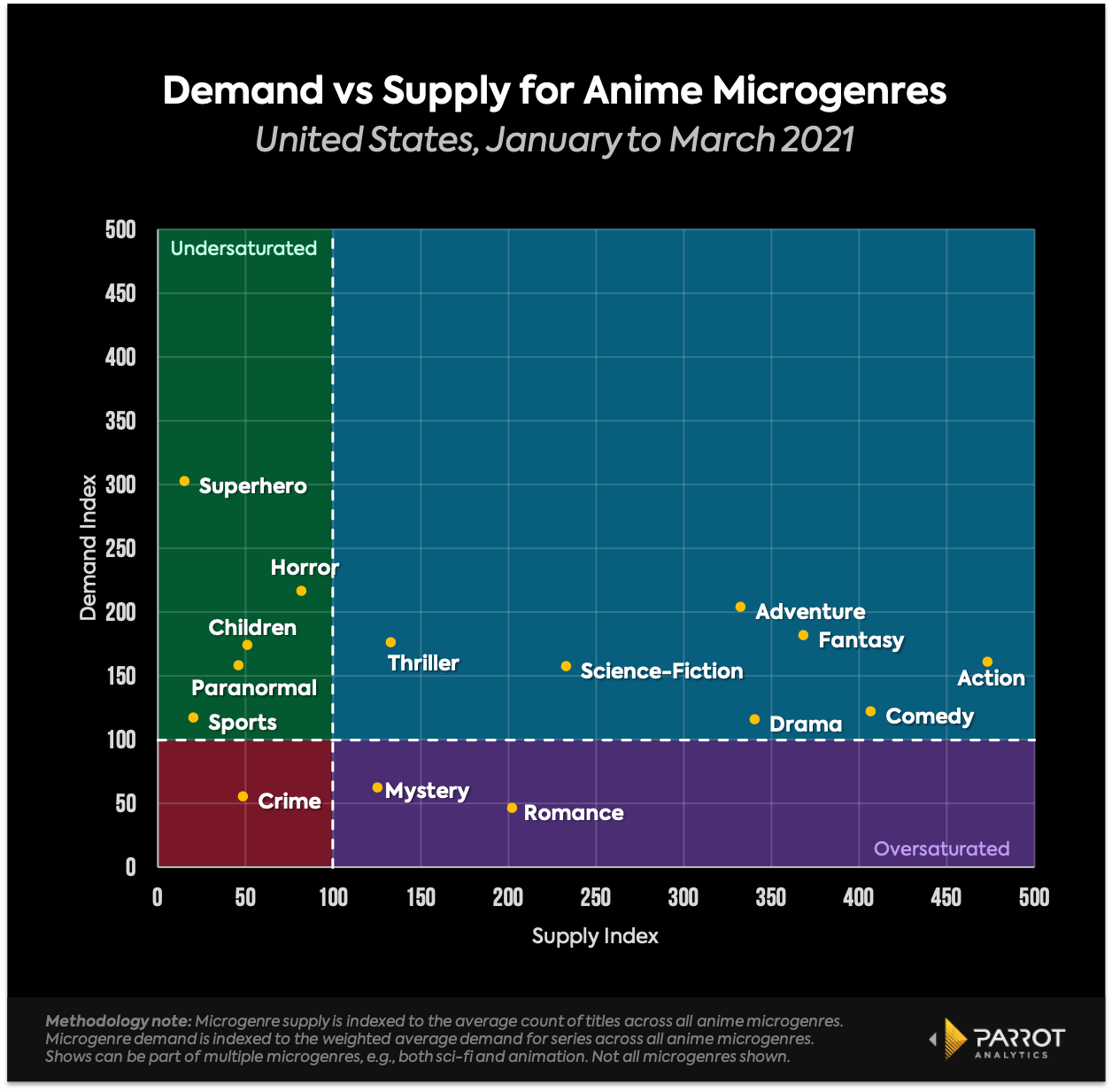

While the above data makes clear the robust global demand for anime, to fully contextualize this we also need to understand what the supply of anime content looks like. Is the demand for anime being driven by a glut of anime titles or is this truly an audience-driven trend? In fact, the global supply of anime titles has not kept up with global demand.

