By reading this article you will learn:

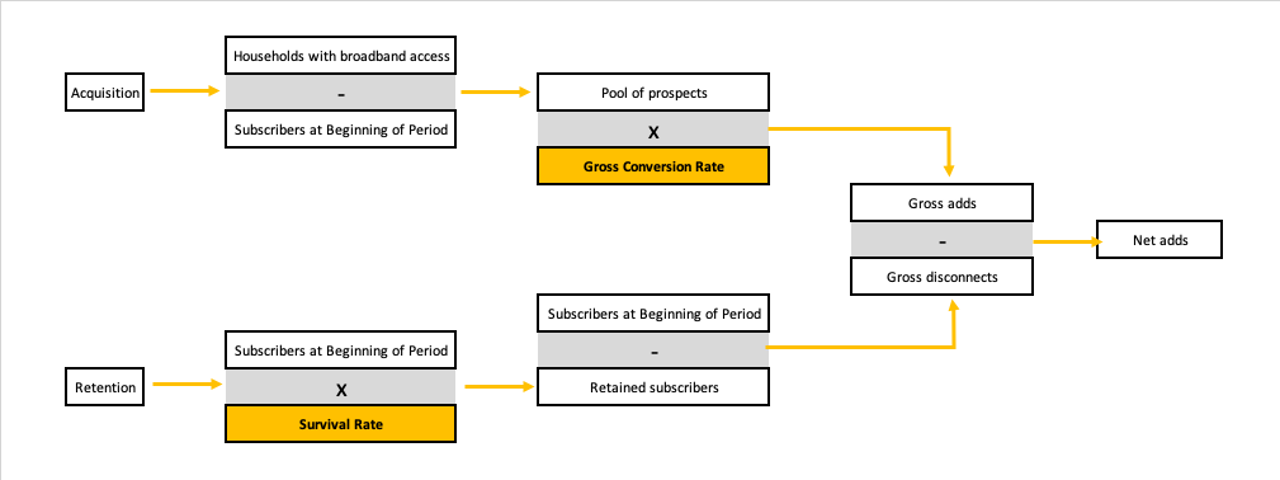

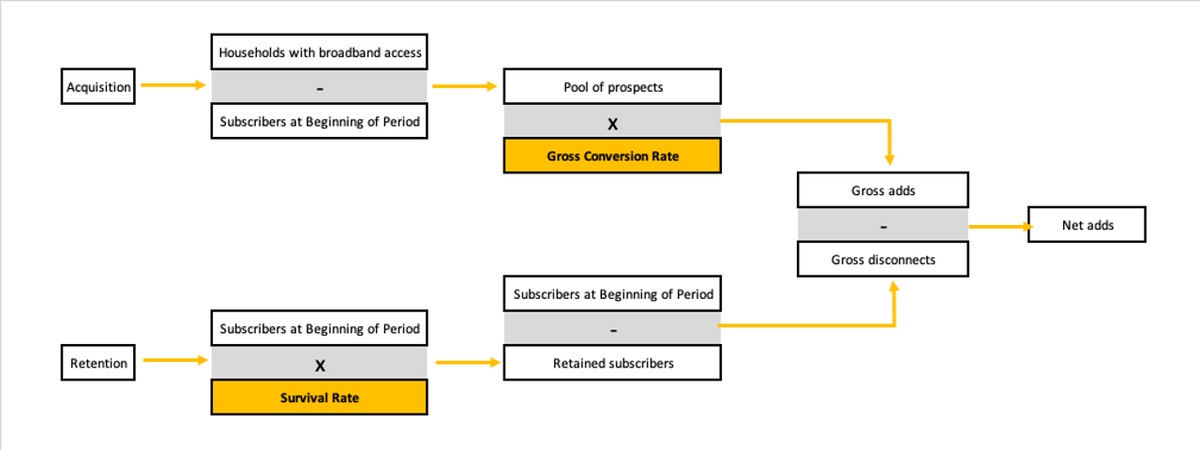

How the TV streamer business model can be broken down into key levers that drive subscriber growth and retention.

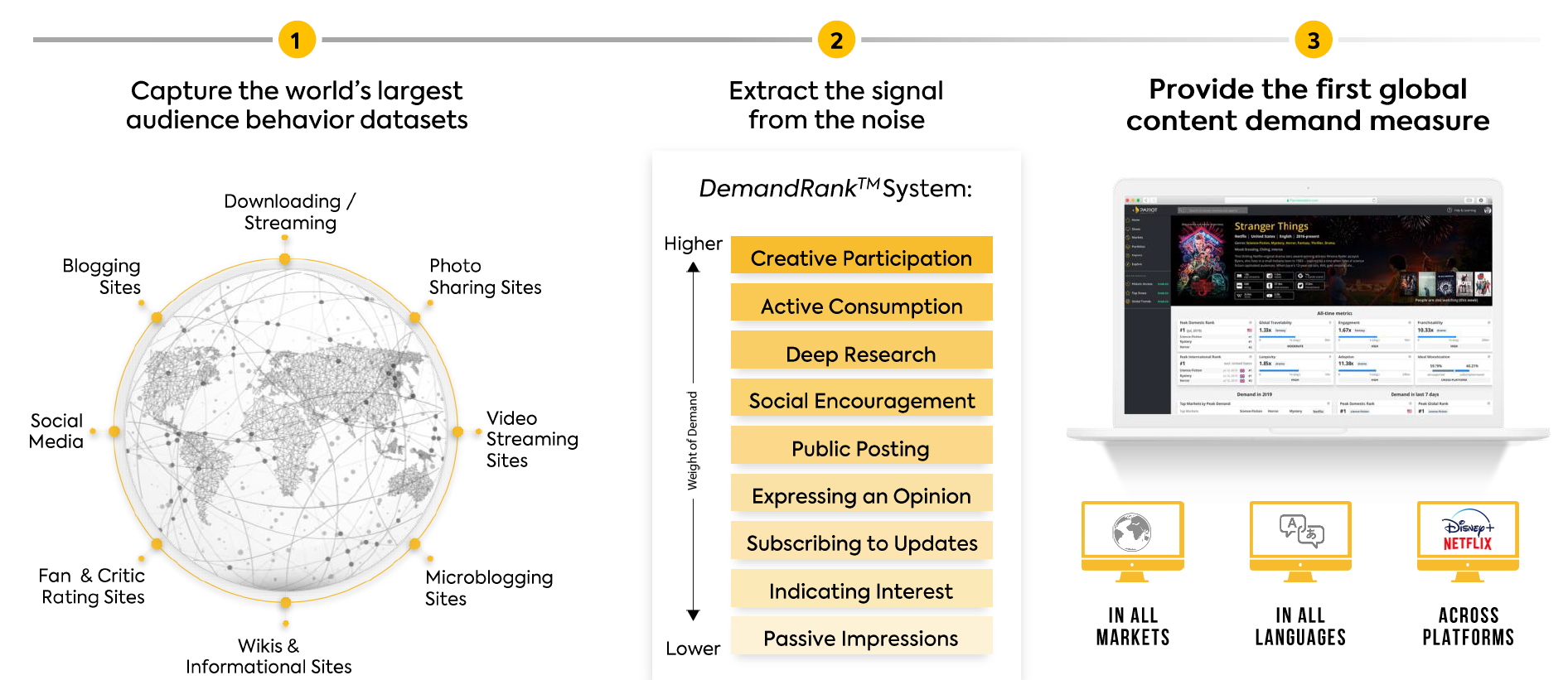

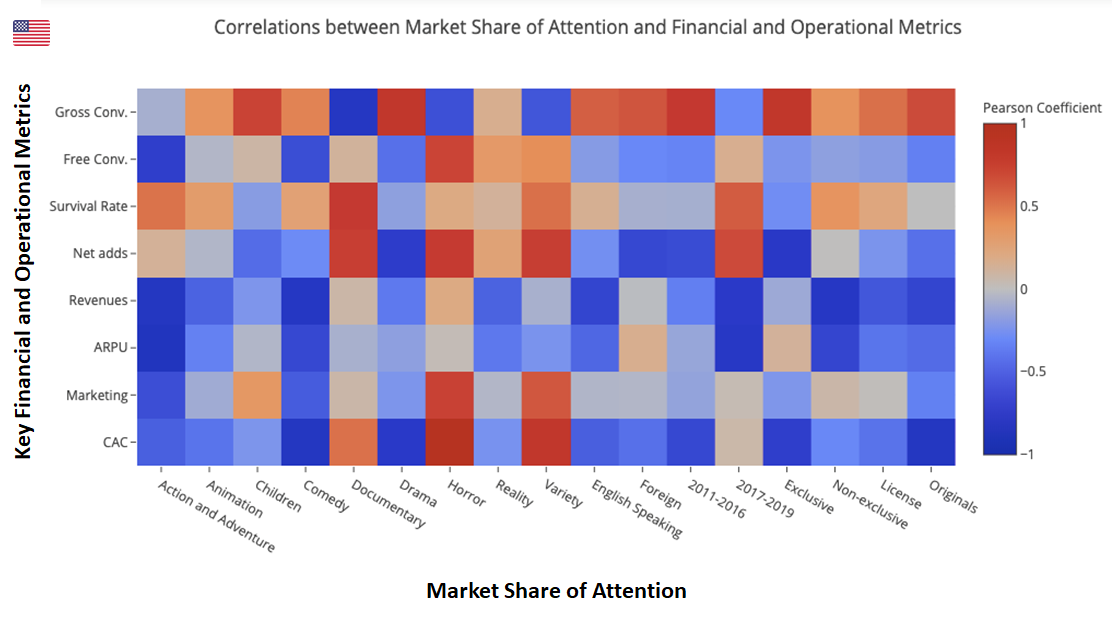

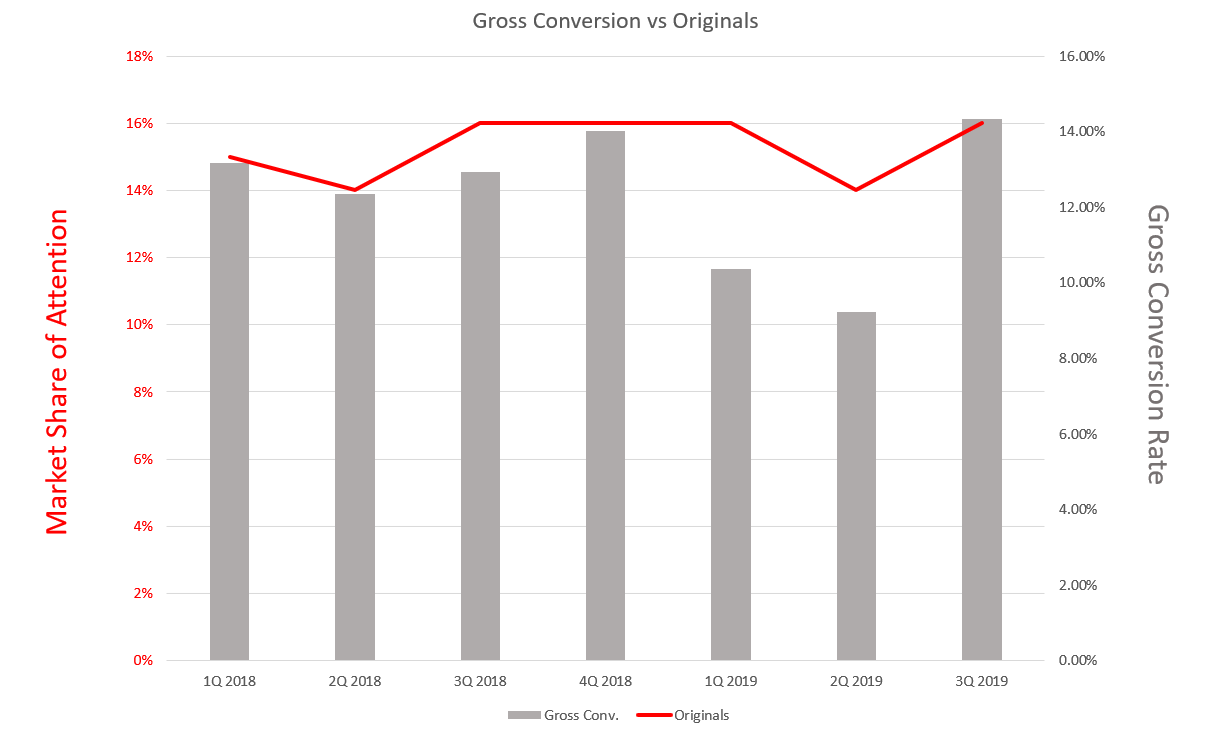

How the demonstration of the value of Parrot Analytics’ global TV demand dataset can be used as a leading indicator for key financial and operational metrics.