While 4.7% of global demand was for an anime series, only 3.2% of shows fall into this category. This 33% gap between the share of attention audiences give to the genre and the supply of titles available to them represents an expansion opportunity for more anime titles. Creating more anime to meet this demand is a production opportunity. From an acquisitions perspective the above result means that currently, anime titles are in hot demand and short supply so they can be valuable additions to a catalog to capture audience attention.

What types of anime do audiences crave?

All anime is not created equal and while the anime genre has a unifying style, the breadth of topics, themes, and target audiences is much wider than the typical genre. Remember, this is the genre that includes both kid-friendly Pokemon and the mature and violent Attack on Titan.

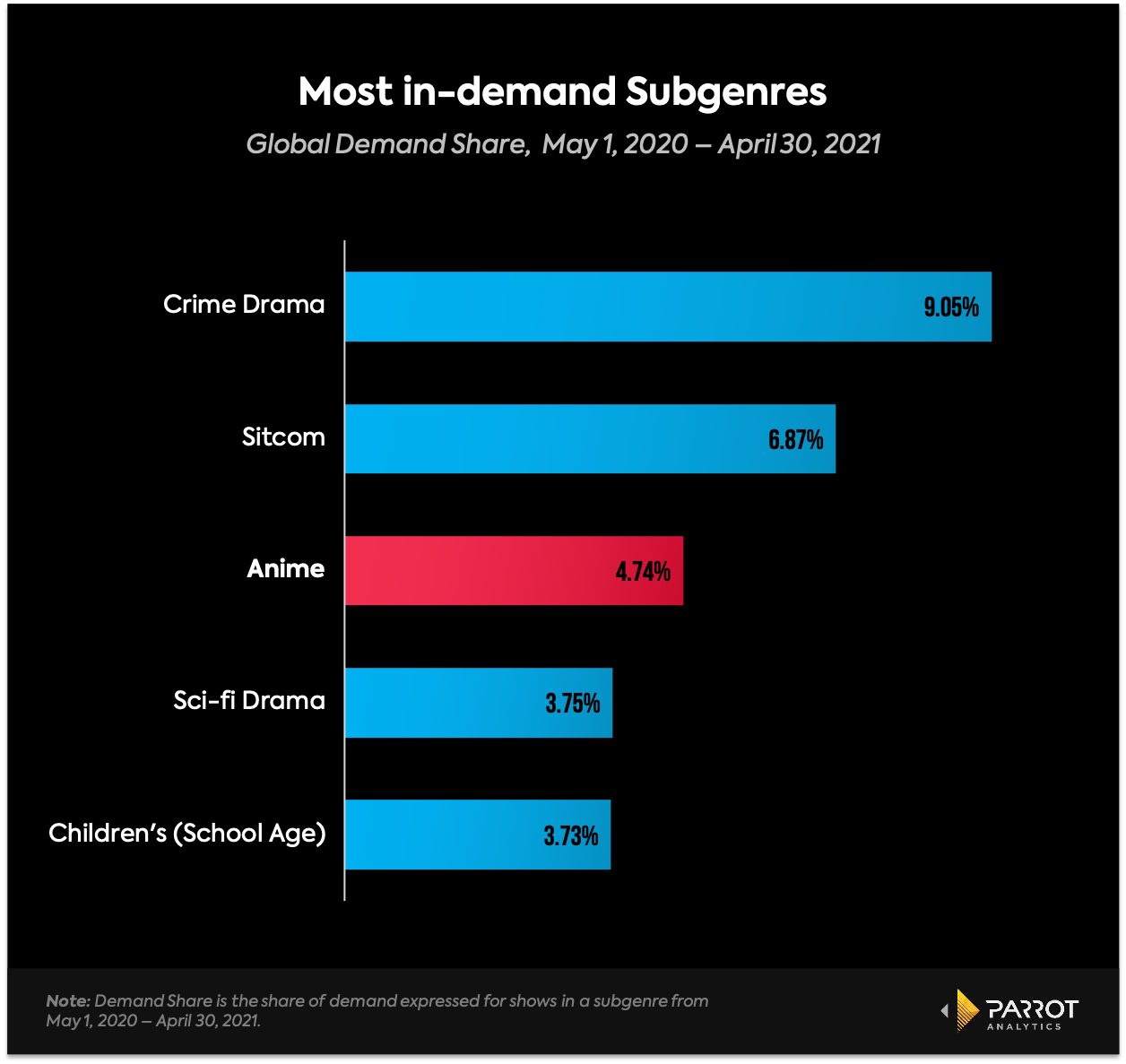

Below is a look at which of the ‘microgenres’ within anime are succeeding, specifically in the US market. This is a useful guide to understand which areas audience demand is being met and where there is a mismatch between supply and demand.