How quantifying the relationship between consumer demand for content and these key metrics can help investors assess and predict business value.

Explore demand Academy

Beginner

Understanding the attention economy

Understanding the Attention Economy

Beginner

Understanding the attention economy

What is demand? An introduction to global audience demand measurement

Beginner

Understanding the attention economy

Learn the methodology behind demand measurement

Beginner

Understanding the attention economy

Why demand? An introduction to audience demand applications

Beginner

Understanding the attention economy

How demand is a key measurement for streaming video-on-demand services

Beginner

Understanding the attention economy

Originals : The Critical "O" in SVOD

Beginner

Understanding the attention economy

Capturing global audience trends with the 2021 Global TV Demand Report

Beginner

Plotting content supply and demand

The Diversity Supply and Demand Gap: Part 1

Beginner

Plotting content supply and demand

The Diversity Supply and Demand Gap: Part 2

Beginner

Plotting content supply and demand

Analyzing supply and demand for content to find whitespace opportunities

Beginner

Globalization and the travelability of content

The effects of a borderless economy and the globalization of content

Beginner

Globalization and the travelability of content

Travelability case study: Measuring "Money Heist" with Alejandro Rojas

Beginner

Globalization and the travelability of content

From niche to mainstream: Anime’s journey around the world

Beginner

Globalization and the travelability of content

All about anime: A conversation between experts

Beginner

Globalization and the travelability of content

See it in action: Demand for anime content soars

Beginner

Globalization and the travelability of content

See it in action: Netflix’s Biggest Advantage Is Foreign Language TV

Beginner

Talent Demand

Introducing Talent Demand: The Power of Japanese and South Korean Talent

Beginner

Talent Demand

See it in action: How should talent be paid for streaming?

Beginner

Miscellaneous

Measuring the success of children’s content featuring "CoComelon"

Beginner

Movie Demand

The Future of Theatricality: How Movie Demand Can Drive Better Strategic Decisions

Beginner

Talent Demand

Talent Demand Whitepaper - FIFA World Cup Qatar 2022 Demand Trends

Beginner

MENA Trends

Rise Studios x Parrot Analytics Whitepaper: Beyond Borders - The Evolution of Non-English Content in MENA

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card- Q3 2023

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card- Q2 2023

Intermediate

Content Valuation

Learn how to apply content valuation to establish the true value of entertainment content