It’s not a surprise that the microgenre with the largest opportunity is superhero series. This is generally true even outside of anime. Superhero series consistently punch above their weight when it comes to demand, and the supply of anime superhero shows has room to grow to meet the demand for this microgenre. Anime superhero series can help to fill the large opportunity gap for superhero content more generally. Other animated superhero content has already had success filling this demand gap (Invincible, Harley Quinn, etc.). The superhero microgenre could even be an expansion opportunity for anime to attract superhero fans that have not previously discovered anime.

There appears to be a pattern of high demand for the related horror, paranormal, and thriller microgenres. Anime series with these elements tend to be more in-demand than the average anime, while the horror and paranormal microgenres have fewer titles than the average anime microgenre. These are prime conditions for an expansion of titles in this space. Jojo’s Bizarre Adventure is an example of a show that falls in each of these categories that audiences want more of.

The mystery and romance microgenres of anime are oversaturated. These categories have an above average number of titles and yet generate relatively low demand compared to the rest of the anime genre. When considering whether to produce a new anime series in one of these categories or add one of these titles to a catalog, proceed with caution. Anime audiences already have an abundance of these titles to choose from and do not give an above average amount of attention to them

Global Opportunities for Anime Content:

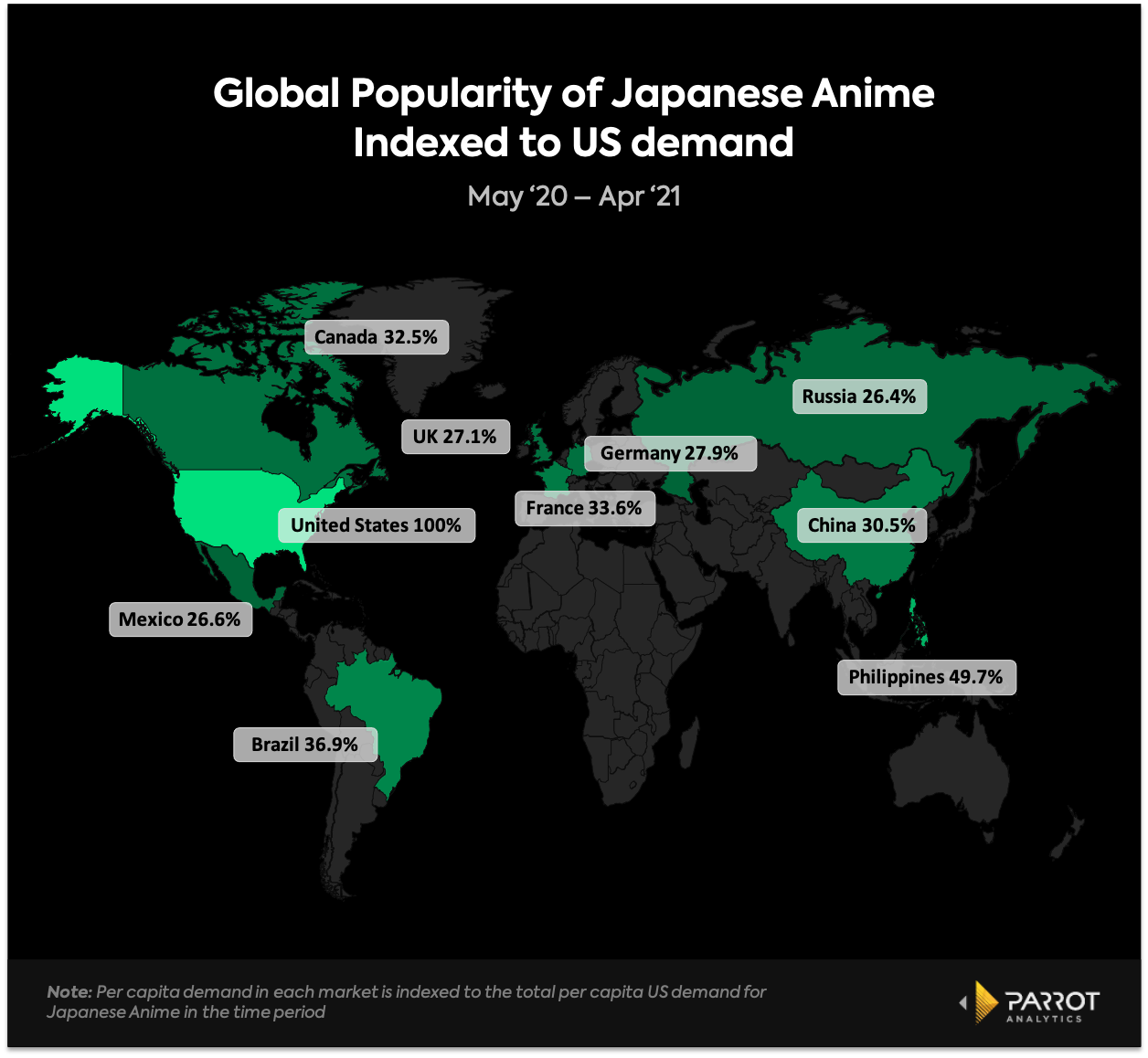

Market level insights into the travelability of anime from Japan can help guide acquisition and distribution decisions.

The markets most hungry for Japanese anime are the US, the Philippines, Brazil, and France. The geographic spread of these countries illustrates how Japanese anime has found fans in every corner of the world.

A few observations on the above results:

- The United States is the market with the highest demand for anime exported from Japan.

- The Philippines comes second to the US with about half as much demand for Japanese content. Outside of its home market in Asia, Japanese anime is most in demand in the Philippines. This has consistently been the case as far back as 2018 when we first looked at anime travelability.

- Brazil stands out as the most anime-loving market in Latin America.