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card- Q4 2022

Intermediate

Affinity, longevity and advanced context analysis

Understand affinity as a means to uncover audience preferences

Intermediate

Market shares and advanced platform analysis

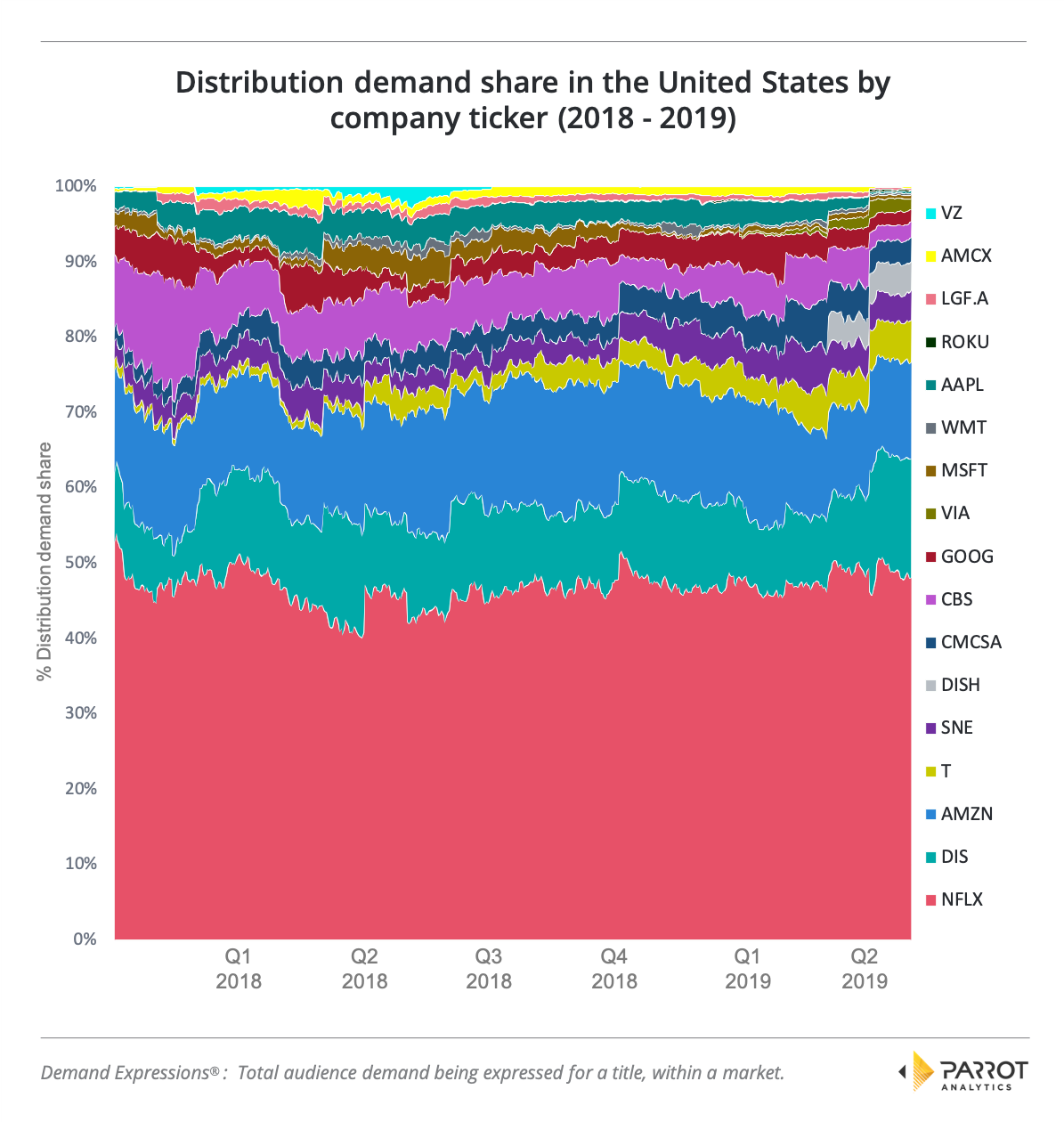

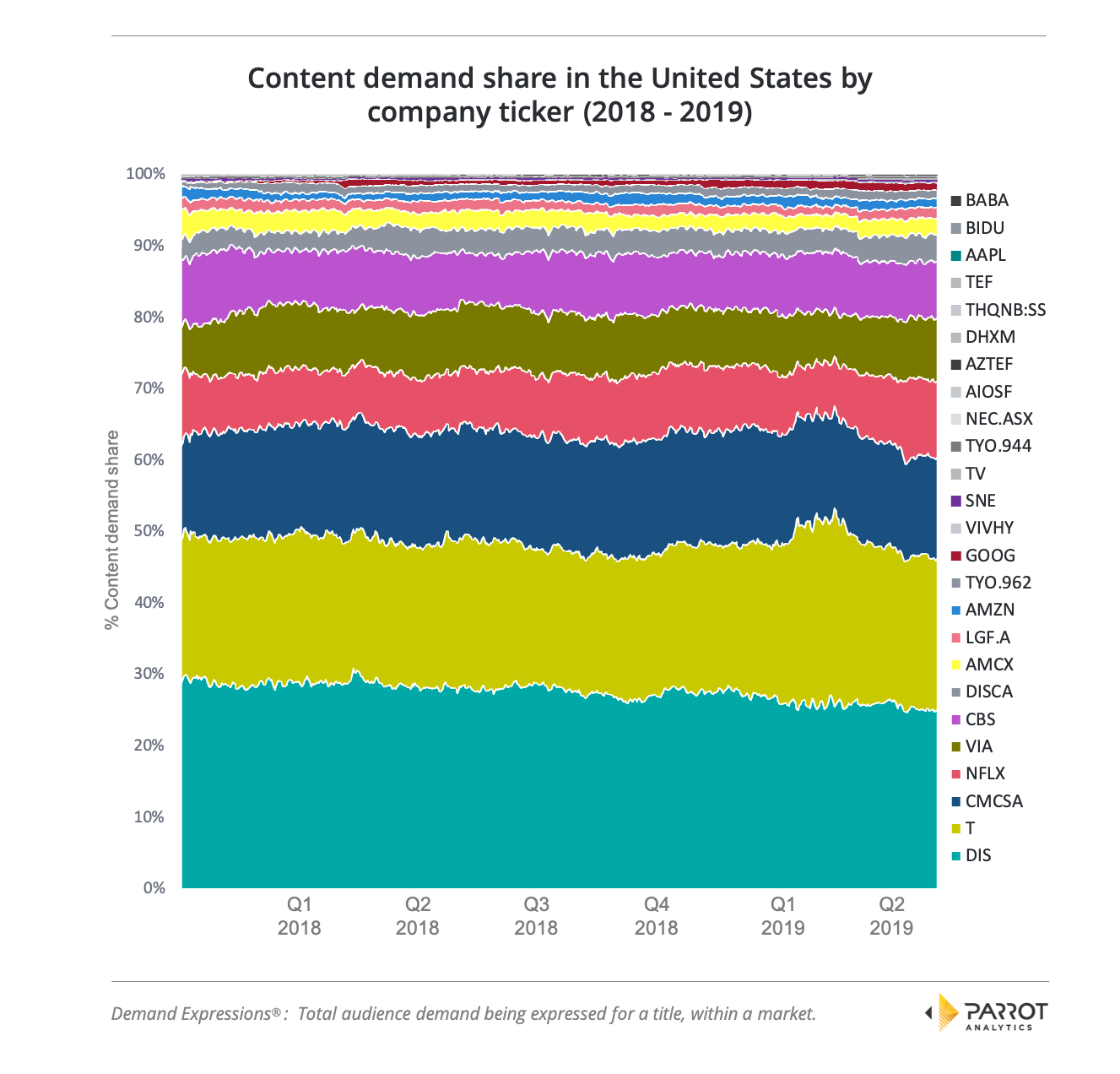

Using demand to determine who's winning the battle for audience attention

Intermediate

Market shares and advanced platform analysis

Measuring the power of original content for defined platforms

Intermediate

Market shares and advanced platform analysis

Measuring the power of original content for combined platforms

Intermediate

Market shares and advanced platform analysis

See it in action: The consolidation of two powerhouse content dealers

Intermediate

Market shares and advanced platform analysis

Editorial: Sr. Strategy Analyst on Disney+’s global success

Intermediate

Monetizing Talent Demand

Leveraging talent demand data to drive compensation conversations

Intermediate

Affinity, longevity and advanced context analysis

Understanding how affinity analysis unlocks audience insights

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card- Q1 2022

Intermediate

Monetizing Talent Demand

Representation in Hollywood in the Streaming Era

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card- Q3 2022

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card- Q4 2023

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card- Q1 2024

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card - Q2 2024

Intermediate

Market shares and advanced platform analysis