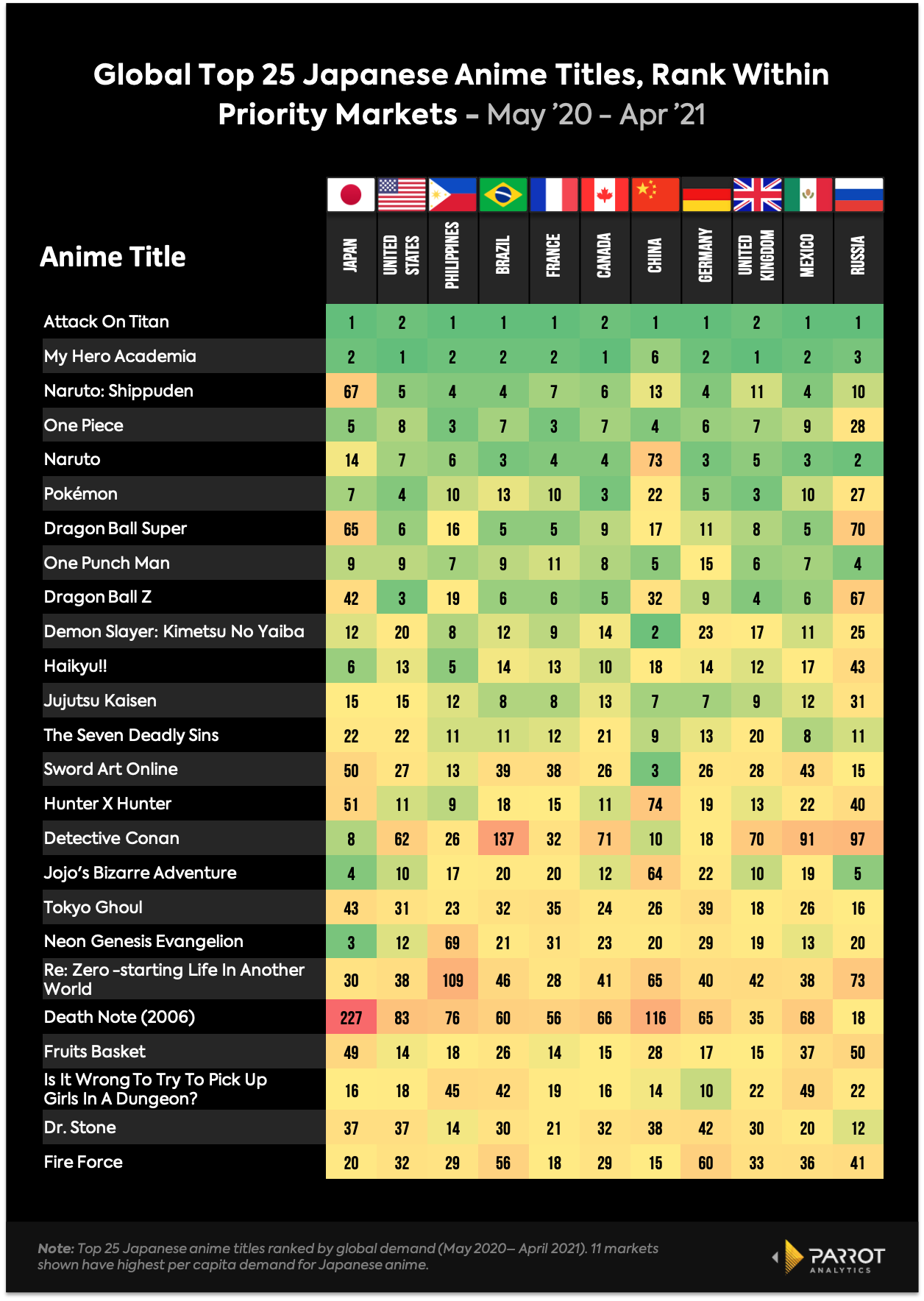

Diving further into market differences, we break down the top Japanese anime titles in the highest opportunity markets. The chart below shows the top 25 anime titles globally and how each ranks within the most anime-loving markets. These shows can roughly be thought of as falling into three categories:

- Global Hits - Shows like Attack on Titan and My Hero Academia that are globally in-demand across markets.

- Rising Stars - Shows that may have had early success in Japan but are gradually being discovered by global audiences.

- Local Favorites - Shows that, for various reasons, have unique market specific appeal.

Dragon Ball Super exemplifies how titles often peak in Japan before other markets due to a lag time in dubbing and distribution to international markets. It is the 7th most in-demand anime series globally, but only the 65th most in-demand series in Japan. However in 2017, the year of this series premiere, it was the 14th most in-demand show overall in Japan and the 39th most in-demand show in the US.

These results show how Japan serves as a trendsetter and early indicator - there can be a lag before home-market preferences reach the rest of the world.

When we last did this analysis, we highlighted Haikyu!! as potentially the next Japanese anime to break out globally - and in fact it has not only moved up the rankings in global markets but in Japan as well compared to the last time we looked at it. It is still more popular in its home market than the rest of the world (the 6th most in-demand anime in Japan, 11th ranked globally) but the gap between its home market demand and global demand has narrowed. Last year there was a gap of 12 spots between its rank in Japan and its rank in the US (#12 vs #24). This year that gap has narrowed to 7 spots.

Of course lag time doesn’t explain all the differences in anime preference between markets. Naruto: Shippuden is an example of an anime series that has consistently performed better abroad than in Japan. This year it was the 3rd most in-demand anime globally but ranked only 67 in Japan. Even when we look at how it performed when its final season was released, it ranked significantly higher in the US than in Japan during the first month of its final season (#1 vs #37).

This shows that there is not always a delayed demand effect but that some anime series simply appeal to international audiences more. Two examples of this stand out from the above data: Sword Art Online has exceptionally high demand in China alone while Is It Wrong to Try to Pick Up Girls in a Dungeon excels in Germany more than any other market here. These results hint at the potential for anime series produced mainly for international export or even non-Japanese origin anime to satisfy global audiences.

To sum up, Japanese anime is no longer a niche genre of content. It is among the most in-demand subgenres in the world. Despite this, anime still remains undersupplied relative to audiences’ demand for it. There are targeted opportunities for anime producers to create specific types of anime content and even tailor these to the tastes of particular markets. Platforms can also not afford to overlook anime as a powerful tool for attracting subscribers from the growing global anime audience.