Capturing corporate gains and losses with the Streaming Report Card - Q4 2024

Advanced

Strategy

How to ensure title success by optimizing pre-release marketing

Advanced

Content Valuation

Streaming Economics: How Parrot Analytics Measures The Value of Content in the Streaming Era

Advanced

Strategy

How Hollywood can find its next global hit

Advanced

Strategy

The truth of binge vs. weekly release strategies

Advanced

Strategy

Streaming consolidation's next big problem: Strategies for integrating and expanding content libraries

Advanced

Strategy

Which metrics matter most when selling your content

Advanced

Strategy

How much is a global hit teen show worth to Netflix — and why it matters

Advanced

Strategy

One final linear strategy that Netflix and the SVOD industry can steal

Advanced

Strategy

Parrot Perspective: Part 1 - Biggest trends and lessons from 2022, and predictions for 2023

Advanced

Strategy

Parrot Perspective: Part 2 - Biggest trends and lessons from 2022, and Predictions for 2023

Advanced

Strategy

AVODs and The Impact of Netflix's Missing Titles

Advanced

Strategy

Learn about the value of broadcast TV

Advanced

Strategy

How to use franchises to win and retain customers

Advanced

Strategy

Gaming Adaptations: The recipe to success

Advanced

Strategy

Wise spending: Data, creative intuition and franchise-first thinking

Advanced

Strategy

The Rebundling Era: Learn how rapid consolidation has forced bundling innovation

Advanced

Release strategies, windowing & platform fit

Editorial: “Netflix invented the ‘binge watch’ - now it must die”

Advanced

Global Expansion

Creating sustainable growth using demand-driven pathways

Advanced

Demand and Investment

Harness global content supply and audience demand to deliver Alpha

Advanced

Strategy

Smart Streaming: Leveraging Global Demand Data to Capitalize on White Space

Advanced

Strategy

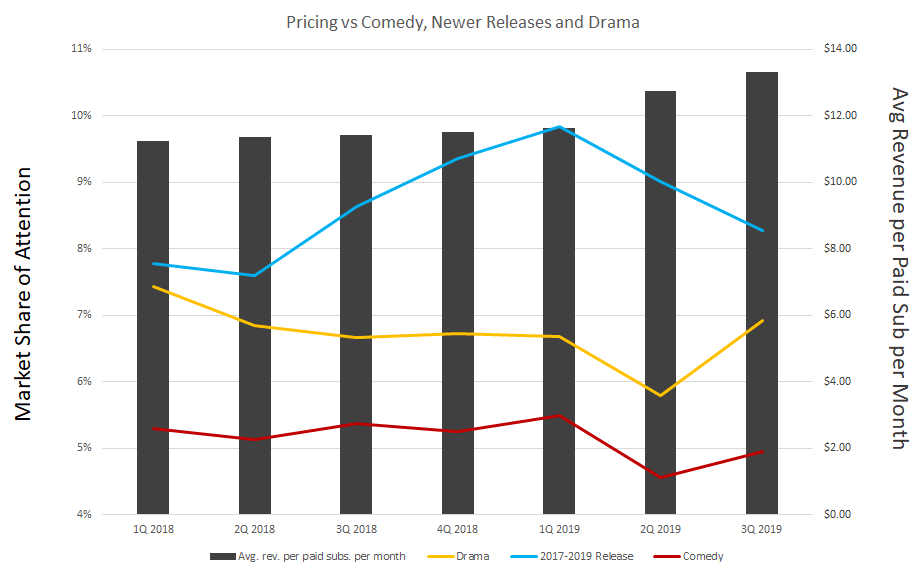

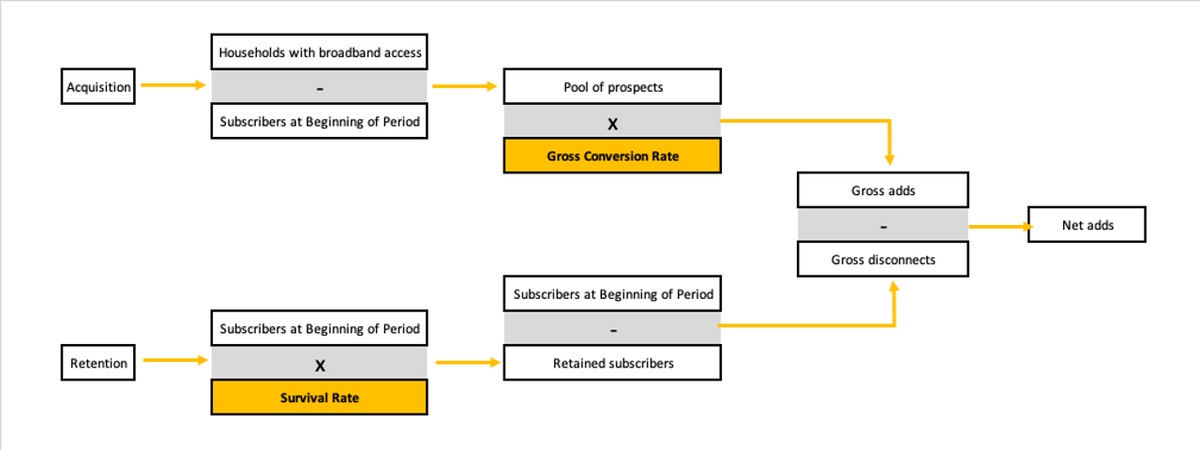

Deconstructing SVOD subscriber acquisition and retention metrics

Advanced

Strategy

Strategies for thriving a decentralized era of programming

Advanced

Strategy

Streamer strategies for audience retention without prestige linear series

Advanced

Strategy

What You Need to Know About Netflix's Shifting Movie Strategy

Advanced

Strategy

Theatrical & Streaming Strategies For Creating New Hollywood Franchises